0001305767 false N-CSRS 0001305767 2022-06-01 2022-11-30 0001305767 2022-12-01 2023-05-31 iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811‑21654

Pioneer Floating Rate Fund, Inc.

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742‑7825

Date of fiscal year end: November 30, 2023

Date of reporting period: December 1, 2022 through May 31, 2023

Form N‑CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e‑1 under the Investment Company Act of 1940 (17 CFR 270.30e‑1). The Commission may use the information provided on Form N‑CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N‑CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Pioneer Floating

Rate Fund, Inc.

Semiannual Report | May 31, 2023

visit us: www.amundi.com/us

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/231

President’s Letter

Dear Stockholders,

On February 13, 2023, Amundi US celebrated the 95th anniversary of Pioneer Fund, the second-oldest mutual fund in the United States. We recognized the anniversary with ringing of the closing bell at the New York Stock Exchange, which seemed fitting for this special milestone.

Pioneer Fund was launched on February 13, 1928 by Phil Carret, one of the earliest proponents of value investing and a leading innovator in the asset management industry. Mr. Carret began investing in the 1920s and founded Pioneer Investments (now Amundi US) in 1928, and was one of the first investors to realize he could uncover value through rigorous, innovative, fundamental research techniques.

Consistent with Mr. Carret’s investment approach and employing many of the same techniques utilized in the 1920s, Amundi US's portfolio managers have adapted Mr. Carret’s philosophy to a new age of “active” investing.

The last few years have seen investors face some unprecedented challenges, from a global pandemic that shuttered much of the world’s economy for months, to geopolitical strife, to rising inflation that has reached levels not seen in decades. Now, more than ever, Amundi US believes active management – that is, making active investment decisions across all of our portfolios – can help mitigate risk during periods of market volatility.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating frequently with the management teams of the companies and other entities issuing the securities, and working together to identify those securities that we believe best meet our investment criteria for our family of funds. Our risk management approach begins with each security under consideration, as we strive to develop a deep understanding of the potential opportunity, while considering any potential risk factors.

Today, as stockholders, we have many options. It is our view that active management can serve stockholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

2Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

July 2023

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/233

Portfolio Management Discussion | 5/31/23

In the following interview, Jonathan Sharkey discusses the factors that influenced the performance of Pioneer Floating Rate Fund, Inc. during the six-month period ended May 31, 2023. Mr. Sharkey, a senior vice president and a portfolio manager at Amundi Asset Management US, Inc., is responsible for the day-to-day management of the Fund.

|

|

| Q |

How did the Fund perform during the six-month period ended May 31, 2023? |

| A |

Pioneer Floating Rate Fund, Inc. returned 4.66% at net asset value (NAV) and -0.78% at market price during the six-month period ended May 31, 2023, while the Fund’s benchmark, the Morningstar Loan Syndications & Trading Association Leveraged Loan Index (the Morningstar/LSTA Index), returned 4.55%. Unlike the Fund, the Morningstar/LSTA Index does not use leverage. While the use of leverage increases investment opportunity, it also increases investment risk. |

|

During the same six-month period, the average return at NAV of the 69 closed end funds in Morningstar’s Bank Loan Closed End Funds category (which may or may not be leveraged), was 3.44%, and the average return at market price of the closed-end funds in the same Morningstar category was 0.03%. |

|

The shares of the Fund were selling at a 13.83% discount to NAV on May 31, 2023. Comparatively, the shares of the Fund were selling at a 9.10% discount to NAV on November 30, 2022. |

|

The Fund’s standardized, 30 day SEC yield was 11.16% on May 31, 2023*. |

| Q |

How would you describe the environment for investing in bank loans during the six-month period? |

| A |

As the period opened in December 2022, with inflation showing signs of modest easing, investors began to anticipate a pivot by the US Federal Reserve (Fed) to a more dovish policy stance despite another 75 basis point fed funds rate hike in early November. However, the market soon turned its attention to the potential recessionary impact of the higher fed funds target range |

| * |

The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. |

4Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

|

|

|

implemented by the Fed, leading risk assets including leveraged loans to give-up some of the fourth quarter’s gains in December. The Fed implemented a more modest 50 basis point rate increase at its December meeting, leaving the fed funds target range at 4.25% to 4.50% at the end of 2022. |

|

Entering 2023, risk assets rallied amid growing optimism that the Fed and other leading central banks were poised to stop raising interest rates. January saw Treasury yields ease off their highs on the prospect of easier monetary policy, boosting performance of bonds generally. In addition, the reopening of China’s economy as the government unwound its zero-Covid policy eased concerns about slowing global growth. Against this backdrop, areas of the market that had lagged during the 2022 sell-off, such as leveraged loans and corporate credit, outperformed. On February 1, 2023, the Fed raised its benchmark overnight lending rate by 25 basis points, to a target range of 4.50% to 4.75%. |

|

In March, the failure of two U.S. banks and collapse of European giant Credit Suisse raised fears of a financial crisis, leading investors to flee leveraged loans and other credit sensitive assets. In response to the bank failures, the Fed implemented a new lending program to support bank liquidity, while the market began to anticipate Fed rate cuts over the second half of the year. The prospect of easier monetary policy and a flight to safety spurred by the banking concerns drove Treasury yields sharply lower. At its March 23 meeting the Fed went forward with another modest quarter-point increase in the fed funds target to a range of 4.75%-5.0%. The increase was largely received by financial markets as an indication that the Fed believed the financial system remained sound overall. The fed funds rate target finished the period at 5.0%-5.25% following another increase on May 3rd. |

|

Loan issuance was relatively weak during the six months ended May 31, 2023, given higher interest rates and recession fears, and driven mostly by refinancings. At the same time, collateralized loan obligation issuance remained strong, supporting demand for loans. Returns for the asset class were buoyed over the period by increases in the LIBOR and SOFR reference rates (London Interbank Offer Rate and Secured Overnight Financing Rate, respectively) driven by the Fed’s rate hikes. In addition, loan |

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/235

|

|

|

returns benefited from credit spread tightening, although some of this was given back in the wake of the bank crisis. Outflows continued for loans during the period despite positive investment returns for the asset class. |

| Q |

What factors had the biggest effects on the Fund’s performance relative to the benchmark during the six-month period? |

| A |

With respect to the Fund’s allocation across loan rating categories, an overweight to the single-B credit quality tier contributed to the Fund's positive benchmark-relative performance during the period. However, this impact was more than offset by an overweight to the lower-rated CCC segment, which underperformed. Security selection proved additive within the entertainment, technology hardware and specialty retail sectors. Security selection was most detrimental within the software sector, where the Fund mantains a significant underweight relative to the benchmark and which is the largest segment in the loan universe. Security selection also weighed on return within IT services and household products. Sector allocations which helped performance included underweights to media, diversified telecommunications and real estate management. On the downside, overweights to health care providers and technology hardware detracted, along with the underweight to software. |

|

With respect to individual positions, a loan for movie theater chain AMC outperformed due to an improved outlook for theater attendance given a number of major movie releases in the pipeline. A loan for Michael’s Stores also performed well, as results for the arts and crafts supplies retailer have rebounded with the normalization of economic activity. A loan for sustainable construction solutions company Groupe Solmax was a notable contributor as well. On the downside, sentiment with respect to GoTo (formerly LogMeIn) suffered as the company experienced a pair of data breaches and workers returned to the office. Results for kitchenware provider Instant Brands suffered from a post-COVID slump in demand and supply chain issues, leading to the structural subordination of some company assets. During the period, customer loyalty program provider Loyalty Ventures filed for bankruptcy, having failed to renegotiate its |

6Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

|

|

|

debt on a timely basis after incurring operational losses driven by the loss of a large customer and supply chain issues. |

|

The Fund typically maintains moderate out-of-benchmark exposure to high yield corporate bonds in an effort to attain yield as well to gain access to faster settling instruments to provide flexibility in managing the fund. The high yield allocation of approximately 7% detracted from the Fund's benchmark-relative performance due to the higher interest rate sensitivity of the asset class relative to loans in a rising rate environment. The Fund’s small exposure to insurance-linked securities, issued by insurers to help spread the risk of large settlements in the wake of natural disasters. weighed modestly on Fund performance due to final settlements for storms that occurred in 2022. On the positive side, the Fund’s roughly 4% out-of-benchmark exposure to residential mortgage-backed securities aided the Fund's benchmark-relative return. |

| Q |

Did the Fund have any investments in any derivative securities during the six-month period? If so, did the derivatives have any material effect on results? |

| A |

The Fund had some exposure to forward foreign currency exchange contracts (currency forwards) during the six-month period. We utilized the currency forwards as a hedge against the portfolio's foreign exchange exposure for a credit denominated in the Mexican peso. The currency forwards had no material effect on the Fund's performance. |

| Q |

How did the level of leverage in the Fund change over the six-month period ended May 31, 2023? |

| A |

The Fund employs leverage through a credit agreement. (See Note 9 to the Financial Statements.) |

|

As of May 31, 2023, 32.7% of the Fund’s total managed assets were financed by leverage (or borrowed funds), compared with 32.4% of the Fund’s total managed assets financed by leverage at the start of the six-month period on December 1, 2022. The slight change in the percentage of the Fund’s total managed assets financed by leverage during the six-month period was the result of a decrease in the value of the Fund’s net assets. |

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/237

|

|

| Q |

Did the Fund’s distributions to stockholders change during the six-month period? |

| A |

The Fund’s monthly distribution rate increased from $0.0775 per share/per month, to $0.0900 per share/per month over the six-month period, as loan payments to the Fund re-set higher with the general increase in short-term interest rates. |

| Q |

What is your investment outlook? |

| A |

The default rate on loans for the six months ended May 31, 2023 was 1.58% by loan volume, above the 10-year lows seen six months earlier but still well below the historical average of slightly under 3%. The default rate by number of issuers was 1.60%. While recovery rates for defaulted loans have been below historical norms in recent years, they improved notably over the 12-month period. |

|

With elevated inflation proving to be sticky and the Fed committed to bringing inflation down to its two percent long-term target, we believe the fed funds rate will stay higher for longer, contrary to market expectations, which continue to price in rate cuts in the latter part of 2023. We believe financial conditions will become more restrictive, and that the likelihood of recession has risen as banks tighten lending standards and as the Fed maintains higher rates. Consequently, we expect to remain in a relatively defensive posture as recession risk increases over the course of the year. Given the large percentage of loans in the B3 category (below investment-grade, highly speculative) we could anticipate an uptick in defaults if interest rates stay higher for longer or that the economy hits a hard landing. |

|

As always during a recession, some borrowers will end up in trouble, leading to increased defaults. However, we do not expect a deep recession, such as during the Global Financial Crisis (GFC) of 2007-2008. In our view, the economy will likely be on the upswing with the default rate headed higher at first and then lower at some point in 2024. There is a reasonable probability that by the end of 2024 inflation will have fallen to the Fed’s targeted 2% area and that Treasury yields will be lower than today’s levels. |

8Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

In this scenario, we expect the default rate to stay lower than after the GFC and below that experienced during the pandemic. Despite an uptick in the loan default rate, we expect higher coupons to more than offset default losses over the remainder of 2023.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/239

Please refer to the Schedule of Investments on pages 15–41 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia's military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

The Fund may invest in floating-rate loans. The value of collateral, if any, securing a floating-rate loan can decline or may be insufficient to meet the issuer’s obligations or may be difficult to liquidate. No active trading market may exist for many floating rate loans, and many loans are subject to restrictions on resale. Any secondary market may be subject to irregular trading activity and extended settlement periods. There is less readily available, reliable information about most floating-rate loans than is the case for many other types of securities.

Securities with floating interest rates generally are less sensitive to interest-rate changes, but may decline in value if their interest rates do not rise as much, or as quickly, as prevailing interest rates. Unlike fixed-rate securities, floating-rate securities generally will not increase in value if interest rates decline. Changes in interest rates also will affect the amount of interest income the Fund earns on its floating-rate investments.

The Fund’s investments, payment obligations and financing terms may be based on floating rates, such as LIBOR (London Interbank Offered Rate), or SOFR (Secured Overnight Financing Rate). Plans are underway to phase out the use of LIBOR. There remains uncertainty regarding the nature of any replacement rate and the impact of the transition from LIBOR on the Fund, issuers of instruments in which the Fund invests, and financial markets generally.

The Fund may use derivatives, which may include futures and options, for a variety of purposes, including: in an attempt to hedge against adverse changes in the marketplace of securities, interest rates or currency exchange rates; as a substitute for purchasing or selling securities; to attempt to increase the Fund’s return as a non-hedging strategy that may be considered speculative; and to manage portfolio characteristics. Using derivatives can increase fund losses and reduce opportunities for gains when the market prices, interest rates or the

10Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

derivative instruments themselves behave in a way not anticipated by the Fund. These types of instruments can increase price fluctuation.

The Fund is not limited in the percentage of its assets that may be invested in illiquid securities. Illiquid securities may be difficult to sell at a price reflective of their value at times when the Fund believes it is desirable to do so and the market price of illiquid securities is generally more volatile than that of more liquid securities. Illiquid securities may be difficult to value, and investment of the Fund’s assets in illiquid securities may restrict the Fund’s ability to take advantage of market opportunities.

The Fund employs leverage through a revolving credit facility. Leverage creates significant risks, including the risk that the Fund’s income or capital appreciation from investments purchased with the proceeds of leverage will not be sufficient to cover the cost of leverage, which may adversely affect the return for stockholders.

The Fund is required to maintain certain regulatory and other asset coverage requirements in connection with the Fund’s use of leverage. In order to maintain required asset coverage levels, the Fund may be required to reduce the amount of leverage employed by the Fund, alter the composition of the Fund’s investment portfolio or take other actions at what might be inopportune times in the market. Such actions could reduce the net earnings or returns to stockholders over time, which is likely to result in a decrease in the market value of the Fund’s shares.

Investments in high-yield or lower-rated securities are subject to greater-than-average risk. The Fund may invest in securities of issuers that are in default or that are in bankruptcy.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates and economic, social and political conditions, which could increase volatility. These risks are magnified in emerging markets.

The Fund invests in insurance-linked securities (ILS). The return of principal and the payment of interest on ILS are contingent on the non-occurrence of a predefined “trigger” event, such as a hurricane or an earthquake of a specific magnitude.

These risks may increase share price volatility.

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2311

Portfolio Summary | 5/31/23

Portfolio Diversification

(As a percentage of total investments)*

† Amount rounds to less than 0.1%.

10 Largest Holdings

|

|

|

| (As a percentage of total investments)* |

| 1. |

Traverse Midstream Partners LLC, Advance, 8.997% (1 Month Term SOFR + 375.0 bps), 2/16/28 |

1.69% |

| 2. |

Team Health Holdings, Inc., Extended Term Loan, 10.403% (Term SOFR + 525 bps), 3/2/27 |

1.22 |

| 3. |

Clear Channel Outdoor Holdings, Inc., Term B Loan, Term Loan, 8.807% (Term SOFR + 350 bps), 8/21/26 |

1.11 |

| 4. |

Garda World Security Corp., Term B-2 Loan, Term Loan, 9.444% (Term SOFR + 425 bps), 10/30/26 |

1.11 |

| 5. |

Verscend Holding Corp., Term B-1 Loan, Term Loan, 9.154% (LIBOR + 400 bps), 8/27/25 |

1.07 |

| 6. |

Upstream Newco, Inc., First Lien August 2021 Incremental Term Loan, Term Loan, 9.41% (Term SOFR + 425 bps), 11/20/26 |

1.00 |

| 7. |

Chobani LLC., 2020 New Term Loan, Term Loan, 8.768% (Term SOFR + 350 bps), 10/25/27 |

0.97 |

| 8. |

First Brands Group LLC, First Lien 2021 Term Loan, Term Loan, 10.252% (Term SOFR + 500 bps), 3/30/27 |

0.94 |

| 9. |

Numericable U.S. LLC, USD TLB-[14] Loan, 10.486% (Term SOFR + 550 bps), 8/15/28 |

0.93 |

| 10. |

Carnival Corp., Initial Advance, Term Loan, 8.154% (LIBOR + 300 bps), 6/30/25 |

0.91 |

|

|

| * |

Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

12Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Prices and Distributions | 5/31/23

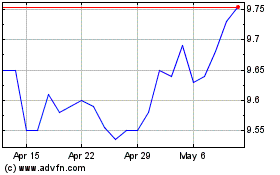

Market Value per Share^

| |

5/31/23 |

11/30/22 |

| Market Value |

$8.41 |

$8.99 |

| Discount |

(13.83)% |

(9.10)% |

Net Asset Value per Share^

| |

5/31/23 |

11/30/22 |

| Net Asset Value |

$9.76 |

$9.89 |

Distributions per Share

| |

Net Investment

Income |

Short-Term

Capital Gains |

Long-Term

Capital Gains |

| 12/1/22 – 5/31/23 |

$0.5200 |

$— |

$— |

Yields

| |

5/31/23 |

11/30/22 |

| 30-Day SEC Yield |

11.16% |

10.36% |

The data shown above represents past performance, which is no guarantee of future results.

^ Net asset value and market value are published in Barron's on Saturday, The Wall Street Journal on Monday and The New York Times on Monday and Saturday. Net asset value and market value are published daily on the Fund's website at www.amundi.com/us.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2313

Performance Update | 5/31/23

Investment Returns

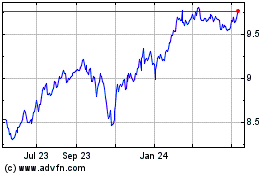

The mountain chart on the right shows the change in market value, including reinvestment of dividends and distributions, of a $10,000 investment made in common shares of Pioneer Floating Rate Fund, Inc. during the periods shown, compared to that of the Morningstar/LSTA Leveraged Loan Index, which provides broad and comprehensive total return metrics of the U.S. universe of syndicated term loans.

Average Annual Total Return

(As of May 31, 2023) |

| Period |

Net

Asset

Value

(NAV) |

Market

Price |

Morningstar/

LSTA

Leveraged

Loan Index |

| 10 Years |

3.96% |

2.04% |

3.77% |

| 5 Years |

2.90 |

1.53 |

3.69 |

| 1 Year |

2.42 |

-0.23 |

5.91 |

Value of $10,000 Investment

Call 1-800-710-0935 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and your shares may trade below NAV, due to such factors as interest rate changes, and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions. All performance is for common shares of the Fund.

Shares of closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and, once issued, shares of closed-end funds are bought and sold in the open market through a stock exchange and frequently trade at prices lower than their NAV. NAV per share is total assets less total liabilities, which include preferred shares or borrowings, as applicable, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at the greater of NAV or 95% of the market price. When NAV is higher, dividends are assumed to be reinvested at prices obtained through open-market purchases under the Fund’s dividend reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Had these fees and taxes been reflected, performance would have been lower.

Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. The index does not use leverage. You cannot invest directly in an index.

14Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Schedule of Investments | 5/31/23

(unaudited)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

UNAFFILIATED ISSUERS — 151.3% |

|

| |

Senior Secured Floating Rate Loan

Interests — 125.7% of Net Assets*(a) |

|

| |

Advanced Materials — 2.1% |

|

| 905,452 |

Gemini HDPE LLC, 2027 Advance, 8.307% (Term SOFR + 300 bps), 12/31/27 |

$ 903,997 |

| 1,376,485 |

Groupe Solmax, Inc., Initial Term Loan, 9.909% (LIBOR + 475 bps), 5/29/28 |

1,249,160 |

| 375,000 |

Momentive Performance Materials Inc., Initial Term Loan, 9.653% (Term SOFR + 450 bps), 3/29/28 |

367,500 |

| |

Total Advanced Materials |

$2,520,657 |

| |

| |

| |

Advertising Sales — 1.6% |

|

| 2,054,244 |

Clear Channel Outdoor Holdings, Inc., Term B Loan, 8.807% (Term SOFR + 350 bps), 8/21/26 |

$ 1,938,109 |

| |

Total Advertising Sales |

$1,938,109 |

| |

| |

| |

Advertising Services — 1.5% |

|

| 457,689 |

CB Poly US Holdings, Inc., Initial Term Loan, 10.653% (Term SOFR + 550 bps), 5/18/29 |

$ 424,315 |

| 492,500 |

Dotdash Meredith, Inc., Term Loan B, 9.119% (Term SOFR + 400 bps), 12/1/28 |

455,563 |

| 985,000 |

Summer BC Holdco B LLC, USD Additional Facility B2, 9.659% (LIBOR + 450 bps), 12/4/26 |

917,281 |

| |

Total Advertising Services |

$1,797,159 |

| |

| |

| |

Aerospace & Defense — 2.2% |

|

| 855,000 |

ADS Tactical, Inc., Initial Term Loan, 10.904% (LIBOR + 575 bps), 3/19/26 |

$ 807,975 |

| 500,000 |

Spirit Aerosystems, Inc. (fka Mid-Western Aircraft Systems, Inc and Onex Wind Finance LP.), 2022 Refinancing Term Loan, 9.545% (Term SOFR + 450 bps), 1/15/27 |

500,125 |

| 1,522,554 |

WP CPP Holdings LLC, First Lien Initial Term Loan, 9.03% (LIBOR + 375 bps), 4/30/25 |

1,343,654 |

| |

Total Aerospace & Defense |

$2,651,754 |

| |

| |

| |

Airlines — 1.9% |

|

| 500,000 |

AAdvantage Loyality IP, Ltd. (American Airlines, Inc.), Initial Term Loan, 10.00% (LIBOR + 475 bps), 4/20/28 |

$ 503,063 |

| 417,284 |

Castlelake Aviation One Designated Activity Company, 2023 Incremental Term Loan, 7.783% (Term SOFR + 275 bps), 10/22/27 |

409,982 |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2315

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Airlines — (continued) |

|

| 1,062,500 |

Mileage Plus Holdings LLC (Mileage Plus Intellectual Property Assets, Ltd.), Initial Term Loan, 10.213% (LIBOR + 525 bps), 6/21/27 |

$ 1,101,215 |

| 306,000 |

SkyMiles IP, Ltd. (Delta Air Lines, Inc.), Initial Term Loan, 8.798% (Term SOFR + 375 bps), 10/20/27 |

317,494 |

| |

Total Airlines |

$2,331,754 |

| |

| |

| |

Apparel Manufacturers — 0.6% |

|

| 725,000 |

Hanesbrands Inc., Initial Term Loan B, 8.903% (Term SOFR + 375 bps), 3/8/30 |

$ 720,469 |

| |

Total Apparel Manufacturers |

$720,469 |

| |

| |

| |

Applications Software — 1.6% |

|

| 832,913 |

Central Parent Inc., First Lien Initial Term Loan, 9.148% (Term SOFR + 425 bps), 7/6/29 |

$ 821,649 |

| 547,500 |

EP Purchaser LLC, First Lien Closing Date Term Loan, 8.659% (LIBOR + 350 bps), 11/6/28 |

528,337 |

| 925,000(b) |

Loyalty Ventures, Inc., Term B Loan, 9.689% (LIBOR + 450 bps), 11/3/27 |

104,063 |

| 500,000 |

RealPage, Inc., First Lien Initial Term Loan, 8.154% (LIBOR + 300 bps), 4/24/28 |

481,250 |

| |

Total Applications Software |

$1,935,299 |

| |

| |

| |

Auction House & Art Dealer — 0.4% |

|

| 491,250 |

Sotheby's, 2021 Second Refinancing Term Loan, 9.76% (LIBOR + 450 bps), 1/15/27 |

$ 481,016 |

| |

Total Auction House & Art Dealer |

$481,016 |

| |

| |

| |

Auto Parts & Equipment — 3.5% |

|

| 412,750 |

Adient US LLC, Term B-1 Loan, 8.518% (Term SOFR + 325 bps), 4/10/28 |

$ 412,363 |

| 939,500(c) |

Autokiniton US Holdings, Inc., Closing Date Term B Loan, 4/6/28 |

920,794 |

| 1,697,919 |

First Brands Group LLC, First Lien 2021 Term Loan, 10.252% (Term SOFR + 500 bps), 3/30/27 |

1,641,323 |

| 1,561,135 |

IXS Holdings, Inc., Initial Term Loan, 9.479% (Term SOFR + 425 bps), 3/5/27 |

1,310,377 |

| |

Total Auto Parts & Equipment |

$4,284,857 |

| |

| |

The accompanying notes are an integral part of these financial statements.

16Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Auto-Truck Trailers — 1.0% |

|

| 343,306 |

American Trailer World Corp., First Lien Initial Term Loan, 9.003% (Term SOFR + 375 bps), 3/3/28 |

$ 298,301 |

| 990,000 |

Novae LLC, Tranche B Term Loan, 10.338% (Term SOFR + 500 bps), 12/22/28 |

851,400 |

| |

Total Auto-Truck Trailers |

$1,149,701 |

| |

| |

| |

Beverages — 0.5% |

|

| 165,417 |

Naked Juice LLC, First Lien Initial Term Loan, 8.248% (Term SOFR + 325 bps), 1/24/29 |

$ 151,494 |

| 498,750 |

Pegasus BidCo BV, Initial Dollar Term Loan, 9.336% (Term SOFR + 425 bps), 7/12/29 |

492,516 |

| |

Total Beverages |

$644,010 |

| |

| |

| |

Broadcast Service & Programing — 0.6% |

|

| 742,500 |

Univision Communications, Inc., First Lien Initial Term Loan, 8.404% (LIBOR + 325 bps), 1/31/29 |

$ 708,159 |

| |

Total Broadcast Service & Programing |

$708,159 |

| |

| |

| |

Building & Construction — 1.2% |

|

| 500,000 |

DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 12.018% (Term SOFR + 675 bps), 3/30/29 |

$ 442,500 |

| 981,448 |

Service Logic Acquisition, Inc., First Lien Closing Date Initial Term Loan, 9.273% (LIBOR + 400 bps), 10/29/27 |

952,005 |

| |

Total Building & Construction |

$1,394,505 |

| |

| |

| |

Building & Construction Products — 2.5% |

|

| 1,451,345 |

Cornerstone Building Brands, Inc., Tranche B Term Loan, 8.409% (Term SOFR + 325 bps), 4/12/28 |

$ 1,324,805 |

| 564,459 |

CP Atlas Buyer, Inc., Term B Loan, 9.003% (Term SOFR + 375 bps), 11/23/27 |

510,643 |

| 448,858(c) |

Jeld-Wen, Inc., Replacement Term Loan, 7/28/28 |

447,525 |

| 990,000 |

LHS Borrower LLC, Initial Term Loan, 10.003% (Term SOFR + 475 bps), 2/16/29 |

772,200 |

| |

Total Building & Construction Products |

$3,055,173 |

| |

| |

| |

Building Production — 1.7% |

|

| 493,750 |

Chariot Buyer LLC., First Lien Initial Term Loan, 8.503% (Term SOFR + 325 bps), 11/3/28 |

$ 469,474 |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2317

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Building Production — (continued) |

|

| 750,000 |

Koppers Inc., Initial Term Loan, 8.91% (Term SOFR + 400 bps), 4/10/30 |

$ 748,125 |

| 839,375 |

Vector WP MidCo, Inc. (Vector Canada Acquisition ULC), Initial Term B Loan, 10.188% (LIBOR + 500 bps), 10/12/28 |

828,883 |

| |

Total Building Production |

$2,046,482 |

| |

| |

| |

Building-Air & Heating — 0.3% |

|

| 333,945(c) |

Emerald Borrower LP, Initial Term Loan B, 5/31/30 |

$ 330,553 |

| |

Total Building-Air & Heating |

$330,553 |

| |

| |

| |

Building-Heavy Construction — 0.6% |

|

| 744,332 |

Osmose Utilities Services, Inc., First Lien Initial Term Loan, 8.154% (LIBOR + 300 bps), 6/23/28 |

$ 710,217 |

| |

Total Building-Heavy Construction |

$710,217 |

| |

| |

| |

Building-Maintenance & Service — 0.6% |

|

| 738,750 |

ArchKey Holdings, Inc., First Lien Initial Term Loan, 10.404% (LIBOR + 525 bps), 6/29/28 |

$ 726,745 |

| |

Total Building-Maintenance & Service |

$726,745 |

| |

| |

| |

Cable & Satellite Television — 2.9% |

|

| 519,000 |

DIRECTV Financing LLC, Closing Date Term Loan, 10.154% (LIBOR + 500 bps), 8/2/27 |

$ 493,915 |

| 1,931,801 |

Numericable U.S. LLC, USD TLB-[14] Loan, 10.486% (Term SOFR + 550 bps), 8/15/28 |

1,620,298 |

| 1,036,999 |

Radiate Holdco LLC, Amendment No. 6 Term Loan, 8.404% (LIBOR + 325 bps), 9/25/26 |

864,454 |

| 500,000 |

Virgin Media Bristol LLC, Facility Q, 8.357% (LIBOR + 325 bps), 1/31/29 |

486,250 |

| |

Total Cable & Satellite Television |

$3,464,917 |

| |

| |

| |

Casino Hotels — 0.4% |

|

| 495,000 |

Century Casinos, Inc., Term B Facility Loan, 11.093% (Term SOFR + 600 bps), 4/2/29 |

$ 475,200 |

| |

Total Casino Hotels |

$475,200 |

| |

| |

| |

Casino Services — 0.6% |

|

| 535,799 |

Everi Holdings, Inc., Term B Loan, 7.654% (LIBOR + 250 bps), 8/3/28 |

$ 531,981 |

| 566,159(b) |

Lucky Bucks LLC, Initial Term Loan, 10.67% (LIBOR + 550 bps), 7/30/27 |

180,227 |

| |

Total Casino Services |

$712,208 |

| |

| |

The accompanying notes are an integral part of these financial statements.

18Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Cellular Telecom — 1.8% |

|

| 543,073 |

CCI Buyer, Inc., First Lien Initial Term Loan, 8.898% (Term SOFR + 400 bps), 12/17/27 |

$ 517,899 |

| 847,760 |

Gogo Intermediate Holdings LLC, Initial Term Loan, 9.018% (Term SOFR + 375 bps), 4/30/28 |

840,541 |

| 738,750 |

Xplornet Communications, Inc., First Lien Refinancing Term Loan, 9.154% (LIBOR + 400 bps), 10/2/28 |

599,311 |

| 350,000 |

Xplornet Communications, Inc., Second Lien Initial Term Loan, 12.268% (Term SOFR + 700 bps), 10/1/29 |

215,250 |

| |

Total Cellular Telecom |

$2,173,001 |

| |

| |

| |

Chemicals-Diversified — 2.6% |

|

| 1,000,000 |

ARC Falcon I, Inc., Second Lien Initial Term Loan, 12.154% (LIBOR + 700 bps), 9/30/29 |

$ 853,750 |

| 441,662 |

Hexion Holdings Corp., First Lien Initial Term Loan, 9.779% (Term SOFR + 450 bps), 3/15/29 |

398,785 |

| 300,000 |

Ineos US Finance LLC, 2030 Dollar Term Loan, 8.753% (Term SOFR + 350 bps), 2/18/30 |

298,187 |

| 162,500 |

LSF11 A5 Holdco LLC, Fourth Amendment Incremental Term Loan, 9.504% (Term SOFR + 425 bps), 10/15/28 |

159,555 |

| 498,741 |

LSF11 A5 HoldCo LLC, Term Loan, 8.768% (Term SOFR + 350 bps), 10/15/28 |

482,905 |

| 982,500 |

Mativ Holdings, Inc., Term B Loan, 8.938% (Term SOFR + 375 bps), 4/20/28 |

940,744 |

| |

Total Chemicals-Diversified |

$3,133,926 |

| |

| |

| |

Chemicals-Specialty — 2.9% |

|

| 351,895 |

Avient Corp., Term B-6 Loan, 8.295% (Term SOFR + 325 bps), 8/29/29 |

$ 353,178 |

| 956,293 |

CPC Acquisition Corp., First Lien Initial Term Loan, 8.91% (Term SOFR + 375 bps), 12/29/27 |

747,503 |

| 250,000 |

H.B. Fuller Company, Term Loan B, 7.653% (Term SOFR + 250 bps), 2/15/30 |

251,339 |

| 300,000 |

Ineos Quattro Holdings UK Limited, 2030 Tranche B Dollar Term Loan, 9.003% (Term SOFR + 375 bps), 3/14/30 |

298,688 |

| 400,000 |

Nouryon Finance B.V., 2023 Term Loan, 8.99% (Term SOFR + 400 bps), 4/3/28 |

394,000 |

| 450,000(c) |

Nouryon Finance B.V., Extended Dollar Term Loan, 4/3/28 |

443,025 |

| 18,598 |

Nouryon Finance B.V., Initial Dollar Term Loan, 7.895% (Term SOFR + 275 bps), 10/1/25 |

18,563 |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2319

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Chemicals-Specialty — (continued) |

|

| 400,000(c) |

Olympus Water US Holding Corp., Incremental Term Loan, 11/9/28 |

$ 380,583 |

| 651,688 |

Olympus Water US Holding Corp., Initial Dollar Term Loan, 8.938% (LIBOR + 375 bps), 11/9/28 |

609,898 |

| |

Total Chemicals-Specialty |

$3,496,777 |

| |

| |

| |

Commercial Services — 3.0% |

|

| 537,809 |

CoreLogic, Inc. (fka First American Corporation), First Lien Initial Term Loan, 8.688% (LIBOR + 350 bps), 6/2/28 |

$ 482,539 |

| 478,750 |

Corporation Service Company, Term Loan B, 8.503% (Term SOFR + 325 bps), 11/2/29 |

478,930 |

| 588,045 |

Nielsen Consumer, Inc., 2021 Refinancing Dollar Term Loan, 8.904% (LIBOR + 375 bps), 3/6/28 |

508,169 |

| 228,383 |

Pre-Paid Legal Services, Inc., First Lien Initial Term Loan, 8.904% (LIBOR + 375 bps), 12/15/28 |

221,417 |

| 1,881,715 |

Verscend Holding Corp., Term B-1 Loan, 9.154% (LIBOR + 400 bps), 8/27/25 |

1,880,393 |

| |

Total Commercial Services |

$3,571,448 |

| |

| |

| |

Computer Data Security — 1.1% |

|

| 1,132,750 |

Magenta Buyer LLC, First Lien Initial Term Loan, 10.03% (LIBOR + 475 bps), 7/27/28 |

$ 807,792 |

| 612,937 |

Vision Solutions, Inc. (Precisely Software Incorporated), First Lien Third Amendment Term Loan, 9.255% (LIBOR + 400 bps), 4/24/28 |

555,538 |

| |

Total Computer Data Security |

$1,363,330 |

| |

| |

| |

Computer Services — 2.6% |

|

| 1,115,138 |

Ahead DB Holdings LLC, First Lien Term B Loan, 8.909% (LIBOR + 375 bps), 10/18/27 |

$ 1,056,128 |

| 715,635 |

MAG DS Corp., Initial Term Loan, 10.498% (Term SOFR + 550 bps), 4/1/27 |

658,385 |

| 962,112 |

Peraton Corp., First Lien Term B Loan, 9.003% (Term SOFR + 375 bps), 2/1/28 |

917,700 |

| 591,000 |

Sitel Group, Initial Dollar Term Loan, 8.91% (LIBOR + 375 bps), 8/28/28 |

566,252 |

| |

Total Computer Services |

$3,198,465 |

| |

| |

| |

Computer Software — 2.4% |

|

| 1,237,500 |

Cornerstone OnDemand, Inc., First Lien Initial Term Loan, 8.904% (LIBOR + 375 bps), 10/16/28 |

$ 1,117,617 |

| 993,639(c) |

Help/Systems Holdings, Inc., Term Loan, 11/19/26 |

872,167 |

The accompanying notes are an integral part of these financial statements.

20Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Computer Software — (continued) |

|

| 492,462 |

Idera, Inc., First Lien Term B-1 Loan, 8.884% (Term SOFR + 375 bps), 3/2/28 |

$ 473,441 |

| 1,029,000 |

Rackspace Technology Global, Inc., First Lien 2021 Term B Loan, 7.915% (Term SOFR + 275 bps), 2/15/28 |

405,651 |

| |

Total Computer Software |

$2,868,876 |

| |

| |

| |

Computers-Integrated Systems — 0.5% |

|

| 551,100 |

Atlas CC Acquisition Corp., First Lien Term B Loan, 9.775% (Term SOFR + 425 bps), 5/25/28 |

$ 489,388 |

| 112,088 |

Atlas CC Acquisition Corp., First Lien Term C Loan, 9.775% (Term SOFR + 425 bps), 5/25/28 |

99,536 |

| |

Total Computers-Integrated Systems |

$588,924 |

| |

| |

| |

Consulting Services — 0.8% |

|

| 1,031,991 |

Ankura Consulting Group LLC, First Lien Closing Date Term Loan, 9.768% (Term SOFR + 450 bps), 3/17/28 |

$ 990,712 |

| |

Total Consulting Services |

$990,712 |

| |

| |

| |

Consumer Products — 0.2% |

|

| 1,246,656 |

Instant Brands Holdings, Inc., Initial Loan, 10.218% (LIBOR + 500 bps), 4/12/28 |

$ 199,465 |

| |

Total Consumer Products |

$199,465 |

| |

| |

| |

Containers-Metal & Glass — 0.7% |

|

| 975,056 |

Plaze, Inc., 2021-1 Term Loan, 10.75% (Term SOFR + 375 bps), 8/3/26 |

$ 887,301 |

| |

Total Containers-Metal & Glass |

$887,301 |

| |

| |

| |

Containers-Paper & Plastic — 2.8% |

|

| 489,975 |

Charter Next Generation, Inc., First Lien 2021 Initial Term Loan, 9.018% (Term SOFR + 375 bps), 12/1/27 |

$ 477,358 |

| 273,094(c) |

Pactiv Evergreen, Inc., Tranche B-2 U.S. Term Loan, 2/5/26 |

271,494 |

| 777,265 |

Pregis TopCo LLC, First Lien Initial Term Loan, 9.018% (Term SOFR + 375 bps), 7/31/26 |

763,940 |

| 1,284,696 |

ProAmpac PG Borrower LLC, First Lien 2020-1 Term Loan, 8.927% (Term SOFR + 375 bps), 11/3/25 |

1,260,073 |

| 689,897 |

Trident TPI Holdings, Inc., Tranche B-3 Initial Term Loan, 9.159% (LIBOR + 400 bps), 9/15/28 |

660,231 |

| |

Total Containers-Paper & Plastic |

$3,433,096 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2321

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Cruise Lines — 1.3% |

|

| 1,604,625 |

Carnival Corp., Initial Advance, 8.154% (LIBOR + 300 bps), 6/30/25 |

$ 1,594,596 |

| |

Total Cruise Lines |

$1,594,596 |

| |

| |

| |

Diagnostic Equipment — 0.4% |

|

| 497,468 |

Curia Global, Inc., First Lien 2021 Term Loan, 9.003% (Term SOFR + 375 bps), 8/30/26 |

$ 422,102 |

| |

Total Diagnostic Equipment |

$422,102 |

| |

| |

| |

Dialysis Centers — 0.9% |

|

| 2,028,149 |

US Renal Care, Inc., Initial Term Loan, 10.188% (LIBOR + 500 bps), 6/26/26 |

$ 1,098,582 |

| |

Total Dialysis Centers |

$1,098,582 |

| |

| |

| |

Distribution & Wholesale — 1.9% |

|

| 250,000 |

AIP RD Buyer Corp., 2023 First Lien Incremental Term Loan, 10.153% (Term SOFR + 500 bps), 12/22/28 |

$ 244,375 |

| 594,000 |

AIP RD Buyer Corp., First Lien Term Loan B, 9.403% (Term SOFR + 425 bps), 12/22/28 |

568,013 |

| 864,328 |

Patriot Container Corp. (aka Wastequip), First Lien Closing Date Term Loan, 9.003% (Term SOFR + 375 bps), 3/20/25 |

792,660 |

| 687,750 |

SRS Distribution, Inc., 2021 Refinancing Term Loan, 8.654% (LIBOR + 350 bps), 6/2/28 |

653,117 |

| |

Total Distribution & Wholesale |

$2,258,165 |

| |

| |

| |

E-Commerce — 0.8% |

|

| 490,000 |

CNT Holdings I Corp., First Lien Initial Term Loan, 8.459% (Term SOFR + 350 bps), 11/8/27 |

$ 477,597 |

| 497,500 |

TA TT Buyer LLC, First Lien Initial Term Loan, 9.898% (Term SOFR + 500 bps), 4/2/29 |

484,441 |

| |

Total E-Commerce |

$962,038 |

| |

| |

| |

Electric-Generation — 2.0% |

|

| 954,374 |

Compass Power Generation, L.L.C., Tranche B-2 Term Loan, 9.517% (Term SOFR + 425 bps), 4/14/29 |

$ 948,112 |

| 691,793 |

Eastern Power LLC (Eastern Covert Midco LLC), Term Loan, 8.909% (LIBOR + 375 bps), 10/2/25 |

659,624 |

| 877,111 |

Hamilton Projects Acquiror LLC, Term Loan, 9.659% (Term SOFR + 450 bps), 6/17/27 |

863,954 |

| |

Total Electric-Generation |

$2,471,690 |

| |

| |

| |

Electric-Integrated — 2.3% |

|

| 1,087,433 |

Constellation Renewables LLC, Loan, 8.057% (3 Month USD LIBOR + 250.0 bps), 12/15/27 |

$ 1,081,122 |

The accompanying notes are an integral part of these financial statements.

22Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Electric-Integrated — (continued) |

|

| 1,414,988 |

PG&E Corp., Term Loan, 8.188% (LIBOR + 300 bps), 6/23/25 |

$ 1,407,028 |

| 138,095 |

Talen Energy Supply, LLC, Initial Term Loan B, 9.59% (Term SOFR + 450 bps), 5/17/30 |

135,143 |

| 111,905 |

Talen Energy Supply, LLC, Initial Term Loan C, 9.59% (Term SOFR + 450 bps), 5/17/30 |

109,513 |

| |

Total Electric-Integrated |

$2,732,806 |

| |

| |

| |

Electronic Composition — 2.5% |

|

| 1,691,356 |

Energy Acquisition LP, First Lien Initial Term Loan, 9.614% (Term SOFR + 425 bps), 6/26/25 |

$ 1,582,124 |

| 1,024,829 |

Natel Engineering Co., Inc., Initial Term Loan, 11.41% (LIBOR + 625 bps), 4/30/26 |

901,849 |

| 479,452 |

Pike Corp., 2028 Initial Term Loan, 8.268% (Term SOFR + 300 bps), 1/21/28 |

475,423 |

| |

Total Electronic Composition |

$2,959,396 |

| |

| |

| |

Engines — 1.0% |

|

| 1,300,000 |

Arcline FM Holdings LLC, Second Lien Term Loan, 13.409% (LIBOR + 825 bps), 6/25/29 |

$ 1,183,000 |

| |

Total Engines |

$1,183,000 |

| |

| |

| |

Enterprise Software & Services — 1.3% |

|

| 250,000 |

Applied Systems, Inc., 2026 First Lien Term Loan, 9.398% (Term SOFR + 450 bps), 9/18/26 |

$ 250,094 |

| 500,000 |

First Advantage Holdings LLC, First Lien Term B-1 Loan, 7.904% (LIBOR + 275 bps), 1/31/27 |

496,146 |

| 298,485 |

Polaris Newco LLC, First Lien Dollar Term Loan, 9.159% (LIBOR + 400 bps), 6/2/28 |

268,413 |

| 400,000(c) |

Quartz Acquireco, LLC, Term Loan B, 4/14/30 |

397,000 |

| 212,384 |

Skopima Consilio Parent LLC, First Lien Initial Term Loan, 9.154% (LIBOR + 400 bps), 5/12/28 |

200,205 |

| |

Total Enterprise Software & Services |

$1,611,858 |

| |

| |

| |

Finance-Credit Card — 0.4% |

|

| 500,000(c) |

Blackhawk Network Holdings, Inc., First Lien Term Loan, 6/15/25 |

$ 488,250 |

| |

Total Finance-Credit Card |

$488,250 |

| |

| |

| |

Finance-Investment Banker — 0.5% |

|

| 696,953 |

Hudson River Trading LLC, Term Loan, 8.268% (Term SOFR + 300 bps), 3/20/28 |

$ 660,146 |

| |

Total Finance-Investment Banker |

$660,146 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2323

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Food-Dairy Products — 1.4% |

|

| 1,706,250 |

Chobani LLC., 2020 New Term Loan, 8.768% (Term SOFR + 350 bps), 10/25/27 |

$ 1,690,609 |

| |

Total Food-Dairy Products |

$1,690,609 |

| |

| |

| |

Footwear & Related Apparel — 0.4% |

|

| 480,000 |

Crocs, Inc., Term Loan, 8.753% (Term SOFR + 350 bps), 2/20/29 |

$ 479,782 |

| |

Total Footwear & Related Apparel |

$479,782 |

| |

| |

| |

Gambling (Non-Hotel) — 0.7% |

|

| 398,000 |

Flutter Entertainment plc, Third Amendment 2028-B Term Loan, 8.41% (Term SOFR + 325 bps), 7/22/28 |

$ 399,327 |

| 497,494 |

Light and Wonder International, Inc., Initial Term B Loan, 8.159% (Term SOFR + 300 bps), 4/14/29 |

493,659 |

| |

Total Gambling (Non-Hotel) |

$892,986 |

| |

| |

| |

Golf — 0.6% |

|

| 700,000 |

Topgolf Callaway Brands Corp , Intial Term Loan, 8.753% (Term SOFR + 350 bps), 3/15/30 |

$ 691,188 |

| |

Total Golf |

$691,188 |

| |

| |

| |

Hotels & Motels — 1.0% |

|

| 699,500(c) |

Playa Resorts Holding B.V., 2022 Term Loan, 1/5/29 |

$ 697,606 |

| 498,750 |

Travel + Leisure Co., 2022 Incremental Term Loan, 9.159% (Term SOFR + 400 bps), 12/14/29 |

498,126 |

| |

Total Hotels & Motels |

$1,195,732 |

| |

| |

| |

Human Resources — 0.8% |

|

| 980,000 |

Ingenovis Health, Inc. (fka CCRR Parent, Inc.), First Lien Initial Term Loan, 8.91% (LIBOR + 375 bps), 3/6/28 |

$ 940,800 |

| |

Total Human Resources |

$940,800 |

| |

| |

| |

Independent Power Producer — 1.2% |

|

| 1,449,441 |

EFS Cogen Holdings I LLC, Term B Advance, 8.66% (Term SOFR + 350 bps), 10/1/27 |

$ 1,433,814 |

| |

Total Independent Power Producer |

$1,433,814 |

| |

| |

| |

Internet Content — 0.2% |

|

| 300,000(c) |

MH Sub I, LLC (Micro Holding Corp.), 2023 May Incremental First Lien Term Loan, 4/25/28 |

$ 284,812 |

| |

Total Internet Content |

$284,812 |

| |

| |

The accompanying notes are an integral part of these financial statements.

24Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Investment Companies — 0.7% |

|

| 751,184 |

Diebold Nixdorf Holding Germany GmbH, Term Loan, 11.629% (Term SOFR + 650 bps), 7/15/25 |

$ 899,542 |

| |

Total Investment Companies |

$899,542 |

| |

| |

| |

Investment Management & Advisory Services — 1.1% |

|

| 248,744 |

Allspring Buyer LLC, Initial Term Loan, 8.188% (LIBOR + 300 bps), 11/1/28 |

$ 243,536 |

| 590,996 |

Edelman Financial Engines Center LLC, First Lien 2021 Initial Term Loan, 8.904% (LIBOR + 375 bps), 4/7/28 |

568,279 |

| 492,179 |

Russell Investments US Institutional Holdco, Inc., 2025 Term Loan, 8.753% (Term SOFR + 350 bps), 5/30/25 |

467,509 |

| |

Total Investment Management & Advisory Services |

$1,279,324 |

| |

| |

| |

Lottery Services — 0.6% |

|

| 796,000 |

Scientific Games Holdings LP, First Lien Initial Dollar Term Loan, 8.421% (Term SOFR + 350 bps), 4/4/29 |

$ 769,632 |

| |

Total Lottery Services |

$769,632 |

| |

| |

| |

Machinery — 1.6% |

|

| 777,857 |

East West Manufacturing LLC, Initial Term Loan, 10.793% (Term SOFR + 575 bps), 12/22/28 |

$ 657,289 |

| 1,481,250 |

Engineered Components & Systems LLC, First Lien Initial Term Loan, 11.108% (LIBOR + 600 bps), 8/2/28 |

1,325,719 |

| |

Total Machinery |

$1,983,008 |

| |

| |

| |

Machinery-Pumps — 0.8% |

|

| 921,307 |

Circor International, Inc., Initial Term Loan, 10.654% (LIBOR + 550 bps), 12/20/28 |

$ 917,276 |

| |

Total Machinery-Pumps |

$917,276 |

| |

| |

| |

Medical Diagnostic Imaging — 0.7% |

|

| 833,820 |

US Radiology Specialists, Inc. (US Outpatient Imaging Services, Inc.), Closing Date Term Loan, 10.503% (Term SOFR + 525 bps), 12/15/27 |

$ 784,483 |

| |

Total Medical Diagnostic Imaging |

$784,483 |

| |

| |

| |

Medical Information Systems — 2.3% |

|

| 796,320 |

athenahealth Group, Inc., Initial Term Loan, 8.598% (Term SOFR + 350 bps), 2/15/29 |

$ 752,357 |

| 490,022 |

Azalea TopCo, Inc., First Lien 2021 Term Loan, 9.018% (Term SOFR + 375 bps), 7/24/26 |

464,194 |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2325

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Medical Information Systems — (continued) |

|

| 944,733 |

Gainwell Acquisition Corp., First Lien Term B Loan, 8.998% (Term SOFR + 400 bps), 10/1/27 |

$ 898,913 |

| 982,500 |

One Call Corp., First Lien Term B Loan, 10.829% (Term SOFR + 550 bps), 4/22/27 |

712,312 |

| |

Total Medical Information Systems |

$2,827,776 |

| |

| |

| |

Medical Labs & Testing Services — 2.4% |

|

| 374,063 |

Charlotte Buyer, Inc., First Lien Initial Term Loan B, 10.304% (Term SOFR + 525 bps), 2/11/28 |

$ 358,554 |

| 766,124(b) |

Envision Healthcare Corp., 2018 Third Out Term Loan, 8.648% (Term SOFR + 375 bps), 3/31/27 |

2,490 |

| 489,924 |

eResearchTechnology, Inc., First Lien Initial Term Loan, 9.768% (Term SOFR + 450 bps), 2/4/27 |

453,443 |

| 1,451,588 |

FC Compassus LLC, Term B-1 Loan, 9.494% (Term SOFR + 425 bps), 12/31/26 |

1,306,429 |

| 498,728 |

Phoenix Guarantor Inc., First Lien Tranche B-3 Term Loan, 8.654% (LIBOR + 350 bps), 3/5/26 |

483,766 |

| 491,250 |

Sound Inpatient Physicians, Inc., First Lien 2021 Incremental Term Loan, 8.273% (LIBOR + 300 bps), 6/27/25 |

319,108 |

| |

Total Medical Labs & Testing Services |

$2,923,790 |

| |

| |

| |

Medical Products — 1.0% |

|

| 1,235,707 |

NMN Holdings III Corp., First Lien Closing Date Term Loan, 9.018% (Term SOFR + 375 bps), 11/13/25 |

$ 1,059,619 |

| 213,500 |

NMN Holdings III Corp., First Lien Delayed Draw Term Loan, 9.003% (Term SOFR + 375 bps), 11/13/25 |

183,076 |

| |

Total Medical Products |

$1,242,695 |

| |

| |

| |

Medical-Biomedical & Generation — 0.8% |

|

| 983,510 |

ANI Pharmaceuticals, Inc., Initial Term Loan, 11.154% (LIBOR + 600 bps), 11/19/27 |

$ 976,748 |

| |

Total Medical-Biomedical & Generation |

$976,748 |

| |

| |

| |

Medical-Drugs — 1.8% |

|

| 1,477,992 |

Endo Luxembourg Finance Company I S.a r.l., 2021 Term Loan, 14.25% (LIBOR + 400 bps), 3/27/28 |

$ 1,129,740 |

| 442,863 |

Jazz Pharmaceuticals Public Limited Company, Initial Dollar Term Loan, 8.654% (LIBOR + 350 bps), 5/5/28 |

442,482 |

| 705,882 |

Padagis LLC, Term B Loan, 9.969% (LIBOR + 475 bps), 7/6/28 |

646,324 |

| |

Total Medical-Drugs |

$2,218,546 |

| |

| |

The accompanying notes are an integral part of these financial statements.

26Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Medical-Hospitals — 1.2% |

|

| 1,404,771 |

Quorum Health Corp., Exit Term Loan, 13.245% (Term SOFR + 825 bps), 4/29/25 |

$ 877,982 |

| 586,966 |

Surgery Center Holdings, Inc., 2021 New Term Loan, 8.858% (LIBOR + 375 bps), 8/31/26 |

584,031 |

| |

Total Medical-Hospitals |

$1,462,013 |

| |

| |

| |

Medical-Outpatient & Home Medicine — 0.6% |

|

| 374,062 |

EyeCare Partners, LLC, Incremental First Lien Term Loan, 9.753% (Term SOFR + 450 bps), 11/15/28 |

$ 283,119 |

| 495,386 |

Medical Solutions Holdings, Inc., First Lien Initial Term Loan, 8.614% (Term SOFR + 325 bps), 11/1/28 |

461,560 |

| |

Total Medical-Outpatient & Home Medicine |

$744,679 |

| |

| |

| |

Medical-Wholesale Drug Distribution — 0.3% |

|

| 450,000 |

CVET Midco 2 LP, First Lien Initial Term Loan, 9.898% (Term SOFR + 500 bps), 10/13/29 |

$ 417,281 |

| |

Total Medical-Wholesale Drug Distribution |

$417,281 |

| |

| |

| |

Metal Processors & Fabrication — 1.6% |

|

| 492,500 |

Grinding Media, Inc. (Molycop, Ltd.), First Lien Initial Term Loan, 9.199% (Term SOFR + 400 bps), 10/12/28 |

$ 469,106 |

| 736,875 |

Tiger Acquisition LLC, First Lien Initial Term Loan, 8.503% (Term SOFR + 325 bps), 6/1/28 |

701,797 |

| 780,261 |

WireCo WorldGroup, Inc., Initial Term Loan, 9.375% (LIBOR + 425 bps), 11/13/28 |

771,809 |

| |

Total Metal Processors & Fabrication |

$1,942,712 |

| |

| |

| |

Multimedia — 0.3% |

|

| 348,125 |

The E.W. Scripps Company, Tranche B-3 Term Loan, 8.018% (Term SOFR + 275 bps), 1/7/28 |

$ 330,229 |

| |

Total Multimedia |

$330,229 |

| |

| |

| |

Office Automation & Equipment — 0.7% |

|

| 882,000 |

Pitney Bowes, Inc., Refinancing Tranche B Term Loan, 9.268% (Term SOFR + 400 bps), 3/17/28 |

$ 815,850 |

| |

Total Office Automation & Equipment |

$815,850 |

| |

| |

| |

Oil-Field Services — 0.3% |

|

| 127,727 |

ProFrac Holdings II LLC, Term Loan, 12.42% (Term SOFR + 725 bps), 3/4/25 |

$ 127,009 |

| 246,875 |

ProFrac Holdings II, LLC, Delayed Draw Term A Loan, 12.148% (Term SOFR + 725 bps), 3/4/25 |

245,949 |

| |

Total Oil-Field Services |

$372,958 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2327

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Pastoral & Agricultural — 0.5% |

|

| 641,875 |

Alltech, Inc., Term B Loan, 9.268% (Term SOFR + 400 bps), 10/13/28 |

$ 622,619 |

| |

Total Pastoral & Agricultural |

$622,619 |

| |

| |

| |

Pharmacy Services — 0.3% |

|

| 345,625 |

Option Care Health, Inc., First Lien 2021 Refinancing Term Loan, 7.904% (LIBOR + 275 bps), 10/27/28 |

$ 345,085 |

| |

Total Pharmacy Services |

$345,085 |

| |

| |

| |

Physical Practice Management — 1.8% |

|

| 3,441,548 |

Team Health Holdings, Inc., Extended Term Loan, 10.403% (Term SOFR + 525 bps), 3/2/27 |

$ 2,140,213 |

| |

Total Physical Practice Management |

$2,140,213 |

| |

| |

| |

Physical Therapy & Rehabilitation Centers — 2.2% |

|

| 924,000 |

Summit Behavioral Healthcare LLC, First Lien Initial Term Loan, 10.237% (Term SOFR + 475 bps), 11/24/28 |

$ 910,140 |

| 2,184,890 |

Upstream Newco, Inc., First Lien August 2021 Incremental Term Loan, 9.41% (Term SOFR + 425 bps), 11/20/26 |

1,758,836 |

| |

Total Physical Therapy & Rehabilitation Centers |

$2,668,976 |

| |

| |

| |

Pipelines — 3.7% |

|

| 600,000 |

Brazos Delaware II, LLC, Initial Term Loan, 8.805% (Term SOFR + 375 bps), 2/11/30 |

$ 587,125 |

| 492,282(c) |

GIP III Stetson I, L.P. (GIP III Stetson II, L.P.), Initial Term Loan, 7/18/25 |

490,231 |

| 398,000 |

M6 Etx Holdings II Midco, LLC, Term Loan B, 9.682% (Term SOFR + 450 bps), 9/19/29 |

392,428 |

| 3,002,477 |

Traverse Midstream Partners LLC, Advance, 8.997% (1 Month Term SOFR + 375.0 bps), 2/16/28 |

2,963,070 |

| |

Total Pipelines |

$4,432,854 |

| |

| |

| |

Professional Sports — 0.4% |

|

| 500,000 |

Formula One Management, Ltd. First Lien Facility B Loan, 8.153% (Term SOFR + 300 bps), 1/15/30 |

$ 500,625 |

| |

Total Professional Sports |

$500,625 |

| |

| |

| |

Property & Casualty Insurance — 2.3% |

|

| 490,000 |

Asurion LLC, New B-9 Term Loan, 8.404% (LIBOR + 325 bps), 7/31/27 |

$ 446,665 |

| 1,250,000 |

Asurion LLC, Second Lien New B-4 Term Loan, 10.404% (LIBOR + 525 bps), 1/20/29 |

1,026,116 |

| 223,875 |

Asurion, LLC, New B-10 Term Loan, 9.253% (Term SOFR + 400 bps), 8/19/28 |

206,357 |

The accompanying notes are an integral part of these financial statements.

28Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Property & Casualty Insurance — (continued) |

|

| 247,409 |

Asurion, LLC, New B-11 Term Loan, 9.503% (Term SOFR + 425 bps), 8/19/28 |

$ 228,668 |

| 864,194 |

Sedgwick Claims Management Services, Inc. (Lightning Cayman Merger Sub, Ltd.), 2023 Term Loan, 8.903% (Term SOFR + 375 bps), 2/24/28 |

841,809 |

| |

Total Property & Casualty Insurance |

$2,749,615 |

| |

| |

| |

Protection-Safety — 1.6% |

|

| 1,477,500 |

APX Group, Inc., Initial Term Loan, 3.25% (LIBOR + 325 bps), 7/10/28 |

$ 1,469,652 |

| 496,203 |

Prime Security Services Borrower LLC, First Lien 2021 Refinancing Term B-1 Loan, 7.844% (LIBOR + 275 bps), 9/23/26 |

493,747 |

| |

Total Protection-Safety |

$1,963,399 |

| |

| |

| |

Publishing — 2.0% |

|

| 843,484 |

Cengage Learning, Inc., First Lien Term B Loan, 9.88% (LIBOR + 475 bps), 7/14/26 |

$ 798,463 |

| 796,000 |

Houghton Mifflin Harcourt Company, First Lien Term B Loan, 10.503% (Term SOFR + 525 bps), 4/9/29 |

702,470 |

| 988,750 |

McGraw-Hill Education, Inc., Initial Term Loan, 9.985% (LIBOR + 475 bps), 7/28/28 |

929,796 |

| |

Total Publishing |

$2,430,729 |

| |

| |

| |

Publishing-Periodicals — 0.3% |

|

| 371,250 |

MJH Healthcare Holdings LLC, Initial Term B Loan, 8.753% (Term SOFR + 350 bps), 1/28/29 |

$ 361,969 |

| |

Total Publishing-Periodicals |

$361,969 |

| |

| |

| |

Recycling — 0.6% |

|

| 835,866 |

LTR Intermediate Holdings, Inc., Initial Term Loan, 9.654% (LIBOR + 450 bps), 5/5/28 |

$ 706,306 |

| |

Total Recycling |

$706,306 |

| |

| |

| |

Retail — 5.9% |

|

| 537,687 |

Great Outdoors Group LLC, Term B-2 Loan, 8.904% (LIBOR + 375 bps), 3/6/28 |

$ 523,461 |

| 498,721 |

Harbor Freight Tools USA, Inc., 2021 Initial Term Loan, 7.904% (LIBOR + 275 bps), 10/19/27 |

479,934 |

| 1,012,667 |

Highline Aftermarket Acquisition LLC, First Lien Initial Term Loan, 9.753% (Term SOFR + 450 bps), 11/9/27 |

972,160 |

| 1,031,625 |

Michaels Cos, Inc., The Term B Loan, 9.409% (LIBOR + 425 bps), 4/15/28 |

912,472 |

| 473,603 |

Petco Health & Wellness Co., Inc., First Lien Initial Term Loan, 8.41% (Term SOFR + 325 bps), 3/3/28 |

464,368 |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2329

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Retail — (continued) |

|

| 1,031,625 |

PetSmart LLC, Initial Term Loan, 9.003% (Term SOFR + 375 bps), 2/11/28 |

$ 1,019,503 |

| 735,070 |

RVR Dealership Holdings LLC, Term Loan, 8.971% (Term SOFR + 375 bps), 2/8/28 |

662,482 |

| 916,811 |

Staples, Inc., 2019 Refinancing New Term B-2 Loan, 9.799% (LIBOR + 450 bps), 9/12/24 |

903,059 |

| 462,500 |

Torrid LLC, Closing Date Term Loan, 10.768% (Term SOFR + 550 bps), 6/14/28 |

408,156 |

| 744,347 |

White Cap Supply Holdings LLC, Initial Closing Date Term Loan, 8.903% (Term SOFR + 375 bps), 10/19/27 |

732,768 |

| |

Total Retail |

$7,078,363 |

| |

| |

| |

Rubber & Plastic Products — 1.3% |

|

| 1,127,170 |

Gates Global LLC, Initial B-3 Dollar Term Loan, 7.753% (Term SOFR + 250 bps), 3/31/27 |

$ 1,116,667 |

| 497,500 |

Gates Global LLC, Initial B-4 Dollar Term Loan, 8.653% (Term SOFR + 350 bps), 11/16/29 |

496,598 |

| |

Total Rubber & Plastic Products |

$1,613,265 |

| |

| |

| |

Schools — 1.1% |

|

| 299,250 |

Bach Finance Limited (aka Nord Anglia/Fugue Finance), First Lien Seventh Amendment Dollar Term Loan, 9.764% (Term SOFR + 450 bps), 1/31/28 |

$ 297,754 |

| 1,066,535 |

KUEHG Corp. (fka KC MergerSub, Inc.), Term B-3 Loan, 8.909% (LIBOR + 375 bps), 2/21/25 |

1,065,963 |

| |

Total Schools |

$1,363,717 |

| |

| |

| |

Security Services — 2.3% |

|

| 349,114 |

Allied Universal Holdco LLC (f/k/a USAGM Holdco LLC), Initial U.S. Dollar Term Loan, 9.003% (Term SOFR + 375 bps), 5/12/28 |

$ 328,797 |

| 600,000(c) |

Allied Universal Holdco LLC, Incremental Term Loan, 5/12/28 |

570,375 |

| 1,964,719 |

Garda World Security Corp., Term B-2 Loan, 9.444% (Term SOFR + 425 bps), 10/30/26 |

1,937,459 |

| |

Total Security Services |

$2,836,631 |

| |

| |

| |

Semiconductor Equipment — 0.9% |

|

| 1,131,365 |

Ultra Clean Holdings, Inc., Second Amendment Term B Loan, 8.904% (LIBOR + 375 bps), 8/27/25 |

$ 1,132,603 |

| |

Total Semiconductor Equipment |

$1,132,603 |

| |

| |

The accompanying notes are an integral part of these financial statements.

30Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Shipbuilding — 1.1% |

|

| 475,000(c) |

LSF11 Trinity Bidco, Inc., Term Loan, 4/26/30 |

$ 467,875 |

| 843,061 |

MHI Holdings LLC, Initial Term Loan, 10.154% (LIBOR + 500 bps), 9/21/26 |

843,061 |

| |

Total Shipbuilding |

$1,310,936 |

| |

| |

| |

Soap & Cleaning Preparation — 0.4% |

|

| 987,500 |

Knight Health Holdings LLC, Term B Loan, 10.404% (LIBOR + 525 bps), 12/23/28 |

$ 498,687 |

| |

Total Soap & Cleaning Preparation |

$498,687 |

| |

| |

| |

Steel Producers — 0.5% |

|

| 151,041(d) |

Phoenix Services International LLC, Initial Term Loan, 17.136% (Term SOFR + 200 bps), 7/29/23 |

$ 144,999 |

| 434,414 |

Phoenix Services International LLC, Roll-Up Loan (DIP), 17.136% (Term SOFR + 0 bps), 7/29/23 |

417,037 |

| 1,156,379 |

Phoenix Services International LLC, Term B Loan, 9.249% (LIBOR + 0 bps), 3/1/25 |

— |

| |

Total Steel Producers |

$562,036 |

| |

| |

| |

Telecom Services — 1.2% |

|

| 646,750 |

Patagonia Holdco LLC, Amendment No.1 Term Loan, 10.789% (Term SOFR + 575 bps), 8/1/29 |

$ 525,484 |

| 1,022,020 |

Windstream Services II, LLC, Initial Term Loan, 11.503% (Term SOFR + 625 bps), 9/21/27 |

928,505 |

| |

Total Telecom Services |

$1,453,989 |

| |

| |

| |

Telephone-Integrated — 0.4% |

|

| 500,000 |

Level 3 Financing, Inc., Tranche B 2027 Term Loan, 7.018% (Term SOFR + 175 bps), 3/1/27 |

$ 438,750 |

| |

Total Telephone-Integrated |

$438,750 |

| |

| |

| |

Textile-Home Furnishings — 0.6% |

|

| 990,000 |

Runner Buyer, Inc., Initial Term Loan, 10.654% (LIBOR + 550 bps), 10/20/28 |

$ 753,637 |

| |

Total Textile-Home Furnishings |

$753,637 |

| |

| |

| |

Theaters — 1.0% |

|

| 522,253 |

AMC Entertainment Holdings, Inc. (fka AMC Entertainment, Inc.), Term B-1 Loan, 8.107% (LIBOR + 300 bps), 4/22/26 |

$ 400,422 |

| 600,000(c) |

Cinemark USA, Inc., Term Loan, 5/24/30 |

591,750 |

| 200,000 |

Cirque du Soleil Canada Inc., Initial Term Loan, 9.148% (Term SOFR + 425 bps), 3/8/30 |

198,750 |

| |

Total Theaters |

$1,190,922 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/2331

Schedule of Investments | 5/31/23

(unaudited) (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Transport-Air Freight — 0.3% |

|

| 350,000 |

Rand Parent LLC, First Lien Term B Loan, 9.127% (Term SOFR + 425 bps), 3/17/30 |

$ 302,167 |

| |

Total Transport-Air Freight |

$302,167 |

| |

| |

| |

Transportation - Trucks — 0.4% |

|

| 492,500 |

Carriage Purchaser, Inc., Term B Loan, 9.404% (LIBOR + 425 bps), 9/30/28 |

$ 483,676 |

| |

Total Transportation - Trucks |

$483,676 |

| |

| |

| |

Transportation Services — 2.1% |

|

| 1,182,000 |

AIT Worldwide Logistics Holdings, Inc., First Lien Initial Term Loan, 9.849% (LIBOR + 475 bps), 4/6/28 |

$ 1,130,288 |

| 373,091 |

First Student Bidco Inc., 2022 Incremental Term B Loan, 8.998% (Term SOFR + 400 bps), 7/21/28 |

359,287 |

| 25,974 |

First Student Bidco Inc., 2022 Incremental Term C Loan, 8.998% (Term SOFR + 400 bps), 7/21/28 |

25,013 |

| 540,932 |

First Student Bidco, Inc., Initial Term B Loan, 8.143% (LIBOR + 300 bps), 7/21/28 |

504,335 |

| 202,206 |

First Student Bidco, Inc., Initial Term C Loan, 8.143% (LIBOR + 300 bps), 7/21/28 |

188,525 |

| 344,750 |

LaserShip, Inc., First Lien Initial Term Loan, 9.659% (LIBOR + 450 bps), 5/7/28 |

281,833 |

| |

Total Transportation Services |

$2,489,281 |

| |

| |

| |

Veterinary Diagnostics — 0.4% |

|

| 500,000(c) |

Southern Veterinary Partners LLC, First Lien Initial Term Loan, 10/5/27 |

$ 485,000 |

| |

Total Veterinary Diagnostics |

$485,000 |

| |

| |

| |

Total Senior Secured Floating Rate Loan Interests

(Cost $166,398,821) |

$151,861,209 |

| |

| |

| Shares |

|

|

|

|

|

|

| |

Common Stock — 0.4% of Net Assets |

|

| |

Passenger Airlines — 0.4% |

|

| 40,684(e) |

Grupo Aeromexico SAB de CV |

$ 459,992 |

| |

Total Passenger Airlines |

$459,992 |

| |

| |

| |

Total Common Stock

(Cost $665,000) |

$459,992 |

| |

| |

The accompanying notes are an integral part of these financial statements.

32Pioneer Floating Rate Fund, Inc. | Semiannual Report | 5/31/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Asset Backed Securities — 2.9% of Net Assets |

|

| 1,000,000(a) |

522 Funding CLO, Ltd., Series 2019-4A, Class E, 12.25% (3 Month USD LIBOR + 700 bps), 4/20/30 (144A) |

$ 870,431 |

| 1,000,000(a) |

Goldentree Loan Management US CLO 2, Ltd., Series 2017-2A, Class E, 9.95% (3 Month USD LIBOR + 470 bps), 11/28/30 (144A) |

899,378 |

| 1,000,000 |