0001935979false00019359792023-07-312023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2023

Biohaven Ltd.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| British Virgin Islands | 001-41477 | Not applicable |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

c/o Biohaven Pharmaceuticals, Inc.

215 Church Street

New Haven, Connecticut 06510

(Address of principal executive offices, including zip code)

(203) 404-0410

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Shares, no par value | BHVN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2023, Biohaven Ltd. (the “Registrant”) issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of this press release is furnished herewith as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02, and Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Registrant’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| 104 | | The cover page of this Current Report on Form 8-K formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 31, 2023

| | | | | |

| Biohaven Ltd. |

|

| By: | /s/ Matthew Buten |

| Matthew Buten |

| Chief Financial Officer |

Exhibit 99.1

Biohaven Reports Second Quarter 2023 Financial Results and Recent Business Developments

–Cash, cash equivalents, and marketable securities totaled $349.0 million as of June 30, 2023

–Announced positive interim data from BHV-7000 EEG biomarker study demonstrating evidence of central nervous system (CNS) target engagement, confirming previously reported preclinical and clinical data, and highlighting the paradigm-changing potential of BHV-7000 in the treatment of epilepsy and mood disorders

–Brain penetrant TYK2/JAK1 inhibitor, BHV-8000, advanced into Phase 1 with projected therapeutic concentrations achieved and well-tolerated profile observed to date

•Biohaven anticipates initiating a Phase 2 clinical trial in Parkinson's disease and potentially other neuroinflammatory diseases in 2024

–Advanced targeted extracellular protein degradation platform with potential to support numerous clinical candidates across a broad range of high unmet need indications

•Investigational New Drug (IND) submission for pan-IgG degrader, BHV-1300, on track for the second half of 2023 with potential to treat multiple immune-mediated diseases

•IND submission with IgA degrader for IgA nephropathy expected in the first half of 2024

–Orphan drug designation (ODD) granted by the European Commission for taldefgrobep alfa a novel anti-myostatin adnectin, for the treatment of spinal muscular atrophy (SMA)

•taldefgrobep previously received Fast-Track and ODD from the FDA

•taldefgrobep Phase 3 SMA trial expected to complete enrollment in the second half of 2023

–Type A meeting planned with FDA regarding troriluzole program in Spinocerebellar Ataxia Type 3 (SCA3) and enrollment in Phase 3 obsessive compulsive disorder (OCD) trial expected to complete at end of 2023

NEW HAVEN, Conn., July 31, 2023 /PRNewswire/ – Biohaven Ltd. (NYSE: BHVN) (Biohaven or the Company), a global clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of life-changing therapies to treat a broad range of rare and common diseases, today reported financial results for the second quarter ended June 30, 2023, and provided a review of recent accomplishments and anticipated upcoming milestones.

Vlad Coric, M.D., Chairman and Chief Executive Officer of Biohaven, commented, "In less than a year since our spin-off, the Biohaven team has driven strong and consistent progress across multiple drug development platforms. We were excited to recently report positive interim data from the ongoing EEG biomarker study of our lead Kv7 activator, BHV-7000. As expected, BHV-7000 demonstrated CNS activity consistent with what has been reported in EEG studies with other Kv7 channel activators in development that are clinically effective in treating epilepsy and with other approved anti-seizure medications. Importantly, BHV-7000 demonstrates CNS target engagement but is not associated with the typical CNS adverse events associated with other ASMs, like somnolence and fatigue. We look forward to completing the higher dose groups in this EEG study and initiating Phase 2/3 studies with our once daily, extended-release oral formulation later this year."

Dr. Coric continued, "We also shared a number of equally exciting announcements across our broader pipeline this quarter. We successfully administered the first three doses in the SAD portion of our ongoing SAD/MAD study evaluating BHV-8000, an oral, brain-penetrant, dual TYK2/JAK1 inhibitor. Potential therapeutic concentrations of BHV-8000 were achieved and BHV-8000 was well tolerated with only mild adverse events reported, reinforcing our plans to start a Phase 2 clinical trial with BHV-8000 in Parkinson's disease and potentially other neuroinflammatory diseases in 2024. In addition, we have advanced IND enabling preclinical studies and remain on track to submit an IND with our IgG degrader, BHV-1300, later this year. We also anticipate submitting an IND with our IgA degrader in 2024 as we continue to advance multiple clinical degrader candidates across a wide range of indications. We also shared key updates for our taldefgrobep alfa program (an anti-myostatin) with enrollment completion in our pivotal study in SMA and a planned Phase 2 trial initiation in obesity."

"Finally, I want to reaffirm Biohaven's commitment to the SCA3 patient community in spite of the recent disappointing regulatory decision by the FDA not to review our submitted NDA. Given the seriousness of SCA3 and consistent treatment benefits observed across multiple prespecified outcome measures, including an 80% delay in disease progression over the one-year study period with substantial risk reduction in falls, we believe that full consideration of all available data is warranted for this ultra-rare disease. Biohaven has built its foundation

around our patient mission and we plan to continue to work with regulatory agencies to try to advance troriluzole for individuals suffering from SCA3."

Second Quarter 2023 and Recent Business Highlights

•Announced positive interim data from EEG biomarker study with BHV-7000 - In July 2023, the Company provided a preliminary data update from the ongoing electroencephalogram (EEG) biomarker study for the Kv7 Channel Activator platform. Preliminary Phase 1 data confirmed evidence of target engagement in the central nervous system for subjects with projected therapeutic concentrations of BHV-7000 (based on the EC50 from preclinical models), measured by changes from baseline in EEG spectral power that occurred after dosing. These pharmacodynamic (PD) effects were similar to those reported in the literature for anti-seizure medicines (ASMs), including Kv7 activators in development that are clinically effective in treating epilepsy. BHV-7000's PD effects were also differentiated from those reported for other Kv7 activators including, specifically, the absence of increases in EEG spectral power in frequency bands associated with drowsiness and somnolence. Results from the low-dose group validate the preclinical hypothesis, confirm the Phase 1 SAD/MAD clinical data, and provide strong support for Biohaven's plans to initiate pivotal studies with BHV-7000 in focal epilepsy and bipolar disorder in the second half of 2023. The preliminary data highlight BHV-7000's differentiation and potentially favorable clinical profile compared to other ASMs, and the Company expects to present the complete EEG results by the end of the year. Additionally, new pharmacokinetic data from multiple clinical formulations being studied has now confirmed a once daily extended-release oral formulation that will be used in the Phase 2/3 clinical programs.

•Successfully dosed three cohorts with single ascending doses of oral, brain penetrant, dual TYK2/JAK1 agent, BHV-8000 - In July 2023, the Company announced that it successfully dosed three cohorts in the SAD portion of an ongoing SAD/MAD Phase 1 study evaluating brain penetrant TYK2/JAK1 agent, BHV-8000 in healthy volunteers. The ongoing Phase 1 study is designed to evaluate the safety, tolerability, pharmacokinetics (PK) and PD of single and multiple ascending doses of BHV-8000 in healthy volunteers. Based on the preliminary data available, projected therapeutic concentrations of BHV-8000 were achieved, and BHV-8000 was well tolerated with only mild adverse events reported. These data provide support for further development of BHV-8000, and the Company anticipates beginning a Phase 2 clinical trial with BHV-8000 in Parkinson's disease and potentially other neuroinflammatory diseases in 2024. The Company had previously reported initiation of dosing with BHV-8000 in the Phase 1 study at Biohaven's R&D Day in May 2023.

•Reported on continued progress observed with Biohaven's first-in-class bispecific IgG degrader, BHV-1300, as compound advances to IND filing in 2H2023 - In July 2023, the Company shared an update on BHV-1300's highly competitive safety, manufacturable and PD profile. The Company is assembling a pipeline of partially de-risked, follow-on IgG degraders as well as antigen-specific degraders providing both optionality and a sustainable output of drug candidates for several years. An IND application for BHV-1300 is on track for submission in 2023 and an IND application for Biohaven's IgA degrader on track for submission in 2024

•Type A meeting planned to comprehensively address FDA's concerns in connection with Troriluzole program in SCA3 - In July 2023, the Company announced that the FDA informed Biohaven it would not review the recently submitted New Drug Application (NDA) for troriluzole for the treatment of spinocerebellar ataxia type 3 (SCA3), an ultra-rare, genetically-defined, neurodegenerative disease associated with progressive disability, frequent falls, loss of ambulation, speech and swallowing impairment, and premature death that is the most common SCA genotype worldwide. The FDA informed Biohaven it would not review the application given that the study's primary endpoint was not met and thus, would not permit a substantive review. Biohaven is committed to working closely with the FDA to bring troriluzole to people with SCA3 as quickly as possible given no therapy is currently approved for this ultra-rare genetic disorder. Biohaven plans to request a Type A meeting to comprehensively address FDA's concerns cited in the refusal to file letter.

•EMA orphan drug designation granted for taldefgrobep alfa for the treatment of SMA: - In July 2023, the Company announced that taldefgrobep alfa received orphan drug designation (ODD) from the European Commission for taldefgrobep for the treatment of SMA. Taldefgrobep previously received Fast-

Track and ODD from the FDA. At Biohaven's R&D Day, the Company announced plans to complete randomization of approximately 180 patients in global SMA trial.

Upcoming Milestones:

Biohaven is progressing its product candidates through clinical programs in a number of common and rare disorders. The Company plans to reach significant pipeline milestones in the coming periods. Biohaven expects to:

•Announce Phase 1 EEG study results by year-end 2023: The Company expects to present complete results from its ongoing EEG study with BHV-7000 in healthy volunteers by the end of the year.

•Initiate Phase 2/3 studies with BHV-7000 in the second half of 2023: Biohaven expects to initiate pivotal trials in patients with focal epilepsy and bipolar disorder in the second half of 2023.

•Submit IND with BHV-1300, the Company's lead extracellular degrader: The Company expects to submit an IND with pan-IgG degrader BHV-1300 in the second half of 2023 and expects to initiate Phase 2 studies in 2024.

•Submit IND with selective Gd-IgA1 degrader: The Company expects to submit an IND with a Gd-IgA1 degrader indicated for IgA nephropathy in the first half of 2024.

•Initiate Phase 2 study with BHV-8000: The Company commenced Phase 1 studies with BHV-8000, an oral, brain-penetrant, dual TYK2/JAK1 inhibitor for neuroinflammatory disorders, in the first half of 2023 and expects to initiate a Phase 2 study in Parkinson's disease in 2024.

•Submit IND with BHV-2100 in chronic pain: The Company expects to submit an IND with BHV-2100, a selective TRPM3 antagonist in the Company's ion channel platform, in the second half of 2023.

•Complete enrollment in Phase 3 study of troriluzole in OCD in 2023: Two Phase 3 randomized, double-blind, placebo-controlled studies of troriluzole in OCD are expected to enroll up to 700 patients (in each trial) across nearly 200 global study sites. The Company anticipates completing enrollment in at least one Phase 3 trial by year-end 2023.

•Complete enrollment in Phase 3 clinical study of taldefgrobep alfa in SMA: The Company expects to complete enrollment in the study of taldefgrobep in SMA in the second half of 2023.

•Continue advancements across multiple neuroscience and immunoscience indications: The Company's preclinical pipeline includes a platform of bispecific degraders of extracellular proteins directed against IgG, IgA and other targets, TRPM3 and Kv7 family of ion channels, and other undisclosed targets, including those with disease-modifying potential.

Capital Position:

Cash, cash equivalents and marketable securities as of June 30, 2023 was $349.0 million, including $13.9 million of restricted cash, and excluding $40.4 million of cash payable to Biohaven Pharmaceutical Holding Company Ltd. (the Former Parent), compared to $467.9 million, including $2.5 million of restricted cash, and excluding $35.2 million of cash payable to the Former Parent, as of December 31, 20221.

Second Quarter 2023 Financial Highlights:

Research and Development (R&D) Expenses: R&D expenses, including non-cash share-based compensation costs, were $79.5 million for the three months ended June 30, 2023, compared to $177.1 million for the three months ended June 30, 2022. Non-cash share-based compensation expense was $2.5 million for the three months ended June 30, 2023, a decrease of $10.3 million as compared to the same period in 2022. Non-cash share-based

1 On May 9, 2022, the Board of Directors of the Former Parent approved and directed the Former Parent’s management to effect the spin-off of the Kv7 ion channel activators, glutamate modulation and myostatin inhibition platforms, preclinical product candidates, and certain corporate infrastructure then owned by the Former Parent in connection with the sale of the Former Parent to Pfizer. On October 3, 2022, the purchase of the Former Parent by Pfizer was consummated and the Former Parent completed the distribution to holders of its common shares of all of the outstanding common shares of Biohaven Ltd.

compensation expense was higher in the second quarter of 2022 primarily because expense allocated from the Former Parent equity plan, prior to the spin-off, was based on equity awards with higher grant date fair values.

General and Administrative (G&A) Expenses: General and administrative expenses were $14.5 million for the three months ended June 30, 2023, compared to $20.0 million for the three months ended June 30, 2022. The decrease of $5.5 million was primarily due to decreased non-cash share-based compensation costs. Non-cash share-based compensation expense was $2.2 million for the three months ended June 30, 2023, a decrease of $5.8 million as compared to the same period in 2022. Non-cash share-based compensation expense was higher in the second quarter of 2022 primarily because expense allocated from the Former Parent equity plan, prior to the spin-off, was based on equity awards with higher grant date fair values.

Other Income (Expense), Net: Other income (expense), net was a net income of $5.8 million for the three months ended June 30, 2023, compared to net expense of $0.1 million for the three months ended June 30, 2022. The increase of $5.9 million was primarily due to an increase in net investment income and an increase of $1.7 million in other income related to our transition services provided to the Former Parent, which is largely non-recurring.

Net Loss: Biohaven reported a net loss for the three months ended June 30, 2023, of $90.3 million, or $1.32 per share, compared to $203.3 million, or $5.16 per share, for the same period in 2022. Non-GAAP adjusted net loss for the three months ended June 30, 2023 was $85.7 million, or $1.25 per share, compared to $182.5 million, or $4.63 per share for the same period in 2022. These non-GAAP adjusted net loss and non-GAAP adjusted net loss per share measures, more fully described below under “Non-GAAP Financial Measures,” exclude non-cash share-based compensation charges. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the tables below. For periods prior to Biohaven's spin-off from the Former Parent on October 3, 2022 (the "Spin-Off"), net loss per share and non-GAAP adjusted net loss per share were calculated based on the 39,375,944 common shares of Biohaven distributed to the Former Parent shareholders at the time of the distribution, including common shares issued in connection with the Former Parent share options that were settled on October 3, 2022 and common shares issued in connection with the Former Parent restricted share units that vested on October 3, 2022. The same number of shares is being utilized for the calculation of basic and diluted earnings per share for all periods presented prior to the Spin-Off.

Non-GAAP Financial Measures

This press release includes financial results prepared in accordance with accounting principles generally accepted in the United States (GAAP), and also certain non-GAAP financial measures. In particular, Biohaven has provided non-GAAP adjusted net loss and adjusted net loss per share, which are adjusted to exclude non-cash share-based compensation, which is substantially dependent on changes in the market price of common shares. Non-GAAP financial measures are not an alternative for financial measures prepared in accordance with GAAP. However, Biohaven believes the presentation of non-GAAP adjusted net loss and adjusted net loss per share, when viewed in conjunction with GAAP results, provides investors with a more meaningful understanding of ongoing operating performance and can assist investors in comparing Biohaven's performance between periods.

In addition, these non-GAAP financial measures are among those indicators Biohaven uses as a basis for evaluating performance, and planning and forecasting future periods. These non-GAAP financial measures are not intended to be considered in isolation or as a substitute for GAAP financial measures. A reconciliation between these non-GAAP measures and the most directly comparable GAAP measures is provided later in this news release.

About Biohaven

Biohaven is a global clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of life-changing therapies to treat a broad range of rare and common diseases. Biohaven's experienced management team brings with it a track record of delivering new drug approvals for products for diseases such as migraine, depression, bipolar and schizophrenia. The company is advancing a pipeline of therapies for diseases, many of which have limited or no treatment options, leveraging its proven drug development capabilities and proprietary platforms, including Kv7 ion channel modulation for epilepsy and neuronal hyperexcitability, glutamate modulation for obsessive-compulsive disorder and spinocerebellar ataxia, myostatin inhibition for neuromuscular diseases and metabolic disorders, and brain-penetrant TYK2/JAK1 inhibition for neuroinflammatory disorders. Biohaven's portfolio of early- and late-stage product candidates also includes discovery research programs focused on TRPM3 channel activation for neuropathic pain, CD-38 antibody recruiting, bispecific molecules for multiple myeloma, antibody drug conjugates (ADCs), and targeted

extracellular protein degradation platform technology (MoDE™) with potential application in neurological disorders, cancer, and autoimmune diseases.

Forward-looking Statements

This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The use of certain words, including "continue", "plan", "will", "believe", "may", "expect", "anticipate" and similar expressions, is intended to identify forward-looking statements. Investors are cautioned that any forward-looking statements, including statements regarding the future development, timing and potential marketing approval and commercialization of development candidates, are not guarantees of future performance or results and involve substantial risks and uncertainties. Actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors including: the expected timing, commencement and outcomes of Biohaven's planned and ongoing clinical trials; the timing of planned interactions and filings with the FDA; the timing and outcome of expected regulatory filings; complying with applicable U.S. regulatory requirements; the potential commercialization of Biohaven's product candidates; the potential for Biohaven's product candidates to be first in class therapies; and the effectiveness and safety of Biohaven's product candidates. Additional important factors to be considered in connection with forward-looking statements are described in Biohaven's filings with the Securities and Exchange Commission, including within the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". The forward-looking statements are made as of the date of this new release, and Biohaven does not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

BIOHAVEN LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| | | | | | | | |

| Research and development | | $ | 79,490 | | | $ | 177,087 | | | $ | 142,951 | | | $ | 247,183 | |

General and administrative | | 14,521 | | | 20,023 | | | 28,842 | | | 39,700 | |

| Total operating expenses | | 94,011 | | | 197,110 | | | 171,793 | | | 286,883 | |

| Loss from operations | | (94,011) | | | (197,110) | | | (171,793) | | | (286,883) | |

Other income (expense): | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other income (expense), net | | 5,842 | | | (67) | | | 14,071 | | | (71) | |

Total other income (expense), net | | 5,842 | | | (67) | | | 14,071 | | | (71) | |

Loss before provision for income taxes | | (88,169) | | | (197,177) | | | (157,722) | | | (286,954) | |

Provision for income taxes | | 2,177 | | | 6,110 | | | 3,116 | | | 13,365 | |

Net loss | | $ | (90,346) | | | $ | (203,287) | | | $ | (160,838) | | | $ | (300,319) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share — basic and diluted | | $ | (1.32) | | | $ | (5.16) | | | $ | (2.36) | | | $ | (7.63) | |

| Weighted average common shares outstanding— basic and diluted | | 68,248,023 | | | 39,375,944 | | | 68,227,564 | | | 39,375,944 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

BIOHAVEN LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | (Unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 147,612 | | | $ | 204,877 | |

| Marketable securities | | 187,503 | | | 260,464 | |

| | | | |

| | | | |

| Prepaid expenses | | 27,654 | | | 20,945 | |

| Income tax receivable | | 8,656 | | | 46,139 | |

| Restricted cash held on behalf of Former Parent | | 40,415 | | | 35,212 | |

| Other current assets | | 22,278 | | | 19,331 | |

| Total current assets | | 434,118 | | | 586,968 | |

| Property and equipment, net | | 17,277 | | | 17,512 | |

| | | | |

| Intangible assets | | 18,400 | | | 18,400 | |

| Goodwill | | 1,390 | | | 1,390 | |

| Other non-current assets | | 35,551 | | | 37,513 | |

| Total assets | | $ | 506,736 | | | $ | 661,783 | |

| Liabilities and Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 12,039 | | | $ | 10,703 | |

| Due to Former Parent | | 40,415 | | | 35,212 | |

| Accrued expenses and other current liabilities | | 35,393 | | | 44,106 | |

| | | | |

| | | | |

| Total current liabilities | | 87,847 | | | 90,021 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Long-term operating lease liability | | 29,115 | | | 30,581 | |

| Other non-current liabilities | | 2,519 | | | 2,410 | |

| Total liabilities | | 119,481 | | | 123,012 | |

| | | | |

| | | | |

| Shareholders' Equity: | | | | |

| | | | |

| Preferred shares, no par value; 10,000,000 shares authorized, no shares issued and outstanding as of June 30, 2023 and December 31, 2022 | | — | | | — | |

| Common shares, no par value; 200,000,000 shares authorized as of June 30, 2023 and December 31, 2022; 68,316,953 and 68,190,479 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | | 617,510 | | | 615,742 | |

| Additional paid-in capital | | 21,687 | | | 13,869 | |

| Accumulated deficit | | (251,962) | | | (91,124) | |

| Accumulated other comprehensive income | | 20 | | | 284 | |

| | | | |

| Total shareholders' equity | | 387,255 | | | 538,771 | |

| Total liabilities and shareholders' equity | | $ | 506,736 | | | $ | 661,783 | |

BIOHAVEN LTD.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Amounts in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of GAAP to Non-GAAP adjusted net loss: | | | | | | | | |

| GAAP net loss | | $ | (90,346) | | | $ | (203,287) | | | $ | (160,838) | | | $ | (300,319) | |

| Add: non-cash share-based compensation expense | | 4,695 | | | 20,810 | | | 8,460 | | | 60,930 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP adjusted net loss | | $ | (85,651) | | | $ | (182,477) | | | $ | (152,378) | | | $ | (239,389) | |

| | | | | | | | |

| Reconciliation of GAAP to Non-GAAP adjusted net loss per share — basic and diluted: | | | | |

| GAAP net loss per share — basic and diluted | | $ | (1.32) | | | $ | (5.16) | | | $ | (2.36) | | | $ | (7.63) | |

| Add: non-cash share-based compensation expense | | 0.07 | | | 0.53 | | | 0.12 | | | 1.55 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP adjusted net loss per share — basic and diluted | | $ | (1.25) | | | $ | (4.63) | | | $ | (2.23) | | | $ | (6.08) | |

MoDEs is a trademark of Biohaven Therapeutics Ltd.

Investor Contact:

Jennifer Porcelli

Vice President, Investor Relations

jennifer.porcelli@biohavenpharma.com

+1 (201) 248-0741

Media Contact:

Mike Beyer

Sam Brown Inc.

mikebeyer@sambrown.com

+1 (312) 961-2502

v3.23.2

Cover

|

Jul. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

Biohaven Ltd.

|

| Document Period End Date |

Jul. 31, 2023

|

| Entity Incorporation, State or Country Code |

D8

|

| Entity File Number |

001-41477

|

| Entity Address, Address Line One |

c/o Biohaven Pharmaceuticals, Inc.

|

| Entity Address, Address Line Two |

215 Church Street

|

| Entity Address, City or Town |

New Haven

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06510

|

| City Area Code |

203

|

| Local Phone Number |

404-0410

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value

|

| Trading Symbol |

BHVN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001935979

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

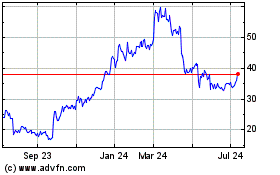

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

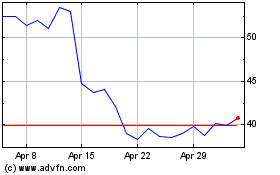

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2023 to Apr 2024