0001413754

true

Amendment No 1

0001413754

2023-05-07

2023-05-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

Amendment No. 1 to

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 7, 2023

MARIZYME,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53223 |

|

82-5464863 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 555

Heritage Drive, Suite 205, Jupiter, Florida |

|

33458 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(561)

935-9955

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not applicable. |

|

|

|

|

EXPLANATORY NOTE

This Amendment No. 1

to the Current Report on Form 8-K (this “Form 8-K/A”) of Marizyme, Inc. (the “Company”) amends the Current Report

on Form 8-K filed by the Company with the Securities and Exchange Commission (the “SEC”) on May 10, 2023 (the “Original

Report”) and is being filed to include information about the triggering of a default provision in the Company’s outstanding

10% Secured Convertible Promissory Notes (the “Convertible Notes”) by the same triggering event that was previously reported

in the Original Report.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Default Under Promissory Note

As

previously reported in a Current Report on Form 8-K filed by Marizyme, Inc. (the “Company”) on February 7, 2023, on February

6, 2023, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Walleye Opportunities

Master Fund Ltd (the “Investor”), pursuant to which the Company issued to the Investor an Unsecured Subordinated Convertible

Promissory Note (the “Walleye Note”) in the aggregate principal amount of $1,000,000 (the “Subscription Amount”)

and a Class D Common Stock Purchase Warrant (the “Warrant”) to purchase up to a number of shares of the Company’s common

stock equal to the quotient of 250% of the Subscription Amount divided by the price per share at which shares are sold under the registration

statement on Form S-1 of the Company (File No. 333-262697) (the “Public Offering Registration Statement”) registering units

to be issued in the proposed public offering of the Company (the “Warrant Shares”).

The

principal amount of the Walleye Note must be repaid in full by the Company to the holder of the Walleye Note on or before

the date that is 90 days following the issuance of the Walleye Note, or May 7, 2023 (the “Maturity Date”). The Walleye

Note bears no interest. If an event constituting an event of default under the Walleye Note occurs, including non-payment,

defaults of covenants, an adverse judgment for payment of $500,000 or more, defaults on certain other indebtedness, bankruptcy-type events,

or failure to maintain directors and officers insurance coverage of at least $1,000,000, and such event of default is not cured with

the period specified, the obligations of the Company under the Walleye Note will become subject to immediate repayment obligations.

If all obligations arising under the Walleye Note are not paid or otherwise satisfied in full on the Maturity Date, then the principal

amount of the Walleye Note shall be increased from $1,000,000 to $1,250,000.

As

of the Maturity Date, the balance under the Walleye Note was not repaid or otherwise satisfied in full. The principal amount of

the Walleye Note therefore increased from $1,000,000 to $1,250,000. The number of Warrant Shares was also increased accordingly; however,

the Public Offering Registration Statement was withdrawn as of April 21, 2023. Due to the non-payment, the obligations of the Company

under the Walleye Note became subject to immediate repayment obligations.

The

foregoing summary of the terms and conditions of each of the Securities Purchase Agreement, the Walleye Note and the Warrant does

not purport to be complete and is qualified in its entirety by reference to such documents which are filed hereto as Exhibits 10.1, 4.1

and 4.2.

Cross-Default

under Convertible Notes

As

previously reported in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed on March 24, 2023, as of May

7, 2023, the Convertible Notes had been issued in a private placement from December 2021 to August 2022. Each of the Convertible Notes

provides that any default on indebtedness of more than $100,000, other than indebtedness under the respective Convertible Notes, will

also result in default under the Convertible Notes. The Convertible Notes provide that such default is not subject to any cure period.

Due to the non-repayment of the initial principal amount of $1,000,000 under the Walleye Note by the Maturity Date, the Company also

defaulted under the Convertible Notes on the same date. The Convertible Notes provide that due to this default, the Company became obligated

to pay 135% of the outstanding principal amount under each of the Convertible Notes on the date on which the default occurred (the “Mandatory

Default Amount”). The Mandatory Default Amount may be declared due by each holder immediately. The aggregate Mandatory Default

Amount that may be due under the Convertible Notes was $21,871,631 on the date of the default, or approximately $5.3 million more than

would otherwise have been due under the Convertible Notes on the date of the default.

Under the Unit Purchase

Agreement entered into on May 27, 2021 with certain holders of several of the Convertible Notes, each of the Company’s subsidiaries

entered into a guaranty to guarantee the repayment of the Company’s obligations under the Convertible Notes, and the Company and

its subsidiaries entered into security agreements granting security interests in all of their respective assets for up to the dollar

value owed under the respective Convertible Notes. The respective Convertible Notes were issued for aggregate principal of approximately

$1.2 million. Under each Unit Purchase Agreement entered into with respect to subsequent issuances of the Convertible Notes, the Company

and its subsidiaries were obligated to enter into similar security agreements and guaranties, but did not do so.

The holders of the Convertible Notes have not exercised any remedies applicable to the Convertible Notes as of

the date of this report. In the event that the balance owed

under the Convertible Notes, including the respective Mandatory Default Amount, is not repaid upon demand, the holders of the Convertible

Notes may seek to take possession of some or all of the Company’s and its subsidiaries’ assets, force the Company and its

subsidiaries into bankruptcy proceeds, or seek other legal remedies against the Company and its subsidiaries. In such event, the Company’s

business, operating results and financial condition may be materially adversely affected.

Item

7.01 Regulation FD Disclosure.

As

previously reported by the Original Report, on May

10, 2023, the Company issued two press releases announcing certain developments relating to the Company’s intellectual property

assets, one of which was issued for distribution in the United States, and one of which was issued for distribution outside the United

States. Copies of the press release were furnished as Exhibit 99.1 and Exhibit 99.2 to the Original Report, and are also furnished

as Exhibit 99.1 and Exhibit 99.2 to this Form 8-K/A, respectively.

The

information furnished pursuant to this Item 7.01 (including the information contained in Exhibit 99.1 and

Exhibit 99.2 to this Form 8-K/A), shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Exchange

Act or the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference

in such a filing.

The

press releases furnished with this Form 8-K/A contain statements that do not relate to historical facts but are “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These

statements can generally (although not always) be identified by their use of terms and phrases such as anticipate, appear, believe, continue,

could, estimate, expect, indicate, intend, may, plan, possible, predict, project, pursue, will, would and other similar terms and phrases,

as well as the use of the future tense. Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they are based only on current beliefs, expectations and assumptions regarding the future of the business of the Company, future

plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and

many of which are outside of the Company’s control, including the risks described in the Company’s Annual Reports on Form

10-K under the heading “Risk Factors” as filed with the SEC. Actual results and financial condition may differ materially

from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking

statements in the press releases speak only as of the date thereof. Unless otherwise required by law, the Company undertakes no obligation

to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits.

(d)

| Number |

|

Description |

| 4.1 |

|

Unsecured Subordinated Convertible Promissory Note issued by Marizyme, Inc., dated February 6, 2023 (incorporated by reference to Exhibit 4.1 to Form 8-K filed on February 7, 2023) |

| 4.2 |

|

Class D Common Stock Purchase Warrant issued by Marizyme, Inc. (incorporated by reference to Exhibit 4.2 to Form 8-K filed on February 7, 2023) |

| 10.1 |

|

Securities Purchase Agreement, dated as of February 6, 2023, by and between Marizyme, Inc. and Walleye Opportunities Master Fund Ltd. (incorporated by reference to Exhibit 10.1 to Form 8-K filed on February 7, 2023) |

| 99.1 |

|

Press Release dated May 10, 2023 for distribution within the United States (incorporated by reference to Exhibit 99.1 to Form 8-K filed on May 10, 2023) |

| 99.2 |

|

Press Release dated May 10, 2023 for distribution outside the United States (incorporated by reference to Exhibit 99.2 to Form 8-K filed on May 10, 2023) |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

July 31, 2023 |

MARIZYME,

INC. |

| |

|

|

| |

By: |

/s/

David Barthel |

| |

Name: |

David

Barthel |

| |

Title: |

Chief

Executive Officer |

v3.23.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

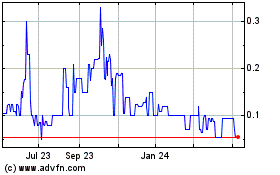

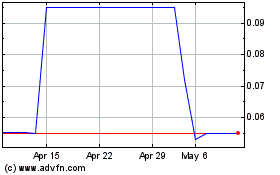

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2023 to Apr 2024