0001510518

false

--09-30

0001510518

2023-07-22

2023-07-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 22, 2023

GENUFOOD ENERGY ENZYMES CORP.

(Exact name of registrant as specified in charter)

| Nevada |

|

000-56112 |

|

68-0681158 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

1108 S. Baldwin Avenue,

Suite 107

Arcadia, California |

|

91007 |

| (Address of principal executive offices) |

|

(Zip Code) |

(855) 707-2077

Registrant’s telephone number

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 22, 2023, Shao Cheng

(Will) Wang resigned from the Chief Financial Officer position of Genufood Energy Enzymes Corp. (the “Company”), effective

immediately. Shao Cheng (Will) Wang resigned due to his personal reasons and his resignation is

not the result of any disagreement with the Company, the Board, or management, or any matter relating to the Company’s operations,

policies or practices.

On July 22, 2023, the Company’s

board of directors (the “Board”) appointed Kuang Ming (James) Tsai as the Company’s new Chief Financial Officer to fill

the vacancy created by the resignation of Shao Cheng (Will) Wang, effective July 22, 2023.

Mr. Tsai has served as our

Chief Operating Officer since July 14, 2022, and has served as a director since June 11, 2018. Mr. Tsai served as our President from June

29, 2018, to March 4, 2020, our Chief Executive Officer from June 29, 2018, to March 18, 2020, and our Chief Financial Officer from September

12, 2018, to March 18, 2020. From July 2017 to June 2018, Mr. Tsai served as the President of YAMA KAWA Bilingual Club, part of District

67 Toastmasters International. From 2010 to 2017, Mr. Tsai was retired, during which period he was an investor of securities. From 2006

to 2010, he served as the President of Blanfield Pty Ltd., an import company. Mr. Tsai received a Bachelor of Arts Degree from National

Taiwan University in 1973, majoring in Economics.

On July 22,

2023, the Board approved a form of the employment agreement with Kuang Ming (James) Tsai (the “CFO Employment Agreement”),

pursuant to which Mr. Tsai will be responsible for duties pertaining to the Chief Financial Officer, including financial reporting and

fund raising. The Company and Mr. Tsai hereby agree that the Company will pay Mr. Tsai a special one-time bonus upon successful fund

raise of the Company as a result of Mr. Tsai ’s efforts or relationships, payable upon receipt of such investment. The special

one-time bonus will be four percent (4%) of the total proceeds for any new funding up to $250,000.00, and five percent (5%) of the total

proceeds for any new funding over $250,000.00.

Additionally, as Mr. Tsai is a significant shareholder

in the Company, he will forgo any monthly cash compensation, and pursuant to the agreement, the compensation arrangement will be reviewed

quarterly, subject to adjustment as needed.

There

are no arrangements or understandings between the Company and the newly appointed executive officer or director and any other person or

persons pursuant to which each executive officer or director was appointed and there is no family relationship between or among any director

or executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer.

There

are no transactions between the Company and any newly appointed executive officer or director that are reportable pursuant to Item 404(a)

of Regulation SK. The Company did not enter into or materially amend any material plan, contract or arrangement with any newly appointed

executive officer or director in connection with his or her appointment as a director or executive officer.

The foregoing description

of the CFO Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

CFO Employment Agreement, a form of which is filed herein as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by

reference.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

Pursuant to a meeting held

by the Board of the Company on July 22, 2023, in which a quorum was present, the Board hereby has approved and adopted the amended and

restated Bylaws of the Company (the “Amended Bylaws”). The foregoing description of the Amended Bylaws does not purport to

be complete and is qualified in its entirety by reference to the full text of the Amended Bylaws, a form of which is filed herein as Exhibit

3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

GENUFOOD ENERGY ENZYMES CORP. |

| |

|

|

| Date: July 27, 2023 |

By: |

/s/ David Tang |

| |

|

David Tang |

| |

|

Chief Executive Officer |

3

Exhibit 3.1

BYLAWS

OF

GENUFOOD ENERGY ENZYMES CORP.

ARTICLE I—OFFICES

The registered office of the Corporation

in the State of Nevada shall be located in the City and State designated in the Articles of Incorporation. The Corporation may also maintain

offices at such other places within or without the State of Nevada, and within and without the United States, as the Board of Directors

may, from time to time, determine.

ARTICLE II—MEETING

OF SHAREHOLDERS

Section 1—Annual Meetings:

The annual meeting of the shareholders

of the Corporation shall be held at the time fixed, from time to time, by the Directors, for the purposes of electing directors and transacting

such other business as may properly come before the meeting. Such meeting may be held by any means then authorized by the Nevada Revised

Statutes.

Section 2—Special Meetings:

Special meetings of the shareholders

may be called by the Board of Directors, or such person or persons authorized from time to time by the Board of Directors, or as otherwise

required by law. Such meeting shall be held within or without the State of Nevada by any means then authorized by the Nevada Revised Statutes.

Section 3—Place of Meetings:

Meetings of shareholders shall be

held virtually or in person at the principal office of the Corporation, or at such other places, within or without the State of Nevada

or within or without the United States, as the Directors may from time to time designate.

Section 4—Notice of Meetings:

(a) Except

as otherwise provided by statute, written notice of each meeting of shareholders, whether annual or special, stating the time when and

place where it is to be held, shall be served either personally, by mail, or by electronic transmission not less than ten (10) or more

than sixty (60) days before the meeting, upon each shareholder of record entitled to vote at such meeting, and to any other shareholder

to whom the giving of notice may be required by law. Notice of a special meeting shall also state the purpose or purposes for which the

meeting is called, and shall indicate that it is being issued by, or at the direction of, the person or persons calling the meeting. If,

at any meeting, action is proposed to be taken that would, if taken, entitle shareholders to receive payment for their shares pursuant

to statute, the notice of such meeting shall include a statement of that purpose and to that effect. If mailed, such notice shall be deemed

to be given when deposited in the United States mail, addressed to the shareholder as it appears on the share transfer records of the

Corporation or to the current address, which a shareholder has delivered to the Corporation in a written notice. If notice is given by

electronic mail, it shall be deemed to be delivered when the notice is sent, provided that delivery receipt of such electronic transmission

is obtained.

(b) Notice

of any meeting need not be given to any person who may become a shareholder of record after the mailing of such notice and prior to the

meeting, or to any shareholder who attends such meeting, in person or by proxy, or to any shareholder who, in person or by proxy, submits

a signed waiver of notice either before or after such meeting. Notice of any adjourned meeting of shareholders need not be given, unless

otherwise required by statute.

Section 5—Quorum:

(a) Except as otherwise provided

herein, by statute, or in the Articles of Incorporation (such articles and any amendments thereof being hereinafter collectively

referred to as the “Articles of Incorporation”), at all meetings of shareholders of the Corporation, a quorum for the

transaction of any business shall be present at all meetings of shareholders of the Corporation, if the holders of a majority of the

shares entitled to vote on that matter are represented at the meeting in person or by proxy.

(b) The

subsequent withdrawal of any shareholder from the meeting, after the commencement of a meeting, or the refusal of any shareholder represented

in person or by proxy to vote, shall have no effect on the existence of a quorum, after a quorum has been established at such meeting.

(c) Despite

the absence of a quorum at any meeting of shareholders, the shareholders present may adjourn the meeting. At any such adjourned meeting

at which a quorum is present, any business may be transacted at the meeting as originally called if a quorum had been present.

Section 6—Voting:

(a) Except

as otherwise provided by statute, the Articles of Incorporation or these Bylaws, for any corporate action, other than the election of

directors, taken by vote of the shareholders, the affirmative vote of the majority of shares entitled to vote on that matter and represented

either in person or by proxy at a meeting of shareholders at which a quorum is present, shall be the act of the shareholders of the Corporation.

(b) Except

as otherwise provided by statute or by the Articles of Incorporation or these Bylaws, at each meeting of shareholders, each holder of

record of stock of the Corporation entitled to vote thereat, shall be entitled to one vote for each share of stock registered in his name

on the books of the Corporation.

(c) Each

shareholder entitled to vote or to express consent or dissent without a meeting, may do so by proxy; provided, however, so long as such

proxy is executed in writing by the shareholder himself, his authorized officer, director, employee or agent or by the signature of the

shareholder to be affixed to the writing by any reasonable means, including, but not limited to, an electronic signature, a facsimile

signature, or by his attorney-in-fact thereunto duly authorized in writing. Every proxy shall be revocable at will unless the proxy conspicuously

states that it is irrevocable and the proxy is coupled with an interest. No proxy shall be valid after the expiration of six (6) months

from the date of its execution, unless otherwise provided in the proxy. Such instrument shall be exhibited to the Secretary at the meeting

and shall be filed with the records of the Corporation. A photographic, photostatic or facsimile copy of the original proxy shall be treated

as a valid proxy, and treated as a substitution of the original proxy, so long as such transmission is a complete reproduction executed

by the shareholder. If any shareholder designates two or more persons to act as proxies, a majority of those persons present at the meeting,

or, if one is present, then that one has and may exercise all of the powers conferred by the shareholder upon all of the persons so designated

unless the shareholder provides otherwise.

(d) Unless

otherwise provided for in the Articles of Incorporation of the Corporation, any action to be taken at any annual or special shareholders’

meeting, may be taken without a meeting, without prior notice and without a vote, if a written consent is signed by shareholders holding

at least a majority of the voting power; provided that if a different proportion of voting power is required by law, the Articles of Incorporation

or these Bylaws, than that proportion of written consent shall be required. Such written consent shall be filed with the minutes of the

proceedings of the shareholders of the Corporation.

ARTICLE III—BOARD

OF DIRECTORS

Section 1—Number, Election and Term

of Office:

(a) The

number of the directors of the Corporation shall be not less than one (1) nor more than seven (7), the actual number thereof to be determined

by the Board of Directors from time to time.

(b) Except

as may otherwise be provided in the Articles of Incorporation or these Bylaws, the members of the Board of Directors of the Corporation

shall be elected by a plurality of the votes cast at a meeting of shareholders, by the holders of shares present, in person or by proxy,

that are entitled to vote in the election. A Director need not be a shareholder of the Corporation unless the Articles of Incorporation

or these Bylaws so require.

(c) Each

director shall hold office for an initial term of one (1) year, after which they shall continue to hold office until the next meeting

of the shareholders thereafter, where they shall either be reelected or their successor shall be elected and qualified, or until their

prior death, resignation or removal. Any Director may resign at any time upon written notice of such resignation to the Corporation.

Section 2—Duties and Powers:

(a) The

Board of Directors shall be responsible for the control and management of the business and affairs, property and interests of the Corporation,

and may exercise all powers of the Corporation, except such as those stated under Nevada state law, are in the Articles of Incorporation

or by these Bylaws, expressly conferred upon or reserved to the shareholders or any other person or persons named therein.

(b) The

following actions require a vote of two-thirds of the Board of Directors:

| (i) | Any action by the Corporation which incurs any form of debt in the amount of $1,500,000 USD or greater. |

| | | |

| (ii) | Any transaction by the Corporation with a value in an amount of $1,500,000 USD or greater. |

| | | |

| (iii) | Any other expenses or costs that would be incurred by the Corporation in an amount equal to $1,500,000

USD or greater. |

| | | |

| (iv) | Veto of any previous resolution passed by the Board of Directors. |

(c) Each

member of the Board of Directors shall abide by the following duties:

| (i) | Conflicts of Interest. Prior to assuming office and for the duration of their term, disclose

in writing to the Board of Directors all actual and potential Conflicts of Interest. A “Conflict of Interest” shall mean any

situation or circumstance where, in relation to the Director’s performance of obligations to or on behalf of the Corporation, the

Director’s other commitments, relationships or financial interests (1) could or could be seen to exercise an improper influence

over the objective, unbiased, and impartial exercise of their independent judgement; or (2) could or could be seen to compromise, impair,

or be incompatible with the effective performance of its obligations to or on behalf of the Corporation. |

| (ii) | Mandatory Recusal. Recuse themselves from any duty to or on behalf of the Corporation wherein

an actual Conflict of Interest, as defined above in this Article III, Section 2(c)(i), exists or a potential Conflict of Interest is reasonably

likely to occur or otherwise affect the Director’s ability to fulfill their obligations to the Corporation. |

| (iii) | Confidentiality. Refrain from disclosing, distributing, publishing, communicating or in any way

cause to be disclosed, distributed, published, or communicated in any way or at any time, Confidential Information of the Corporation

(as defined herein), or any part of Confidential Information of the Corporation, to any person, firm, corporation, association, or any

other operation or entity except on behalf of the Corporation in performance of their duties and responsibilities for the Corporation,

and then only in a fashion consistent with protecting the Confidential Information of the Corporation from unauthorized use or disclosure,

except as otherwise approved by the Corporation. |

Directors shall further refrain from

the reproduction of any Confidential Information of the Corporation except on behalf of the Corporation in their capacity as a Director

of the Company. Directors agree to take all reasonable care to avoid the unauthorized disclosure or use of any Confidential Information

of the Corporation. Directors further assume responsibility for and agree to indemnify and hold harmless the Corporation from and against

any disclosure or use of the Confidential Information of the Corporation in violation of this Article III, Section 2(b)(iii).

“Confidential Information of

the Corporation” shall mean all information disclosed to the Director in connection with and resulting from Directors’ position

as a member of the Board of Directors and Director of the Corporation, whether orally or in writing, that is designated as confidential

or that reasonably should be understood to be confidential given the nature of the information and the circumstances of disclosure. Confidential

Information includes all information material to the operations of the Corporation which cannot otherwise be learned outside the Corporation,

including but not limited to business and marketing plans, technology and technical information, product or service plans and designs

and business processes. However, Confidential Information of the Corporation does not include any information that (1) is or becomes generally

known to the public without breach of any obligation owed to the Corporation, (2) was known to the Director prior to its disclosure by

the Corporation without breach of any obligation owed to the Corporation, (iii) is received from a third party without breach of any obligation

owed to the Corporation, or (iv) was independently developed by the Director.

| (iv) | Non-Disparagement. Refrain from, directly or indirectly, making, publishing or communicating

to any person or entity or in any public forum any defamatory or disparaging remarks, comments, or statements concerning the Corporation

or its business, or any of its employees, officers, shareholders, members or advisors, or any member of the Board of Directors. Notwithstanding

the foregoing, this Section 2(b)(iv) does not, in any way, restrict or impede any Director from exercising protected rights to the extent

that such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of

competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation,

or order and Director promptly provides written notice of any such order to the Board of Directors. |

| (v) | Non-Compete. For as long as the Director holds office and for a period of twelve (12) months

following the Director’s expiration of their term, removal or resignation from the Board of Directors of the Corporation (the “Restricted

Period”), the Director shall not, directly or indirectly, (1) in any manner whatsoever engage in any capacity with any business

competitive with the Corporation’s current lines of business or any business then engaged in by the Corporation (the “Corporation’s

Business”) for the Director’s own benefit or for the benefit of any person or entity other than the Corporation; or (2) have

any interest as owner, sole proprietor, stockholder, partner, lender, director, officer, manager, employee, consultant, agent or otherwise

in any business competitive with the Corporation’s Business; provided, however, that the Director may hold, directly or indirectly,

solely as an investment, not more than one percent (1%) of the outstanding securities of any person or entity which is listed on any national

securities exchange or regularly traded in the over-the-counter market notwithstanding the fact that such person or entity is engaged

in a business competitive with the Corporation’s Business. In addition, during the Restricted Period, the Director shall not develop

any property for use in the Corporation’s Business on behalf of any person or entity other than the Corporation. |

Section 3—Annual and Regular Meetings;

Notice:

(a) A

regular annual meeting of the Board of Directors shall be held immediately following the annual meeting of the shareholders, at the place

of such annual meeting of shareholders or as otherwise designated by the Board of Directors.

(b) The

Board of Directors, from time to time, may provide by resolution for the holding of other regular meetings of the Board of Directors,

and may fix the time and place thereof.

(c) No

notice shall be required of any regular meeting of the Board of Directors and, if given, need not specify the purpose of the meeting;

provided, however that in case the Board of Directors shall fix or change the time or place of any regular meeting when such time and

place was fixed before such change, notice of such action shall be given to each director who shall not have been present at the meeting

at which such action was taken within the time limited, and in the manner set forth in these Bylaws with respect to special meetings,

unless such notice shall be waived in the manner set forth in these Bylaws.

Section 4—Special Meetings; Notice:

(a) Special

meetings of the Board of Directors shall be held whenever called by the President, the Chairman of the Board or by a majority of the directors

then in office, at such time and place as may be specified in the respective notices of waivers of notice thereof.

(b) Except

as otherwise required statute, written notice of special meetings shall be mailed directly to each director, addressed to him at his residence

or usual place of business, at least four (4) days before the day on which the meeting is to be held, or shall be sent to him at such

place by telegram, radio or cable, or shall be delivered to him personally, orally or by means of electronic transmission (including but

not limited to electronic mail), not later than the day before the day on which the meeting is to be held. If mailed, the notice of any

special meeting shall be deemed to be delivered on the second day after it is deposited in the United States mails, so addressed, with

postage prepaid. If notice is given by electronic mail, it shall be deemed to be delivered when the notice is sent, provided that delivery

receipt of such electronic transmission is obtained. Except as required by these Bylaws, a notice, or waiver of notice, need not specify

the business to be transacted at or the purpose or purposes of the meeting.

(c) Notice

of any special meeting shall not be required to be given to any director who shall attend such meeting without protesting prior thereto

or at its commencement, the lack of notice to him, or who submits a signed waiver of notice, whether before or after the meeting. Notice

of any adjourned meeting shall not be required to be given.

Section 5—Chairman:

At all meetings of the Board of Directors,

the Chairman of the Board, if any and if present, shall preside. If there shall be no Chairman, or they shall be absent, then the Vice

Chairman, if any and present, shall preside, and in his absence, a Chairman chosen by the directors shall preside.

Section 6—Quorum and Adjournments:

(a) At

all meetings of the Board of Directors, or any committee thereof, the presence of a majority of the entire Board shall be necessary and

sufficient to constitute a quorum for the transaction of business, except as otherwise provided by law, by the Articles of Incorporation,

or by these Bylaws.

(b) A

majority of the directors present at the time and place of any regular or special meeting, although less than a quorum, may adjourn the

same from time to time without notice, until a quorum shall be present. Notice of such adjourned meeting shall be given to each director

not present at time of the adjournment and, unless the time and place of the adjourned meting are announced at the time of the adjournment,

to all directors who were present at the adjourned meeting.

Section 7—Manner of Acting:

(a) At

all meetings of the Board of Directors, each director present shall have one vote, irrespective of the number of shares of stock, if any,

which they may hold.

(b) Except

as otherwise provided by statute, by the Articles of Incorporation, or by these Bylaws, the action of a majority of the directors present

at any meeting at which a quorum is present shall be the act of the Board of Directors.

(c) Unless

otherwise required by statue or the Articles of Incorporation, any action required or permitted to be taken at any meeting of the Board

of Directors or any committee thereof may be taken without a meeting if a written consent thereto is signed by all the members of the

Board of Directors, or such committee entitled to vote thereon. Such written consent shall be filed with the minutes of the proceedings

of the Board of Directors or such committee. Any such action shall be the act of the Board of Directors, or any committee thereof, and

have the same force and effect as if the same had been passed by unanimous vote at a duly called meeting of the Board or committee for

all purposes.

(d) Unless

otherwise prohibited by statute or the Articles of Incorporation, members of the Board of Directors or any committee thereof may participate

in a meeting by means of a conference telephone network or any other communications method by which all persons participating in the meeting

can hear each other. Such participation at such meeting, and each person participating in the meeting, shall sign the minutes thereof,

which may be signed in counterparts.

Section 8—Vacancies:

Unless otherwise provided for by the

Articles of Incorporation, any vacancy in the Board of Directors occurring by reason of an increase in the number of directors, or by

reason of the death, resignation, disqualification, removal or inability to act of any director, or other cause, shall be filled by an

affirmative vote of a majority of the remaining directors, though less than a quorum of the Board of the Directors or by a sole remaining

director, at any regular meeting or special meeting of the Board of Directors called for that purpose; except whenever the shareholders

of any class or classes or series thereof are entitled to elect one or more directors by the Articles of Incorporation, vacancies and

newly created directorships of such class or classes or series may be filled by a majority of the directors elected by such class or classes

or series thereof then in office, or by a sole remaining director so elected.

Section 9—Resignation:

Any director may resign at any time

by giving written notice to the Board of Directors, the President or the Secretary of the Corporation. Unless otherwise specified in such

written notice, such resignation shall take effect upon receipt thereof by the Board of Directors or such officer, and the acceptance

of such resignation shall not be necessary to make it effective.

Section 10—Removal:

Unless otherwise provided for by the

Articles of Incorporation, one or more or all the directors of the Corporation may be removed with or without cause at any time by a vote

of two-thirds of the shareholders entitled to vote thereon, at a special meeting of the shareholders called for that purpose. If a director

subject to a vote for removal has violated any of the duties set forth in Article III, Section 2(c) or has otherwise breached any fiduciary

duty owed to the Corporation under applicable law, such director may be removed by a vote of the majority of the shareholders entitled

to vote thereon, at a special meeting of the shareholders called for that purpose. If a director was elected by shareholders of any class

or classes or series thereof entitled to elect such directors, only the shareholders of that class or classes or series may participate

in the vote to remove that director.

Section 11—Compensation:

The Board of Directors may authorize

and establish reasonable compensation of the directors for their service to the Corporation by a vote of two-thirds of the disinterested

directors, taking into account attendance at any annual or special meetings of the Board of Directors, or any committee of which they

are a member. Nothing herein contained shall be construed to preclude any director from serving the Corporation in any other capacity

and receiving compensation therefor.

Section 12—Transactions with Interested

Directors or Officers:

No contract or transaction shall be

void or voidable if such contract or transaction is between the corporation and one or more of its directors or officers, or between the

Corporation and any other corporation, partnership, association, or other organization in which one or more of its directors or officers,

are directors or officers, or have a financial interest, or any other entity controlling, controlled by or under common control with,

its directors and officers, when such director or officer is present at or participates in the meeting of the Board of Directors or a

committee thereof, if:

(a) the

material facts as to his, her or their relationship or interest and as to the contract or transaction are disclosed or are known to the

Board of Directors or the committee and are noted in the minutes of such meeting, and the Board of Directors or committee in good faith

authorizes the contract or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested

Directors be less than a quorum; or

(b) the

material facts as to his, her or their relationship or relationships or interest or interests and as to the contract or transaction are

disclosed or are known to the shareholders entitled to vote thereon, and the contract or transaction is specifically approved in good

faith by vote of the shareholders; or

(c) the

contract or transaction is fair as to the Corporation as of the time it is authorized, approved or ratified, by the Board of Directors,

a committee of the shareholders; or

(d) the

fact of the common directorship, office or financial interest is not disclosed or known to the director or officer at the time the transaction

is brought before the Board of Directors for such action.

All such interested directors may be counted

when determining the presence of a quorum at the meeting of the Board of Directors or committee thereof authorizing the contract or transaction.

Section 13—Committees:

The Board of Directors may from time

to time designate from among its members one or more committees, including but not limited to committees required pursuant to the Sarbanes-Oxley

Act, and alternate members thereof, as they deem desirable, each such committee consisting of one or more members, with such powers and

authority (to the extent permitted by law and these Bylaws) as may be provided in such resolution. Each such committee shall serve at

the pleasure of the Board of Directors and, unless otherwise stated by law, the Articles of Incorporation or these Bylaws, shall be governed

by the rules and regulations stated herein regarding the Board of Directors.

ARTICLE IV—OFFICERS

Section 1—Number, Qualifications,

Election and Term of Office:

(a) The

Corporation’s officers shall have such titles and duties as shall be stated in these Bylaws or in a resolution of the Board of Directors

which is not inconsistent with these Bylaws. The officers of the Corporation shall consist of a president, secretary and treasurer, and

also may have one or more vice presidents, assistant secretaries and assistant treasurers and such other officers as the Board of Directors

may from time to time deem advisable. Any officer may hold two or more offices in the Corporation.

(b) The

officers of the Corporation shall be elected by the Board of Directors at the regular annual meeting of the Board following the annual

meeting of shareholders.

(c) Each

officer shall hold office until the annual meeting of the Board of Directors next succeeding his election, and until his successor shall

have been duly elected and qualified, subject to earlier termination by his or her death, resignation or removal.

Section 2—Resignation:

Any officer may resign at any time

by giving written notice of such resignation to the Board of Directors, or to the President or the Secretary of the Corporation. Unless

otherwise specified in such written notice, such resignation shall take effect upon receipt thereof by the Board of Directors or by such

officer, and the acceptance of such resignation shall not be necessary to make it effective.

Section 3—Removal:

Any officer may be removed, either

with or without cause, and a successor elected by the Board of Directors, at any time

Section 4—Vacancies:

A vacancy in

any office by reason of death, resignation, inability to act, disqualification, or any other cause, may at any time be filled for the

unexpired portion of the term by the Board of Directors.

Section 5—Duties of Officers:

Officers of the Corporation shall,

unless otherwise provided by the Board of Directors, each have such powers and duties as generally pertain to their respective offices

as well as such powers and duties as may be set forth in these Bylaws or may from time to time be specifically conferred or imposed by

the Board of Directors. The President shall be the chief executive officer of the Corporation. The Treasurer shall be responsible for

the accurate recording and security of corporate funds unless the Board of Directors shall designate a Chief Financial Officer to perform

the duties. The same person may serve as Treasurer and Chief Financial Officer. The Secretary shall be responsible for maintaining the

corporate records.

Section 6 - Compensation:

The compensation of the officers of

the Corporation shall be fixed from time to time by the Board of Directors or a duly appointed committee thereof.

Section 7—Sureties and Bonds:

The Corporation may require any or

all of its officers or Agents to post a bond, or otherwise, to the Corporation for the faithful performance of their positions or duties.

Section 8—Shares of Stock of Other

Corporations:

Whenever the Corporation is the holder of shares

of stock of any other corporation, any right or power of the Corporation as such shareholder (including the attendance, acting and voting

at shareholders’ meetings and execution of waivers, consents, proxies or other instruments) may be exercised on behalf of the Corporation

by the President, any Vice President, or such other person as the Board of Directors may authorize.

ARTICLE V—SHARES

OF STOCK

Section 1—Certificate of Stock:

(a) The

shares of all classes and series of stock of the Corporation may be represented by certificates or may be uncertificated.

(b) Certificated

shares of the Corporation shall be in such form as shall be adopted by the Board of Directors and shall be numbered and registered in

the order issued. They shall bear the holder’s name and the number of shares of stock and shall be signed by (i) the Chairman of

the Board or the President or a Vice President and (ii) the Secretary or Treasurer, or any Assistant Secretary or Assistant Treasurer,

and shall bear the Corporate Seal. If any officer who has signed or whose facsimile signature has been placed upon such certificate, shall

have ceased to be such officer before such certificate is issued, it may be issued by the Corporation with the same effect as if they

were such officer at the date of its issue.

(c) If

the Corporation issues uncertificated shares as provided for in these Bylaws, within a reasonable time after the issuance or transfer

of such uncertificated shares, and at least annually thereafter, the Corporation shall send the shareholder a written statement certifying

the number of shares owned by such shareholder in the Corporation.

(d) Except

as otherwise provided by law, the rights and obligations of the holders of uncertificated shares and the rights and obligations of the

holders of certificates representing shares of the same class and series shall be identical.

(e) No

certificate representing shares of stock shall be issued, and no uncertificated shall be entered, until the full amount of consideration

therefor has been paid, except as otherwise permitted by law.

(f) To

the extent permitted by law, the Board of Directors may authorize the issuance of shares for a fraction of a share of stock, which shall

entitle the holder to exercise any applicable voting rights, receive dividends and participate in liquidating distributions, in proportion

to the fractional holdings; or it may authorize the payment in cash of the fair value of a fraction of a share of stock as of the time

when those entitled to receive such fraction is determined; or it may authorize the issuance, subject to such conditions as may be permitted

by law, of scrip in registered or bearer form over the signature of an officer or agent of the Corporation, exchangeable as therein provided

for full shares of stock, but such scrip shall not entitle the holder to any rights of a shareholder, except as therein provided.

Section 2—Lost or Destroyed Certificates:

The holder of any certificate representing

shares of stock of the Corporation shall immediately notify the Corporation of any loss or destruction of the certificate representing

the same. The Corporation may issue a new certificate in the place of any certificate theretofore issued by it, alleged to have been lost

or destroyed. On production of such evidence of loss or destruction as the Board of Directors in its discretion may require, the Board

of Directors may, in its discretion, require the owner of the lost or destroyed certificate, or his legal representatives, to give the

Corporation a bond in such sum as the Board may direct, and with such surety or sureties as may be satisfactory to the Board, to indemnify

the Corporation against any claims, loss, liability or damage it may suffer on account of the issuance of the new certificate. A new certificate

may be issued without requiring any such evidence or bond when, in the judgment of the Board of Directors, it is proper so to do.

Section 3—Transfers of Shares:

(a) Transfers

or registration of transfers of shares of the Corporation shall be made on the stock transfer books of the Corporation by the registered

holder thereof, or by his attorney duly authorized by a written power of attorney; and in the case of shares represented by certificates,

only after the surrender to the Corporation of the certificates representing such shares with such shares properly endorsed, with such

evidence of the authenticity of such endorsement, transfer, authorization and other matters as the Corporation or its agent may require,

and the payment of all stock transfer taxes due thereon.

(b) The

Corporation shall be entitled to treat the holder of record of any share or shares as the absolute owner thereof for all purposes and,

accordingly, shall not be bound to recognize any legal, equitable or other claim to, or interest in, such share or shares on the part

of any other person, whether or not it shall have express or other notice thereof, except as otherwise expressly provided by law.

Section 4—Record Date:

(a) The

Board of Directors may fix, in advance, a date which shall not be more than sixty (60) days, nor less than ten (10) days, before the meeting

or action requiring a determination of shareholders, as the record date for the determination of shareholders entitled to receive notice

of, or to vote at, any meeting of shareholders, or to consent to any proposal without a meeting, or for the purpose of determining shareholders

entitled to receive payment of any dividends, or allotment of any rights, or for the purpose of any other action. If no record date is

fixed, the record date for shareholders entitled to notice of meeting shall be at the close of business on the day preceding the day on

which notice is given, or, if no notice is given, the day on which the meeting is held, or if notice is waived, at the close of business

on the day before the day on which the meeting is held.

(b) A

determination of shareholders entitled to notice of or to vote at a shareholders’ meeting is effective for any adjournment of the meeting

unless the Board of Directors fixes a new record date for the adjourned meeting.

ARTICLE VI—DIVIDENDS

(a) Subject

to applicable law, dividends may be declared and paid out of any funds available therefor, as often, in such amounts, and at such time

or times as the Board of Directors may determine.

(b) Shares

of one class or series may not be issued as a share dividend to shareholders of another class or series unless:

| (i) | so authorized by the Articles of Incorporation; |

| (ii) | a majority of the shareholders of the class or series to

be issued approve the issue; or |

| (iii) | there are no outstanding shares of the class or series of

shares that are authorized to be issued. |

ARTICLE VII—FISCAL

YEAR

The fiscal year of the Corporation

shall be September 30 and may be changed by the Board of Directors from time to time, subject to applicable law.

ARTICLE VIII—CORPORATE

SEAL

The corporate seal, if any, shall

be in such form as shall be prescribed and altered, from time to time, by the Board of Directors. The use of a seal or stamp by the Corporation

on corporate documents is not necessary and the lack thereof shall not in any way affect the legality of a corporate document.

ARTICLE IX—PERSONAL

LIABILITY AND INDEMNIFICATION

Section 1—Personal Liability:

No director or officer shall be personally

liable to the Corporation or its shareholders for damages for breach of fiduciary duty as a director or officer of the Corporation except

for his acts or omissions involving intentional misconduct, fraud, a knowing violation of law or the payment of distributions in violation

of Section 78.300 of the Nevada Revised Statutes, or any successor statute, and the Corporation may purchase insurance or make other financial

arrangements for the payment of any liability or expenses assessed against such director of officer of the Corporation including his attorneys’

fees and costs of litigation. The Corporation may also purchase insurance or make other financial arrangements for the payment of any

liability or expenses assessed against one of its directors, officers, employees or agents arising out of his services as a director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise at the request of the Corporation.

Section 2—Indemnification:

(a) Any

person made a party to any action, suit or proceeding, by reason of the fact that their, their testator or intestate representative is

or was a director, officer or employee of the Corporation, or of any corporation in which they served as such at the request of the Corporation,

shall be indemnified by the Corporation against the reasonable expenses, including attorneys’ fees, actually and necessarily incurred

by them in connection with the defense of such action to the fullest extent of the law, except in relation to matters as to which it shall

be adjudged in such action, suit or proceedings, or in connection with any appeal therein that such officer, director or employee is liable

for gross negligence or misconduct in the performance of his duties.

(b) The

foregoing right of indemnification shall not be deemed exclusive of any other rights to which any officer or director or employee may

be entitled apart from the provisions of this section.

(c) The

amount of indemnification to which any officer or any director may be entitled shall be fixed by the Board of Directors, except that in

any case where there is no disinterested majority of the Board available, the amount shall be fixed by arbitration pursuant to the then

existing rules of the American Arbitration Association.

ARTICLE X—AMENDMENTS

Section 1—By Shareholders:

All Bylaws of the Corporation shall

be subject to alteration, amendment or repeal, and new Bylaws may be made, by the affirmative vote of shareholders holding of record in

the aggregate at least a majority of the outstanding shares of stock entitled to vote in the election of directors at any annual or special

meeting of shareholders, provided that the notice or waiver of notice of such meeting shall have summarized or set forth in full therein,

the proposed amendment, and even though all Bylaws may also be altered, amended or repealed, or new Bylaws made, by the Board of Directors.

Section 2—By Directors:

The Board of Directors shall have

power to make, adopt, alter, amend and repeal, from time to time, Bylaws of the Corporation.

14

Exhibit 10.1

EMPLOYMENT CONTRACT AGREEMENT

PARTIES

This Employment Contract Agreement (hereinafter referred to as the

“Agreement”) is entered into on 開會日期 (the “Effective Date”), by and between GEEC

, with an address of 1108 S. Baldwin Ave Suite 107, Arcadia, CA 91007 (hereinafter referred to as the “Company”), and Kuang

Ming Tsai (aka James), with an address of Tsai’s address (hereinafter referred to as the “Employee”) (collectively

referred to as the “Parties”).

DUTIES AND RESPONSIBILITIES

| - | Employee is hereby appointed as Company’s Chief Financial Officer. |

| - | During the employment period, the Employee shall have the responsibility

to perform the following duties: |

| 1. | Be responsible for duties pertaining to Chief Financial Officer, including

financial reporting |

PAY AND COMPENSATION

| - | The Parties hereby agree that in recognition

of Company’s financial status, with the Employee also a significant shareholder in

the Company, Employee will forgo any monthly cash compensation. |

| - | Employee’s monthly cash compensation

situation will be reviewed quarterly, subject to adjustment as needed. |

| - | The Parties hereby agree that the Employer

will pay the Employee a special one-time bonus upon successful fund raise as result of Employee’s

efforts or relationship, payable upon investor’s fund is in the bank. |

| o | The Parties agree the special one-time

bonus will be up to 4% for new funding up to $250,000, and 5% for new fundings over $250,000. |

| o | New funding is defined by new funding by

new investor to the Company. |

BENEFITS

| - | The Parties hereby agree that the Employee shall receive no benefits. |

WORKING HOURS AND LOCATION

| - | The Employee agrees that he/she will be working hours as needed. |

TERMs OF AGREEMENT

| - | This Agreement shall be effective on the date of signing this Agreement

(hereinafter referred to as the “Effective Date”). |

TERMINATION

| - | This Agreement may be terminated in case the following occurs: |

| 1. | Immediately in case one of the Parties breaches this Agreement. |

| 2. | At any given time by providing a written notice to the other party

30 days prior to terminating the Agreement. |

CONFIDENTIALITY

| - | All terms and conditions of this Agreement

and any materials provided during the term of the Agreement must be kept confidential by

the Employee, unless the disclosure is required pursuant to process of law. |

| - | Disclosing or using this information for any

purpose beyond the scope of this Agreement, or beyond the exceptions set forth above, is

expressly forbidden without the prior consent of the Employer. |

INTELLECTUAL PROPERTY

| - | Hereby, the Employee agrees that any intellectual

property provided to him/her by the Employer will remain the sole property of the Employer

including, but not limited to, copyrights, patents, trade secret rights, and other intellectual

property rights associated with any ideas, concepts, techniques, inventions, processes, works

of authorship, Confidential Information or trade secrets. |

LIMITATION OF LIABILITY

| - | In no event shall the Employer nor the Employee

be individually liable for any damages for breach of duty by third parties, unless the Employer’s

or Employee’s act or failure to act involves intentional misconduct, fraud, or a knowing

violation of the law. |

GOVERNING LAW

| - | This Agreement shall be governed by and construed

in accordance with the laws of California. |

ATTORNEY FEES

| - | In the event of any dispute between the parties

concerning the terms and provisions of this Agreement, the party prevailing in such dispute

shall be entitled to collect from the other party all costs incurred in such dispute, including

reasonable attorneys’ fees. |

ENTIRE AGREEMENT

| - | This Agreement contains the entire agreement

and understanding among the Parties hereto with respect to the subject matter hereof, and

supersedes all prior agreements, understandings, inducements and conditions, express or implied,

oral or written, of any nature whatsoever with respect to the subject matter hereof. The

express terms hereof control and supersede any course of performance and/or usage of the

trade inconsistent with any of the terms hereof. |

AMENDMENTS

| - | The Parties agree that any amendments made

to this Agreement must be in writing where they must be signed by both Parties to this Agreement. |

| - | As such, any amendments made by the Parties

will be applied to this Agreement. |

SIGNATURE AND DATE

| - | The Parties hereby agree to the terms and conditions set forth in this

Agreement and such is demonstrated throughout by their signatures below: |

| |

|

|

| EMPLOYEE |

|

EMPLOYER |

| |

|

|

| Name: |

|

|

Name: |

|

| |

|

|

| Signature: |

|

|

Signature: |

|

| |

|

|

| Date: |

|

|

Date: |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

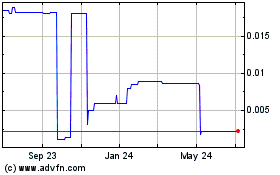

Genufood Energy Enzymes (PK) (USOTC:GFOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

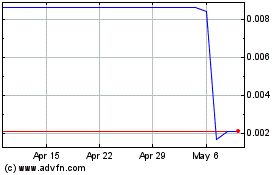

Genufood Energy Enzymes (PK) (USOTC:GFOO)

Historical Stock Chart

From Apr 2023 to Apr 2024