US Index Futures rose in premarket trading on Friday as traders

eyed recent corporate earnings results and the Dow Jones on course

to extend its bullish streak for a 10th straight session.

By 6:55 AM, Dow Jones (DOWI:DJI) futures were up 38 points,

or 0.11%. S&P 500 futures were up 0.26%, while Nasdaq-100

futures were up 0.49%. The 10-year Treasury yield is at

3.843%.

European markets operate without a single direction, with an eye

on quarterly results and elections in Spain.

In June, UK retail sales increased by 0.70% from the previous

month, beating expectations of 0.20%. In the annual

comparison, there was a drop of 1.0%, less than the estimated

retraction of 1.5%. These weaker economic data indicate the

possibility of a less restrictive monetary policy in the country

and in Europe. Meanwhile, shares in Swedish steelmaker SSAB

fell more than 1% due to a lower-than-expected second-quarter

profit and warning of a slowdown in European steel demand in the

third quarter.

On Friday’s American economic agenda, investors will follow the

disclosure of the number of oil rigs by Baker Hughes at 1:00

pm.

In commodities markets, West Texas Intermediate crude for

September is up 1.12% at $76.50 a barrel. Brent crude for

September is up 1.12% near $80.53 a barrel. Iron ore futures

traded in Dalian, China, fell 0.12% to $117.86 a tonne in a week

marked by wide swings on weak data from China.

At Thursday’s close, the Dow closed up 163.97 points, or 0.47%,

at 35,225.18 points. The S&P 500 fell 30.85 points, or

0.68%, to 4,354.87 points. The Nasdaq Composite dropped 294.71

points or 2.05% to 14,063.31 points. The weekly Unemployment

Insurance data showed greater resilience in the job market and

helped to raise expectations for further US rate hikes.

Ahead of Friday’s corporate results, traders are awaiting

reports from American Express (NYSE:AXP), Schlumberger (NYSE:SLB),

Huntington Bancshares (NASDAQ:HBAN), Roper Technologies

(NASDAQ:ROP), AutoNation (NYSE:AN), Autoliv (NYSE:ALV), IPG

(NYSE:IPG), among others.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT)

– Leading artificial intelligence companies have agreed to comply

with safeguards brokered by the Joe Biden

administration. Commitments include security testing by

independent experts, public reporting on vulnerabilities, and use

of digital watermarking to detect deepfakes. Some experts call

for tighter regulations, while the Senate plans to legislate AI

regulation. The White House is looking at ways to ensure that

AI products are safe before launch, while other countries are also

looking at regulations to govern AI.

Apple (NASDAQ:AAPL) – Apple is late to the

buy now, pay later (BNPL) shopping market, but is quickly gaining

ground. Nearly 20% of users tried Apple Pay Later during the

first three months, beating offers from more established

competitors like PayPal (NASDAQ:PYPL) and Afterpay. Brand

trust and ease of use are key factors that benefit Apple in this

competitive industry.

Alphabet (NASDAQ:GOOGL) – YouTube,

Google’s video streaming service, has raised prices on its premium

plans in the US for the first time since 2018. The YouTube Premium

plan is now priced at $13.99/month and $139.99/year. Older

members get three months at the old price. YouTube Music has

also increased to $10.99/month.

Microsoft (NASDAQ:MSFT) – Microsoft has

faced a new antitrust complaint from German company alfaview over

Teams, part of Office, and is under the radar of the European

Commission. Alfaview claims the integration gives an unfair

advantage, calling for a formal investigation. Microsoft has

offered solutions, but regulators want more price cuts.

Amazon (NASDAQ:AMZN) – Soon, Whole Foods

Market customers will be able to pay with just the palm of their

hand, thanks to Amazon One payment technology. Amazon plans to

expand this biometric solution to all of the grocery store’s 500+

locations by the end of 2023, offering ease and privacy for

customers. The technology is already present in more than 200

stores and has aroused interest from other potential partners, such

as Panera Bread and the Colorado Rockies stadium.

Taiwan Semiconductor

Manufacturing (NYSE:TSM) – President Joe Biden faces

a significant setback in his strategy to bring high-tech jobs to

the U.S., as Taiwan Semiconductor Manufacturing has delayed

production at its Arizona plant until 2025. The delay is cited due

to a lack of skilled labor and costs in the U.S. The chipmaker

is one of the main pieces of the Bidenomic push to revitalize

semiconductor manufacturing in the country, but the delay could

affect its political image in a key state in next year’s

elections.

Tesla (NASDAQ:TSLA) – Detroit automakers

and the United Auto Workers union will not alone negotiate terms

for the transition to electric vehicles. Tesla and Toyota (TM)

will also have hidden roles in the talks. Tesla’s

profitability per vehicle outpaces that of traditional automakers,

thanks to advantages in labor, distribution and technology

costs. Competition with Tesla drives the search for

“competitive” deals to transition to electric vehicles in the

US.

Carvana (NYSE:CVNA) – Shares were down

0.7% in premarket trade on Friday. On Thursday, analysts at

Piper Sandler downgraded the stock from “Overweight” to “Neutral,”

followed by a downgrade from “Sector Perform” to “Underperform” by

RBC Capital Markets. As a result, shares of the used car

retailer fell 16% on Thursday.

Delta Air Lines (NYSE:DAL) – US

Transportation Secretary Pete Buttigieg is investigating why Delta

Air Lines passengers sat for hours on a plane on the Las Vegas in

extreme heat. Delta is reviewing the incident and offering

compensation to affected passengers.

Ryanair Holdings (NASDAQ:RYAAY) – Ryanair

plans to base up to 30 new Boeing 737 MAX aircraft at major

airports in Ukraine and carry more than five million passengers a

year when the fighting eventually ends. The Irish airline

plans to expand its operations to include Kiev, Lviv and Odesa

airports, connecting them to more than 20 European capitals with

600 weekly flights. The company expects the 30 new

Ukraine-based jets to be worth more than $3 billion. Ryanair

has committed to resuming low-fare flights to Ukraine eight weeks

after the reopening of Ukrainian airspace.

Sirius XM Holdings (NASDAQ:SIRI) – Shares

in Sirius XM Holdings were down 9% in premarket trading on Friday,

after rising 42% on Thursday, driven by an apparent combination of

short coverage, the unfolding of a spread trade involving Liberty

SiriusXM and a potential buy related to a Nasdaq 100 index

rebalancing.

Arista Networks (NYSE:ANET) – Exane BNP

Paribas analyst Karl Ackerman began coverage of Arista stock with a

“Buy” rating and a price target of $210, indicating a 19% upside

potential. He sees the company benefiting from increasing

investments in AI by the cloud giants and projects solid sales

growth through 2025.

Goldman Sachs (NYSE:GS) – Goldman Sachs

has added senior executive Tom Montag to the board, seeking to

reverse an ill-fated foray into retail banking. Montag, an

ally of CEO David Solomon, will reinforce the bank’s refocusing on

the core businesses of investment banking, trading and asset

management.

JPMorgan Chase (NYSE:JPM) – A $1.4 billion

fund from JPMorgan Asset Management is bullish on Asian chip

stocks, expecting them to match US counterparts. Artificial

intelligence growth in Asia could drive valuations through the

second half of 2023. Asian companies are bouncing back in the AI

race after Nvidia’s upbeat outlook. Korean vendors can

benefit from potential DRAM shortages in 2024, while future

earnings estimates for Asian semiconductors have increased

significantly relative to those in the US.

Bain Capital (NYSE:BCSF) – Bain Capital

has raised its offer to acquire SoftwareOne Holding AG by

approximately CHF 3.2 billion ($3.72 billion), offering around CHF

20 per share, a premium of 43.6% over the last

close. SoftwareOne’s board rejected an earlier offer from Bain

last month. The Swiss company assists in the management of

software purchases from large suppliers.

Nasdaq (NASDAQ:NDAQ) – The rebalancing of

the Nasdaq 100 is adding complexity to stock trading with a number

of options expiring on Friday. The index will undergo changes

to reduce the dominance of technology megacapitals, impacting the

market with an estimated US$ 60 billion in transactions.

Pfizer (NYSE:PFE) – A tornado damaged a

Pfizer plant in Rocky Mount, NC, raising the threat of critical

drug shortages. The facility is one of the largest producers

of sterile injectable medications in the US. Experts warn that

shortages of existing products could be made worse by

damage. Pfizer is assessing the impact on production after the

tornado. The full extent of impact will depend on the degree

of damage to production lines.

Eli Lilly (NYSE:LLY) Novo

Nordisk (NYSE:NVO) – Morgan

Stanley (NYSE:MS) increased its annual weight loss

drug sales forecast to $77 billion due to high demand driven by

interest in social media. Analysts predict an expanding

market, with emphasis on the injectable drug Wegovy, from Novo

Nordisk, which also benefits diabetic patients. Pharmaceutical

companies such as Eli Lilly and Novo Nordisk will be the main

beneficiaries, while other companies are developing drugs to enter

the market.

Lowe’s (NYSE:LOW), Home

Depot (NYSE:HD) – Lowe’s is ramping up its same-day

delivery strategy to compete with Home Depot. Going forward,

all Lowe’s US customers will have access to the same day delivery

option for orders placed before 2pm. This initiative is part

of Lowe’s Total Home strategy to enhance its digital capabilities

and become an omnichannel retailer. Home Depot has offered

same-day delivery for five years and has expanded those

capabilities by partnering with Walmart’s GoLocal.

Macy’s (NYSE:M) – Macy’s is revamping its

private label brands to increase sales and improve

margins. The “On 34th” collection is the first label under the

new strategy. The company plans to upgrade all 24 existing

private labels over the next 2 1/2 years. Shares are down 21%

this year, reflecting concerns about sluggish earnings and margin

growth.

AMC Entertainment (NYSE:AMC) – AMC has

said it will not proceed with its controversial rollout of

premium-priced seating in its theaters. The testing of the

pricing plan, which charged more for better seats, will end soon

and will not roll out across the country. The company plans

instead to lure patrons to the theater’s front row by investing in

more comfortable seats with recliners. The move was taken

after some online outrage when the plans were announced. The

stock is up 6.4% this year but has fallen 59% over the last 12

months.

Chewy (NYSE:CHWY) – Chewy announced

Thursday that its chief financial officer, Mario Marte, has decided

to retire effective July 28. As the specialty retailer looks

for a permanent CFO, Chief Accounting Officer Stacy Bowman has been

appointed as the interim CFO. Chewy shares are flat premarket

after closing down 7.5% on Thursday.

Earnings

Intuitive Surgical (NASDAQ:ISRG) –

Intuitive Surgical beat expectations for quarterly sales and

earnings, but its stock declined as the base of da Vinci robotic

surgery installed fell short of forecasts. The company

increased its global installs by 12.5% to 8,042, but expectations

were higher. Sales of instruments and disposable accessories

had a strong growth of 20%. Sales advanced 15% overall to

$1.76 billion, and adjusted earnings increased nearly 25% to $1.42

per share. However, Intuitive Surgical did not provide a

perspective for the future.

CSX (NASDAQ:CSX) – Rail operator CSX

reported second-quarter revenue of $3.69 billion, down 3%

year-over-year and below Wall Street expectations. The company

attributed the shortfall to lower fuel and coal prices. As a

result, the stock is down 4.9% in premarket trading on Friday.

Knight-Swift Transportation (NYSE:KNX) –

Knight-Swift Transportation announced a 21% drop in second-quarter

revenue due to weaker demand in its trucking business. As a

result, Knight-Swift shares were down 5.3% in premarket trade.

Newmont Corp (NYSE:NEM) – Newmont missed

second-quarter earnings estimates due to reduced production and

higher costs due to the strike at its Penasquito, Mexico mine and

wildfires in Quebec. The company withdrew its annual forecast

for the mine and expects cost improvements by the end of the

year. Quarterly gold production fell 17.3% to 1.24 million

ounces, and total forecast annual production is 5.7 million to 6.3

million ounces. Its total cost of holding gold increased

nearly 23% to $1,472 per ounce for the quarter. Adjusted

earnings per share were 33 cents, below analysts’ average estimate

of 44 cents.

Abbott Laboratories (NYSE:ABT) – Abbott

Laboratories beat quarterly earnings expectations as recovery in

surgical procedure volumes boosted demand for medical

devices. Adjusted earnings were $1.08 per share, above the

average analyst estimate of $1.05. Abbott maintained its

annual earnings per share forecast of between $4.30 and $4.50.

Kenvue (NYSE:KVUE) – Kenvue, Johnson &

Johnson’s former consumer health unit, forecast full-year profit

above Wall Street estimates, buoyed by resilient demand for skin

care and self-care products such as Neutrogena and

Tylenol. However, shares fell on Thursday after J&J

announced a possible public offering to sell its stake. The

company’s quarterly net sales increased 5.4%, but the adjusted

gross profit margin declined due to factors including a strong

dollar and higher labor and raw material costs.

Philip Morris International (NYSE:PM) – Philip

Morris beat quarterly profit expectations, driven by rising demand

for its smokeless products such as Zyn and IQOS, and falling

tobacco and labor costs. The company raised its full-year

earnings forecast, with second-quarter adjusted earnings per share

hitting $1.60, beating analysts’ estimates. IQOS devices and

Zyn nicotine pouches helped protect the company’s margins.

Capital One Financial (NYSE:COF) – Capital One

reported second-quarter earnings that beat analyst estimates,

driven by higher borrowing income due to rising benchmark lending

rates. Net interest income increased 9% to $7.11

billion. Total deposits increased 12% to $343.71 billion in

the second quarter. The bank earned $3.52 per share on an

adjusted basis, beating analyst expectations of $3.23 per

share.

Blackstone (NYSE:BX) – Blackstone Inc reached

the $1 trillion mark in alternative investment management assets

but faced a 39% drop in distributable earnings in the second

quarter. The company pursues growth opportunities in a variety

of areas, including private credit and insurance, infrastructure,

energy transition and wealth management. Blackstone is also

establishing banking partnerships and expanding its products to

retail and wealthy investors.

PPG Industries (NYSE:PPG) – PPG Industries

reported second-quarter results that beat Wall Street estimates and

raised its full-year profit forecast. However, management

warned of continued “lukewarm” industrial production and falling

home sales.

SAP (NYSE:SAP) – SAP reported

second-quarter financial results that were below Wall Street

estimates. Despite CEO Christian Klein emphasizing the

potential of generative AI, revenue and adjusted profit were below

consensus. SAP also slightly lowered its full-year cloud

revenue forecast. The company is investing in generative AI

software and has made investments in language model

companies. US-listed SAP shares fell 6.3% to $133.93 on

Thursday.

The Travelers (NYSE:TRV) – The Travelers

posted a second-quarter loss of $14 million, or seven cents a

share, down sharply from the $551 million in revenue, or $2.27 a

share, posted in the year-ago quarter. This was mainly due to

multiple and intense wind and hail storms in different

states. In the second quarter, US$ 1.5 billion was disbursed

in damages resulting from catastrophes, double the amount

registered in the same period of the previous year (US$ 746

million).

Scholastic Corp (NASDAQ:SCHL) – Scholastic

beat earnings per share expectations and announced a $100 million

increase in its share repurchase program. Scholastic posted

earnings per share of $2.26, above a FactSet analyst’s $1.70

forecast. However, revenue came in below expectations, coming

in at $428.3 million, compared to analysts’ forecast of $541.8

million.

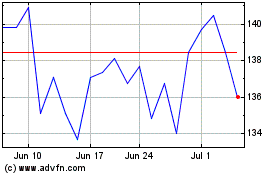

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

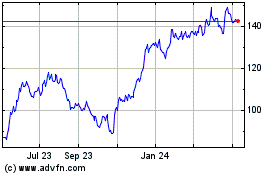

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024