UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

(Amendment

No. ___)

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

| ☒ |

Definitive

Information Statement |

Pacific

Ventures Group, Inc.

(Name

of Registrant as Specified In Its Charter)

Copies

of communications to:

Shannon

Masjedi, Chief Executive Officer

Pacific

Ventures Group, Inc.

117

West 9th Street, Suite 316

Los

Angeles, California 90015

Telephone:

(310) 392-5606

| Payment

of Filing Fee (Check the appropriate box): |

| |

|

|

|

| |

☒ |

No fee required. |

| |

|

|

| |

☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

|

|

|

| |

|

1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

|

| |

|

2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

|

| |

|

3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined): |

| |

|

|

|

| |

|

4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

|

| |

|

5) |

Total

fee paid: |

| |

|

|

|

| |

☐ |

Fee paid previously with preliminary materials. |

| |

|

|

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

|

| |

|

1) |

Amount

Previously Paid: |

| |

|

|

|

| |

|

2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

|

| |

|

3) |

Filing

Party: |

| |

|

|

|

| |

|

4) |

Date

Filed: |

PACIFIC

VENTURES GROUP, INC.

117

West 9th Street, Suite 316

Los

Angeles, California 90015

| To: |

The

Holders of the Common Stock of Pacific Ventures Group, Inc. |

| |

Re: |

Action

by Written Consent in Lieu of a Special Meeting of Shareholders |

This

Information Statement is furnished by the Board of Directors of Pacific Ventures Group, Inc., a Delaware corporation (the “Company”),

to holders of record of the Company’s common stock, $0.001 par value per share (the “Common Stock”), at the close of

business on June 27, 2023. The purpose of this Information Statement is to inform the Company’s shareholders of an action taken

by the written consent of the holders of a majority of the Company’s voting stock, dated as of June 27, 2023, in lieu of a special

meeting of shareholders, to wit:

The

authorization and approval of a reverse split of the issued and outstanding shares of the Company’s Common Stock, including shares

of Common Stock reserved for issuance, in a ratio to be determined by the Company’s Board of Directors, not to exceed a one-for-two-hundred-fifty

(1:250) basis (the “Reverse Split”).

The

foregoing actions were approved on June 27, 2023, by the Company’s Board of Directors. In addition, on June 27, 2023, the holder

of 90.28% of the voting power of the Company’s outstanding voting securities (the “Consenting Stockholder”), as of

the record date, approved the foregoing action. The number of shares voting for the Reverse Split was sufficient for approval.

Section

228 of Title 8 of the Delaware General Corporation Law provides, in part, that any action required or permitted to be taken at a meeting

of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders

holding at least a majority of the voting power, except that if a different proportion of voting power is required for such an action

at a meeting, then that proportion of written consents is required.

In

order to eliminate the costs and management time involved in obtaining proxies and, in order to effect the above action as early as possible

in order to accomplish the purposes of the Company as herein described, the Board of Directors consented to the utilization of, and did

in fact obtain, the written consent of the Consenting Stockholder who owns shares representing a majority of the Company’s voting

stock.

The

entire cost of furnishing this Information Statement will be borne by the Company. The Company may request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Company’s

Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

WE

ARE NOT ASKING YOU FOR A PROXY,

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

No

action is required by you. The accompanying Information Statement is furnished only to inform the Company’s shareholders of the

action described above before it takes place, in accordance with Rule 14c-2 of the Securities Exchange Act of 1934. This Information

Statement will be first distributed to you on or about July 19, 2023.

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

Shannon Masjedi |

| |

Shannon

Masjedi |

| |

Chief

Executive Officer and Director |

July

19, 2023

Los

Angeles, California

PACIFIC

VENTURES GROUP, INC.

WE

ARE NOT ASKING YOU FOR A PROXY,

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

INFORMATION

STATEMENT

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS AND NO SHAREHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF THE COMPANY’S COMMON STOCK.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THERE ARE NO DISSENTERS’ RIGHTS WITH RESPECT TO

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT.

Information

Statement Pursuant to Section 14C of the Securities Exchange Act of 1934

This

Information Statement is being filed by Pacific Ventures Group, Inc. (the “Company”) with the Securities and Exchange Commission

(the “SEC”) on July 19, 2023, based upon the Unanimous Written Consent of the Board of Directors dated June 27, 2023

(the “Board Consent”), and the consent of the holder of a majority of outstanding shares of voting capital stock of the Company

dated June 27, 2023 (the “Majority Consenting Stockholder”), of the Company dated June 27, 2023 (the “Stockholder Consent”).

The

purpose of this Information Statement is to provide disclosure to our stockholders regarding the corporate action (the “Corporate

Action”) ratified and approved by the Board Consent and the Stockholder Consent, respectively, including Shares of outstanding

Common Stock and shares of Series E Convertible Preferred Stock, par value $0.001 per share (the “Series E Preferred”) and

the Series F Preferred Stock, par value $.001 per share (the “Series F Preferred”) held by the holders of our voting capital

stock, to implement a reverse split in a ratio and at a time and date to be determined by the Company’s Board of Directors, not

to exceed a one-for-two-hundred-fifty (1:250) basis, within ninety (90) days from the date of the filing with the SEC of the Company’s

Definitive Information Statement on Schedule 14C (the “Reverse Split”).

In

order the implement the Reverse Split, sometimes also referred to herein as the “Corporate Action,” after filing of the Definitive

Information Statement on Schedule 14C with the SEC, the Company must make application with FINRA to process the Corporate Action. FINRA

can choose not to process the Corporate Action pursuant to FINRA Rule 6490.

The

Board Consent and the Stockholder Consent approving the Reverse Split were adopted pursuant to the provisions of Sections 141 and 228

of Title 8 of the Delaware General Corporation Law (“DGCL”).

Pursuant

to Rule 14c-2(b) promulgated by the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”), the actions approved

by the Board Consent and the Stockholder Consent cannot become effective until twenty (20) days from the date of mailing of the Definitive

Information Statement to our stockholders. This Information Statement shall constitute notice to our stockholders of the above Corporate

Action taken by the Corporation pursuant to the Board Consent and the Stockholder Consent.

New

Common Stock certificates will not be issued on or after the date that FINRA processes the Reverse Split (the “Effective Date”),

but may be issued subsequently with respect to any certificates returned to the transfer agent upon a sale, exchange or for any other

purpose, following the implementation of the Reverse Split. No fractional shares will be issued in connection with the Reverse Split.

Any fractional share will be rounded up to the next whole share in such a manner that every stockholder shall own at least one (1) share

as a result of the Reverse Split.

The

Company’s Common Stock is subject to quotation on the OTC Market under the symbol “PACV.” On the Effective Date of

the Reverse Split, FINRA will change our symbol from “PACV” to “PACVD” for a period of twenty (20) business days

to indicate to the brokerage and investment community that the Reverse Split has occurred, following which our symbol will be “PACV”

once again.

REVERSE

SPLIT

On

June 27, 2023, the Company’s Board of Directors unanimously approved the of the Reverse Split of the issued and outstanding shares

of Common Stock, including shares of Common Stock reserved for issuance, in a ratio and at a time and date to be determined by the Company’s

Board of Directors, not to exceed a one-for-two-hundred-fifty (1:250) basis within ninety (90) days from the date of the filing with

the SEC of the Definitive Information Statement on Schedule14C.

The

Corporate Action, which provides for the implementing of the Reverse Split, was based upon and approved by the Board Consent dated June

27, 2023, and the Stockholder Consent dated June 27, 2023.

Material

Terms of the Reverse Split

As

of June 27, 2023, the Record Date, and the date of filing of this Definitive Information Statement, the Company has 781,784,701 issued

and outstanding shares of Common Stock, which does not include shares of Common Stock reserved for issuance underlying certain convertible

notes. In addition, the Company has issued and outstanding (a) 6,000,000 shares of Series E Preferred Stock, par value $0.001 per share

(the “Series E Preferred Stock”) that have ten (10) votes per share and (b) 10,000 shares of Series F Preferred Stock, par

value $0.001 per share (the “Series F Preferred Stock”). Shannon Masjedi, the Company’s CEO, director and principal

stockholder, is the holder of the outstanding shares of Series F Preferred Stock, which will not be subject to the Reverse Split. Each

share of Series E Preferred Stock has the equivalent of ten (10) votes of Common. Each share of Series F Preferred Stock is entitled

to a number of votes equal to 0.1% of the issued and outstanding Common Stock on the Record Date. The Majority Consenting Stockholder

owns approximately 90.28% of the total voting power of all issued and outstanding voting shares of the Company.

In

the event that the Board of Directors implements a one-for-two-hundred-fifty (1:250) reverse split, the maximum authorized by the Board

Consent and the Stockholder Consent, of which there can be no assurance, there will be approximately 3,127,139 shares of Common Stock

issued and outstanding, excluding the shares reserved for issuance underlying the convertible preferred shares and convertible notes.

The Reverse Split will affect all holders of shares of Common Stock and holders of convertible notes equally (but will not affect the

outstanding shares of Series E Preferred Stock or Series F Preferred Stock). The Company believes that the Reverse Split will benefit

all stockholders, as, without the Reverse Split, the Company will, in all likelihood, have difficulties if and when it seeks to raise

additional capital for its anticipated future growth and seeks to list its shares of Common Stock on a National Exchange, of which there

can be no assurance.

However,

the reduction in the number of outstanding shares of Common Stock following implementation of the Reverse Split, if implemented, could

adversely affect the trading market for our Common Stock by reducing the relative level of liquidity of the shares of Common Stock. Further,

there can be no assurance that the Reverse Split will result in a proportionate increase or, for that matter, any increase, in the price

of the shares of Common Stock subject to quotation on the OTC Market.

Any

new shares issued following the Effective Date of the Reverse Split will be fully-paid and non-assessable shares. On the Effective Date

of the Reverse Split, the number of stockholders will remain unchanged because those stockholders who would otherwise receive only be

entitled to receive a fractional share will receive a number of shares rounded up to the next whole number.

The

Reverse Split will not change the number of authorized shares of Common Stock, which will continue to be 900,000,000 shares of Common

Stock, or the par value of our Common Stock, which will continue to be $0.001 per share. While the aggregate par value of our outstanding

Common Stock will be reduced as a result of the Reverse Split, our additional paid-in capital will be increased by a corresponding amount.

Therefore, the Reverse Split will not affect our total stockholders’ equity. All share and per share information will be retroactively

adjusted to reflect the Reverse Split for all periods presented in our future financial reports and regulatory filings.

On

July 18, 2023, the date immediately preceding the filing of this Definitive Information Statement on Schedule 14C, the closing

price of our shares subject to quotation on the OTC Market was approximately $0.0005 and the total market value was approximately

$390,892, based on the 781,784,701 shares of Common Stock issued and outstanding.

Rationale

for the Reverse Split

The

Company’s Board of Directors believes that a Reverse Split should, at least initially, increase the price of the shares of Company

Common Stock to approximately $0.20 per share, in the event that our Board of Directors elects to implement the maximum reverse based

on a one-for-two-hundred-fifty (1:250) ratio, which ratio is subject to the discretion of the Company’s Board of Directors. The

Company’s stockholders should understand that, as of the date of this Information Statement, the Board has not determined the exact

ratio of the Reverse Split nor the date that the Reverse Split will be implemented. Nevertheless, the Board Consent and the Stockholder

Consent provide that the Reverse Split, if implemented, must be initiated within 90 days of the filing of this Definitive Information

Statement, subject to the processing of the Reverse Split by FINRA.

While

the Reverse Split will not increase the total market value of our Common Stock, the Board of Directors believes that the increase in

the price of our shares of Common Stock, which increase may not necessarily be sustained, should make our shares of Common Stock more

attractive to potential investors, encourage investor interest and trading in, and possibly the marketability of, our Common Stock.

In

addition, because brokers’ commissions on lower-priced stocks generally represent a higher percentage of the stock price than commissions

on higher-priced stocks, the current per share price of our Common Stock can result in individual stockholders paying transaction costs

(commissions, markups or markdowns) that constitute a higher percentage of their total share value than would be the case if the share

price of our Common Stock were higher. This difference in transaction costs may also limit the willingness of institutional investors

to purchase shares of our Common Stock.

Trading

in our shares of Common Stock also may be adversely affected by a variety of policies and practices of brokerage firms that discourage

individual brokers within those firms from dealing in low-priced stocks. These policies and practices pertain to the payment of brokers’

commissions and to time-consuming procedures that make the handling of low-priced stocks unattractive to brokers from an economic standpoint.

Similarly, many brokerage firms are reluctant to recommend low-priced stocks to their customers and the analysts at many brokerage firms

do not provide coverage for such stocks. The Board also believes that the decrease in the number of shares of Common Stock outstanding

as a consequence of the Reverse Split, and the anticipated increase in the price of the Common Stock, could generate interest in the

Common Stock and possibly promote greater liquidity for the Company’s stockholders. However, the Company’s aggregate market

capitalization could be reduced to the extent that any increase in the market price of the Common Stock resulting from the Reverse Split

is proportionately less than the decrease in the number of shares of Common Stock outstanding.

The

Board of Directors further believes that the total number of shares of our Common Stock currently outstanding is disproportionately large

relative to our present market capitalization and that the Reverse Split would bring the number of outstanding shares to a level more

in line with other companies with comparable market capitalizations. Moreover, the Board considered that the number of outstanding shares

of Common Stock is unreasonably large in relation to the Company’s operations. Upon implementation of the Reverse Split and decrease

the number of shares of Common Stock that are issued and outstanding, the Company’s investors may more easily understand the impact

on earnings or loss per share attributable to future developments in our business.

The

Company ultimately cannot predict whether, and to what extent, the Reverse Split would achieve the desired results. The price per share

of the Company’s Common Stock is a function of various factors, including the profitability of its business operations.

Accordingly,

there can be no assurance that the market price of the Company’s Common Stock after the Reverse Split would increase in an amount

proportionate to the decrease in the number of issued and outstanding shares, or would increase at all, that any increase can be sustained

for a prolonged period of time or that the Reverse Split would enhance the liquidity of, or investor interest in, the Company’s

Common Stock.

Notwithstanding

the foregoing, our Board of Directors believes that the potential positive effects of the Reverse Split outweigh the potential disadvantages.

In making this determination, our Board of Directors has taken into account various negative factors, including: (a) the negative perception

of Reverse Splits held by some stock market participants; (b) the adverse effect on liquidity that might be caused by a reduced number

of shares outstanding; and (c) the costs associated with implementing the Reverse Split. The effect of the Reverse Split upon the market

price of our Common Stock cannot be predicted with any certainty, and the history of similar stock splits for companies in similar circumstances

to ours is varied. It is also possible that the Reverse Split may not increase the per share price of our Common stock in proportion

to the reduction in the number of shares of our Common Stock outstanding or result in a permanent increase in the per share price, which

depends on many factors.

After

considering the foregoing factors, the Company’s Board of Directors determined that amending the Company’s Certificate of

Incorporation to implement the Reverse Split is in the Company’s best interests and in the best interests of its stockholders.

Effects

of the Reverse Split

After

the filing of this Information Statement on Schedule 14C and the determination by the Board of Directors of the ratio of the Reverse

Split, the Company will file a Certificate of Amendment to its Certificate of Incorporation with the State of Delaware and make application

to FINRA to process the Reverse Split of our issued and outstanding Common Stock, to be effective upon notification from FINRA (the “Effective

Date”), which will also change our symbol on the OTC Market from “PACV” to “PACVD” for a period of twenty

(20) business days following the Effective Date to indicate to the brokerage and investment community that the Reverse Split has occurred.

Except

for the number of shares of Common Stock outstanding, the rights and preferences of shares of our Common Stock prior and subsequent to

the Reverse Split would remain the same. We do not anticipate that our financial condition, the percentage of our stock owned by management,

the number of our stockholders, or any aspect of our current business would materially change as a result of the Reverse Split.

The

Company’s Common Stock is currently registered under Section 12(g) of the Exchange Act and, as a result, we are subject to periodic

reporting and other requirements. The Reverse Split, if implemented, would not affect the registration of the Company’s Common

Stock under the Exchange Act.

After

the Effective Date of the Reverse Split, each stockholder would own a reduced number of shares of our Common Stock, based upon the ratio

of the reverse, which will be subject to the determination of our Board of Directors. However, a Reverse Split would affect all stockholders

equally and will not affect any stockholder’s percentage ownership of the Company, except for the immaterial result that the Reverse

Split shall involve in the rounding up of any fractional shares up to the next whole in such a manner that every stockholder shall own

at least one (1) share subsequent to the Reverse Split, as described herein. Proportionate voting rights and other rights and preferences

of the holders of our Common Stock would not be affected by the Reverse Split. There will be no payment of cash in lieu of any fractional

shares. Furthermore, the number of stockholders of record would not be affected by the Reverse Split.

Authorized

but Unissued Shares; Potential Dilution; and Anti-Takeover Effects.

Upon

the Effective Date of the Reverse Split, the Company is expected to have approximately 3,127,139 shares issued and outstanding, assuming

a 1:250 Reverse Split and will continue to have 900,000,000 shares of Common Stock authorized. However, if the Board of Directors determines

that it is in the best interests of the Company and its stockholders to implement a 1:200 or a 1:100 Reverse Split, the Company would

have approximately 3,908,923 shares or 7,817,847 shares of Common Stock issued and outstanding, respectively, depending upon the effect

of rounding up fractional, after implementation of the Reverse Split. The ultimate determination of the Board of Directors on the ratio

of the Reverse Split shall be based upon, among other factors, the prevailing market price of the Company’s shares of Common Stock

during the period immediately preceding the Reverse Split determination. After the Reverse Split is implemented, there will be available,

in any event, a significant number of authorized but unissued shares of Common Stock available for issuance from time to time for business

purposes as reasonably determined by the Board of Directors, including for use in capital-raising transactions and acquisitions, among

other purposes, consistent with our business objectives.

The

significant increase in the proportion of unissued authorized shares to issued shares after the Reverse Split could, under certain circumstances,

have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect

a change in the composition of our Board of Directors or contemplating a tender offer or other transaction for the combination of our

company with another company), we are not proposing the Reverse Split in response to any effort of which we are aware to accumulate any

of our shares of our Common Stock or to otherwise seek to obtain control of the Company. Our Board of Directors does not currently contemplate

recommending the adoption of any other proposals that could be construed to affect the ability of anyone to take over or change the control

of the Company.

The

Company believes that the availability of the additional shares will provide it with the flexibility to pursue potential transactions

as they arise, to take advantage of desirable business opportunities and to respond effectively in a changing corporate environment.

For example, the Company may elect to issue shares of Common Stock to raise equity capital, to make acquisitions using shares of Common

Stock, to establish strategic relationships with other companies, to adopt additional employee benefit plans or reserve additional shares

for issuance under such plans, where the Board determines it advisable to do so, without the necessity of soliciting further stockholder

approval, subject to applicable stockholder vote requirements.

If

the Company issues additional shares for any of the above purposes, the aggregate ownership interest of our current stockholders, and

the interest of each such existing stockholder, would be diluted, possibly substantially. Although the Company continually examines potential

transactions, it has no current plans or arrangements to issue any additional shares of Common Stock. Furthermore, the additional shares

of Common Stock that would become available for issuance upon the Effective Date of the Reverse Split could also be used by the Company’s

management to oppose any potential hostile takeover attempt or delay or prevent changes in control or changes in or removal of the Company.

For

example, without further stockholder approval, the Board of Directors could authorize the issuance and sale of shares of Common Stock

in one or more private transactions to purchasers who would oppose a takeover or favor the current Board. Although the Reverse Split

was based upon business and financial considerations that the Board considers reasonable and necessary as of the Record Date, as discussed

above, stockholders nevertheless should be aware that approval of one or more of the proposals could facilitate future efforts by management

to deter or prevent a change in control of the Company.

Accounting

Matters

The

Reverse Split would not affect the par value of the Company’s Common Stock. As a result, on the Effective Date of the Reverse Split,

the stated par value capital on our balance sheet attributable to the Company’s Common Stock would be reduced and the additional

paid-in capital account would be credited with the amount by which the stated capital is reduced. The per-share net income or loss and

net book value per share of the Company’s Common Stock would be increased because there would be fewer shares of our Common Stock

outstanding.

The

Company presents earnings per share (“EPS”) in accordance with Statement of Financial Accounting Standards (“SFAS”)

No. 128, “Earnings per Share,” and it will comply with the requirements of SFAS No. 128 with respect to reverse stock splits.

In pertinent part, SFAS No. 128 states: “If the number of common shares outstanding decreases as a result of a reverse stock split,

the computations of basic and diluted EPS shall be adjusted retroactively for all periods presented to reflect that change in capital

structure. If changes in Common Stock resulting from reverse stock splits occur after the close of the period but before issuance of

the financial statements, the per-share computations for those and any prior-period financial statements presented shall be based on

the new number of shares. If any per-share computations reflect such changes in the number of shares, that fact shall be disclosed.”

Fairness

of the Process

The

Board of Directors did not obtain a report, opinion, or appraisal from an appraiser or financial advisor with respect to the Reverse

Split and no representative or advisor was retained on behalf of the unaffiliated stockholders to review or negotiate the transaction.

The Board of Directors concluded that the additional expense of these independent appraisal procedures was unreasonable in relation to

the Company’s available cash resources and concluded that the Board of Directors could adequately establish the fairness of the

Reverse Split without the engagement of third parties.

Street

Name Holders of Common Stock

The

Company intends for the Reverse Split to treat stockholders holding Common Stock in street name through a nominee (such as a bank or

broker) in the same manner as stockholders whose shares are registered in their names. Nominees will be instructed to affect the Reverse

Split for their beneficial holders. However, nominees may have different procedures. Accordingly, stockholders holding Common Stock in

street name should contact their nominees.

Stock

Certificates

Mandatory

surrender of certificates is not required by our stockholders. The Company’s transfer agent will adjust the record books of the

company to reflect the Reverse Split as of the Effective Date of the Reverse Split. New certificates will not be mailed to stockholders.

Federal

Income Tax Consequences

The

following description of federal income tax consequences of the reverse stock split is based on the Internal Revenue Code of 1986, as

amended, the applicable Treasury Regulations promulgated thereunder, judicial authority, and current administrative rulings and practices

as in effect on the date of this information statement. The discussion is for general information only and does not cover any consequences

that apply for special classes of taxpayers (e.g., non-resident aliens, broker-dealers or insurance companies). The Company urges all

stockholders to consult their own tax advisers to determine the particular consequences to each of them of the reverse stock split.

The

Company has not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income

tax consequences of the reverse stock split. The Company believes, however, that because the Reverse Split is not part of a plan to periodically

increase or decrease any stockholder’s proportionate interest in the assets or earnings and profits of our company, the Reverse

Stock would have the federal income tax effects described below.

The

exchange of pre-split shares for post-split shares should not result in recognition of gain or loss for federal income tax purposes.

In the aggregate, a stockholder’s basis in the post-split shares would equal that stockholder’s basis in the pre-split shares.

A stockholder’s holding period for the post-split shares would be the same as the holding period for the pre-split shares exchanged

therefor. Provided that a stockholder held the pre-split shares as a capital asset, the post-split shares received in exchange therefore

would also be held as a capital asset.

There

is no provision for stockholders’ receiving cash in lieu of any fractional share interest because any fractional shares will be

rounded up to the next whole integer in such a manner that every stockholder shall own at least one (1) share as a result of the Reverse

Split, instead fractional shares are being rounded up to the next whole share.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table lists the number of shares of Common Stock of the Company and, with respect to Shannon Masjedi, the Company’s Chief

Executive Officer and principal stockholder, shares of Series E Preferred Stock and Series F Preferred Stock, as of June 27, 2023, the

Record Date, and as of the date of this Information Statement, that are beneficially owned by (i) each person or entity known to the

Company to be the beneficial owner of more than 5% of the outstanding Common Stock; (ii) each officer and director of the Company; and

(iii) all officers and directors as a group. Information relating to beneficial ownership of Common Stock and voting Preferred Stock

by the Company’s principal stockholders and is based upon information furnished by each person using “beneficial ownership”

concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of

a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment

power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any

security of which that person has a right to acquire beneficial ownership within sixty (60) days. Under the rules of the SEC, more than

one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities

as to which he/she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment

power. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect

to the shares. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have

sole voting and investment power with respect to all shares of Company Common Stock held by them.

| Name of Stockholder | |

Number of Shares of Common Stock | | |

Number of Votes of Series E Preferred Stockholder | | |

Number of Votes of Series F Preferred Stockholder | | |

Total Votes | | |

Percentage of Voting Equity (1) | |

| Shannon Masjedi | |

| 169,187,040 | (2) | |

| 60,000,000 | (3) | |

| 7,817,847,010 | (3) | |

| 8,047,034,050 | | |

| 92.28 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Marc Shenkman | |

| 39,522,827 | | |

| 0 | | |

| 0 | | |

| 39,522,827 | | |

| Less than 1 | % |

All directors and officers as a

group (2 persons) | |

| 208,709,867 | | |

| 60,000,000 | | |

| 7,817,847,010 | | |

| 8,086,556,877 | | |

| 92.74. | % |

| Total | |

| 208,709,867 | | |

| 60,000,000 | | |

| 7,817,847,010 | | |

| 8,086,556,877 | | |

| 92.74 | % |

| (1) |

Based

upon 781,784,701 shares of Common Stock issued and outstanding as of the Record Date of June 27, 2023, plus the voting power of the

Series E Preferred Stock and Series F Preferred Stock |

(2)

|

Includes

57,103,000 shares of Common Stock owned by ACD Trust (the “Trust”). Shannon Masjedi is the Trustee of the Trust. Shannon

Masjedi holds voting and investment power over all shares of Common Stock owned by the Trust.

Shannon

Masjedi, the Company’s Chief Executive Officer, is the record and beneficial owner of 6,000,000 shares of Series |

| (3) |

E Preferred

Stock having ten (10) votes per share on all matters subject to the vote of the Company’s holders of Common Stock, and all

10,000 issued and outstanding shares of Series F Preferred Stock, each share of which is entitled to a number of votes equal to 0.1%

of the issued and outstanding Common Stock. |

ADDITIONAL

INFORMATION

The

Company is subject to the filing requirements of the Exchange Act, and in accordance therewith files reports, proxy/information statements

and other information including annual and quarterly reports on Form 10-K and 10-Q (the “Exchange Act Filings”) with the

SEC. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at

the Commission at 100 F Street, NE Washington, D.C, 20549. Copies of such material can be obtained upon written request addressed to

the Commission, Public Reference Section, 100 F Street, NE Washington, D.C 20549, at prescribed rates. The Commission maintains a web

site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers

that file electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”).

The

Company will provide without charge, to each person to whom a proxy/information statement is delivered, upon written or oral request

of such person and by first class mail or other equally prompt means within one business day of receipt of such request, a copy of any

and all of the information that has been incorporated by reference in this proxy statement (not including exhibits to the information

that is incorporated by reference unless such exhibits are specifically incorporated by reference into the information that the proxy

statement incorporates). Such requests should be directed to the address and phone number indicated below. This includes information

contained in documents filed subsequent to the date on which definitive copies of the proxy statement are sent or given to security holders,

up to the date of responding to the request.

| By

Order of the Board of Directors: |

| /s/

Shannon Masjedi |

|

| Name: |

Shannon

Masjedi |

|

| Title: |

Chief

Executive Officer and Director |

|

| |

|

|

| /s/

Marc Shenkman |

|

| Name: |

Marc

Shenkman |

|

| Title: |

Chairman

of the Board |

|

July

19, 2023

Los

Angeles, California

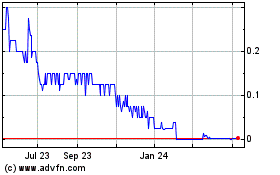

Pacific Ventures (PK) (USOTC:PACV)

Historical Stock Chart

From Mar 2024 to Apr 2024

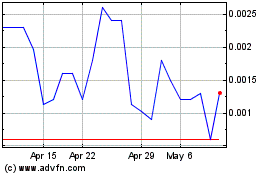

Pacific Ventures (PK) (USOTC:PACV)

Historical Stock Chart

From Apr 2023 to Apr 2024