UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July

2023

Commission file number: 001-38206

TDH HOLDINGS, INC.

(Registrant’s name)

cc/o Qingdao Tiandihui Pet Foodstuff Co., Ltd

2521 Tiejueshan Road, Huangdao District, Qingdao,

Shandong Province

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Explanatory Note:

As previously disclosed, on July 26, 2022, TDH Holdings, Inc. (the

“Company”) completed a private placement of securities with eight accredited investors (the “Investors”)

and entered into a securities purchase agreement (the “Securities Purchase Agreement”) pursuant to which the Company

issued common stock purchase warrants (the “Existing Warrants”) to purchase up to an aggregate 4,000,000 of its Common

Shares at an exercise price of $2.44 per share.

On July 11, 2023, the Company and Investors agreed to extend the exercise

period of the Existing Warrants to July 26, 2027, and issued amended and restated warrants reflecting the new exercise period (the “Amended

and Restated Warrants”). The Amended and Restated Warrants are immediately exercisable.

The foregoing description of the Amended and Restated Warrants does

not purport to be complete and is qualified in its entirety by reference to the form of Amended and Restated Warrant, a copy of which

is filed herewith as Exhibit 4.1 and incorporated herein by reference.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

TDH HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Dandan Liu |

| |

|

Dandan Liu |

| |

|

Chair and Chief Executive Officer |

| |

|

|

| Dated: July 18, 2023 |

|

|

2

Exhibit 4.1

THIS WARRANT AND THE SHARES ISSUABLE UPON EXERCISE

OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THIS WARRANT AND THE SHARES ISSUABLE UPON

EXERCISE OF THIS WARRANT MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT

OR APPLICABLE EXEMPTION OR SAFE HARBOR PROVISION.

FORM OF

TDH HOLDINGS, INC.

COMMON SHARES AMENDED AND RESTATED PURCHASE

WARRANT

Warrant Shares: [●]

Issuance Date: July 11, 2023

This AMENDED AND RESTATED WARRANT (this “Warrant”)

is issued as of July 11, 2023 (the “Amendment Issuance Date”) and amends, restates and supersedes that certain original

warrant (the “Original Warrant”), issued on July 26, 2022 (the “Initial Issuance Date”), by TDH Holdings,

Inc., a British Virgin Islands corporation (the “Company”), to [●] (“Purchaser” and, together with

any assignee(s) or transferee(s), “holder” or “holders”).

WHEREAS, In connection with the closing

of the transaction contemplated by that certain Securities Purchase Agreement, dated of July 26, 2022, by and among the Company, and the

other signatories thereto (the “Securities Purchase Agreement”), the Company agreed to issue Purchaser the Original

Warrant to purchase [●] common shares, $0.02 par value per share (the “Common Shares”), of the Company

set forth herein, subject to the terms and conditions contained in the Original Warrant; and

WHEREAS, the Company and Purchaser desire

to amend and restate the Original Warrant in order to restate the Exercise Period (as defined hereunder) hereof.

NOW THEREFORE, for good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Company and Purchaser agree as follows:

Unless otherwise separately defined herein, all

capitalized terms in this Warrant shall have the same meaning as is set forth in the Securities Purchase Agreement.

1. Issuance of Warrant; Exercise Price.

The Warrant shall provide that Purchaser and such other holder(s) of the Warrant, as such may be assigned in accordance herewith, shall

have the right to purchase an aggregate of up to [●] shares of Common Shares for an exercise price equal to $2.44 per share

(the “Exercise Price”), as described more fully herein. The number, character and Exercise Price of such shares are

subject to adjustment as hereinafter provided, and the term “shares” shall mean, unless the context otherwise requires, the

shares of Common Shares and other securities and property receivable upon exercise of the Warrant. The term “Exercise Price”

shall mean, unless the context otherwise requires, the price per share purchasable under the Warrant as set forth in this Section 1,

as adjusted from time to time pursuant to Section 4.

2. No Impairment. The Company

shall not, by amendment of its organizational documents or through any reorganization, transfer of assets, consolidation, merger, dissolution,

issue or sale of securities, or any other action, avoid or seek to avoid the observance or performance of any other action, avoid or seek

to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith take any and all action

as may be necessary in order to protect the rights of the holder(s) of the Warrant against impairment. Without limiting the generality

of the foregoing, the Company (a) will at all times reserve and keep available, solely for issuance and delivery upon exercise of

the Warrant, shares issuable from time to time upon exercise of the Warrant, and (b) will take all such action as may be necessary

or appropriate in order that the Company may validly and legally issue fully paid and non-assessable shares upon the exercise of the Warrant,

or any portion of it.

3. Exercise of Warrant.

(a) Exercise for Cash. At

any time and from time to time on or after the issuance of this Warrant and expiring on July 26, 2027 at 11:59 p.m., Eastern Standard

Time (the “Exercise Period”), the Warrant may be exercised as to all or any portion of the whole number of shares covered

by the Warrant by the holder thereof by surrender of the Warrant, in whole or in part, by delivery (whether via facsimile or otherwise)

of a written notice, in the form attached hereto as Exhibit A (the “Exercise Notice”) and by a wire transfer

or check payable to the order of the Company in the amount required for purchase of the shares as to which the Warrant is being exercised,

delivered to the Company at its principal office at 2521 Tiejueshan Road, Huangdao District, Qingdao, Shandong Province,

PRC.

(b) Cashless Exercise. In lieu of

an exercise under Section 3(a), the Warrant may be exercised in whole or in part and, in lieu of making the cash payment otherwise contemplated

to be made to the Company upon such exercise in payment, elect instead to receive upon such exercise the “Net Number” of Common

Shares determined according to the following formula (a “Cashless Exercise”):

| |

Net Number = |

(A x B) - (A x C) |

|

| |

|

D |

|

For purposes of the foregoing formula:

A= the total number of shares with respect to

which this Warrant is then being exercised.

B = the quotient of (x) the sum of the closing

sales price of the Common Shares as reported by NASDAQ of each of the ten (10) trading days prior to and ending at the close of business

of NASDAQ on the date of exercise as set forth in the applicable Exercise Notice, divided by (y) ten (10).

C = the exercise price then in effect for the

applicable Common Shares at the time of such exercise.

D = as elected by the holder, either (i) the closing

sale price of the Common Shares on the trading day immediately preceding the date of the applicable Exercise Notice, (ii) the bid price

of the Common Shares as of the time of the holder’s execution of the applicable Exercise Notice if such Exercise Notice is executed

during “regular trading hours” on a trading day and is delivered within two (2) hours to the Company, or (iii) the closing

sale price of the Common Shares on the date of the applicable Exercise Notice if the date of such Exercise Notice is a trading day and

such Exercise Notice is both executed and delivered to the Company after the close of “regular trading hours” on such trading

day.

In no event shall the Net Number of Common Shares

issued under a Cashless Exercise exceed the aggregate amount of Common Shares identified in paragraph 1 to this Warrant. If the Common

Shares are issued in a Cashless Exercise, for purposes of Rule 144(d) promulgated under the 1933 Act, as currently in effect, it is intended

that the Common Shares issued in a Cashless Exercise shall be deemed to have been acquired by the holder, and the holding period for the

Common Shares shall be deemed to have commenced, on the date this Warrant was originally issued pursuant to the Securities Purchase Agreement.

(c) Issuance of Shares. Upon

the exercise of a Warrant in whole or in part, and upon receipt of an Exercise Notice, the Company will, within fifteen (15) days

thereafter, at its expense (including the payment by the Company of any applicable issue or transfer taxes), cause to be issued in the

name of and delivered to the Warrant holder a certificate or certificates for the number of fully paid and non-assessable shares to which

such holder is entitled upon exercise of the Warrantor or issue the number of Common Shares to which the Holder shall be entitled pursuant

to such exercise to the Transfer Agent via book-entry for the account of the holder. In the event such holder is entitled to a fractional

share, in lieu thereof, such holder will receive the number of Common Shares rounded down to the nearest whole number. Certificates for

shares issuable by reason of the exercise of the Warrant or book entry shall be dated and shall be effective as of the date of the surrendering

of the Warrant for exercise, notwithstanding any delays in the actual execution, issuance or delivery of the certificates or transfer

to book-entry for the shares so purchased. In the event the Warrant is exercised as to less than the aggregate amount of all shares issuable

upon exercise of the Warrant held by such person, the Company shall issue a new Warrant to the holder of the Warrant so exercised covering

the aggregate number of shares as to which the Warrant remains unexercised.

4. Protection Against Dilution.

The Exercise Price for the shares and number of shares issuable upon exercise of the Warrant, in whole or in part, is subject to adjustment

from time to time as described in this Section 4. The Exercise Price will be equitably adjusted for any distributions or corporate

actions that would otherwise have the effect of reducing the value of the warrants except for ordinary monthly cash dividends. Specifically,

Exercise Price adjustments shall result from stock dividends, splits, subdivisions, reclassifications, reorganization, consolidation,

and any other extraordinary corporate action that has the effect of reducing the value of the warrants. This provision shall not, however,

be interpreted to grant the Warrant holder price protection on any subsequent financing.

(a) Certificate as to Adjustments.

In the event of adjustment as herein, the Company shall promptly mail to each Warrant holder a certificate setting forth the Exercise

Price and number of shares issuable upon exercise after such adjustment and setting forth a brief statement of facts requiring such adjustment.

Such certificate shall also set forth the kind and amount of stock or other securities or property into which the Warrant shall be exercisable

after any adjustment of the Exercise Price as provided in this Warrant.

(b) Minimum Adjustment.

Notwithstanding the foregoing, no certificate as to adjustment of the Exercise Price hereunder shall be made if such adjustment results

in a change in the Exercise Price then in effect of less than five cents ($0.05) and any adjustment of less than five cents ($0.05) of

any Exercise Price shall be carried forward and shall be made at the time of and together with any subsequent adjustment that, together

with any subsequent adjustment that, together with the adjustment or adjustments so carried forward, amounts to five cents ($0.05) or

more; provided however, that upon the exercise of a Warrant, the Company shall have made all necessary adjustments (to the nearest cent)

not theretofore made to the Exercise Price up to and including the date upon which such Warrant is exercised.

5. Successors and Assigns; Binding Effect.

This Warrant shall be binding upon and inure to the benefit of Purchaser and the Company and their respective successors and permitted

assigns.

6. Notices. Any notice hereunder

shall be given by registered or certified mail, if to the Company, at its principal office referred to in Section 3(a) and, if to

a holder, to the holder’s address shown in the Warrant ledger of the Company, provided that any holder may at any time on three

(3) days’ written notice to the Company designate or substitute another address where notice is to be given. Notice shall be

deemed given and received after a certified or registered letter, properly addressed with postage prepaid, is deposited in the U.S. mail.

7. Assignment; Replacement of Warrant.

Subject to the terms of the Securities Act of 1933, relevant state securities law this Warrant is assignable. If the Warrant is assigned,

in whole or in part, the Warrant shall be surrendered at the principal office of the Company, and thereupon, in the case of a partial

assignment, a new Warrant shall be issued to the holder thereof covering the number of shares not assigned, and the assignee shall be

entitled to receive a new Warrant covering the number of shares so assigned. Upon receipt of evidence reasonably satisfactory to the Company

of the loss, theft, destruction or mutilation of any Warrant and appropriate bond or indemnification protection, the Company shall issue

a new Warrant of like tenor.

9. Rights of Shareholders. Until

exercised, the Warrant shall not entitle the holder thereof to any of the rights of a shareholder of the Company.

10. Governing Law. This Warrant

shall be governed and construed in accordance with the laws of the State of New York without giving effect to the principles of choice

of laws thereof.

11. Definition. All references

to the word “Purchaser” in this Warrant shall be deemed to apply with equal effect to any persons or entities to whom a Warrant

has been transferred in accordance with the terms hereof, and, where appropriate, to any persons or entities holding shares issuable upon

exercise of a Warrant.

12. Headings. The headings herein

are for purposes of reference only and shall not limit or otherwise affect the meaning of any of the provisions hereof.

| |

TDH HOLDINGS, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Dandan Liu |

| |

Title: |

Chair and CEO |

EXHIBIT A

EXERCISE

NOTICE

TO BE

EXECUTED BY THE REGISTERED HOLDER TO EXERCISE THIS

WARRANT

TO PURCHASE common SHARES

TDH HOLDINGS, INC.

The undersigned holder hereby

elects to exercise the Warrant to Purchase Common Shares No. _______ (the “Warrant”) of TDH Holdings, Inc. a British

Virgin Islands business company (the “Company”) as specified below. Capitalized terms used herein and not otherwise

defined shall have the respective meanings set forth in the Warrant.

1. Form of Exercise Price.

The Holder intends that payment of the Aggregate Exercise Price shall be made as:

| |

☐ |

a “Cash Exercise” with respect to _________________ Warrant Shares; and/or |

| |

|

|

| |

☐ |

a “Cashless Exercise” with respect to _______________ Warrant Shares. |

In the event that the Holder

has elected a Cashless Exercise with respect to some or all of the Warrant Shares to be issued pursuant hereto, the Holder hereby represents

and warrants that (i) this Exercise Notice was executed by the Holder at __________ [a.m.][p.m.] on the date set forth below and (ii)

if applicable, the Bid Price as of such time of execution of this Exercise Notice was $________.

2. Payment of Exercise

Price. In the event that the Holder has elected a Cash Exercise with respect to some or all of the Warrant Shares to be issued pursuant

hereto, the Holder shall pay the Aggregate Exercise Price in the sum of $___________________ to the Company in accordance with the terms

of the Warrant.

3. Delivery of Warrant

Shares. The Company shall deliver to Holder, or its designee or agent as specified below, __________ Common Shares in accordance with

the terms of the Warrant. Delivery shall be made to Holder, or for its benefit, as follows:

☐ Check here

if requesting delivery as a certificate to the following name and to the following address:

☐ Check here if requesting delivery by Deposit/Withdrawal at Custodian as follows:

| |

DTC Participant: |

|

| |

DTC Number: |

|

| |

Account Number: |

|

☐ Check here

if requesting delivery as book-entry to VStock Transfer LLC:

| |

Issue to: |

|

| |

Account Number: |

|

| Date: _____________ __,____ |

|

| ________________________ |

|

| Name of Registered Holder |

|

| |

Tax ID:____________________________ |

|

| |

Facsimile:__________________________ |

|

| |

E-mail Address:_____________________ |

|

5

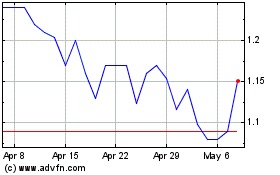

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

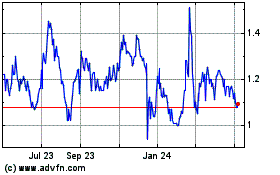

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Apr 2023 to Apr 2024