0000101538false--12-31FY20220.0013000000001063733411062403610.0110000000075000017790416926720075000075000017790416926721779041692672978474434001134220.750000000750000001015382022-01-012022-12-310000101538uamy:PreferredStockDSeriesMemberus-gaap:SubsequentEventMember2023-01-250000101538us-gaap:SubsequentEventMember2023-01-012023-01-260000101538us-gaap:SubsequentEventMember2023-01-2500001015382020-04-012020-04-200000101538uamy:TotalAntimonyMember2022-01-012022-12-310000101538uamy:TotalAntimonyMember2021-01-012021-12-310000101538uamy:SubtotalPreciousMetalsMember2022-01-012022-12-310000101538uamy:SubtotalPreciousMetalsMember2021-01-012021-12-310000101538uamy:SubtotalAntimonyMember2022-01-012022-12-310000101538uamy:SubtotalAntimonyMember2021-01-012021-12-310000101538uamy:MexicoAntimonyMember2022-01-012022-12-310000101538uamy:MexicoAntimonyMember2021-01-012021-12-310000101538uamy:UnitedStatesAntimonyMember2022-01-012022-12-310000101538uamy:UnitedStatesAntimonyMember2021-01-012021-12-310000101538uamy:ZeoliteMember2021-12-310000101538uamy:ZeoliteMember2022-12-310000101538uamy:SubtotalPreciousMetalsMember2021-12-310000101538uamy:SubtotalPreciousMetalsMember2022-12-310000101538uamy:PreciousMetalsMexicoMember2022-12-310000101538uamy:PreciousMetalsMexicoMember2021-12-310000101538uamy:PreciousMetalsUnitedStatesMember2022-12-310000101538uamy:PreciousMetalsUnitedStatesMember2021-12-310000101538uamy:SubtotalAntimonyMember2022-12-310000101538uamy:SubtotalAntimonyMember2021-12-310000101538uamy:UnitedStatesAntimonyMember2021-12-310000101538uamy:UnitedStatesAntimonyMember2022-12-310000101538uamy:Warrant2Member2022-12-310000101538uamy:CommonStockWarrantsMember2021-02-030000101538uamy:CommonStockWarrantsMember2021-12-310000101538uamy:CommonStockWarrantsMember2021-02-012021-02-030000101538uamy:CommonStockWarrantsMember2021-01-012021-12-310000101538uamy:FebruaryTwentyTwentyOneMember2021-02-012021-02-030000101538uamy:FebruaryTwentyTwentyOneMember2021-02-012021-02-180000101538uamy:FebruaryTwentyTwentyOneMember2022-01-012022-12-310000101538uamy:FebruaryTwentyTwentyOneMember2021-02-180000101538uamy:FebruaryTwentyTwentyOneMember2021-02-030000101538us-gaap:SeriesBPreferredStockMember2020-12-310000101538us-gaap:SeriesDPreferredStockMember2022-02-042022-02-280000101538uamy:StockRepurchaseMember2022-11-210000101538uamy:StockRepurchaseMember2022-12-3100001015382022-08-240000101538uamy:Warrant4Member2022-01-012022-12-310000101538uamy:Warrant3Member2022-01-012022-12-310000101538uamy:Warrant2Member2022-01-012022-12-310000101538uamy:Warrant1Member2022-01-012022-12-310000101538srt:MinimumMember2021-01-012021-12-310000101538srt:MaximumMember2021-01-012021-12-310000101538srt:BoardOfDirectorsChairmanMember2021-12-310000101538srt:BoardOfDirectorsChairmanMember2022-01-012022-12-310000101538srt:BoardOfDirectorsChairmanMember2021-01-012021-12-310000101538uamy:GeologicConsultingMember2021-01-012021-12-310000101538uamy:GeologicConsultingMember2022-01-012022-12-310000101538srt:BoardOfDirectorsChairmanMember2022-12-310000101538uamy:WadleyPropertyMember2022-12-310000101538uamy:WadleyPropertyMember2022-08-012022-08-080000101538srt:MinimumMember2022-01-012022-12-310000101538srt:MaximumMember2022-01-012022-12-310000101538us-gaap:MexicanTaxAuthorityMember2022-01-012022-12-310000101538us-gaap:MexicanTaxAuthorityMember2019-12-310000101538us-gaap:MexicanTaxAuthorityMember2016-12-310000101538us-gaap:MexicanTaxAuthorityMember2018-12-310000101538us-gaap:MexicanTaxAuthorityMember2022-12-310000101538uamy:IdahoStateMember2022-12-310000101538uamy:MontanaStateMember2022-12-3100001015382020-01-012020-12-310000101538uamy:FirstSecurityBankofMissoulaMember2021-12-310000101538uamy:CaterpillarFinancialServicesMember2022-12-310000101538uamy:FirstSecurityBankofMissoulaMember2022-12-310000101538uamy:CaterpillarFinancialServicesMember2021-12-310000101538uamy:MexicoAntimonyMember2021-12-310000101538uamy:UnitedStateMember2021-12-310000101538uamy:MexicoAntimonyMember2022-12-310000101538uamy:UnitedStateMember2022-12-310000101538uamy:PreciousMetalsSegmentMember2021-12-310000101538uamy:ZeoliteSegmentBRZMember2021-12-310000101538uamy:AntimonySegmentUSAMSAMember2021-12-310000101538uamy:AntimonySegmentUSACMember2021-12-310000101538uamy:PreciousMetalsSegmentMember2022-12-310000101538uamy:ZeoliteSegmentBRZMember2022-12-310000101538uamy:AntimonySegmentUSAMSAMember2022-12-310000101538uamy:AntimonySegmentUSACMember2022-12-310000101538uamy:zeoliteProductsMember2021-12-310000101538uamy:zeoliteProductsMember2022-12-310000101538uamy:AntimonyMember2021-12-310000101538uamy:AntimonyMember2022-12-310000101538uamy:AntimonyOreConcentratesMember2021-12-310000101538uamy:AntimonyOreConcentratesMember2022-12-310000101538uamy:AntimonyMetalsMember2021-12-310000101538uamy:AntimonyMetalsMember2022-12-310000101538uamy:AntimonyOxidesMember2021-12-310000101538uamy:AntimonyOxidesMember2022-12-310000101538uamy:TeckAmericansIncMember2022-12-310000101538uamy:TeckAmericansIncMember2021-12-310000101538uamy:CompanyFMember2022-12-310000101538uamy:CompanyFMember2021-12-310000101538uamy:CompanyIMember2022-12-310000101538uamy:CompanyIMember2021-12-310000101538uamy:CompanyHMember2021-12-310000101538uamy:CompanyHMember2022-12-310000101538uamy:CompanyDMember2021-01-012021-12-310000101538uamy:CompanyDMember2022-01-012022-12-310000101538uamy:CompanyCMember2021-01-012021-12-310000101538uamy:CompanyCMember2022-01-012022-12-310000101538uamy:CompanyFMember2021-01-012021-12-310000101538uamy:CompanyEMember2021-01-012021-12-310000101538uamy:CompanyBMember2021-01-012021-12-310000101538uamy:CompanyFMember2022-01-012022-12-310000101538uamy:CompanyEMember2022-01-012022-12-310000101538uamy:CompanyBMember2022-01-012022-12-310000101538uamy:CompanyGMember2021-01-012021-12-310000101538uamy:CompanyAMember2021-01-012021-12-310000101538uamy:CompanyGMember2022-01-012022-12-310000101538uamy:CompanyAMember2022-01-012022-12-310000101538uamy:MexicosMember2021-01-012021-12-310000101538uamy:MexicosMember2022-01-012022-12-310000101538uamy:CanadasMember2021-01-012021-12-310000101538uamy:CanadasMember2022-01-012022-12-310000101538uamy:UnitedStateMember2021-01-012021-12-310000101538uamy:UnitedStateMember2022-01-012022-12-310000101538uamy:PreciousMetalsMember2021-01-012021-12-310000101538uamy:ZeoliteMember2021-01-012021-12-310000101538uamy:PreciousMetalsMember2022-01-012022-12-310000101538uamy:ZeoliteMember2022-01-012022-12-310000101538uamy:AntimonyMember2022-01-012022-12-310000101538uamy:AntimonyMember2021-01-012021-12-310000101538uamy:IVAReceivableAndOtherAssetsMember2022-12-3100001015382022-08-170000101538us-gaap:CumulativePreferredStockMember2021-01-012021-12-310000101538us-gaap:CumulativePreferredStockMember2022-01-012022-12-310000101538uamy:WarrantsMember2021-01-012021-12-310000101538uamy:WarrantsMember2022-01-012022-12-310000101538us-gaap:RetainedEarningsMember2022-12-310000101538uamy:SharestobereturnedtotreasuryMember2022-12-310000101538us-gaap:AdditionalPaidInCapitalMember2022-12-310000101538us-gaap:CommonStockMember2022-12-310000101538us-gaap:PreferredStockMember2022-12-310000101538us-gaap:RetainedEarningsMember2022-01-012022-12-310000101538uamy:SharestobereturnedtotreasuryMember2022-01-012022-12-310000101538us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000101538us-gaap:CommonStockMember2022-01-012022-12-310000101538us-gaap:PreferredStockMember2022-01-012022-12-310000101538us-gaap:RetainedEarningsMember2021-12-310000101538uamy:SharestobereturnedtotreasuryMember2021-12-310000101538us-gaap:AdditionalPaidInCapitalMember2021-12-310000101538us-gaap:CommonStockMember2021-12-310000101538us-gaap:PreferredStockMember2021-12-310000101538us-gaap:RetainedEarningsMember2021-01-012021-12-310000101538uamy:SharestobereturnedtotreasuryMember2021-01-012021-12-310000101538us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000101538us-gaap:CommonStockMember2021-01-012021-12-310000101538us-gaap:PreferredStockMember2021-01-012021-12-3100001015382020-12-310000101538us-gaap:RetainedEarningsMember2020-12-310000101538us-gaap:AdditionalPaidInCapitalMember2020-12-310000101538uamy:SharestobereturnedtotreasuryMember2020-12-310000101538us-gaap:CommonStockMember2020-12-310000101538us-gaap:PreferredStockMember2020-12-3100001015382021-01-012021-12-310000101538us-gaap:SeriesDPreferredStockMember2021-12-310000101538us-gaap:SeriesDPreferredStockMember2022-12-310000101538us-gaap:SeriesCPreferredStockMember2021-12-310000101538us-gaap:SeriesCPreferredStockMember2022-12-310000101538us-gaap:SeriesBPreferredStockMember2021-12-310000101538us-gaap:SeriesBPreferredStockMember2022-12-310000101538us-gaap:SeriesAPreferredStockMember2021-12-310000101538us-gaap:SeriesAPreferredStockMember2022-12-3100001015382021-12-3100001015382022-12-3100001015382023-07-1700001015382022-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended: December 31, 2022 |

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from_______________ to______________ |

Commission file number: 001-08675

UNITED STATES ANTIMONY CORPORATION |

(Exact name of registrant as specified in its charter) |

Montana | | 81-0305822 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

P.O. Box 643, Thompson Falls, Montana | | 59873 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (406) 827-3523

Securities registered under Section 12(b) of the Exchange Act: |

|

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, $0.01 par value | | UAMY | | NYSE American |

Securities registered under Section 12(g) of the Exchange Act:

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

Emerging Growth Company | ☐ | | |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the financial statements included in the filing reflects a correction of an error to previously issued financial statements:(1) Yes ☐ No ☐

Indicate by check mark whether any of those error corrections are restatements requiring a recovery analysis of incentive-based compensation under the registrant’s clawback policies:(1) Yes ☐ No ☐

(1) Check boxes are blank until we are required to have a recovery policy under the applicable listing standard of NYSE American.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates was $40,189,594 based on the reported last sale price of common stock on June 30, 2022, which was the last business day of the registrant’s most recently completed second fiscal quarter. For purposes of this computation, all executive officers and directors were deemed affiliates.

The number of shares outstanding of the registrant’s common stock as of July 17, 2023: 107,647,317

UNITED STATES ANTIMONY CORPORATION

2022 ANNUAL REPORT

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statement that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always using words or phrases such as “believes”, “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates”, or “intends”, or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| · | Risks related to some of the Company’s properties being in the exploration stage; |

| | |

| · | Risks related to the mineral operations being subject to government regulation; |

| | |

| · | Risks related to the Company’s ability to obtain additional capital to develop the Company’s resources, if any; |

| | |

| · | Risks related to mineral exploration and development activities; |

| | |

| · | Risks related to mineral estimates; |

| | |

| · | Risks related to the Company’s insurance coverage for operating risks; |

| | |

| · | Risks related to the fluctuation of prices for precious and base metals; |

| | |

| · | Risks related to the competitive industry of mineral exploration; |

| | |

| · | Risks related to the title and rights in the Company’s mineral properties; |

| | |

| · | Risks related to environmental hazards; |

| | |

| · | Risks related to metallurgical and other processing problems; |

| | |

| · | Risks related to unexpected geological formations; |

| | |

| · | Risks related to global economic and political conditions; |

| | |

| · | Risks related to staffing in remote locations; |

| | |

| · | Risks related to changes in product costing; |

| | |

| · | Risks related to inflation on operational costs and profitability; |

| | |

| · | Risks related to competitive technology positions and operating interruptions (including, but not limited to, labor disputes, leaks, fires, flooding, landslides, power outages, explosions, unscheduled downtime, transportation interruptions, war and terrorist activities); |

| | |

| · | Risks related to global pandemics or civil unrest; |

| · | Risks related to Mexican labor and cartel issues regarding safety and organized control over our properties; |

| | |

| · | Risks related to the possible dilution of the Company’s common stock from additional financing activities; |

| | |

| · | Risks related to potential conflicts of interest with the Company’s management; and |

| | |

| · | Risks related to the Company’s shares of common stock. |

This list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Risk Factors”, “Description of Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. United States Antimony Corporation disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law. The Company advises readers to carefully review the reports and documents filed from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

As used in this Annual Report, the terms “we,” “us,” “our,” “U.S. Antimony,” and the “Company”, mean United States Antimony Corporation, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

PART I

Item 1. Description of Business.

General and History

AGAU Mines, Inc., predecessor of United States Antimony Corporation (“USAC”, “U.S. Antimony” or “the Company”), was incorporated in June 1968 as a Delaware corporation to mine gold and silver. USAC was incorporated in Montana in January 1970 to process and sell antimony products. In June 1973, AGAU Mines, Inc. was merged into USAC. In December 1983, the Company suspended its antimony mining operations when it became possible to purchase antimony raw materials more economically from foreign sources.

In March 1998, we formed United States Antimony, Mexico S.A. de C.V. (“USAMSA”), to mine and smelt antimony in Mexico. Bear River Zeolite Company (“BRZ”) was incorporated in 2000, and it is mining and producing zeolite in southeastern Idaho.

During 2000, the Company formed a 75% owned subsidiary, Bear River Zeolite Company (“BRZ”), to mine and market zeolite and zeolite products from a mineral deposit in southeastern Idaho. In 2001, an operating plant was constructed at the zeolite site and zeolite extraction and sales commenced. During 2002, the Company acquired the remaining 25% of BRZ and continued to extract and sell zeolite products.

On August 19, 2005, the Company formed a 100% owned subsidiary, Antimonio de Mexico S.A. de C.V. (“AM”), to explore and develop potential antimony and silver deposits in Mexico.

During 2006, the Company acquired 100% ownership in USAMSA, which became a wholly-owned subsidiary of the Company.

In 2018, the Company acquired 100% ownership in Stibnite Holding Company US Inc. (previously Lanxess Holding Company US Inc.), Antimony Mining and Milling US LLC (previously Lanxess Laurel US LLC), a Delaware limited liability company and Lanxess Laurel de Mexico, S.A. de C.V (“Lanxess Laurel Mexico”), a Mexico corporation, both of which became a wholly-owned subsidiary of the Company.

Our principal business is the extraction, processing and sale of antimony, zeolite, silver and gold products. On May 16, 2012, we started trading on the NYSE MKT (now NYSE American) under the symbol UAMY.

As a mining company, we are subject to Subpart 1300 of Regulation S-K (“S-K 1300”), a regulation adopted by the U.S. Securities and Exchange Commission (“SEC”). Although we extract minerals from several of our properties that we later process and sell, S-K 1300 classifies each of our mining properties as an exploration stage property and our company as an exploration stage issuer because we have not prepared a technical report summary for any of our properties making a determination that the property contains proven and probable mineral reserves.

Recent Developments

In August 2022, the Company entered into an agreement in principle with SB Wadley, S.A. de C.V. contemplating the purchase of the property, deposit, auxiliary infrastructure and equipment at a property in Mexico known as the Wadley property in exchange for an aggregate of $9 million plus tax, of which $2 million would be paid by the Company at execution of the definitive agreement and an additional $1 million would be paid by the Company on each of the first seven anniversaries of the execution of the definitive agreement. The transaction is subject to due diligence which must be completed by April 15, 2023, and definitive agreements which must be completed by April 30, 2023. During the due diligence period, the Company has the right to mine, retain sole ownership of all ore extracted from the mining claims, and conduct geological, geophysical and geochemical studies in exchange for monthly payments of $10,000 plus tax. In Feb 2023, because the owners of the Wadley had failed to provide USAC with the fiscal, corporate, and legal documentation they agreed to provide, it was agreed that the 8-month due-diligence period be extended another 8 months until October 15, 2023. This arrangement was accompanied with same monthly lease agreement and ore-rights exclusivity.

In August 2022, the Company’s 100% owned Mexican subsidiary, United States Antimony de Mexico S.A. de C.V. (“USAMSA”), agreed to pay Soluciones Empresariales Surmit, S.A. de C.V. (“Contractor”) up to approximately $1 million to assist USAMSA in its efforts to acquire surface rights on certain properties on which it holds mining claims [at the Sierra Guadalupe property]. As of June 30, 2023, USAMSA has paid the Contractor a total of $135,726 under this contract.

Products and Segments

Our products consist of the foregoing:

| · | Antimony: includes antimony oxide, sodium antimonite, antimony trisulfide and antimony metal; |

| | |

| · | Zeolite: includes coarse and fine zeolite crushed in various sizes; and |

| | |

| · | Precious metals: includes unrefined and refined gold and silver. |

In our operations in Montana, we produce antimony oxide, antimony metal, and precious metals. Antimony oxide is a fine, white powder that is used primarily in conjunction with a halogen to form a synergistic flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings and paper. Antimony oxide is also used as a color fastener in paint, as a catalyst for production of polyester resins and fibers and film, as a catalyst for production of polyethylene phthalate in plastic bottles, as a phosphorescent agent in fluorescent light bulbs, and as an opacifier for porcelains. The Company also sells antimony metal for use in bearings, storage batteries and ordnance.

In its operations in Idaho, the Company produces zeolite, a group of industrial minerals used in a variety of purposes including soil amendment and fertilizer. Zeolite is also used for water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation and other miscellaneous applications.

The Company is currently organized and managed by four segments, which represent our operating units: United States antimony operations, Mexican antimony operations, precious metals recovery and United States zeolite operations.

The Puerto Blanco mill and the Madero smelter at the Company’s Mexico operation bring antimony up to an intermediate or finished stage, which may be sold directly or shipped to the United States operation for finishing at the Montana plant. The Puerto Blanco mill in Mexico is the site of our crushing and floatation plant, and a cyanide leach plant which will recover precious metals after the ore goes through the crushing and flotation cycles. A precious metals recovery plant is operated in conjunction with the antimony processing plant in Montana, where a 99% precious metals mix will be produced. Almost all of the sales of products from the United States antimony and zeolite operations are to customers in the United States, although the Company does have a sales operation in Canada.

For further information regarding our sales, see Note 16 in our consolidated audited financial statements included in this Annual Report.

Antimony

Our Montana antimony smelter and precious metals plant is located in the Burns Mining District of Sanders County, Montana, approximately 15 miles west of Thompson Falls, Montana. We hold two patented mill sites where the plant is located. Environmental restrictions preclude mining at this site.

We rely on foreign sources for raw materials, and there are risks of interruption in procurement from these sources and/or volatile changes in world market prices for these materials that are not controllable by us. We have our own sources of antimony in Mexico, but we depend on foreign companies for raw material. We expect to receive raw materials from our owned and leased properties for 2023 and later years. We also work with suppliers in North America (including Mexico) and Central America. The acquisition of antimony ores is technically complex and a function of the country’s laws and regulations. U.S. Antimony’s policy consequently requires flexibility regarding supply agreements and is tailored on specific suppliers accordingly.

We currently own 100% of USAMSA, which was formed in April 1998. We currently own 100% of Antimony de Mexico SA de CV (“ADM”), which owns the San Miguel concession of the Los Juarez property. USAMSA has two divisions, (1) the Madero smelter in Coahuila, and (2) the Puerto Blanco flotation mill and oxide circuit in Guanajuato. ADM possesses the Los Juarez mineral deposit. ADM owns all of the mining concessions pertaining to the Los Juarez property except for the San Juan 3 concession, for which we have a long-term lease.

None of our antimony properties contains proven and probable mineral reserves.

We estimate (but have not independently confirmed) that our present share of the domestic market and international market for antimony oxide products is approximately 4% and less than 1%, respectively. We are the only significant U.S. producer of antimony products, while China supplies 92% of the world antimony demand. We believe we are competitive both domestically and world-wide due to the following:

| · | We have a reputation for quality products delivered on a timely basis. |

| | |

| · | We have the only two operating, permitted antimony smelters in North and Central America. |

| | |

| · | We are the only U.S. domestic producer of antimony products. |

| | |

| · | We can ship on short notice to domestic customers. |

| | |

| · | We are vertically integrated, with raw materials from our own mines, mills, and smelter in Mexico, along with the raw materials from exclusive supply agreements we have with numerous ore and raw material suppliers. |

| | |

| · | Our smelter in Coahuila is the largest operating antimony smelter in Mexico or the United States with a current maximum capacity of about 32,600 pounds of feed per day and permitting for 50% to 70% expansion. |

Following is a five-year schedule of our antimony sales:

Year | | Lbs. Metal Contained | | | Sales ($) | | | Average Price/Lb. | |

2022 | | | 1,394,036 | | | $ | 7,631,671 | | | $ | 5.47 | |

2021 | | | 911,079 | | | $ | 4,815,524 | | | $ | 5.29 | |

2020 | | | 815,310 | | | $ | 2,942,628 | | | $ | 3.61 | |

2019 | | | 1,566,585 | | | $ | 5,450,649 | | | $ | 3.48 | |

2018 | | | 1,486,120 | | | $ | 6,113,014 | | | $ | 4.11 | |

Concentration of Sales:

During the years ended December 31, 2022 and 2021, the following sales were made to our four largest customers:

| | For the year ended December 31, | |

Sales to largest customers | | 2022 | | | 2021 | |

Company A | | $ | 1,882,667 | | | $ | 1,141,608 | |

Company B | | | 1,863,958 | | | | - | |

Company C | | | 827,822 | | | | - | |

Company D | | | 751,328 | | | | 518,227 | |

Company E | | | 737,189 | | | | 474,738 | |

Company F | | | 735,194 | | | | 850,301 | |

Company G | | | 226,633 | | | $ | 1,728,406 | |

| | | 7,024,791 | | | | 4,713,280 | |

% of Total Revenues | | | 64 | % | | | 61 | % |

Marketing: We employ full-time marketing personnel and have negotiated various commission-based sales agreements with other chemical distribution companies.

Antimony Price Fluctuations: Our operating results have been, and will continue to be, related to the market prices of antimony metal, which have fluctuated widely in recent years. The volatility of prices is illustrated by the following table, which sets forth the average prices of antimony metal per pound, as reported by sources deemed reliable by us.

A five-year range of prices for antimony oxide and antimony metal, per pound, as reported by Argus Metals was as follows:

| | USAC SALES | |

Year | | Metal Contained Price | | | Rotterdam | |

2022 | | $ | 5.47 | | | $ | 6.01 | |

2021 | | $ | 5.29 | | | $ | 4.91 | |

2020 | | | 3.61 | | | | 2.45 | |

2019 | | | 3.48 | | | | 3.03 | |

2018 | | | 4.11 | | | | 3.74 | |

Antimony metal prices are determined by a number of variables over which we have no control. These include the availability and price of imported metals, the quantity of new metal supply, and industrial demand. If metal prices decline and remain depressed, our revenues and profitability may be adversely affected.

Suppliers: We use various antimony raw materials to produce our products. We currently obtain antimony raw material from sources in Canada and Mexico and Central America.

Zeolite

We own 100% of Bear River Zeolite, Inc. (“BRZ”). BRZ has a lease with Webster Farm, L.L.C. that entitles BRZ to surface mine and process zeolite on property located near Preston, Idaho, in exchange for a royalty payment. In 2010 the royalty was adjusted to $10 per ton sold. The current minimum annual royalty is $60,000. In addition, BRZ has identified more zeolite located on U.S. Bureau of Land Management land. The Company pays various royalties on the sale of zeolite products. Other royalty holders are paid a royalty that varies from $1 to $5 per ton. On a combined basis, royalties vary from 8%-13% of sales.

Shortly after inception, BRZ constructed a processing plant on the property which improved its productive capacity. Ground-breaking for an additional warehouse to store additional inventory and a shop to service equipment started in 2021 and the warehouse and shop were expected to be completed last year. A vertical-shaft-impactor crusher was replaced by a hammer mill for crushing line number 1 in 2021 for increased production rate. A replacement jaw crusher was installed and put into service in 2021. The new jaw crusher was further improved with a variable-speed apron feeder in late 2021 and subsequent and substantial improvements have been made to the jaw crusher in 2022. In 2021, the Company purchased a house in Preston Idaho for the express purpose of housing workers for its zeolite operation.

None of our zeolite properties contains any proven and probable mineral reserves.

“Zeolite” refers to a group of industrial minerals that consist of hydrated aluminosilicates that hold cations such as calcium, sodium, ammonium, various heavy metals, and potassium in their crystal lattice. Water is loosely held in cavities in the lattice. BRZ zeolite is regarded as one of the best zeolites in the world due to its high cation exchange capacity (“ CEC”) of approximately 180-220 meq/100 gr., its hardness and high clinoptilolite content, its absence of clay minerals, and its low sodium content. BRZ’s zeolite deposits’ characteristics which make the mineral useful for a variety of purposes including:

| · | Soil Amendment and Fertilizer. Zeolite has been successfully used to fertilize golf courses, sports fields, parks and common areas, and high value agricultural crops |

| | |

| · | Water Filtration. Zeolite is used for particulate, heavy metal and ammonium removal in swimming pools, municipal water systems, fisheries, fish farms, and aquariums. |

| | |

| · | Sewage Treatment. Zeolite is used in sewage treatment plants to remove nitrogen and as a carrier for microorganisms. |

| | |

| · | Nuclear Waste and Other Environmental Cleanup. Zeolite has shown a strong ability to selectively remove strontium, cesium, radium, uranium, and various other radioactive isotopes from solution. Zeolite can also be used for the cleanup of soluble metals such as mercury, chromium, copper, lead, zinc, arsenic, molybdenum, nickel, cobalt, antimony, calcium, silver and uranium. |

| | |

| · | Odor Control. A major cause of odor around cattle, hog, and poultry feed lots is the generation of the ammonium in urea and manure. The ability of zeolite to absorb ammonium prevents the formation of ammonia gas, which disperses the odor. |

| | |

| · | Gas Separation. Zeolite has been used for some time to separate gases, to re-oxygenate downstream water from sewage plants, smelters, pulp and paper plants, and fish ponds and tanks, and to remove carbon dioxide, sulfur dioxide and hydrogen sulfide from methane generators as organic waste, sanitary landfills, municipal sewage systems, animal waste treatment facilities, and is excellent in pressure swing apparatuses. |

| | |

| · | Animal Nutrition. According to other research, feeding up to 2% zeolite increases growth rates, decreases conversion rates, and prevents scours. BRZ does not make these claims. |

| | |

| · | Miscellaneous Uses. Other uses include catalysts, petroleum refining, concrete, solar energy and heat exchange, desiccants, pellet binding, horse and kitty litter, floor cleaner and carriers for insecticides, pesticides and herbicides. |

Precious Metals

The Company processes antimony sources that sometimes contain precious metals. In such cases, the metallurgical techniques employed for the recovery of antimony are altered to also recover the precious metals. In 2022, the principal sources of antimony concentrates bearing precious metals came from a North American supply and to a much lesser extent, concentrates from the Los Juarez property. Financial and operational performance of precious metals for the year ended December 31, 2022 and 2021 was as follows:

| | Year ended December 31, | | | | | | | |

Precious metals | | 2022 | | | 2021 | | | $ Change | | | % Change | |

Total revenue - precious metals | | $ | 261,707 | | | $ | 338,341 | | | | (76,634 | ) | | | (22.6 | %) |

Gross profit precious metals | | | 151,167 | | | | 231,077 | | | | (79,910 | ) | | | (34.6 | %) |

Ounces sold - gold | | | 43.77 | | | | 70 | | | | (26.23 | ) | | | (37.5 | %) |

Ounces sold - silver | | | 25,122 | | | | 27,342 | | | | (2,220 | ) | | | (8.1 | %) |

Governmental Regulation

We are subject to the requirements of the Federal Mining Safety and Health Act of 1977, the Occupational Safety and Health Administration’s regulations, requirements of the state of Montana and the state of Idaho, federal and state health and safety statutes and Sanders County, Montana and Franklin County, Idaho health ordinances. The following is a summary of governmental regulation compliance areas which we believe are significant to our business and may have a material effect on our consolidated financial statements, earnings and/or competitive position.

Health and Safety

We are subject to the regulations of the Mine Safety and Health Administration (“MSHA”) in the United States and the Mexico Ministry of Economy and Mining, and work with these agencies to address issues outlined in any investigations and inspections and continue to evaluate our safety practices. We strive to achieve excellent mine safety and health performance, and attempt to implement reasonable best practices with respect to mine safety and emergency preparedness. Achieving and maintaining compliance with regulations will be challenging and may increase our operating costs.

Environmental

Our operations are subject to various environmental laws and regulations at the federal and state level. Compliance with environmental regulations, and litigation based on environmental laws and regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities. Mine closure and reclamation regulations impose substantial costs on our operations and include requirements that we provide financial assurance supporting those obligations. We have over $200,000 of financial assurances, primarily in the form of surety bonds, for reclamation company-wide. We anticipate approximately $15,000 in expenditures in 2023 for idle property management and environmental permit compliance.

Licenses, Permits and Claims/Concessions

We are required to obtain various licenses and permits to operate our mines and conduct exploration and reclamation activities. Targets at our Los Juarez exploration project in Mexico, our planned exploration at Wadley and Sierra Guadalupe can only be developed if we are successful in obtaining the necessary permits. In addition, our operations and exploration activities in Mexico are conducted pursuant to claims or concessions granted by the host government, and otherwise are subject to claims renewal and minimum work commitment requirements, which are subject to certain political risks associated with foreign operations.

Environmental Matters

Our exploration, development and production programs conducted in the United States are subject to local, state and federal regulations regarding environmental protection. Some of our production and mining activities are conducted on public lands. We believe that our current discharge of waste materials from our processing facilities is in material compliance with environmental regulations and health and safety standards. The U.S. Forest Service extensively regulates mining operations conducted in National Forests. Department of Interior regulations cover mining operations carried out on most other public lands. All operations by us involving the exploration for or the production of minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of water sources, waste materials, odor, noise, dust and other environmental protection requirements adopted by federal, state and local governmental authorities. We may be required to prepare and present data to these regulatory authorities pertaining to the effect or impact that any proposed exploration for, or production of, minerals may have upon the environment. Any changes to our reclamation and remediation plans, which may be required due to changes in state or federal regulations, could have an adverse effect on our operations. The range of reasonably possible loss in excess of the amounts accrued, by site, cannot be reasonably estimated at this time.

We accrue environmental liabilities when the occurrence of such liabilities is probable and the costs are reasonably estimable. The initial accruals for all our sites are based on comprehensive remediation plans approved by the various regulatory agencies in connection with permitting or bonding requirements. Our accruals are further based on presently enacted regulatory requirements and adjusted only when changes in requirements occur or when we revise our estimate of costs to comply with existing requirements. As remediation activity has physically commenced, we have been able to refine and revise our estimates of costs required to fulfill future environmental tasks based on contemporaneous cost information, operating experience, and changes in regulatory requirements. In instances where costs required to complete our remaining environmental obligations are clearly determined to be in excess of the existing accrual, we have adjusted the accrual accordingly. When regulatory agencies require additional tasks to be performed in connection with our environmental responsibilities, we evaluate the costs required to perform those tasks and adjust our accrual accordingly, as the information becomes available. In all cases, however, our accrual at year-end is based on the best information available at that time to develop estimates of environmental liabilities.

Antimony Processing Site

We have environmental remediation obligations at our antimony processing site near Thompson Falls, Montana (“the Stibnite Hill Mine Site”). We are under the regulatory jurisdiction of the U.S. Forest Service and subject to the operating permit requirements of the Montana Department of Environmental Quality. At December 31, 2022 and 2021, we have accrued $100,000 to fulfill our environmental responsibilities.

BRZ

During 2001, we recorded a reclamation accrual for our BRZ subsidiary, based on an analysis performed by us and reviewed and approved by regulatory authorities for environmental bonding purposes. The accrual of $7,500 represents our estimated costs of reclaiming, in accordance with regulatory requirements, the acreage disturbed by our zeolite operations, and remains unchanged at December 31, 2022.

General

Reclamation activities at the Thompson Falls Antimony Plant were performed regularly under supervision of the U.S. Forest Service and Montana Department of Environmental Quality. We have complied with regulators’ requirements and do not expect the imposition of substantial additional requirements.

We have posted cash performance bonds with a bank and the U.S. Forest Service in connection with our reclamation activities.

We believe we have accrued adequate reserves to fulfill our environmental remediation responsibilities as of December 31, 2022 and 2021. We have made significant reclamation and remediation progress on all our properties over thirty years and have complied with regulatory requirements in our environmental remediation efforts.

Competition

We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties and for equipment and labor related to exploration and development of mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources. Accordingly, competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary to develop its mineral properties.

We provide no assurance we will be able to compete in any of our business areas effectively with current or future competitors or that the competitive pressures faced by us will not have a material adverse effect on the business, financial condition and operating results.

Employees

As of December 31, 2022, we employed 16 full-time employees in Montana. In addition, we employed 23 people at our zeolite plant and mining operation in Idaho, and 39 employees at our mining, milling and smelting operation in Mexico. The number of full-time employees may vary seasonally. None of our employees are covered by any collective bargaining agreement,

Intellectual Property

We hold no material patents, licenses, franchises or concessions. However, we consider our antimony processing plants proprietary in nature.

Item 1A. Risk Factors.

The following risks and uncertainties, together with the other information set forth in this report, should be carefully considered by those who invest in our securities. Any of the following material risk factors could adversely affect our business, financial condition or operating results and could decrease the value of our common or preferred stock or other outstanding securities. These are not all of the risks we face, and other factors not presently known to us or that we currently believe are immaterial may also affect our business if they occur

Financial Risks

We have experienced losses in recent years and may continue to incur losses.

We have experienced a loss from operations and a net loss in each of the fiscal years ended December 31, 2019, 2020, and 2021. We may continue to experience losses in the future. Many of the factors affecting our operating results are beyond our control, including, but not limited to, the volatility of metals prices; smelter terms; rock and soil conditions; seismic events; availability of hydroelectric power; diesel fuel prices; interest rates; foreign exchange rates; global or regional political or economic policies; inflation; availability and cost of labor; economic developments and crises; governmental regulations; continuity of orebodies; ore grades; recoveries; performance of equipment; price speculation by certain investors; and purchases and sales by central banks and other holders and producers of gold and silver in response to these factors. We cannot assure you that we will not experience net losses in the future. Continued losses may have an adverse effect on our cash balances, require us to curtail certain activities and investments, raise additional capital or sell assets.

Deferred or contingent payment obligations may create financial risk for our business

We are conducting due diligence pursuant to a preliminary agreement to acquire assets located in Mexico known as the Wadley property. If the transaction proceeds on the terms set out in the preliminary agreement, we will be required to make an initial payment of $2 million followed by seven annual payments of $1 million (in each case, plus tax). We cannot assure you that such efforts would be successful. As a result, our business and financial condition could be harmed.

We may seek or require additional financing, which may not be available on acceptable terms, if at all.

We may seek to source additional financing by way of private or public offerings of equity or debt or the sale of project or property interests in order to have sufficient capital to engage in acquisitions, investments and for general working capital. We can give no assurance that financing will be available to it or, if it is available, that it will be offered on acceptable terms. If additional financing is raised by the issuance of our equity securities, control of our company may change, security holders will suffer additional dilution and the price of the common stock may decrease. If additional financing is raised through the issuance of indebtedness, we will require additional financing in order to repay such indebtedness. Failure to obtain such additional financing could result in the delay or indefinite postponement of further acquisitions, investments, exploration and development, curtailment of business activities or even a loss of property interests.

Metal prices are volatile. A substantial or extended decline in metals prices would have a material adverse effect on us.

Our revenue is derived primarily from the sale of antimony and zeolite products, and to a lesser extent silver and gold products, and, as a result, our earnings are directly related to the prices of these metals and products. Antimony, zeolite, silver and gold prices fluctuate widely and are affected by numerous factors, including:

| · | speculative activities; |

| | |

| · | relative exchange rates of the U.S. dollar; |

| | |

| · | global and regional demand and production; |

| | |

| · | political instability; |

| | |

| · | inflation, recession or increased or reduced economic activity; and |

| | |

| · | other political, regulatory and economic conditions. |

These factors are largely beyond our control and are difficult to predict. If the market prices for these metals and products fall below our production, exploration or development costs for a sustained period of time, we will experience losses and may have to discontinue exploration, development or operations, or incur asset write-downs at one or more of our properties. See Item 1. Business - Introduction for information on the average price of antimony for the last five years.

An extended decline in metals prices, an increase in operating or capital costs, mine accidents or closures, increasing regulatory obligations, or our inability to convert resources or exploration targets to reserves may cause us to record write-downs, which could negatively impact our results of operations.

When events or changes in circumstances indicate the carrying value of our long-lived assets may not be recoverable, we review the recoverability of the carrying value by estimating the future undiscounted cash flows expected to result from the use and eventual disposition of the asset. Impairment must be recognized when the carrying value of the asset exceeds these cash flows. Recognizing impairment write-downs could negatively impact our results of operations. Metals price estimates are a key component used in the evaluation of the carrying values of our assets, as the evaluation involves comparing carrying values to the average estimated undiscounted cash flows resulting from operating plans using various metals price scenarios. Our estimates of undiscounted cash flows for our long-lived assets also include an estimate of the market value of the resources and exploration targets beyond the current operating plans.

We determined no impairments were required for 2022. If the prices of antimony or zeolite decline for an extended period of time, if we fail to control production or capital costs, if regulatory issues increase costs or decrease production, or if we do not realize the mineable ore reserves, resources or exploration targets at our mining properties, we may be required to recognize asset write-downs in the future. In addition, the perceived market value of the resources and exploration targets of our properties is dependent upon prevailing metals prices as well as our ability to discover economic ore. A decline in metals prices for an extended period of time or our inability to convert resources or exploration targets to reserves could significantly reduce our estimates of the value of the resources or exploration targets at our properties and result in asset write-downs.

Our profitability could be affected by the prices of other commodities.

Our profitability is sensitive to the costs of commodities such as fuel, steel, and cement. While the recent prices for such commodities have been stable or in decline, prices have been historically volatile, and material increases in commodity costs could have a significant effect on our results of operations.

We are subject to the risk of fluctuations in the relative values of the U.S. Dollar and Mexican Peso.

We may be adversely affected by foreign currency fluctuations. Certain of our assets are located in Mexico. Our expenses relative to our Mexican assets, and in certain cases those assets themselves, may be denominated in Mexican Pesos. Fluctuations in the exchange rates between the U.S. Dollar and the Mexican Peso may therefore have a material adverse effect on the Company’s financial results. Mexico has experienced periods of significant inflation. If Mexico experiences substantial inflation in the future, the Company’s costs in peso terms will increase significantly, subject to movements in applicable exchange rates.

Our liabilities for environmental reclamation may exceed the amounts accrued on our financial statements.

Our research, development, manufacturing and production processes involve the controlled use of hazardous materials, and we are subject to various environmental and occupational safety laws and regulations governing the use, manufacture, storage, handling, and disposal of hazardous materials and some waste products. The risk of accidental contamination or injury from hazardous materials cannot be completely eliminated. In the event of an accident, we could be held liable for any damages that result and any liability could exceed our financial resources. We also have one ongoing environmental reclamation and remediation project at our current production facility in Montana. Adequate financial resources may not be available to ultimately finish the reclamation activities if changes in environmental laws and regulations occur, and these changes could adversely affect our cash flow and profitability. We expect to have environmental reclamation obligations, and may be liable for environmental contamination, on our other current and former mining properties and processing facilities. We do not have environmental liability insurance now, and we do not expect to be able to obtain insurance at a reasonable cost. If we incur liability for environmental damages while we are uninsured, it could have a harmful effect on our financial condition and results of operations. The range of reasonably possible losses from our exposure to environmental liabilities in excess of amounts accrued to date cannot be reasonably estimated at this time.

Our accounting and other estimates may be imprecise.

Preparing consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| · | mineral reserves, resources, and exploration targets that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations; |

| | |

| · | environmental, reclamation and closure obligations; |

| | |

| · | permitting and other regulatory considerations; |

| | |

| · | asset impairments; |

| | |

| · | valuation of business combinations; |

| | |

| · | future foreign exchange rates, inflation rates and applicable tax rates; |

| | |

| · | reserves for contingencies and litigation; and |

| | |

| · | deferred tax asset and liability valuation allowance. |

Future estimates and actual results may differ materially from these estimates as a result of using different assumptions or conditions. For additional information, see Critical Accounting Estimates in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Note 2 of Notes to Consolidated Financial Statements.”

Risks Related to Our Operations and the Mining Industry

Mining is an inherently speculative business. The properties on which we have the right to mine for precious minerals are not known to have any proven and probable mineral reserves and we have proceeded to extract minerals without having completed the technical work required to declare a mineral reserve. If we are unable to extract antimony, zeolite or other minerals which can be mined at a profit, our business could fail.

Natural resource mining, and precious metal mining, in particular, is a business that by its nature is speculative. We have not completed an S-K 1300 technical report summary, nor have we declared proven and probable mineral reserves on any of our properties. Where applicable, we have commenced extraction activities prior to identifying a mineral reserve. There is a strong possibility that we will not discover antimony, zeolite, or any other minerals which can be mined or extracted at a profit. Even if we do discover and mine precious metal deposits, the deposits may not be of the quality or size necessary for us or a potential purchaser of the property to make a profit from mining it. Few properties that are explored are ultimately developed into producing mines, and mines that are developed may not be profitable. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits. If we are unable to extract antimony, zeolite or other minerals which can be mined at a profit, our business could fail.

Natural disasters, public health crises (including COVID-19), political crises, and other catastrophic events or other events outside of our control may materially and adversely affect our business or financial results.

If any of our facilities or the facilities of our suppliers, third-party service providers, or customers is affected by natural disasters, such as earthquakes, floods, fires, power shortages or outages, public health crises (such as pandemics and epidemics), political crises (such as terrorism, war, political instability or other conflict), or other events outside of our control, our operations or financial results could suffer. Any of these events could materially and adversely impact us in a number of ways, including through decreased production, increased costs, decreased demand for our products due to reduced economic activity or other factors, or the failure by counterparties to perform under contracts or similar arrangements.

Our business could be materially and adversely affected by the risks, or the public perception of the risks, related to a pandemic or other health crisis, such as the recent outbreak of novel coronavirus (COVID-19). A significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect our planned operations. Such events could result in the complete or partial closure of our operations. In addition, it could impact economies and financial markets, resulting in an economic downturn that could impact our ability to raise capital. The pandemic that has been going on for the past two years has specifically affected our ability to obtain supplies and services to maintain our business. This ongoing health crisis has reduced the ability of the regulating agencies to process our permits on a timely basis which could delay our ability to operate at maximum efficiency. Our ability to obtain and retain qualified employees has also been adversely affected by this global health crisis.

We continue to monitor the rapidly evolving situation and guidance from federal, state, local and foreign governments and public health authorities and may take additional actions based on their recommendations. The extent of the impact of COVID-19 and any subsequent variants on our business and financial results will also depend on future developments, including the duration and spread of the outbreak within the markets in which we operate and the related impact on prices, demand, creditworthiness and other market conditions and governmental reactions, all of which are highly uncertain.

Mining accidents or other adverse events at an operation could decrease our anticipated production or otherwise adversely affect our operations.

Production may be reduced below our historical or estimated levels for many reasons, including, but not limited to, mining accidents; unfavorable ground or shaft conditions; work stoppages or slow-downs; lower than expected ore grades; unexpected regulatory actions; if the metallurgical characteristics of ore are less economic than anticipated; or because our equipment or facilities fail to operate properly or as expected. Our operations are subject to risks relating to ground instability, including, but not limited to, pit wall failure, crown pillar collapse, seismic events, backfill and stope failure or the breach or failure of a tailings impoundment. The occurrence of an event such as those described above could result in loss of life or temporary or permanent cessation of operations, any of which could have a material adverse effect on our financial condition and results of operations. Other closures or impacts on operations or production may occur at any of our mines at any time, whether related to accidents, changes in conditions, changes to regulatory policy, or as precautionary measures.

In addition, our operations are typically in remote locations, where conditions can be inhospitable, including with respect to weather, surface conditions, interactions with wildlife or otherwise in or near dangerous conditions. In the past we have had employees, contractors, or employees of contractors get injured, sometimes fatally, while working in such challenging locations. An accident or injury to a person at or near one of our operations could have a material adverse effect on our financial condition and results of operations.

We may not be able to maintain the infrastructure necessary to conduct mining activities.

Our mining activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our mining activities and financial condition.

Our mining activities may be adversely affected by the local climate.

The local climate sometimes affects our mining activities on our properties. Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our property, or could occasionally prevent us temporarily from conducting mining activities on our property. [Because of their rural location and the lack of developed infrastructure in the area, our mineral properties in Montana and Idaho are occasionally impassable during the winter season.] During this time, it may be difficult for us to access our property, maintain production rates, make repairs, or otherwise conduct mining activities on them.

Certain of our mining properties and smelter operations are located in Mexico and may be subject to geo-political risk.

Certain of our mining properties and smelter operations are located in Mexico. Any political or social disruptions unique to Mexico would have a material impact on our operations, financial performance and stability. Additionally, our properties and projects are subject to the laws of Mexico, and we may be negatively impacted by the existing laws and regulations of that country, as they apply to mineral exploration, land ownership, royalty interests and taxation, and by any potential changes of such laws and regulations.

Any changes in regulations or shifts in political conditions are beyond our control or influence and may adversely affect our business, or if significant enough, may result in the impairment or loss of mineral concessions or other mineral rights, or may make it impossible to continue its mineral exploration and mining activities in such areas.

Our operations are subject to hazards and risks normally associated with the exploration and development of mineral properties.

Our operations are subject to hazards and risks normally associated with the exploration and development of mineral properties, any of which could cause delays in the progress of our exploration and development plans, damage or destruction of property, loss of life and/or environmental damage. Some of these risks include, but are not limited to, unexpected or unusual geological formations, rock bursts, cave-ins, flooding, fires, earthquakes; unanticipated changes in metallurgical characteristics and mineral recovery; unanticipated ground or water conditions; changes in the regulatory environment; industrial or labor disputes; hazardous weather conditions; cost overruns; land claims; and other unforeseen events. A combination of experience, knowledge and careful evaluation may not be able to overcome these risks.

The nature of these risks is such that liabilities may exceed any insurance policy coverages; the liabilities and hazards might not be insurable or the Company might not elect to insure itself against such liabilities due to excess premium costs or other factors. Such liabilities may have a material adverse effect on our financial condition and operations and could reduce or eliminate any future profitability and result in increased costs and a decline in the value of our securities.

Our non-extractive properties may not be brought into a state of commercial production.

Development of mineral properties involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. The commercial viability of a mineral deposit is dependent upon a number of factors which are beyond our control, including the attributes of the deposit, commodity prices, government policies and regulation and environmental protection. Fluctuations in the market prices of minerals may render reserves and deposits containing relatively lower grades of mineralization uneconomic. The development of our non-extractive properties will require obtaining land use consents, permits and the construction and operation of mines, processing plants and related infrastructure. We are subject to all of the risks associated with establishing new mining operations, including:

| · | the timing and cost, which can be considerable, of the construction of mining and processing facilities and related infrastructure; |

| | |

| · | the availability and cost of skilled labor and mining equipment; |

| | |

| · | the availability and cost of appropriate smelting and/or refining arrangements; |

| | |

| · | the need to obtain and maintain necessary environmental and other governmental approvals and permits, and the timing of those approvals and permits; |

| | |

| · | in the event that the required permits are not obtained in a timely manner, mine construction and ramp-up will be delayed and the risks of government environmental authorities issuing directives or commencing enforcement proceedings to cease operations or administrative, civil and criminal sanctions being imposed on our company, directors and employees; |

| | |

| · | delays in obtaining, or a failure to obtain, access to surface rights required for current or future operations; |

| | |

| · | the availability of funds to finance construction and development activities; |

| | |

| · | potential opposition from non-governmental organizations, environmental groups or local community groups which may delay or prevent development activities; and |

| | |

| · | potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies and foreign exchange rates. |

It is common in new mining operations to experience unexpected costs, problems and delays during development, construction and mine ramp-up. Accordingly, there are no assurances that our non-extractive properties will be brought into a state of commercial production.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that any future development activities will result in profitable mining operations.

The capital costs to take projects into commercial production may be significantly higher than anticipated. Capital costs, operating costs, production and economic returns and other estimates may prove to differ significantly from those used by us to decide to commence extraction, and there can be no assurance that our actual capital and operating costs will not be higher than currently anticipated. As a result of higher capital and operating costs, production and economic returns may differ significantly from those we have anticipated.

We may face equipment shortages, access restrictions and lack of infrastructure.

Natural resource exploration, development and mining activities are dependent on the availability of mining, drilling and related equipment in the particular areas where such activities are conducted. A limited supply of such equipment or access restrictions may affect the availability of such equipment to us and may delay exploration, development or extraction activities. Certain equipment may not be immediately available or may require long lead time orders. A delay in obtaining necessary equipment for mineral exploration, including drill rigs, could have a material adverse effect on our operations and financial results.

Mining, processing, development and exploration activities also depend, to one degree or another, on the availability of adequate infrastructure. Reliable roads, bridges, power sources, fuel and water supply and the availability of skilled labor and other infrastructure are important determinants that affect capital and operating costs. The establishment and maintenance of infrastructure, and services are subject to a number of risks, including risks related to the availability of equipment and materials, inflation, cost overruns and delays, political or community opposition and reliance upon third parties, many of which are outside our control. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay development or ongoing operation of our projects.

Exploration of mineral properties is less intrusive, and generally requires fewer surface and access rights, than properties developed for mining. No assurances can be provided that we will be able to secure required surface rights on favorable terms, or at all. Any failure by us to secure surface rights could prevent or delay development of our projects.

Insurance may not be available to us.

Mineral exploration is subject to risks of human injury, environmental and legal liability and loss of assets. We may elect not to have insurance for certain risks because of the high premiums associated with insuring those risks or, in some cases, insurance may not be available for certain risks. Occurrence of events for which we are not insured could have a material adverse effect on our financial position or results of operations.

Our business depends on availability of skilled personnel and good relations with employees.

We are dependent upon the ability and experience of our executive officers, managers, employees, contractors and their employees, and other personnel, and we cannot assure you that we will be able to attract or retain such employees or contractors. We may at times have insufficient executive or operational personnel, or personnel whose skills require improvement. We compete with other companies both in and outside the mining industry in recruiting and retaining qualified employees and contractors knowledgeable about the mining business. From time to time, we have encountered, and may in the future encounter, difficulty recruiting skilled mining personnel at acceptable wage and benefit levels in a competitive labor market, and may be required to utilize contractors, which can be more costly. Temporary or extended lay-offs due to mine closures may exacerbate such issues and result in vacancies or the need to hire less skilled or efficient employees or contractors. The loss of skilled employees or contractors or our inability to attract and retain additional highly skilled employees and contractors could have an adverse effect on our business and future operations.

A significant disruption to our information technology could adversely affect our business, operating result and financial position.

We rely on a variety of information technology and automated systems to manage and support our operations. For example, we depend on our information technology systems for financial reporting, data base management, operational and investment management and internal communications. These systems contain our proprietary business information and personally identifiable information of our employees. The proper functioning of these systems and the security of this data is critical to the efficient operation and management of our business. In addition, these systems could require upgrades as a result of technological changes or growth in our business. These changes could be costly and disruptive to our operations and could impose substantial demands on management time. Our systems and those of third-party providers, could be vulnerable to damage or disruption caused by catastrophic events, power outages, natural disasters, computer system or network failures, viruses, ransomware or malware, physical or electronic break-ins, unauthorized access, or cyber-attacks. Any security breach could compromise our networks, and the information contained there-in could be improperly accessed, disclosed, lost or stolen. Because techniques used to sabotage, obtain unauthorized access to systems or prohibit authorized access to systems change frequently and generally are not detected until successfully launched against a target, we may not be able to anticipate these attacks nor prevent them from harming our business or network. Any unauthorized activities could disrupt our operations, damage our reputation, be costly to fix or result in legal claims or proceedings, any of which could adversely affect our business, reputation or operating results.

Competition from other mining companies may harm our business.

We compete with other mining companies, some of which have greater financial resources than we do or other advantages, in various areas which include:

| · | attracting and retaining key executives, skilled labor, and other employees; |

| | |

| · | for the services of other skilled personnel and contractors and their specialized equipment, components and supplies, such as drill rigs, necessary for exploration and development; |

| | |

| · | for contractors that perform mining and other activities and milling facilities which we lease or toll mill through; and |

| | |

| · | for rights to mine properties. |

Risks Relating to Our Organization and Common Stock

Our Articles of Incorporation allow for our board to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock.

Our board of directors (the “Board”) has the authority to fix and determine the relative rights and preferences of preferred stock. Our Board also has the authority to issue preferred stock without further stockholder approval. As a result, our Board could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our Board could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing stockholders.

If we lose John Gustavsen, our Chief Executive Officer, or any of our other key personnel, we may encounter difficulty replacing their expertise, which could impair our ability to implement our business plan successfully.

We believe that our ability to implement our business strategy and our future success depends on the continued employment of our management team, in particular our President, Russell Lawrence, and our Chief Executive Officer, John Gustavsen. Our management team, who have extensive experience in the mining industry, may be difficult to replace. The loss of the technical knowledge and mining industry expertise of these key employees could make it difficult for us to execute our business plan effectively and could cause a diversion of resources while we seek replacements.

In addition, our operations require employees, consultants, advisors and contractors with a high degree of specialized technical, management and professional skills, such as engineers, trades people, geologists and equipment operators. We compete both locally and internationally for such professionals. We may be unsuccessful in attracting and maintaining key employees. If we are unable to acquire the talents we seek, we could experience higher operating costs, poorer results and an overall lack of success in implementing our business plans.

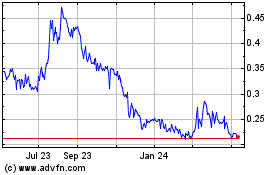

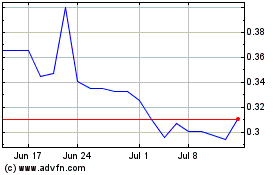

The price of our common stock has a history of volatility and could decline in the future.

Shares of our common stock are listed on NYSE American. The market price for our common stock has been volatile, often based on:

| · | changes in metals prices, particularly antimony; |

| | |

| · | our results of operations and financial condition as reflected in our public news releases or periodic filings with the SEC; |

| | |