0001123596

false

--11-30

2023

Q2

11

9

7

5

0.01

1

6

1

1

1

1

1

0.50

3

0.001

0.001

0

0

0.001

0.001

0

0

0.001

0.001

00011235962022-12-012023-05-31

thunderdome:item

utr:Y

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2021-03-042021-03-04

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2019-02-222019-02-22

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2017-05-222017-05-22

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2015-08-182015-08-18

xbrli:pure

00011235962013-05-06

iso4217:USDxbrli:shares

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2013-05-06

xbrli:shares

00011235962013-05-062013-05-06

0001123596babb:QuarterlyDividendMember2021-12-062021-12-06

0001123596babb:QuarterlyDividendMember2022-03-072022-03-07

0001123596babb:QuarterlyDividendMember2022-06-032022-06-03

0001123596babb:QuarterlyDividendMember2022-09-092022-09-09

0001123596babb:SpecialCashDistributionMember2022-12-012022-12-07

0001123596babb:QuarterlyDividendMember2022-12-012022-12-07

00011235962022-12-072022-12-07

00011235962023-03-132023-03-13

0001123596us-gaap:SubsequentEventMember2023-06-062023-06-06

00011235962021-12-012022-05-31

iso4217:USD

00011235962022-03-012022-05-31

00011235962023-03-012023-05-31

00011235962023-05-31

utr:M

00011235962018-10-012018-10-01

00011235962018-10-01

00011235962022-06-01

00011235962022-06-012022-06-01

00011235962022-05-31

0001123596babb:UnopenedStoreMember2022-05-31

0001123596babb:UnopenedStoreMember2023-05-31

0001123596babb:TotalFranchisedOwnedAndLicensedUnitsMember2022-05-31

0001123596babb:TotalFranchisedOwnedAndLicensedUnitsMember2023-05-31

0001123596babb:LicensedUnitsMember2022-05-31

0001123596babb:LicensedUnitsMember2023-05-31

0001123596us-gaap:FranchisedUnitsMember2022-05-31

0001123596us-gaap:FranchisedUnitsMember2023-05-31

00011235962027-12-012023-05-31

00011235962026-12-012023-05-31

00011235962025-12-012023-05-31

00011235962024-12-012023-05-31

00011235962023-12-012023-05-31

00011235962023-06-012023-05-31

00011235962022-11-30

00011235962021-12-012022-11-30

00011235962021-11-30

0001123596babb:ContractLiabilitiesCurrentAndAccruedExpensesAndOtherCurrentLiabilitiesMember2022-11-30

0001123596babb:ContractLiabilitiesCurrentAndAccruedExpensesAndOtherCurrentLiabilitiesMember2023-05-31

0001123596us-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596us-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596us-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2021-12-012022-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2022-03-012022-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2021-12-012022-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2022-03-012022-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2021-12-012022-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2022-03-012022-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2021-12-012022-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2022-03-012022-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596us-gaap:LeaseholdImprovementsMember2023-05-31

0001123596srt:MaximumMember2023-05-31

0001123596srt:MinimumMember2023-05-31

0001123596babb:UnitsUnderDevelopmentMember2023-05-31

0001123596babb:MarketingFundMember2021-12-012022-05-31

0001123596babb:MarketingFundMember2022-12-012023-05-31

0001123596babb:MarketingFundMember2022-03-012022-05-31

0001123596babb:MarketingFundMember2023-03-012023-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2021-12-012022-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2022-12-012023-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2022-03-012022-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2023-03-012023-05-31

0001123596us-gaap:FranchiseMember2021-12-012022-05-31

0001123596us-gaap:FranchiseMember2022-12-012023-05-31

0001123596us-gaap:FranchiseMember2022-03-012022-05-31

0001123596us-gaap:FranchiseMember2023-03-012023-05-31

0001123596us-gaap:RoyaltyMember2021-12-012022-05-31

0001123596us-gaap:RoyaltyMember2022-12-012023-05-31

0001123596us-gaap:RoyaltyMember2022-03-012022-05-31

0001123596us-gaap:RoyaltyMember2023-03-012023-05-31

0001123596us-gaap:SeriesAPreferredStockMember2022-11-30

0001123596us-gaap:SeriesAPreferredStockMember2023-05-31

0001123596us-gaap:FranchiseMember2022-11-30

0001123596us-gaap:FranchiseMember2023-05-31

0001123596us-gaap:LicenseMember2022-11-30

0001123596us-gaap:LicenseMember2023-05-31

0001123596babb:MarketingFundMember2022-11-30

0001123596babb:MarketingFundMember2023-05-31

00011235962023-07-13

FORM 10-Q

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended May 31, 2023

|

|

☐

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to _________________

Commission file number: 0-31555

|

| |

|

BAB, Inc.

(Name of small business issuer in its charter)

|

Delaware

|

36-4389547

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

500 Lake Cook Road, Suite 475, Deerfield, Illinois 60015

(Address of principal executive offices) (Zip Code)

Issuer's telephone number (847) 948-7520

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered

|

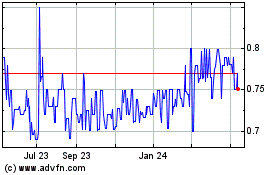

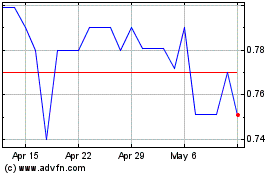

| Common Stock |

BABB |

OTCQB |

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by checkmark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company. Yes ☐ No ☒

As of July 13, 2023 BAB, Inc. had: 7,263,508 shares of Common Stock outstanding.

TABLE OF CONTENTS

|

PART I

|

FINANCIAL INFORMATION

|

3 |

| |

|

|

|

Item 1.

|

Financial Statements

|

3 |

| |

|

|

|

Item 2

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

16 |

| |

|

|

|

Item 3

|

Quantitative and Qualitative Disclosures About Market Risk

|

19 |

| |

|

|

|

Item 4

|

Controls and Procedures

|

19 |

| |

|

|

|

PART II

|

OTHER INFORMATION

|

20 |

| |

|

|

|

Item 1.

|

Legal Proceedings

|

20 |

| |

|

|

|

Item 2

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

20 |

| |

|

|

|

Item 3

|

Defaults Upon Senior Securities

|

20 |

| |

|

|

|

Item 4

|

Mine Safety Disclosures

|

20 |

| |

|

|

|

Item 5

|

Other Information

|

20 |

| |

|

|

|

Item 6

|

Exhibits

|

21 |

| |

|

|

|

SIGNATURE

|

|

22 |

PART I

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

BAB, Inc.

Consolidated Balance Sheets

| |

|

May 31, 2023

|

|

|

November 30, 2022

|

|

| |

|

(unaudited) |

|

|

(audited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivelants

|

|

$ |

1,682,226 |

|

|

$ |

1,623,256 |

|

|

Restricted cash

|

|

|

337,340 |

|

|

|

279,405 |

|

| Receivables |

|

|

|

|

|

|

|

|

|

Trade accounts and notes receivable (net of allowance for doubtful accounts of $10,873 in 2023 and 2022 )

|

|

|

59,338 |

|

|

|

73,972 |

|

|

Marketing fund contributions receivable from franchisees and stores

|

|

|

22,366 |

|

|

|

12,811 |

|

|

Lease receivable

|

|

|

5,864 |

|

|

|

5,827 |

|

|

Prepaid expenses and other current assets

|

|

|

90,730 |

|

|

|

159,226 |

|

|

Total Current Assets

|

|

|

2,197,864 |

|

|

|

2,154,497 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment (net of accumulated depreciation of $159,414 in 2023 and 2022)

|

|

|

- |

|

|

|

- |

|

|

Lease receivable

|

|

|

35,364 |

|

|

|

38,305 |

|

|

Trademarks

|

|

|

461,445 |

|

|

|

461,445 |

|

|

Goodwill

|

|

|

1,493,771 |

|

|

|

1,493,771 |

|

|

Definite lived intangible assets (net of accumulated amortization of $136,579 in 2023 and $134,733 in 2022)

|

|

|

17,127 |

|

|

|

18,972 |

|

|

Operating lease right of use

|

|

|

80,802 |

|

|

|

127,617 |

|

|

Total Noncurrent Assets

|

|

|

2,088,509 |

|

|

|

2,140,110 |

|

|

Total Assets

|

|

$ |

4,286,373 |

|

|

$ |

4,294,607 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

14,058 |

|

|

$ |

5,803 |

|

|

Accrued expenses and other current liabilities

|

|

|

345,501 |

|

|

|

324,718 |

|

|

Unexpended marketing fund contributions

|

|

|

359,877 |

|

|

|

291,387 |

|

|

Deferred franchise fee revenue

|

|

|

25,077 |

|

|

|

33,487 |

|

|

Deferred licensing revenue

|

|

|

12,500 |

|

|

|

298 |

|

|

Current portion operating lease liability

|

|

|

97,602 |

|

|

|

113,883 |

|

|

Total Current Liabilities

|

|

|

854,615 |

|

|

|

769,576 |

|

| |

|

|

|

|

|

|

|

|

| Long-term Liabilities (net of current portion) |

|

|

|

|

|

|

|

|

|

Operating lease liability

|

|

|

- |

|

|

|

39,819 |

|

|

Deferred franchise revenue

|

|

|

156,891 |

|

|

|

128,465 |

|

|

Deferred tax liability

|

|

|

255,877 |

|

|

|

281,700 |

|

|

Total Long-term Liabilities

|

|

|

412,768 |

|

|

|

449,984 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

$ |

1,267,383 |

|

|

$ |

1,219,560 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Preferred shares -$.001 par value; 4,000,000 authorized; no shares outstanding as of May 31, 2023 and November 30, 2022

|

|

|

- |

|

|

|

- |

|

|

Preferred shares -$.001 par value; 1,000,000 Series A authorized; no shares outstanding as of May 31, 2023 and November 30, 2022

|

|

|

- |

|

|

|

- |

|

|

Common stock -$.001 par value; 15,000,000 shares authorized; 8,466,953 shares issued and 7,263,508 shares outstanding as of May 31, 2023 and November 30, 2022

|

|

|

13,508,257 |

|

|

|

13,508,257 |

|

|

Additional paid-in capital

|

|

|

987,034 |

|

|

|

987,034 |

|

|

Treasury stock

|

|

|

(222,781 |

) |

|

|

(222,781 |

) |

|

Accumulated deficit

|

|

|

(11,253,520 |

) |

|

|

(11,197,463 |

) |

|

Total Stockholders' Equity

|

|

|

3,018,990 |

|

|

|

3,075,047 |

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

4,286,373 |

|

|

$ |

4,294,607 |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Consolidated Statements of Income

For the Three Months and Six Months ended May 31, 2023 and May 31, 2022

(Unaudited)

| |

|

Three months ended May 31,

|

|

|

Six months ended May 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty fees from franchised stores

|

|

$ |

494,933 |

|

|

$ |

465,491 |

|

|

$ |

937,541 |

|

|

$ |

879,712 |

|

|

Franchise Fees

|

|

|

7,054 |

|

|

|

9,102 |

|

|

|

11,401 |

|

|

|

18,079 |

|

|

Licensing fees and other income

|

|

|

75,674 |

|

|

|

73,729 |

|

|

|

135,994 |

|

|

|

144,072 |

|

|

Marketing fund revenue

|

|

|

286,739 |

|

|

|

276,110 |

|

|

|

525,057 |

|

|

|

520,845 |

|

|

Total Revenues

|

|

|

864,400 |

|

|

|

824,432 |

|

|

|

1,609,993 |

|

|

|

1,562,708 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll and payroll-related expenses

|

|

|

231,904 |

|

|

|

253,502 |

|

|

|

503,623 |

|

|

|

489,631 |

|

|

Occupancy

|

|

|

33,759 |

|

|

|

33,303 |

|

|

|

68,407 |

|

|

|

66,885 |

|

|

Advertising and promotion

|

|

|

4,904 |

|

|

|

5,153 |

|

|

|

7,705 |

|

|

|

8,486 |

|

|

Professional service fees

|

|

|

25,625 |

|

|

|

19,616 |

|

|

|

78,677 |

|

|

|

63,901 |

|

|

Travel

|

|

|

7,043 |

|

|

|

5,855 |

|

|

|

8,274 |

|

|

|

7,672 |

|

|

Employee benefit expenses

|

|

|

38,548 |

|

|

|

35,732 |

|

|

|

77,870 |

|

|

|

77,860 |

|

|

Depreciation and amortization

|

|

|

922 |

|

|

|

1,284 |

|

|

|

1,845 |

|

|

|

2,594 |

|

|

Marketing fund expenses

|

|

|

286,739 |

|

|

|

276,110 |

|

|

|

525,057 |

|

|

|

520,845 |

|

|

Other

|

|

|

63,866 |

|

|

|

61,928 |

|

|

|

118,046 |

|

|

|

104,316 |

|

|

Total Operating Expenses

|

|

|

693,310 |

|

|

|

692,483 |

|

|

|

1,389,504 |

|

|

|

1,342,190 |

|

|

Income from operations

|

|

|

171,090 |

|

|

|

131,949 |

|

|

|

220,489 |

|

|

|

220,518 |

|

|

Interest income

|

|

|

5,438 |

|

|

|

58 |

|

|

|

5,559 |

|

|

|

129 |

|

|

Income before provision for income taxes

|

|

|

176,528 |

|

|

|

132,007 |

|

|

|

226,048 |

|

|

|

220,647 |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current tax expense

|

|

|

75,823 |

|

|

|

21,591 |

|

|

|

90,023 |

|

|

|

30,341 |

|

|

Deferred tax expense (benefit)

|

|

|

(25,823 |

) |

|

|

16,500 |

|

|

|

(25,823 |

) |

|

|

33,500 |

|

|

Total Tax Provision

|

|

|

50,000 |

|

|

|

38,091 |

|

|

|

64,200 |

|

|

|

63,841 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

126,528 |

|

|

$ |

93,916 |

|

|

$ |

161,848 |

|

|

$ |

156,806 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income per share - Basic and Diluted

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - Basic and diluted

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

Cash distributions declared per share

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

0.02 |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Consolidated Statements of Cash Flows

For Six Months Ended May 31, 2023 and May 31, 2022

(Unaudited)

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

|

Operating activities

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

161,848 |

|

|

$ |

156,806 |

|

| Adjustments to reconcile net income to cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

1,845 |

|

|

|

2,594 |

|

|

Deferred tax (expense) benefit

|

|

|

(25,823 |

) |

|

|

33,500 |

|

|

Provision for uncollectible accounts, net of recoveries

|

|

|

- |

|

|

|

(1,028 |

) |

|

Noncash lease expense

|

|

|

49,655 |

|

|

|

49,656 |

|

| Changes in: |

|

|

|

|

|

|

|

|

|

Trade accounts receivable and notes/lease receivable

|

|

|

17,538 |

|

|

|

10,421 |

|

| Marketing fund contributions receivable |

|

|

(9,555 |

) |

|

|

(3,791 |

) |

|

Prepaid expenses and other

|

|

|

68,496 |

|

|

|

1,053 |

|

|

Accounts payable

|

|

|

8,255 |

|

|

|

(8,490 |

) |

|

Accrued liabilities

|

|

|

20,783 |

|

|

|

(25,793 |

) |

|

Unexpended marketing fund contributions

|

|

|

68,490 |

|

|

|

111,140 |

|

|

Deferred revenue

|

|

|

32,218 |

|

|

|

18,885 |

|

|

Operating lease liability

|

|

|

(58,940 |

) |

|

|

(57,616 |

) |

|

Net Cash Provided by Operating Activities

|

|

|

334,810 |

|

|

|

287,337 |

|

| |

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

Purchase of equipment

|

|

|

- |

|

|

|

(41,700 |

) |

|

Net Cash Used In Investing Activities

|

|

|

- |

|

|

|

(41,700 |

) |

| |

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

Cash distributions/dividends

|

|

|

(217,905 |

) |

|

|

(145,270 |

) |

| Net Cash Used In Financing Activities |

|

|

(217,905 |

) |

|

|

(145,270 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Increase in Cash and Restricted Cash

|

|

|

116,905 |

|

|

|

100,367 |

|

|

Cash and Restricted Cash - Beginning of Period

|

|

|

1,902,661 |

|

|

|

2,058,158 |

|

|

Cash and Restricted Cash - End of Period

|

|

$ |

2,019,566 |

|

|

$ |

2,158,525 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$ |

- |

|

|

$ |

- |

|

|

Income taxes paid

|

|

$ |

7,500 |

|

|

$ |

38,100 |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Notes to Unaudited Consolidated Financial Statements

For Three and Six Months Ended May 31, 2023 and May 31, 2022

(Unaudited)

Note 1. Nature of Operations

BAB, Inc. (“the Company”) has three wholly owned subsidiaries: BAB Systems, Inc. (“Systems”), BAB Operations, Inc. (“Operations”) and BAB Investments, Inc. (“Investments”). Systems was incorporated on December 2, 1992, and was primarily established to franchise Big Apple Bagels® (“BAB”) specialty bagel retail stores. My Favorite Muffin (“MFM”) was acquired in 1997 and is included as a part of Systems. Brewster’s (“Brewster’s”) was established in 1996 and the coffee is sold in BAB and MFM locations. SweetDuet® (“SD”) frozen yogurt can be added as an additional brand in a BAB location. Operations was formed in 1995, primarily to operate Company-owned stores of which there are currently none. The assets of Jacobs Bros. Bagels (“Jacobs Bros.”) were acquired in 1999, and any branded wholesale business uses this trademark. Investments was incorporated in 2009 to be used for the purpose of acquisitions. To date there have been no acquisitions.

The Company was incorporated under the laws of the State of Delaware on July 12, 2000. The Company currently franchises and licenses bagel and muffin retail units under the BAB, MFM and SD trade names. At May 31, 2023, the Company had 67 franchise units and 3 licensed units in operation in 20 states. There are 4 units under development. The Company additionally derives income from the sale of its trademark bagels, muffins and coffee through nontraditional channels of distribution including under licensing agreements.

The BAB franchised brand consists of units operating as “Big Apple Bagels®,” featuring daily baked bagels, flavored cream cheeses, premium coffees, gourmet bagel sandwiches and other related products. BAB units are primarily concentrated in the Midwest and Western United States. The MFM brand consists of units operating as “My Favorite Muffin Gourmet Muffin Bakery®” (“MFM Bakery”), featuring a large variety of freshly baked muffins and coffees and units operating as “My Favorite Muffin Your All-Day Bakery Café®” (“MFM Cafe”) featuring these products as well as a variety of specialty bagel sandwiches and related products. The SweetDuet® is a branded self-serve frozen yogurt that can be added as an additional brand in a BAB location. Although the Company doesn't actively market Brewster's stand-alone franchises, Brewster's coffee products are sold in most franchised units.

The Company is leveraging on the natural synergy of distributing muffin products in existing BAB units and, alternatively, bagel products and Brewster's Coffee in existing MFM units. The Company expects to continue to realize efficiencies in servicing the combined base of BAB and MFM franchisees.

The accompanying condensed consolidated financial statements are unaudited. These financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been omitted pursuant to such SEC rules and regulations; nevertheless, the Company believes that the disclosures are adequate to make the information presented not misleading. These financial statements and the notes hereto should be read in conjunction with the financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended November 30, 2022 which was filed February 24, 2023. In the opinion of the Company's management, the condensed consolidated financial statements for the unaudited interim period presented include all adjustments, including normal recurring adjustments, necessary to fairly present the results of such interim period and the financial position as of the end of said period. The results of operations for the interim period are not necessarily indicative of the results for the full year.

2. Summary of Significant Accounting Policies

Unaudited Consolidated Financial Statements

The accompanying unaudited Condensed Consolidated Financial Statements of BAB, Inc. have been prepared pursuant to generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and the rules and regulations of the United States Securities and Exchange Commission (the “SEC”) for Form 10-Q. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the financial statements and accompanying notes are in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reported periods. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, demand deposits and treasury notes with banks and equity firms with original maturities of less than 90 days. The balance of bank accounts may, at times, exceed federally insured credit limits. The Company has not experienced any loss in such accounts and believes it is not subject to any significant credit risk related to cash at May 31, 2023.

Accounts and Notes Receivable

Receivables are carried at original invoice amount less estimates for doubtful accounts. Management determines the allowance for doubtful accounts by reviewing and identifying troubled accounts and by using historical collection experience. A receivable is considered to be past due if any portion of the receivable balance is outstanding 90 days past the due date. Receivables are written off when deemed uncollectible. Recoveries of receivables previously written off are recorded as income when received. Certain receivables have been converted to unsecured interest-bearing notes.

Lease Receivable

The Company leases restaurant equipment to a certain franchisee under a sales-type lease agreement. Under the terms of the agreement, title to the equipment passes to the customer once all lease payments have been made and a reasonable buy-out fee is paid. The Company retains title or a security interest in the equipment until such time. The sales and cost of sales are recognized at the inception of the lease. The profit or loss on the issuance of the lease is recorded in the period of commencement. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and, if applicable, estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the franchisee (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs, if any. Unearned interest income is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables.

Property, Plant and Equipment

Property, equipment and leasehold improvements are stated at cost less accumulated depreciation and amortization. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets. Estimated useful lives are 3 to 7 years for property and equipment and 10 years, or term of lease if less, for leasehold improvements. Maintenance and repairs are charged to expense as incurred. Expenditures that materially extend the useful lives of assets are capitalized.

2. Summary of Significant Accounting Policies (continued)

Advertising and Promotion Costs

The Company expenses advertising and promotion costs as incurred. All advertising and promotion costs were related to the Company’s franchise operations.

Leases

The company accounts for leases under ASC 842. Lease arrangements are determined at the inception of the contract. Operating leases are included in operating lease right-of-use (“ROU”) assets and other current and long-term operating lease liabilities on the consolidated balance sheets. Finance leases are included in property and equipment, other current liabilities, and other long-term liabilities on the consolidated balance sheets.

Operating lease ROU assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As most leases do not provide an implicit rate, we use an incremental borrowing rate based on the information available at commencement date in determining the present value of future payments. The operating lease ROU asset also includes any lease payments made and excludes lease incentives and initial direct costs incurred. The lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The standard’s main goal is to improve financial reporting by requiring earlier recognition of credit losses on financing receivables and other financial assets in scope, including trade receivables. The amendments in this update broaden the information that an entity must consider in developing its expected credit loss estimate for assets measured either collectively or individually. The guidance in ASU 2016-13 is effective for public companies for fiscal years and for interim periods with those fiscal years beginning after December 15, 2023. The Company will adopt ASU 2016-13 for fiscal year ending November 30, 2025.

In December 2019, the FASB issued ASU 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes,” which is intended to simplify various aspects related to accounting for income taxes. ASU 2019-12 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. The amendments in ASU 2019-12 are effective for public business entities for fiscal years beginning after December 15, 2023, including interim periods therein. Early adoption of the standard is permitted, including adoption in interim or annual periods for which financial statements have not yet been issued. The Company will adopt ASU 2019-12 for fiscal year ending November 30, 2025.

Management does not believe that there are any recently issued and effective or not yet effective accounting pronouncements as of May 31, 2023 that would have or are expected to have any significant effect on the Company’s financial position, cash flows or income statement.

Statement of Cash Flows

The chart below shows the cash and restricted cash within the consolidated statements of cash flows as of May 31, 2023 and May 31, 2022 were as follows:

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,682,226 |

|

|

$ |

1,451,214 |

|

|

Restricted cash

|

|

|

337,340 |

|

|

|

707,311 |

|

|

Total cash and restricted cash

|

|

$ |

2,019,566 |

|

|

$ |

2,158,525 |

|

3. Revenue Recognition

Franchise and related revenue

The Company sells individual franchises. The franchise agreements typically require the franchisee to pay an initial, non-refundable fee prior to opening the respective location(s), and continuing royalty fees on a weekly basis based upon a percentage of franchisee net sales. The initial term of franchise agreements are typically 10 years. Subject to the Company’s approval, a franchisee may generally renew the franchise agreement upon its expiration. If approved, a franchisee may transfer a franchise agreement to a new or existing franchisee, at which point a transfer fee is typically paid by the current owner which then terminates that franchise agreement. A franchise agreement is signed with the new franchisee with no franchise fee required. If a contract is terminated prior to its term, it is a breach of contract and a penalty is assessed based on a formula reviewed and approved by management. Revenue generated from a contract breach is termed settlement income by the Company and included in licensing fees and other income.

Under the terms of our franchise agreements, the Company typically promises to provide franchise rights, pre-opening services such as blueprints, operational materials, planning and functional training courses, and ongoing services, such as management of the marketing fund. The Company considers certain pre-opening activities and the franchise rights and related ongoing services to represent two separate performance obligations. The franchise fee revenue has been allocated to the two separate performance obligations using a residual approach. The Company has estimated the value of performance obligations related to certain pre-opening activities deemed to be distinct based on cost plus an applicable margin, and assigned the remaining amount of the initial franchise fee to the franchise rights and ongoing services. Revenue allocated to preopening activities is recognized when (or as) these services are performed. Revenue allocated to franchise rights and ongoing services is deferred until the store opens, and recognized on a straight-line basis over the duration of the agreement, as this ensures that revenue recognition aligns with the customer’s access to the franchise right.

Royalty fees from franchised stores represent a 5% fee on net retail and wholesale sales of franchised units. Royalty revenues are recognized on an accrual basis using actual franchise receipts. Generally, franchisees report and remit royalties on a weekly basis. The majority of month-end receipts are recorded on an accrual basis based on actual numbers from reports received from franchisees shortly after the month-end. Estimates are utilized in certain instances where actual numbers have not been received and such estimates are based on the average of the last 10 weeks’ actual reported sales.

Royalty revenue is recognized during the respective franchise agreement based on the royalties earned each period as the underlying franchise store sales occur.

There are two items involving revenue recognition of contracts that require us to make subjective judgments: the determination of which performance obligations are distinct within the context of the overall contract and the estimated stand-alone selling price of each obligation. In instances where our contract includes significant customization or modification services, the customization and modification services are generally combined and recorded as one distinct performance obligation.

3. Revenue Recognition (continued)

Gift Card Breakage Revenue

The Company sells gift cards to its customers in its retail stores and through its Corporate office. The Company’s gift cards do not have an expiration date and are not redeemable for cash except where required by law. Revenue from gift cards is recognized upon redemption in exchange for product and reported within franchisee store revenue and the royalty and marketing fees are paid and shown in the Condensed Consolidated Statements of Income. Until redemption, outstanding customer balances are recorded as a liability. An obligation is recorded at the time of sale of the gift card and it is included in accrued expenses on the Company’s Condensed Consolidated Balance Sheets.

The liability is reduced when the gift cards are redeemed by a franchise. Although there are no expiration dates for our gift cards, based on our analysis of historical gift card redemption patterns, we can reasonably estimate the amount of gift cards for which redemption is remote, which is referred to as “breakage.” The Company recognizes gift card breakage proportional to actual gift card redemptions on a quarterly basis and the corresponding revenue is included in licensing fees and other revenue. Significant judgments and estimates are required in determining the breakage rate and will be reassessed each quarter.

Nontraditional and rebate revenue

As part of the Company’s franchise agreements, the franchisee purchases products and supplies from designated vendors. The Company may receive various fees and rebates from the vendors and distributors on product purchases by franchisees. In addition, the Company may collect various initial fees, and those fees are classified as deferred revenue in the balance sheet and straight lined over the life of the contract as deferred revenue in the balance sheet. The Company does not possess control of the products prior to their transfer to the franchisee and products are delivered to franchisees directly from the vendor or their distributors. The Company recognizes the rebates as franchisees purchase products and supplies from vendors or distributors and recognizes the initial fees over the contract life and the fees are reported as licensing fees and other income in the Condensed Consolidated Statements of Income.

Marketing Fund

Franchise agreements require the franchisee to pay continuing marketing fees on a weekly basis, based on a percentage of franchisee sales. Marketing fees are not paid on franchise wholesale sales. The balance sheet includes marketing fund cash, which is the restricted cash, accounts receivable and unexpended marketing fund contributions. Although the marketing fees are not separate performance obligations distinct from the underlying franchise right, the Company acts as the principal as it is primarily responsible for the fulfillment and control of the marketing services. As a result, the Company records marketing fees in revenues and related marketing fund expenditures in expenses in the Condensed Consolidated Statement of Income. The Company historically presented the net activities of the marketing fund within the balance sheet in the Condensed Consolidated Balance Sheet. While this reclassification impacts the gross amount of reported revenue and expenses the amounts will be offsetting, and there is no impact on net income.

3. Revenue Recognition (continued)

Disaggregation of Revenue

The following table presents disaggregation of revenue from contracts with customers for the three months and six months ended May 31, 2023 and May 31, 2022:

| |

|

For three

months ended

May 31, 2023

|

|

|

For three

months ended

May 31, 2022

|

|

|

For six

months ended

May 31, 2023

|

|

|

For six

months ended

May 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue recognized at a point in time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign Shop revenue

|

|

$ |

2,022 |

|

|

$ |

3,205 |

|

|

$ |

2,179 |

|

|

$ |

3,296 |

|

|

Settlement revenue

|

|

|

6,000 |

|

|

|

10,000 |

|

|

|

12,500 |

|

|

|

16,750 |

|

|

Total revenue at a point in time

|

|

|

8,022 |

|

|

|

13,205 |

|

|

|

14,679 |

|

|

|

20,046 |

|

| Revenue recognized over time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty revenue

|

|

|

494,933 |

|

|

|

465,491 |

|

|

|

937,541 |

|

|

|

879,712 |

|

|

Franchise fees

|

|

|

7,054 |

|

|

|

9,102 |

|

|

|

11,401 |

|

|

|

18,079 |

|

|

License fees

|

|

|

5,443 |

|

|

|

4,378 |

|

|

|

9,589 |

|

|

|

8,756 |

|

|

Gift card revenue

|

|

|

1,796 |

|

|

|

357 |

|

|

|

2,100 |

|

|

|

2,560 |

|

|

Nontraditional revenue

|

|

|

60,413 |

|

|

|

55,789 |

|

|

|

109,626 |

|

|

|

112,710 |

|

|

Marketing fund revenue

|

|

|

286,739 |

|

|

|

276,110 |

|

|

|

525,057 |

|

|

|

520,845 |

|

|

Total revenue over time

|

|

|

856,378 |

|

|

|

811,227 |

|

|

|

1,595,314 |

|

|

|

1,542,662 |

|

|

Grand total

|

|

$ |

864,400 |

|

|

$ |

824,432 |

|

|

$ |

1,609,993 |

|

|

$ |

1,562,708 |

|

Contract balances

The balance of contract liabilities includes franchise fees, license fees and vendor payments that have ongoing contract rights and the fees are being straight lined over the contract life. Contract liabilities also include marketing fund balances and gift card liability balances.

| |

|

May 31, 2023

|

|

|

November 30, 2022

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

Contract liabilities - current

|

|

$ |

613,310 |

|

|

$ |

563,895 |

|

|

Contract liabilities - long-term

|

|

|

181,593 |

|

|

|

128,465 |

|

|

Total Contract Liabilities

|

|

$ |

794,903 |

|

|

$ |

692,360 |

|

| |

|

May 31, 2023

|

|

|

November 30, 2022

|

|

|

Contracts at beginning of period

|

|

$ |

692,360 |

|

|

$ |

972,470 |

|

| |

|

|

|

|

|

|

|

|

|

Revenue Recognized during period

|

|

|

(711,007 |

) |

|

|

(1,742,303 |

) |

|

Additions during period

|

|

|

813,550 |

|

|

|

1,462,193 |

|

|

Contracts at end of period

|

|

$ |

794,903 |

|

|

$ |

692,360 |

|

3. Revenue Recognition (continued)

Transaction price allocated to remaining performance obligations (franchise agreements and license fee agreement) for the year ended November 30:

|

2023

|

|

|

28,709 |

(a) |

|

2024

|

|

|

34,782 |

|

|

2025

|

|

|

27,133 |

|

|

2026

|

|

|

17,126 |

|

|

2027

|

|

|

15,426 |

|

|

Thereafter

|

|

|

71,291 |

|

|

Total

|

|

$ |

194,468 |

|

|

(a) represents the estimate for the remainder of 2023

|

4. Units Open and Under Development

Units which are open or under development at May 31, 2023 and 2022 are as follows:

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

| Stores open: |

|

|

|

|

|

|

|

|

|

Franchisee-owned stores

|

|

|

67 |

|

|

|

68 |

|

|

Licensed Units

|

|

|

3 |

|

|

|

4 |

|

| |

|

|

70 |

|

|

|

72 |

|

| |

|

|

|

|

|

|

|

|

|

Unopened stores with Franchise

|

|

|

|

|

|

|

|

|

|

Agreements

|

|

|

4 |

|

|

|

2 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating units and units

|

|

|

|

|

|

|

|

|

|

with Franchise Agreements

|

|

|

74 |

|

|

|

74 |

|

5. Earnings per Share

The following table sets forth the computation of basic and diluted earnings per share:

| |

|

For the three months ended:

|

|

|

For the six months ended:

|

|

| |

|

May 31, 2023

|

|

|

May 31, 2022

|

|

|

May 31, 2023

|

|

|

May 31, 2022

|

|

|

Numerator:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common shareholders

|

|

$ |

126,528 |

|

|

$ |

93,916 |

|

|

$ |

161,848 |

|

|

$ |

156,806 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average outstanding shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted common stock

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

Earnings per Share - Basic

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

6. Goodwill and Other Intangible Assets

Accounting Standard Codification (“ASC”) 350 “Goodwill and Other Intangible Assets” requires that assets with indefinite lives no longer be amortized, but instead be subject to annual impairment tests.

Following the guidelines contained in ASC 350, the Company tests goodwill and intangible assets that are not subject to amortization for impairment annually or more frequently if events or circumstances indicate that impairment is possible. The Company has elected to conduct its annual test during the first quarter. During the quarter ended February 28, 2023 and February 28, 2022, management qualitatively assessed goodwill to determine whether testing was necessary. Factors that management considers in this assessment include macroeconomic conditions, industry and market considerations, overall financial performance (both current and projected), changes in management and strategy, and changes in the composition and carrying amounts of net assets. If this qualitative assessment indicates that it is more likely than not that the fair value of a reporting unit is less than it’s carrying value, a quantitative assessment is then performed. Based on the qualitative analysis conducted during the quarter, management does not believe that an impairment existed at May 31, 2023.

7. Lease Receivable Commitments

The Company leases restaurant equipment to a certain franchise under a sales-type lease agreement. The lease agreement does not contain any non-lease components. The lease term is for a period of seven years, beginning June 1, 2022 and ending June 1, 2029. The lease requires weekly payments of $121 for a total 365 payments, and a final optional buy-out payment of $4,800, which management believes estimates residual value. At May 31, 2023, management does not believe the unguaranteed residual asset value of $4,800 to be impaired.

During the six months ending May 31, 2023, the Company recorded interest income from the lease receivable of $237.

The sales lease is included in the balance sheet at the current value of the lease payments at a 1.25% discount rate, which reflects the rate implicit in the lease agreement.

Future minimum lease payments receivable as of May 31, 2023 are as follows:

| |

|

Undiscounted Rent

Payments

|

|

| Year Ending November 30: |

|

|

|

|

|

2023

|

|

$ |

3,142 |

|

|

2024

|

|

|

6,283 |

|

|

2025

|

|

|

6,283 |

|

|

2026

|

|

|

6,283 |

|

|

2027

|

|

|

6,283 |

|

|

thereafter

|

|

|

14,347 |

|

|

Total Undiscounted Lease Payments

|

|

$ |

42,621 |

|

| |

|

|

|

|

|

Unamortized interest income

|

|

|

(1,393 |

) |

|

Lease receivable, net

|

|

$ |

41,228 |

|

| |

|

|

|

|

|

Short-term lease receivable

|

|

$ |

5,864 |

|

|

Long-term lease receivable

|

|

|

35,364 |

|

|

Total lease receivable

|

|

$ |

41,228 |

|

8. Lease Commitments

The Company rents its office under an operating lease which requires it to pay base rent, real estate taxes, insurance and general repairs and maintenance. A lease was signed in June of 2018, effective October 1, 2018, expiring on March 31, 2024 with an option to renew for a 5-year period. A six-month rent abatement and tenant allowance was provided in the lease, with any unused portion to be applied to base rent. The unused portion was determined to be $21,300. The renewal option has not been included in the measurement of the lease liability.

Monthly rent expense is recognized on a straight-line basis over the term of the lease. At May 31, 2023 the remaining lease term was 10 months. The operating lease is included in the balance sheet at the present value of the lease payments at a 5.25% discount rate. The discount rate was considered to be an estimate of the Company’s incremental borrowing rate.

Gross future minimum annual rental commitments as of May 31, 2023 are as follows:

| |

|

Undiscounted Rent

Payments

|

|

|

Year Ending November 30:

|

|

|

|

|

|

2023

|

|

|

59,382 |

|

|

2024

|

|

|

40,177 |

|

|

Total Undiscounted Rent Payments

|

|

$ |

99,559 |

|

| |

|

|

|

|

| Present Value Discount |

|

|

(1,957 |

) |

|

Present Value

|

|

$ |

97,602 |

|

| |

|

|

|

|

|

Short-term lease liability

|

|

$ |

97,602 |

|

|

Long-term lease liability

|

|

|

- |

|

|

Total Operating Lease Liability

|

|

$ |

97,602 |

|

9. Income Taxes

For the three months ended May 31, 2023, the Company recorded current and deferred tax expense of $50,000 for an effective tax rate of 28.3% compared to $38,091 of current and deferred tax expense for the three months ended May 31, 2022 for an effective tax rate of 28.9%.

For the six months ended May 31, 2023, the Company recorded current and deferred tax expense of $64,200 for an effective tax rate of 28.4% compared to $63,841 of current and deferred tax expense for the six months ended May 31, 2022 for an effective tax rate of 28.9%.

10. Stockholder’s Equity

On June 6, 2023 the Board of Directors (“Board”) declared a $0.01 distribution/dividend per share to stockholders of record as of June 22, 2023, payable on July 11, 2023. On March 13, 2023 the Board of Directors declared a $0.01 distribution/dividend per share to stockholders of record as of March 30, 2023, paid on April 19, 2023. On December 07, 2022 the Board of Directors declared a $0.02 cash distribution/dividend per share, $0.01 quarterly and $0.01 special, to stockholders of record as of December 22, 2022, paid January 11, 2023.

On September 9, 2022 the Board declared a $0.01 distribution/dividend per share to stockholders of record as of September 28, 2022, paid October 20, 2022. On June 3, 2022 the Board declared a $0.01 distribution/dividend per share to stockholders of record as of June 22, 2022, paid July 11, 2022. On March 7, 2022 the Board declared a $0.01 cash distribution/dividend per share to stockholders of record as of March 29, 2022, paid April 18, 2022. On December 06, 2021 the Board declared a $0.01 cash distribution/dividend per share to stockholders of record as of December 22, 2021, paid January 11, 2022.

On May 6, 2013, the Board of Directors (“Board”) of BAB, Inc. authorized and declared a dividend distribution of one right for each outstanding share of the common stock of BAB, Inc. to stockholders of record at the close of business on May 13, 2013. Each right entitles the registered holder to purchase from the Company one one-thousandth of a share of the Series A Participating Preferred Stock of the Company at an exercise price of $0.90 per one-thousandth of a Preferred Share, subject to adjustment. The complete terms of the Rights are set forth in a Preferred Shares Rights Agreement, dated May 6, 2013, between the Company and IST Shareholder Services, as rights agent.

The Board adopted the Rights Agreement to protect stockholders from coercive or otherwise unfair takeover tactics. In general terms, it works by imposing a significant penalty upon any person or group that acquires 15% (or 20% in the case of certain institutional investors who report their holdings on Schedule 13G) or more of the Common Shares without the approval of the Board. As a result, the overall effect of the Rights Agreement and the issuance of the Rights may be to render more difficult a merger, tender or exchange offer or other business combination involving the Company that is not approved by the Board. However, neither the Rights Agreement nor the Rights should interfere with any merger, tender or exchange offer or other business combination approved by the Board.

Full details about the Rights Plan are contained in a Form 8-K filed by the Company with the U.S. Securities and Exchange Commission on May 7, 2013.

On June 18, 2014 an amendment to the Preferred Shares Rights Agreement was filed appointing American Stock Transfer & Trust Company, LLC as successor to Illinois Stock Transfer Company. All original rights and provisions remain unchanged. On August 18, 2015 an amendment was filed to the Preferred Shares Rights Agreement changing the final expiration date to mean the fifth anniversary of the date of the original agreement. All other original rights and provisions remain the same. On May 22, 2017 an amendment was filed extending the final expiration date to mean the seventh anniversary date of the original agreement. All other original rights and provisions remain the same. On February 22, 2019 an amendment was filed extending the final expiration date to mean the ninth anniversary date of the original agreement. All other original rights and provisions remain the same. On March 4, 2021 an amendment was filed extending the final expiration date to mean the eleventh anniversary date of the original agreement. All other original rights and provisions remain the same. On April 4, 2023 an amendment was filed extending the final expiration date to mean the fourteenth anniversary date of the original agreement. All other original rights and provisions remain the same.

|

ITEM 2.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Certain statements contained in Management's Discussion and Analysis of Financial Condition and Results of Operations, including statements regarding the development of the Company's business, the markets for the Company's products, anticipated capital expenditures, and the effects of completed and proposed acquisitions, and other statements contained herein regarding matters that are not historical facts, are forward-looking statements as is within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements include risks and uncertainties, actual results could differ materially from those expressed or implied by such forward-looking statements as set forth in this report, the Company's Annual Report on Form 10-K and other reports that the Company files with the Securities and Exchange Commission. Certain risks and uncertainties are wholly or partially outside the control of the Company and its management, including its ability to attract new franchisees; the continued success of current franchisees; the effects of competition on franchisees and consumer acceptance of the Company's products in new and existing markets; fluctuation in development and operating costs; brand awareness; availability and terms of capital; adverse publicity; acceptance of new product offerings; availability of locations and terms of sites for store development; food, labor and employee benefit costs; changes in government regulation (including increases in the minimum wage); regional economic and weather conditions; the hiring, training, and retention of skilled corporate and restaurant management; and the integration and assimilation of acquired concepts. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis only as of the date hereof. The Company undertakes no obligation to publicly release the results of any revision to these forward-looking statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

General

There are 67 franchised and 3 licensed units at May 31, 2023 compared to 68 franchised and 4 licensed units at May 31, 2022. System-wide revenues for the six months ended May 31, 2023 were $19.4 million and May 31, 2022 was $18.3 million.

The Company's revenues are derived primarily from the ongoing royalties paid to the Company by its franchisees and receipt of initial franchise fees. Additionally, the Company derives revenue from the sale of licensed products (My Favorite Muffin mix, Big Apple Bagels cream cheese and Brewster's coffee), and through nontraditional channels of distribution.

Royalty fees represent a 5% fee on net retail and wholesale sales of franchised units. Royalty revenues are recognized on an accrual basis using actual franchise receipts. Generally, franchisees report and remit royalties on a weekly basis. The majority of month-end receipts are recorded on an accrual basis based on actual numbers from reports received from franchisees shortly after the month-end. Estimates are utilized in certain instances where actual numbers have not been received and such estimates are based on the average of the last 10 weeks’ actual reported sales.

There are two items involving revenue recognition of contracts that require us to make subjective judgments: the determination of which performance obligations are distinct within the context of the overall contract and the estimated stand-alone selling price of each obligation. In instances where our contract includes significant customization or modification services, the customization and modification services are generally combined and recorded as one distinct performance obligation.

The Company earns licensing fees from the sale of BAB branded products, which includes coffee, cream cheese, muffin mix and frozen bagels from a third-party commercial bakery, to the franchised and licensed units.

As of May 31, 2023, the Company employed 11 full-time employees and one part-time employee at the Corporate office. The employees are responsible for corporate management and oversight, accounting, advertising and franchising. None of the Company's employees are subject to any collective bargaining agreements and management considers its relations with its employees to be good.

Results of Operations

Three Months Ended May 31, 2023 versus Three Months Ended May 31, 2022

For the three months ended May 31, 2023 and May 31, 2022, the Company reported net income of $127,000 and $94,000, respectively. Total revenue of $864,000 increased $40,000, or 4.9%, for the three months ended May 31, 2023, as compared to total revenue of $824,000 for the three months ended May 31, 2022.

Royalty fee revenue of $495,000, for the quarter ended May 31, 2023, increased $29,000, or 6.2%, from the $466,000 for quarter ended May 31, 2022. The increase in royalties for the quarter ended May 31, 2023 compared to the quarter ended May 31, 2022, was primarily due to franchisees’ continued increase in usage of online ordering and delivery services in their areas and price increases for products sold.

Franchise fee revenue was $7,000, for the quarter ended May 31, 2023, decreased $2,000, or 22.2%, from $9,000 for May 31, 2022. In the second quarter 2023 and 2022 there was one store transfer. Licensing fee and other income of $76,000, for the quarter ended May 31, 2023, increased $2,000 or 2.7% from $74,000 for same quarter 2022.

Marketing Fund revenues of $287,000, for the quarter ended May 31, 2023, increased $11,000, or 4.0% from $276,000 for the quarter ended May 31, 2022.

Total operating expenses of $693,000, for the quarter ended May 31, 2023, increased $1,000, or 0.1% from $692,000 for the quarter ended May 31, 2022. The increase was primarily related to an increase in, marketing fund expenses of $11,000, professional services of $6,000, employee benefit expense increase of $3,000, travel expense of $1,000 and other expenses of $2,000 for the second quarter 2023 versus 2022. This was offset by a decrease in payroll expense of $22,000 which was a result of a combination of marketing fund payroll allocation adjustment and an employee changing from full time to part time in the second quarter 2023 versus 2022.

For the three months ended May 31, 2023 the provision for income tax was $50,000, compared to $38,000 for the three months ending May 31, 2022.

Earnings per share, as reported for basic and diluted outstanding shares, was $0.02 for quarter ended May 31, 2023 versus $0.01 for the quarter ended May 31, 2022.

Six Months Ended May 31, 2023 versus Six Months Ended May 31, 2022

For the six months ended May 31, 2023 and May 31, 2022, the Company reported net income of $162,000 and $157,000, respectively. Total revenue of $1,610,000 increased $47,000, or 3.0%, for the six months ended May 31, 2023, as compared to total revenue of $1,563,000 for the six months ended May 31, 2022.

Royalty fee revenue of $938,000, for the six months ended May 31, 2023, increased $58,000, or 6.6%, from the $880,000 for six months ended May 31, 2022. The increase was primarily due to franchisees’ continued increase in usage of online ordering and delivery services in their areas and price increases for products sold.

Franchise fee revenues of $11,000, for the six months ended May 31, 2023, decreased $7,000, or 38.9%, from the $18,000 for the six months ended May 31, 2022. For the six months ended May 31, 2023, in addition to the normal franchise fee amortization, the Company recorded revenue for one store transfer compared to two transfers in the same period 2022.

Results of Operations (continued)

Licensing fee and other income of $136,000, for the six months ended May 31, 2023, decreased $8,000 or 5.6% from $144,000 for same period 2022. For the six months ended May 31, 2023 there was a $4,000 decrease in settlement income, a $1,000 decrease in Sign Shop revenue and a $3,000 decrease in nontraditional revenue in 2023 compared to same period 2022.

Marketing Fund revenues of $525,000, for the six months ended May 31, 2023, increased $4,000, or 0.8% from $521,000 for the six months ended May 31, 2022.

Total operating expenses of $1,390,000, for the six months ended May 31, 2023, increased $48,000, or 3.6% from $1,342,000 for the same period 2022. The increase was primarily related to a $15,000 increase in legal and accounting fees, a $14,000 increase in salaries, a $5,000 increase in insurance, a $7,000 increase in outside services, a $7,000 increase in annual meeting fees and Corporate expenses and a $4,000 increase in Marketing Fund expenses. This was offset by a $4,000 decrease in franchise development and a $1,000 decrease in depreciation and amortization in the six months ended May 31,2023 compared to same period 2022.

For the six months ended May 31, 2023 the provision for income tax was $64,000 for 2023 and 2022.

Earnings per share, as reported for basic and diluted outstanding shares for the six months ended May 2023 and 2022 were $0.02.

Liquidity and Capital Resources

At May 31, 2023, the Company had working capital of $1,343,000 and unrestricted cash of $1,682,000. At May 31, 2022 the Company had working capital of $1,171,000 and unrestricted cash of $1,451,000.