0001460702

true

FY

0001460702

2022-01-01

2022-12-31

0001460702

2022-06-30

0001460702

2023-04-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

(Amendment

No. 1)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2022

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number 001-37428

Qualigen

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

26-3474527 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

2042

Corte Del Nogal, Carlsbad, California 92011

(Address

of principal executive offices) (Zip Code)

(760)

918-9165

Registrant’s

telephone number, including area code

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name of

Exchange on Which Registered |

| Common Stock, par value

$0.001 per share |

|

QLGN |

|

The Nasdaq Capital Market |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or emerging growth company. See definitions of “large accelerated filer, “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As

of June 30, 2022, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $21,943,148

based on the closing price for the common stock of $5.70 on that date. Shares of common stock held by the registrant’s executive

officers and directors have been excluded from this calculation, as such persons may be deemed to be affiliates of the registrant. This

determination of affiliate status is not necessarily a conclusive determination for other purposes.

As

of April 11, 2023, there were 5,052,463 shares of the registrant’s common stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

| Audit Firm ID |

|

Auditor Name |

|

Auditor Location |

| 23 |

|

BAKER TILLY US, LLP |

|

San Diego, California |

EXPLANATORY

NOTE

Qualigen

Therapeutics, Inc. (“Qualigen”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to correct certain

errors found in the Exhibit Index included in Part IV, Item 15 of its Annual Report on Form 10-K for the fiscal year ended December 31,

2022, as filed with the Securities and Exchange Commission (the “SEC”) on May 2, 2023 (the “Original 10-K”),

and to make certain changes to Exhibit 4.9, which is being refiled with this Amendment. Accordingly, the Exhibit Index has been amended

and restated in its entirety to reflect these changes. Qualigen is also providing new certifications from its principal executive officer

and principal financial officer as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended.

Except

as described above, Qualigen has not modified or updated any disclosures contained in the Original 10-K. Accordingly, this Amendment

does not reflect events occurring after the date of filing of the Original 10-K and therefore continues to speak only as of the date

of the Original 10-K.

PART

IV

Item

15. Exhibits and Financial Statement Schedules

(a)

3. Exhibits. See EXHIBIT INDEX

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

|

Form |

|

File

No. |

|

Exhibit |

|

Filing

Date |

| |

|

|

|

|

|

|

|

|

|

|

| 2.1 |

|

Contingent Value Rights Agreement, dated May 22, 2020, among the Company, John Beck in the capacity of CVR Holders’ Representative and Andrew J. Ritter in his capacity as a consultant to the Company. |

|

8-K |

|

001-37428 |

|

2.4 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.1 |

|

Amended and Restated Certificate of Incorporation of Ritter Pharmaceuticals, Inc. |

|

8-K |

|

001-37428 |

|

3.1 |

|

7/1/2015 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.2 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation |

|

8-K |

|

001-37428 |

|

3.1 |

|

9/15/2017 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.3 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation |

|

8-K |

|

001-37428 |

|

3.1 |

|

3/22/2018 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.4 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series Alpha Preferred Stock of the Company, filed with the Delaware Secretary of State on May 29, 2020 |

|

8-K |

|

001-37428 |

|

3.1 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.5 |

|

Certificate of Amendment to the Certificate of Incorporation of the Company, filed with the Delaware Secretary of State on May 22, 2020 [reverse stock split] |

|

8-K |

|

001-37428 |

|

3.2 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.6 |

|

Certificate of Merger, filed with the Delaware Secretary of State on May 22, 2020 |

|

8-K |

|

001-37428 |

|

3.3 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.7 |

|

Certificate of Amendment to the Certificate of Incorporation of the Company, filed with the Delaware Secretary of State on May 22, 2020 |

|

8-K |

|

001-37428 |

|

3.4 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.8 |

|

Amended and Restated Bylaws of the Company, as of August 10, 2021 |

|

8-K |

|

001-37428 |

|

3.1 |

|

8/13/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.9 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation, as amended. |

|

8-K |

|

001-37428 |

|

3.1 |

|

11/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.1 |

|

Warrant, issued by the Company in favor of Alpha Capital Anstalt, dated May 22, 2020 |

|

8-K |

|

001-37428 |

|

10.13 |

|

5/29/2020 |

| 4.2 |

|

Form of Warrant, issued by the Company in favor of GreenBlock Capital LLC and its designees, dated May 22, 2020 [post-Merger] |

|

8-K |

|

001-37428 |

|

10.10 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.3 |

|

Common Stock Purchase Warrant in favor of Alpha Capital Anstalt, dated July 10, 2020 |

|

8-K |

|

001-37428 |

|

10.2 |

|

7/10/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.4 |

|

Common Stock Purchase Warrant in favor of Alpha Capital Anstalt, dated August 4, 2020 |

|

8-K |

|

001-37428 |

|

10.3 |

|

8/4/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.5 |

|

“Two-Year” Common Stock Purchase Warrant for 1,348,314 shares in favor of Alpha Capital Anstalt, dated December 18, 2020 |

|

8-K |

|

001-37428 |

|

10.3 |

|

12/18/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.6 |

|

“Deferred” Common Stock Purchase Warrant in favor of Alpha Capital Anstalt, dated December 18, 2020 |

|

8-K |

|

001-37428 |

|

10.4 |

|

12/18/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.7 |

|

Form of liability classified Warrant to Purchase Common Stock |

|

10-K |

|

001-37428 |

|

4.13 |

|

3/31/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.8 |

|

Form of “service provider” compensatory equity classified Warrant |

|

10-K |

|

001-37428 |

|

4.14 |

|

3/31/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.9* |

|

Description of Common Stock |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 4.10 |

|

Amended and Restated Common Stock Purchase Warrant to GreenBlock Capital LLC, dated April 25, 2022 |

|

10-Q |

|

001-37428 |

|

4.15 |

|

5/13/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.11 |

|

Amended and Restated Common Stock Purchase Warrant to Christopher Nelson, dated April 25, 2022 |

|

10-Q |

|

001-37428 |

|

4.16 |

|

5/13/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.12 |

|

Common Stock Purchase Warrant for 2,500,000 shares in favor of Alpha Capital Anstalt, dated December 22, 2022 |

|

8-K |

|

001-37428 |

|

4.1 |

|

12/22/2022 |

| 10.1+ |

|

Executive Employment Agreement, by and between Qualigen, Inc. and Michael Poirier, dated as of February 1, 2017 and as amended on January 9, 2018 |

|

8-K |

|

001-37428 |

|

10.1 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.2+ |

|

Executive Employment Agreement, by and between Qualigen, Inc. and Christopher Lotz, dated as of February 1, 2017 and as amended on January 9, 2018 |

|

8-K |

|

001-37428 |

|

10.2 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.3+ |

|

Executive Employment Agreement dated December 10, 2021 with Amy Broidrick |

|

10-K |

|

001-37428 |

|

10.53 |

|

3/31/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.4+ |

|

2020 Stock Equity Incentive Plan

|

|

8-K |

|

001-37428 |

|

10.20 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.5+ |

|

Standard template of Stock Option Agreement for use under 2020 Stock Incentive Plan |

|

8-K |

|

001-37428 |

|

10.1 |

|

6/11/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.6+ |

|

Form of Indemnification Agreement – Qualigen, Inc. |

|

8-K |

|

001-37428 |

|

10.21 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.7 |

|

Exclusive Agreement (QN-247), by and between Qualigen, Inc. and University of Louisville Research Foundation, Inc. dated as of June 8, 2018 |

|

S-4/A |

|

333-236235 |

|

10.58 |

|

3/13/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.8 |

|

Amendment 1 to the Exclusive License Agreement (QN-247), by and between Qualigen, Inc. and University of Louisville Research Foundation, Inc., dated March 16, 2021 |

|

10-K |

|

001-37428 |

|

10.8 |

|

5/2/2023 |

| 10.9 |

|

Amendment 2 to the Exclusive License Agreement (QN-247), by and between Qualigen, Inc. and University of Louisville Research Foundation, Inc., dated January 17, 2023 |

|

10-K |

|

001-37428 |

|

10.9 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.10 |

|

Exclusive License Agreement between the Company and University of Louisville Research Foundation (RAS), Inc., dated as of July 17, 2020 |

|

8-K |

|

001-37428 |

|

10.4 |

|

8/4/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.11 |

|

Amendment 1 to the Exclusive License Agreement (RAS), by and between Qualigen, Inc. and University of Louisville Research Foundation, Inc., dated March 16, 2021 |

|

10-K |

|

001-37428 |

|

10.11 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.12 |

|

License Agreement between Qualigen, Inc. and Advanced Cancer Therapeutics, LLC dated December 17, 2018 |

|

S-4/A |

|

001-37428 |

|

10.59 |

|

3/13/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.13 |

|

Novation Agreement among the Company, Qualigen, Inc. and Advanced Cancer Therapeutics, LLC dated July 29, 2020 |

|

10-K |

|

001-37428 |

|

10.31 |

|

3/31/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.14 |

|

Technology Transfer Agreement dated as of October 7, 2020 between Qualigen, Inc. and Yi Xin Zhen Duan Jishu (Suzhou) Ltd. |

|

8-K |

|

001-37428 |

|

10.1 |

|

10/9/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.15 |

|

Novation Agreement among the Company, Qualigen, Inc. and University of Louisville Research Foundation, Inc. dated January 30, 2021 |

|

10-Q |

|

001-37428 |

|

10.1 |

|

5/14/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.16 |

|

Novation Agreement among the Company, Qualigen, Inc. and University of Louisville Research Foundation, Inc. dated March 1, 2021 |

|

10-Q |

|

001-37428 |

|

10.2 |

|

5/14/2021 |

| 10.17+ |

|

Hire offer letter from the Company to Tariq Arshad, dated April 22, 2021 |

|

10-Q |

|

001-37428 |

|

10.1 |

|

8/16/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.18 |

|

Amendment to Technology Transfer Agreement between Yi Xin Zhen Duan Jishu (Suzhou) Ltd. and Qualigen, Inc., dated August 5, 2021 |

|

10-Q |

|

001-37428 |

|

10.2 |

|

11/15/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.19 |

|

Amendment to 2020 Stock Incentive Plan (approved by the Board of Directors on April 27, 2021 and by the Stockholders on August 9, 2021) |

|

10-Q |

|

001-37428 |

|

10.3 |

|

11/15/2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.20 |

|

Second Amendment to Lease with Bond Ranch LP dated December 15, 2021 |

|

10-K |

|

001-37428 |

|

10.54 |

|

3/31/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.21 |

|

First Deed of Variation to License Agreement with UCL Business Limited dated March 30, 2022 |

|

10-K |

|

001-37428 |

|

10.21 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.22 |

|

Series B Preferred Share Purchase Agreement between the Company and NanoSynex Ltd. dated April 29, 2022 |

|

10-Q |

|

001-37428 |

|

10.1 |

|

5/13/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.23 |

|

Share Purchase Agreement between the Company and Alpha Capital Anstalt dated April 29, 2022 |

|

10-Q |

|

001-37428 |

|

10.2 |

|

5/13/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.24 |

|

Master Agreement for the Operational and Technological Funding of NanoSynex between Qualigen Therapeutics, Inc. and NanoSynex Ltd., dated May 26, 2022 |

|

8-K |

|

001-37428 |

|

10.1 |

|

6/2/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.25+ |

|

Qualigen Therapeutics, Inc. 2022 Employee Stock Purchase Plan |

|

10-Q |

|

001-37428 |

|

10.1 |

|

11/14/2022 |

| 10.26+ |

|

Amendment No. 2 to the 2020 Stock Incentive Plan of Qualigen Therapeutics, Inc. |

|

8-K |

|

001-37428 |

|

10.1 |

|

11/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.27+ |

|

Amendment No. 1 to the 2022 Employee Stock Purchase Plan of Qualigen Therapeutics, Inc. |

|

8-K |

|

001-37428 |

|

10.2 |

|

11/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.28 |

|

Securities Purchase Agreement, dated December 21, 2022, by and between Qualigen Therapeutics, Inc. and Alpha Capital Anstalt |

|

8-K |

|

001-37428 |

|

10.1 |

|

12/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.29 |

|

8% Senior Convertible Debenture Due December 22, 2025 |

|

8-K |

|

001-37428 |

|

10.2 |

|

12/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.30 |

|

Registration Rights Agreement, dated December 22, 2022, by and between Qualigen Therapeutics, Inc. and Alpha Capital Anstalt |

|

8-K |

|

001-37428 |

|

10.3 |

|

12/22/2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.31+ |

|

Letter to Michael P. Poirier, dated January 13, 2023, regarding compensatory changes |

|

10-K |

|

001-37428 |

|

10.31 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.32+ |

|

Letter to Amy Broidrick, dated January 13, 2023, regarding compensatory changes |

|

10-K |

|

001-37428 |

|

10.32 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.33+ |

|

Letter to Tariq Arshad, dated January 13, 2023, regarding compensatory changes |

|

10-K |

|

001-37428 |

|

10.33 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 14.1 |

|

Code of Business Conduct and Ethics |

|

8-K |

|

001-37428 |

|

14.1 |

|

5/29/2020 |

| |

|

|

|

|

|

|

|

|

|

|

| 21.1 |

|

Subsidiaries of the Registrant |

|

10-K |

|

001-37428 |

|

21.1 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 23.1 |

|

Consent of Baker Tilly US, LLP, independent registered public accounting firm |

|

10-K |

|

001-37428 |

|

23.1 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 24.1 |

|

Power of Attorney (included on signature page) |

|

10-K |

|

001-37428 |

|

24.1 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 31.1* |

|

Certificate of principal executive officer pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 31.2* |

|

Certificate of principal financial officer pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 32.1 |

|

Certificate of principal executive officer and principal financial officer pursuant to 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|

10-K |

|

001-37428 |

|

32.1 |

|

5/2/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 101.INS# |

|

Inline

XBRL Instance Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 101.SCH# |

|

Inline

XBRL Taxonomy Extension Schema Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 101.CAL# |

|

Inline

XBRL Taxonomy Extension Calculation Linkbase Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 101.DEF# |

|

Inline

XBRL Taxonomy Extension Definition Linkbase Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 101.LAB# |

|

Inline

XBRL Taxonomy Extension Label Linkbase Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 101.PRE# |

|

Inline

XBRL Taxonomy Extension Presentation Linkbase Document. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

|

|

|

|

|

|

*

Filed or furnished herewith.

**

Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedules will be furnished to the SEC

upon request.

+

Indicates management contract or compensatory plan or arrangement.

#

XBRL (Extensible Business Reporting Language) information is furnished and not filed herewith, is not a part of a registration statement

or Prospectus for purposes of sections 11 or 12 of the Securities Act of 1933, is deemed not filed for purposes of section 18 of the

Securities Exchange Act of 1934, and otherwise is not subject to liability under these sections.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Annual Report

to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Qualigen Therapeutics, Inc. |

| |

|

| |

By: |

/s/

Michael S. Poirier |

| |

|

Michael S. Poirier |

| |

|

Chairman of the Board,

Chief Executive Officer |

| |

|

|

| Date: July 7, 2023 |

|

|

Exhibit

4.9

QUALIGEN

THERAPEUTICS, INC.

DESCRIPTION

OF COMMON STOCK

Qualigen

Therapeutics, Inc. (the “Company”) has one class of securities registered under Section 12 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”) – common stock, par value $0.001 per share (the “Common Stock”).

The Common Stock trades on The Nasdaq Capital Market under the trading symbol “QLGN.”

The

following summary description sets forth some of the general terms and provisions of the Common Stock. Because this is a summary description,

it does not contain all of the information that may be important to you. For a more detailed description of the Common Stock, you should

refer to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate”) and the Amended and Restated

Bylaws (the “Bylaws”), which are filed as exhibits to the Annual Report on Form 10-K to which this description is filed as

an exhibit.

The

Company’s authorized capital stock consists of 240,000,000 shares, all with a par value of $0.001 per share, 225,000,000 of which

are designated as Common Stock and 15,000,000 of which are designated as preferred stock, consisting of (i) 9,500 shares that have been

designated Series A Convertible Preferred Stock, (ii) 6,000 shares that have been designated as Series B Convertible Preferred Stock,

(iii) 1,880 shares that have been designated as Series C Convertible Preferred Stock, and (iv) 7,000 shares that have been designated

Series Alpha Preferred Stock.

Common

Stock

Pursuant

to the terms of our Certificate, the holders of Common Stock are entitled to one vote per share of Common Stock held of record by such

holder on all matters on which stockholders generally are entitled to vote; provided, however, that, except as otherwise required by

law, holders of Common Stock, as such, are not entitled to vote on any amendment to the Certificate (including any Certificate of Designation

relating to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the

holders of such affected series are entitled either separately or together with the holders of one or more other such series, to vote

on such amendment pursuant to the Certificate (including any Certificate of Designation relating to any series of Preferred Stock) or

pursuant to the Delaware General Corporation Law (the “DGCL”).

Subject

to the prior rights of holders of all classes of stock at the time outstanding having prior rights as to dividends, the holders of Common

Stock will be entitled to receive, when and as declared by the board of directors, out of any assets of the Company legally available

for such purpose, such dividends, distributed ratably among the holders of the Common Stock in proportion to the number of shares of

such Common Stock owned by each such holder, as may be declared from time to time by the board of directors.

In

the event of our liquidation, dissolution or winding up, either voluntarily or involuntarily, subject to the prior rights of holders

of all classes of stock at the time outstanding having prior rights as to distributions in the event of liquidation, dissolution or winding

up of the Company, and after any and all distributions are made in accordance therewith, the remaining assets and funds of the Company

legally available for distribution will be distributed ratably among the holders of the Common Stock in proportion to the number of shares

of such Common Stock owned by each such holder.

The

holders of Common Stock will have no preemptive or conversion rights or other subscription rights. There will be no redemption or sinking

fund provisions applicable to our common stock.

Anti-Takeover

Effects of Delaware Law and Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

The

provisions of Delaware law and the Company’s Certificate and Bylaws, could discourage or make it more difficult to accomplish a

proxy contest or other change in our management or the acquisition of control by a holder of a substantial amount of the Company’s

voting stock. It is possible that these provisions could make it more difficult to accomplish, or could deter, transactions that stockholders

may otherwise consider to be in their best interests or in the Company’s best interests. These provisions are intended to enhance

the likelihood of continuity and stability in the composition of the Company’s board of directors and in the policies formulated

by the board of directors and to discourage certain types of transactions that may involve an actual or threatened change of control

of the Company. These provisions are designed to reduce the Company’s vulnerability to an unsolicited acquisition proposal and

to discourage certain tactics that may be used in proxy fights. Such provisions also may have the effect of preventing changes in the

Company’s management.

Delaware

Statutory Business Combinations Provision. The Company is subject to the anti-takeover provisions of Section 203 of the DGCL. Section

203 prohibits a publicly-held Delaware corporation from engaging in a “business combination” with an “interested stockholder”

for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business

combination is, or the transaction in which the person became an interested stockholder was, approved in a prescribed manner or another

prescribed exception applies. For purposes of Section 203, a “business combination” is defined broadly to include a merger,

asset sale or other transaction resulting in a financial benefit to the interested stockholder, and, subject to certain exceptions, an

“interested stockholder” is a person who, together with his or her affiliates and associates, owns, or within three years

prior, did own, 15% or more of the corporation’s voting stock.

Election

and Removal of Directors. Except as may otherwise be provided by the DGCL, any director or the entire board of directors may be removed,

with or without cause, at an annual meeting or a special meeting called for that purpose, by the affirmative vote of the majority of

shares then entitled to vote at an election of directors. Vacancies on the Company’s board of directors resulting from the death,

resignation, removal or otherwise of directors and newly created directorships resulting from any increase in the number of directors

may be filled solely by the affirmative vote of a majority of the remaining directors then in office (although less than a quorum) or

by the sole remaining director. This system of electing and removing directors may discourage a third party from making a tender offer

or otherwise attempting to obtain control of the Company, because it generally makes it more difficult for stockholders to replace a

majority of the Company’s directors. The Company’s Certificate and Bylaws do not provide for cumulative voting in the election

of directors.

Advance

Notice Provisions for Stockholder Proposals and Stockholder Nominations of Directors. The Company’s Bylaws provide that, for

nominations to the board of directors or for other business to be properly brought by a stockholder before a meeting of stockholders,

the stockholder must first have given timely notice of the proposal in writing to the Company’s Secretary. For an annual meeting,

a stockholder’s notice generally must be delivered not less than 90 days or more than 120 days prior to the anniversary of the

previous year’s annual meeting.

Special

Meetings of Stockholders. Special meetings of the stockholders may be called at any time only by the Chairman of the board of directors,

the Chief Executive Officer or the President, subject to the rights of the holders of any series of preferred stock then outstanding.

Blank-Check

Preferred Stock. The Company’s board of directors is authorized to issue, without stockholder approval, preferred stock, the

rights of which will be determined at the discretion of the board of directors and that, if issued, could operate as a “poison

pill” to dilute the stock ownership of a potential hostile acquirer to prevent an acquisition that the board of directors does

not approve.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Equiniti Trust Company.

Exhibit

31.1

CERTIFICATION

OF PRINCIPAL EXECUTIVE OFFICER PURSUANT TO

SECTION

302 OF THE SARBANES-OXLEY ACT OF 2002

I,

Michael S. Poirier, certify that:

| 1. |

I

have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of Qualigen Therapeutics, Inc., a Delaware corporation, for

the year ended December 31, 2022; |

| |

|

| 2. |

Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report; |

| July

7, 2023 |

By: |

/s/

Michael S. Poirier |

| |

Name: |

Michael

S. Poirier |

| |

Title: |

Chief

Executive Officer |

Exhibit

31.2

CERTIFICATION

OF PRINCIPAL FINANCIAL OFFICER PURSUANT TO

SECTION

302 OF THE SARBANES-OXLEY ACT OF 2002

I,

Christopher L. Lotz, certify that:

| 1. |

I

have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of Qualigen Therapeutics, Inc., a Delaware corporation, for

the year ended December 31, 2022; |

| |

|

| 2. |

Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report; |

| July

7, 2023 |

By: |

/s/

Christopher L. Lotz |

| |

Name: |

Christopher

L. Lotz |

| |

Title: |

Chief

Financial Officer (Principal Financial Officer) |

v3.23.2

Cover - USD ($)

|

12 Months Ended |

|

|

Dec. 31, 2022 |

Apr. 11, 2023 |

Jun. 30, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

Qualigen

Therapeutics, Inc. (“Qualigen”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to correct certain

errors found in the Exhibit Index included in Part IV, Item 15 of its Annual Report on Form 10-K for the fiscal year ended December 31,

2022, as filed with the Securities and Exchange Commission (the “SEC”) on May 2, 2023 (the “Original 10-K”),

and to make certain changes to Exhibit 4.9, which is being refiled with this Amendment. Accordingly, the Exhibit Index has been amended

and restated in its entirety to reflect these changes. Qualigen is also providing new certifications from its principal executive officer

and principal financial officer as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended.

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Dec. 31, 2022

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2022

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity File Number |

001-37428

|

|

|

| Entity Registrant Name |

Qualigen

Therapeutics, Inc.

|

|

|

| Entity Central Index Key |

0001460702

|

|

|

| Entity Tax Identification Number |

26-3474527

|

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

|

| Entity Address, Address Line One |

2042

Corte Del Nogal

|

|

|

| Entity Address, City or Town |

Carlsbad

|

|

|

| Entity Address, State or Province |

CA

|

|

|

| Entity Address, Postal Zip Code |

92011

|

|

|

| City Area Code |

(760)

|

|

|

| Local Phone Number |

918-9165

|

|

|

| Title of 12(b) Security |

Common Stock, par value

$0.001 per share

|

|

|

| Trading Symbol |

QLGN

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 21,943,148

|

| Entity Common Stock, Shares Outstanding |

|

5,052,463

|

|

| Documents Incorporated by Reference [Text Block] |

None.

|

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Auditor Firm ID |

23

|

|

|

| Auditor Name |

BAKER TILLY US, LLP

|

|

|

| Auditor Location |

San Diego, California

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionDocuments incorporated by reference. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-23

| Name: |

dei_DocumentsIncorporatedByReferenceTextBlock |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

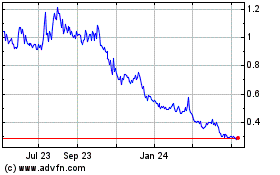

Qualigen Therapeutics (NASDAQ:QLGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qualigen Therapeutics (NASDAQ:QLGN)

Historical Stock Chart

From Apr 2023 to Apr 2024