ZW Data Action Technologies Inc. (Nasdaq: CNET) (the "Company"), an

integrated online advertising, precision marketing, data analytics

and other value-added services provider serving enterprise clients,

today announced its unaudited financial results for the three

months ended March 31, 2023.

First Quarter 2023 Financial

Results

Revenues

For the first quarter of 2023, revenues

decreased by approximately $1.34 million, or 17.5%, to $6.32

million from $7.65 million for the same period last year. The

decrease in revenues was primarily attributable to the decrease in

revenues from our Internet advertising and related data services

business category, as a result of the peak infection of COVID-19 in

China during the first fiscal quarter of 2023, which affected

business of most of our small medium enterprises (“SMEs”)

clients.

Cost of revenues

Total cost of revenues decreased by

approximately $0.89 million, or 11.8%, to $6.63 million for the

first quarter of 2023 from $7.52 million for the same period last

year. The decrease in cost was primarily due to the decrease in

cost related to providing Internet advertising and related data

services on our ad portals, which was in line with the decrease in

the related revenues.

Gross profit (loss) and gross profit (loss)

margin

Gross loss was approximately $0.31 million for

the first quarter of 2023, compared to a gross profit of $0.13

million for the same period last year. Overall gross loss margin

rate was 5% for the first quarter of 2023, compared to a gross

profit margin of 2% for the same period last year.

Operating expenses

Sales and marketing expenses was approximately

$0.05 million for the first quarter of 2023, compared to $0.07

million for the same period last year. The decrease in sales and

marketing expenses was mainly attributable to the peak infection of

COVID-19 in China from November 2022 through February 2023, which

affected a significant number of our workforce employed in our

operations, and thus adversely affected our normal business

activities during the first fiscal quarter of 2023.

General and administrative expenses decreased by

approximately $0.62 million, or 39.8%, to $0.93 million for the

first quarter of 2023 from $1.55 million for the same period last

year. The decrease in general and administrative expenses was

mainly attributable to the decrease in amortization of

administrative assets of approximately $0.45 million and the

decrease in general administrative expenses of approximately $0.47

million, as a result of the cost reduction plan executed by

management and the adverse impact on our normal business activities

of the peak infection of COVID-19 during the first fiscal quarter

of 2023, which was partially offset by increase in allowance for

expected credit losses of approximately $0.30 million.

Research and development expenses was

approximately $0.02 million for the first quarter of 2023, compared

to $0.07 million for the same period last year. The decrease in

research and development expenses was primarily due to a reduction

in headcount in our research and development department.

Operating loss

Loss from operations was approximately $1.31

million for the first quarter of 2023, compared to $1.55 million

for the same period last year. Operating loss margin was 21% for

the first quarter of 2023, compared to 20% for the same period last

year.

Other income, net

Total other income, net was approximately $0.17

million for the first quarter of 2023, compared to $0.83 million

for the same period last year. The decrease was primarily

attributable to the decrease in gain from change in fair value of

warrant liabilities.

Net loss attributable to CNET and loss per

share

Net loss attributable to CNET was approximately

$1.14 million, or loss per share of $0.16, for the first quarter of

2023. This was compared to $0.72 million, or loss per share of

$0.10**, for the same period last year.

Financial Condition

As of March 31, 2023, the Company had cash and

cash equivalents of approximately $1.59 million, compared to $4.39

million as of December 31, 2022. Accounts receivable, net was

approximately $1.57 million as of March 31, 2023, compared to $1.75

million as of December 31, 2022. Working capital was approximately

$5.55 million as of March 31, 2023, compared to $6.61 million as of

December 31, 2022.

Net cash used in operating activities was

approximately $0.92 million for the first quarter of 2023, compared

to $0.89 million for the same period last year. Net cash used in

investing activities was approximately $1.88 million for the first

quarter of 2023, compared to $1.46 million for the same period last

year.

About ZW Data Action Technologies

Inc.

Established in 2003 and headquartered in

Beijing, China, ZW Data Action Technologies Inc. (the “Company”)

offers online advertising, precision marketing, data analytics and

other value-added services for enterprise clients. Leveraging its

fully integrated services platform, proprietary database, and

cutting-edge algorithms, the Company delivers customized,

result-driven business solutions for small and medium-sized

enterprise clients in China. The Company also develops blockchain

enabled web/mobile applications and software solutions for clients.

More information about the Company can be found

at: http://www.zdat.com/.

Safe Harbor Statement

This release contains certain "forward-looking

statements" relating to the business of ZW Data Action Technologies

Inc., which can be identified by the use of forward-looking

terminology such as "believes," "expects," "anticipates,"

"estimates" or similar expressions. Such forward-looking statements

involve known and unknown risks and uncertainties, including

business uncertainties relating market demand, future capital

requirements, and other factors that may cause actual results to be

materially different from those described herein as anticipated,

believed, estimated or expected. Certain of these risks and

uncertainties are or will be described in greater detail in our

filings with the Securities and Exchange Commission. These

forward-looking statements are based on ZW Data Action Technologies

Inc.’s current expectations and beliefs concerning future

developments and their potential effects on the Company. There can

be no assurance that future developments affecting ZW Data Action

Technologies Inc. will be those anticipated by ZW Data Action

Technologies Inc. These forward-looking statements involve a number

of risks, uncertainties (some of which are beyond the control of

the Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. ZW Data Action

Technologies Inc. undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

For more information, please contact:

Sherry

Zheng Weitian Group

LLCEmail: shunyu.zheng@weitian-ir.comPhone: +1 718-213-7386

|

ZW DATA ACTION TECHNOLOGIES

INC.CONSOLIDATED BALANCE SHEETS(In

thousands, except for number of shares and per share data) |

| |

| |

|

|

March 31,2023 |

|

December 31,2022 |

| |

|

|

(US $) |

|

(US $) |

|

|

|

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

1,592 |

|

$ |

4,391 |

|

Accounts receivable, net of allowance for credit loss of $4,070 and

$3,760, respectively |

|

|

|

1,567 |

|

|

1,745 |

|

Prepayment and deposit to suppliers |

|

|

|

4,390 |

|

|

4,567 |

|

Other current assets, net |

|

|

|

3,327 |

|

|

1,610 |

|

Total current assets |

|

|

|

10,876 |

|

|

12,313 |

| |

|

|

|

|

|

| Long-term investments |

|

|

|

1,604 |

|

|

1,596 |

| Operating lease right-of-use

assets |

|

|

|

1,680 |

|

|

1,761 |

| Property and equipment, net |

|

|

|

225 |

|

|

249 |

| Intangible assets, net |

|

|

|

2,964 |

|

|

3,264 |

| Long-term deposits and

prepayments |

|

|

|

69 |

|

|

69 |

| Deferred tax assets, net |

|

|

|

413 |

|

|

406 |

|

Total Assets |

|

|

$ |

17,831 |

|

$ |

19,658 |

| |

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable * |

|

|

$ |

218 |

|

$ |

205 |

|

Advances from customers * |

|

|

|

720 |

|

|

739 |

|

Accrued payroll and other accruals * |

|

|

|

266 |

|

|

438 |

|

Taxes payable * |

|

|

|

3,280 |

|

|

3,248 |

|

Operating lease liabilities * |

|

|

|

310 |

|

|

347 |

|

Lease payment liabilities related to short-term leases * |

|

|

|

103 |

|

|

101 |

|

Other current liabilities * |

|

|

|

341 |

|

|

437 |

|

Warrant liabilities |

|

|

|

84 |

|

|

185 |

|

Total current liabilities |

|

|

|

5,322 |

|

|

5,700 |

|

Long-term liabilities: |

|

|

|

|

|

|

|

Operating lease liabilities-Non current |

|

|

|

1,500 |

|

|

|

1,535 |

|

|

|

Long-term borrowing from a related party |

|

|

|

127 |

|

|

|

126 |

|

|

|

Total Liabilities |

|

|

|

6,949 |

|

|

|

7,361 |

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

ZW Data Action Technologies Inc.’s stockholders’ equity |

|

|

|

|

|

|

|

Common stock (US$0.001 par value; authorized 20,000,000 shares;

issued and outstanding 7,174,506 shares at March 31, 2023 and

December 31, 2022) |

|

|

|

7 |

|

|

7** |

|

|

Additional paid-in capital |

|

|

|

62,017 |

|

|

62,017** |

|

|

Statutory reserves |

|

|

|

2,598 |

|

|

|

2,598 |

|

|

|

Accumulated deficit |

|

|

|

(54,859 |

) |

|

|

(53,525 |

) |

|

|

Accumulated other comprehensive income |

|

|

|

1,119 |

|

|

|

1,200 |

|

|

|

Total stockholders’ equity |

|

|

|

10,882 |

|

|

|

12,297 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

|

|

$ |

17,831 |

|

|

$ |

19,658 |

|

|

* Liabilities recognized as a result of

consolidating these VIEs do not represent additional claims on the

Company’s general assets.

|

ZW DATA ACTION TECHNOLOGIES INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS (In thousands, except for number of shares and per

share data) |

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

(US $) |

|

(US $) |

| |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

Revenues |

|

$ |

6,316 |

|

|

$ |

7,652 |

|

|

Cost of revenues |

|

|

6,630 |

|

|

|

7,518 |

|

|

Gross (loss)/profit |

|

|

(314 |

) |

|

|

134 |

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

Sales and marketing expenses |

|

|

48 |

|

|

|

69 |

|

|

General and administrative expenses |

|

|

932 |

|

|

|

1,548 |

|

|

Research and development expenses |

|

|

18 |

|

|

|

68 |

|

|

Total operating expenses |

|

|

998 |

|

|

|

1,685 |

|

| |

|

|

|

|

| Loss from

operations |

|

|

(1,312 |

) |

|

|

(1,551 |

) |

| |

|

|

|

|

|

Other income/(expenses) |

|

|

|

|

|

Interest income |

|

|

72 |

|

|

|

46 |

|

|

Other expenses, net |

|

|

(5 |

) |

|

|

(9 |

) |

|

Change in fair value of warrant liabilities |

|

|

101 |

|

|

|

795 |

|

|

Total other income |

|

|

168 |

|

|

|

832 |

|

| |

|

|

|

|

| Loss

before income tax benefit |

|

|

(1,144 |

) |

|

|

(719 |

) |

|

Income tax benefit |

|

|

1 |

|

|

|

2 |

|

| Net

loss |

|

$ |

(1,143 |

) |

|

$ |

(717 |

) |

| |

|

|

|

|

| |

|

|

|

|

| Net loss |

|

$ |

(1,143 |

) |

|

$ |

(717 |

) |

| Foreign currency

translation loss |

|

|

(81 |

) |

|

|

(22 |

) |

| Comprehensive

loss |

|

$ |

(1,224 |

) |

|

$ |

(739 |

) |

| |

|

|

|

|

| Loss per

share |

|

|

|

|

| Loss per common

share |

|

|

|

|

| |

|

|

|

|

| Basic and

diluted** |

|

$ |

(0.16 |

) |

|

$ |

(0.10 |

) |

| |

|

|

|

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

| |

|

|

|

|

| Basic and

diluted** |

|

|

7,174,506 |

|

|

|

7,079,962 |

|

|

ZW DATA ACTION TECHNOLOGIES INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In thousands) |

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

(US $) |

(US $) |

|

|

(Unaudited) |

(Unaudited) |

|

Cash flows from operating activities |

|

|

|

Net loss |

$ |

(1,143 |

) |

|

$ |

(717 |

) |

| Adjustments to reconcile

net loss to net cash used in operating activities |

|

|

|

Depreciation and amortization |

|

322 |

|

|

|

554 |

|

|

Amortization of operating lease right-of-use assets |

|

106 |

|

|

|

60 |

|

|

Share-based compensation expenses |

|

35 |

|

|

|

56 |

|

|

Provision for allowance for credit losses |

|

301 |

|

|

|

- |

|

|

Deferred taxes |

|

(1 |

) |

|

|

(2 |

) |

|

Disposal of fixed assets |

|

3 |

|

|

|

- |

|

|

Change in fair value of warrant liabilities |

|

(101 |

) |

|

|

(795 |

) |

|

Other non-operating income |

|

(72 |

) |

|

|

(45 |

) |

| Changes in operating

assets and liabilities |

|

|

|

Accounts receivable |

|

(56 |

) |

|

|

(159 |

) |

|

Prepayment and deposit to suppliers |

|

171 |

|

|

|

914 |

|

|

Other current assets |

|

(1 |

) |

|

|

13 |

|

|

Accounts payable |

|

10 |

|

|

|

(373 |

) |

|

Advances from customers |

|

(27 |

) |

|

|

(203 |

) |

|

Accrued payroll and other accruals |

|

(174 |

) |

|

|

(66 |

) |

|

Other current liabilities |

|

(184 |

) |

|

|

(36 |

) |

|

Taxes payable |

|

(8 |

) |

|

|

7 |

|

|

Lease payment liability related to short-term leases |

|

- |

|

|

|

(42 |

) |

|

Operating lease liabilities |

|

(97 |

) |

|

|

(56 |

) |

|

Net cash used in operating activities |

|

(916 |

) |

|

|

(890 |

) |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

Repayment of short-term loans from ownership investee entities |

|

- |

|

|

|

13 |

|

|

Short-term loan to unrelated parties |

|

(2,000 |

) |

|

|

(2,500 |

) |

|

Repayment of short-term loans and interest income from unrelated

parties |

|

123 |

|

|

|

1,029 |

|

|

Net cash used in investing activities |

|

(1,877 |

) |

|

|

(1,458 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Net cash provided by/(used in) financing

activities |

|

- |

|

|

|

- |

|

|

|

|

|

|

|

Effect of exchange rate fluctuation on cash and cash

equivalents |

|

(6 |

) |

|

|

(1 |

) |

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

(2,799 |

) |

|

|

(2,349 |

) |

|

|

|

|

|

|

Cash and cash equivalents at beginning of the period |

|

4,391 |

|

|

|

7,173 |

|

|

Cash and cash equivalents at end of the period |

$ |

1,592 |

|

|

$ |

4,824 |

|

|

|

|

|

|

**Retrospectively restated for effect of the

1-for-5 reverse stock split effective on January 18, 2023.

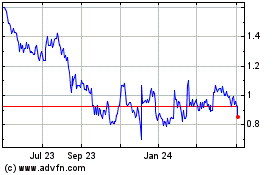

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

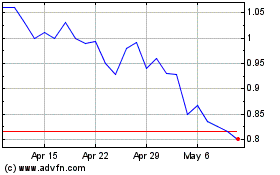

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Apr 2023 to Apr 2024