Current Report Filing (8-k)

May 16 2023 - 5:11PM

Edgar (US Regulatory)

0001451505false--12-3100014515052023-05-162023-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (date of earliest event reported): May 16, 2023 (May 11, 2023)

TRANSOCEAN LTD.

(Exact name of Registrant as specified in its charter)

| | | | |

Switzerland | | 001-38373 | | 98-0599916 |

(State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

incorporation or organization) | | File Number) | | Identification No.) |

| | |

Turmstrasse 30 | | |

Steinhausen, Switzerland | | CH-6312 |

| | |

(Address of principal executive offices) | | (zip code) |

Registrant’s telephone number, including area code: +41 (41) 749-0500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | |

Securities registered pursuant to Section 12(b) of the Act |

Title of each class | Trading Symbol | Name of each exchange on which registered: |

Shares, CHF 0.10 par value | RIG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At the 2023 Annual General Meeting of Shareholders of Transocean Ltd. (the “Company”) held on May 11, 2023 (the “AGM”) in Zug, Switzerland, shareholders of the Company approved the amendment and restatement of the Transocean Ltd. 2015 Long-Term Incentive Plan (the “Amended and Restated LTIP”). As approved by shareholders, the Amended and Restated LTIP reserves an additional 30,000,000 Transocean Ltd. shares, par value CHF 0.10 per share (“Shares”), issuable pursuant to awards thereunder.

The summary of the changes to the Amended and Restated LTIP is subject to and qualified in its entirety by reference to the full text of the Amended and Restated LTIP, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 5.03Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 11, 2023, the Articles of Association of the Company were amended (as amended, the “Articles of Association”) to reflect the approval by our shareholders at the AGM of (i) the general capital authorization proposal, which permits the issuance of up to 159,449,067 Shares pursuant to the authorization, for a one-year period expiring on May 11, 2024; (ii) the specific capital authorization proposal that may be used to satisfy the Company’s equity incentive plans obligations, which permits the issuance of up to 30,000,000 Shares pursuant to the authorization, for a five-year period expiring on May 11, 2028; and (iii) the proposal to amend the Articles of Association to align them with changes that were made to Swiss corporate law effective January 1, 2023, and make certain related changes.

Effective May 12, 2023, the Organizational Regulations (as amended, the “Organizational Regulations”) of the Company were amended by the Company’s Board of Directors to align them with changes that were made to Swiss corporate law effective January 1, 2023, and to make certain related changes, including with respect to the procedures required to consider and approve certain Company actions.

The foregoing descriptions of the Articles of Association and Organizational Regulations, do not purport to be complete and are qualified in their entirety by reference to the full text of the Articles of Association and Organizational Regulations, respectively, copies of which are filed herewith as Exhibit 3.1 and Exhibit 3.2 respectively, and are incorporated herein by reference.

Item 5.07Submission of Matters to a Vote of Security Holders.

At the AGM, the Company’s shareholders took action on the following matters:

| 1. | Proposal regarding the reallocation of CHF 9.5 billion of free capital reserves from capital contribution to statutory capital reserves from capital contribution. |

| | | | | |

For | | Against | | Abstain | |

536,114,004 | | 3,456,242 | | 2,343,240 | |

This item was approved.

| 2. | (a) Proposal regarding the approval of the 2022 Annual Report, including the Audited Consolidated Financial Statements of Transocean Ltd. for Fiscal Year 2022 and the Audited Statutory Financial Statements of Transocean Ltd. for Fiscal Year 2022. |

| | | | | |

For | | Against | | Abstain | |

536,877,252 | | 1,552,189 | | 3,484,045 | |

This item was approved.

| 2. | (b) Proposal regarding the advisory vote to approve the Company’s Swiss Statutory Compensation Report for Fiscal Year 2022. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

386,594,949 | | 15,873,724 | | 1,621,854 | | 137,822,959 | |

This item was approved.

| 3. | Proposal regarding the discharge of the Members of the Board of Directors and the Executive Management Team from liability for activities during Fiscal Year 2022. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

295,203,755 | | 6,308,517 | | 102,578,255 | | 137,822,959 | |

This item was approved.

| 4. | Proposal regarding the Appropriation of the Accumulated Loss for Fiscal Year 2022. |

| | | | | |

For | | Against | | Abstain | |

536,264,968 | | 3,368,901 | | 2,279,617 | |

This item was approved.

| 5. | Proposal regarding approval of the shares authorized for issuance. |

| | | | | |

For | | Against | | Abstain | |

506,501,843 | | 33,489,913 | | 1,921,730 | |

This item was approved.

| 6. | Proposals regarding the election of 11 directors for a term extending until completion of the next Annual General Meeting. |

| | | | | | | | | |

| | | | | | | | | |

Name of Nominee for Director | | For | | Against | | Abstain | | Broker Non-Votes | |

Glyn A. Barker | | 398,649,391 | | 4,468,029 | | 973,107 | | 137,822,959 | |

Vanessa C.L. Chang | | 398,635,298 | | 4,500,240 | | 954,989 | | 137,822,959 | |

Frederico F. Curado | | 398,212,497 | | 4,908,150 | | 969,880 | | 137,822,959 | |

Chadwick C. Deaton | | 400,836,935 | | 2,322,684 | | 930,908 | | 137,822,959 | |

Domenic J. “Nick” Dell’Osso, Jr. | | 401,291,043 | | 1,851,856 | | 947,628 | | 137,822,959 | |

Vincent J. Intrieri | | 384,712,377 | | 18,435,542 | | 942,608 | | 137,822,959 | |

Samuel J. Merksamer | | 400,463,560 | | 2,673,800 | | 953,167 | | 137,822,959 | |

Frederik W. Mohn | | 401,251,667 | | 1,906,967 | | 931,893 | | 137,822,959 | |

Edward R. Muller | | 397,016,196 | | 6,117,884 | | 956,447 | | 137,822,959 | |

Margareth Øvrum | | 399,409,223 | | 3,683,071 | | 998,233 | | 137,822,959 | |

Jeremy D. Thigpen | | 400,839,273 | | 2,335,966 | | 915,288 | | 137,822,959 | |

Each of the 11 persons listed above was duly elected as a director of the Company to hold office until the completion of the 2024 Annual General Meeting of Shareholders.

| 7. | Proposal regarding the election of the Chair of the Board of Directors for a term extending until completion of the next Annual General Meeting. |

| | | | | | | | | |

Name of Chair Nominee | | For | | Against | | Abstain | | Broker Non-Votes | |

Chadwick C. Deaton | | 399,436,480 | | 3,757,519 | | 896,528 | | 137,822,959 | |

Chadwick C. Deaton was elected Chair of the Board of Directors of the Company to hold office until the completion of the 2024 Annual General Meeting of Shareholders.

| 8. | Proposal regarding the election of the members of the Compensation Committee, each for a term extending until completion of the next Annual General Meeting. |

| | | | | | | | | |

Name of Compensation Committee Nominee | | For | | Against | | Abstain | | Broker Non-Votes | |

Glyn A. Barker | | 398,331,722 | | 4,799,768 | | 959,037 | | 137,822,959 | |

Vanessa C.L. Chang | | 398,437,653 | | 4,623,285 | | 1,029,589 | | 137,822,959 | |

Samuel J. Merksamer | | 400,236,110 | | 2,884,068 | | 970,349 | | 137,822,959 | |

Each of the three persons listed above was duly elected to serve as a member of the Compensation Committee of the Company to hold office until completion of the 2024 Annual General Meeting of Shareholders.

| 9. | Proposal regarding the reelection of the independent proxy for a term extending until completion of the next Annual General Meeting. |

| | | | | |

For | | Against | | Abstain | |

536,828,159 | | 3,343,917 | | 1,741,410 | |

This item was approved.

| 10. | Proposal regarding the appointment of Ernst & Young LLP as the Company's Independent Registered Public Accounting Firm for Fiscal Year 2023 and reelection of Ernst & Young Ltd, Zurich, as the Company's Auditor for a further one-year term. |

| | | | | |

For | | Against | | Abstain | |

532,212,237 | | 8,430,465 | | 1,270,784 | |

This item was approved.

| 11. | Proposal regarding the advisory vote to approve Named Executive Officer compensation for Fiscal Year 2023. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

366,793,929 | | 35,399,885 | | 1,896,713 | | 137,822,959 | |

This item was approved.

| 12. | Proposal regarding the advisory vote to approve frequency of Named Executive Officer Compensation vote. |

| | | | | | | |

Every Year | | Two Years | | Three Years | | Abstain | |

396,266,777 | | 723,910 | | 5,341,012 | | 1,758,828 | |

Based upon the voting results from this proposal, the Company’s Board of Directors determined on May 12, 2023, that the Company will continue to hold an advisory vote on executive compensation once every year until the next required advisory vote on the frequency of shareholder advisory votes on executive compensation, which in accordance with applicable law, will occur no later than the Company’s annual general meeting of shareholders in 2029.

| 13. | (a) Proposal regarding the ratification of the maximum aggregate amount of compensation of the Board of Directors for the period between the 2023 Annual General Meeting and the 2024 Annual General Meeting. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

397,902,258 | | 4,232,744 | | 1,955,525 | | 137,822,959 | |

This item was approved.

| 13. | (b) Proposal regarding the ratification of the maximum aggregate amount of compensation of the Executive Management Team for Fiscal Year 2024. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

396,889,384 | | 5,182,613 | | 2,018,530 | | 137,822,959 | |

This item was approved.

| 14. | (a) Proposal regarding the approval of amendment and restatement of the Transocean Ltd. 2015 Long-Term Incentive Plan. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

366,879,857 | | 17,804,774 | | 19,405,896 | | 137,822,959 | |

This item was approved.

| 14. | (b) Proposal regarding the approval of a capital authorization for share-based incentive plans. |

| | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes | |

366,937,833 | | 18,126,282 | | 19,026,412 | | 137,822,959 | |

This item was approved.

| 15. | Proposal regarding the approval of amendments to the Articles of Association to reflect new Swiss corporate law and make certain related changes. |

| | | | | |

For | | Against | | Abstain | |

518,206,920 | | 2,705,845 | | 21,000,721 | |

This item was approved.

Item 9.01Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| TRANSOCEAN LTD. |

| |

| |

Date: May 16, 2023 | By: | /s/ Daniel Ro-Trock |

| | Daniel Ro-Trock |

| | Authorized Person |

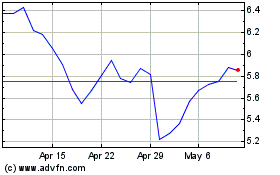

Transocean (NYSE:RIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

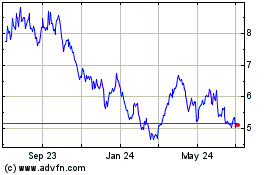

Transocean (NYSE:RIG)

Historical Stock Chart

From Sep 2023 to Sep 2024