Maroussi, Greece, May 15, 2023 – Pyxis Tankers

Inc. (NASDAQ Cap Mkts: PXS), (the “Company” or “Pyxis Tankers”), an

international pure-play product tanker company, today announced

unaudited results for the three months ended March 31, 2023.

Summary

For the three months ended March 31, 2023, our

Revenues, net were $11.6 million. For the same period, our time

charter equivalent (“TCE”) revenues were $9.2 million, an increase

of approximately $5.4 million or 139% from the comparable quarter

in 2022. Our net income attributable to common shareholders for the

three months ended March 31, 2023 was $8.7 million, representing an

increase of $12.4 million from a net loss of $3.7 million in the

comparable period in 2022. For the first quarter of 2023, the net

income per share was $0.81 basic and $0.71 diluted compared to a

net loss per share of $0.34 (basic and diluted) for the same period

in 2022. Our Adjusted EBITDA for the three months ended March 31,

2023 was $4.2 million, which represented an increase of $4.9

million over the same quarter in 2022. Please see “Non-GAAP

Measures and Definitions” below.

On March 23, 2023, the Company sold its oldest

tanker, the 2009 built “Pyxis Malou”, for $24.8 million in cash.

The gain on vessel sale was $8.0 million.

Valentios Valentis, our Chairman and CEO,

commented:

“We are pleased to report strong growth in our

first fiscal quarter, 2023 financial results with Revenues, net of

$11.6 million and Net Income attributable to common shareholders of

$8.7 million. Resilient economic activity, despite recessionary

pressures, and increasing mobility in many parts of the world has

resulted in solid demand for transportation fuels. Favorable

market fundamentals have been supported by low inventories of many

refined products, and more significantly, the impact of the war in

the Ukraine has led to continued market dislocation, including

arbitrage opportunities, as well as the redirection of trade flows

from shorter-haul to longer distances resulting in ton-mile

expansion of seaborne cargoes, thereby reducing available capacity.

Consequently, chartering activity for product tankers remains

robust and asset values high, reflecting an expectation of a

positive outlook for the sector.

After completing the sale of our 14 year old

tanker at a historically high price in March, we now own and

operate four modern Eco- efficient MR’s. During the three months

ended March 31, 2023 our daily TCE rate more than doubled to

$23,508 compared to the same period in 2022. Positive

momentum has continued into the spring of 2023, indicating another

solid year. As of May 11th, 2023, 70% of the available days in the

second quarter of 2023 for our MR’s were booked at an estimated

average TCE of $29,160 per vessel. While all our vessels are

currently under short-term time charters, we expect to prudently

continue our mixed chartering strategy of time charters and spot

voyages.

For the near term, we expect volatility to

prevail, yet we believe charter rates to stay above five-year

average levels given the modest inventories of refined petroleum

products in a number of locations worldwide, the global effects of

the recent G-7 and European Union ban and price caps on seaborne

cargoes of Russian refined products as demand in China increases.

Despite ongoing concerns about slowing economic activity globally,

potential further OPEC+ production cuts, tighter monetary policies,

high inflation and destabilizing geo-political events, supply-side

fundamentals reinforce a positive outlook supported by steady

volumes and longer transport distances. The International Monetary

Fund recently revised its outlook for global GDP growth in 2023 to

2.8% due to a slowdown in the advanced economies. However, China, a

leading consumer of petroleum products, seems to be rebounding on

pace to achieve the 2023 estimate for GDP growth of 5.2%. In

April, the International Energy Agency revised its forecast for

global oil demand to increase 2% or 2.0 million barrels per day to

101.9 Mb/d in 2023. A leading research firm recently

estimated that global product tanker ton-miles were up 13% in the

first quarter, 2023 from the same period in the prior year.

Additionally, the firm estimated that average sailing distances

could increase 7-8% this year. Over the long-term, changes in the

global refinery landscape, led by capacity additions outside of the

OECD, should provide added longer-haul volumes. Our positive

view is further supported by the historically low order book for

MR’s and the large number of inefficient 20+ year old tankers,

which exceed the orderbook and are demolition candidates during the

next 5 years. Overall, we expect MR tanker supply to grow annually

at less than 2% net, through 2024.

While we have taken advantage of the high asset

value environment by recently selling our oldest tanker, we

patiently monitor the market to develop viable opportunities for

fleet expansion, especially for the purchase of modern

eco-efficient MR’s. Our industry and customer relationships,

substantial current cash position, free cash flow generation and

low leverage, give us the resources and flexibility to aggressively

pursue attractive situations which may further enable us to enhance

shareholder value. In the meantime, we maintain our focus to

further increasing balance sheet liquidity and reducing

leverage.

We believe our current share price does not

reflect the value proposition of Pyxis Tankers, let alone the

significant operational progress, financial performance as well as

positive outlook. We continue to trade at a substantial discount to

estimated net asset value, especially in relation to our pure-play

product tanker peers. Consequently, the Board of Directors has

authorized a common stock re-purchase program of up to $2.0 million

through open-market transactions for a period of six months.”

Results for the three months ended March 31, 2022 and

2023

Amounts relating to variations in

period–on–period comparisons shown in this section are derived from

the interim consolidated financials presented below.

For the three months ended March 31, 2023, we

reported Revenues, net of $11.6 million, or 68% higher than $6.9

million in the comparable 2022 period. Our net income attributable

to common shareholders was $8.7 million, or $0.81 basic and $0.71

diluted net income per share, compared to a net loss attributable

to common shareholders of $3.7 million, or $0.34 basic and diluted

loss per share, for the same period in 2022. The weighted average

number of basic share count had increased by approximately 94

thousand common shares from the first quarter 2022 to approximately

10.7 million shares in the same period 2023. The weighted average

number of diluted common shares in 2023 of approximately 12.6

million shares assumes the full conversion of all the outstanding

Series A Convertible Preferred Stock in the most recent period.

The average MR daily TCE rate during the first quarter of

2023 was $23,508 or 109% higher than the $11,227 MR daily TCE rate

for the same period in 2022, due to improved market conditions.

The revenue mix for the first quarter of 2023 was 74% from

short-term time charters and 26% from spot market employment.

Adjusted EBITDA increased by $4.9 million to $4.2 million in the

first quarter, 2023 from negative $0.7 million for the same period

in 2022.

| |

|

Three months ended March 31, |

|

(Amounts in thousands of U.S. dollars, except for daily TCE

rates) |

|

2022 |

|

2023 |

|

|

|

|

|

|

| MR Revenues, net 1 |

$ |

6,309 |

$ |

11,616 |

| MR Voyage related costs and commissions

1 |

|

(2,671) |

|

(2,401) |

| MR Time charter equivalent revenues 1,

2 |

$ |

3,638 |

$ |

9,215 |

| |

|

|

|

|

| MR Total operating days 1, 2 |

|

324 |

|

392 |

| |

|

|

|

|

| MR Daily time charter equivalent rate 1,

2 |

|

11,227 |

|

23,508 |

1 Our non-core small tankers, “Northsea Alpha”

and “Northsea Beta”, which were sold on January 28, 2022 and March

1, 2022, respectively, have been excluded in the above table. Both

vessels were under spot employment for approximately 7 and 36 days,

respectively, in 2022 as of the delivery date to their buyer. For

the quarter ended March 31, 2022, “Revenues, net” attributable to

these vessels was $597 thousand and “Voyage related costs and

commissions” was $385 thousand.

2 Subject to rounding; please see “Non-GAAP

Measures and Definitions” below.

Management’s Discussion and Analysis of

Financial Results for the Three Months ended March 31, 2022 and

2023

Amounts relating to variations in

period–on–period comparisons shown in this section are derived from

the interim consolidated financials presented below. (Amounts are

presented in million U.S. dollars, rounded to the nearest one

hundred thousand, except as otherwise noted)

Revenues, net: Revenues, net of $11.6 million

for the three months ended March 31, 2023, represented an increase

of $4.7 million, or 68%, from $6.9 million in the comparable period

of 2022. In the first quarter of 2023, our MR daily TCE rate for

our fleet was $23,508, a $12,281 per day increase from the same

period in 2022. The aforementioned variations are the result of the

significant improvement in charter rates between the comparable

periods.

Voyage related costs and commissions: Voyage

related costs and commissions of $2.4 million in the first quarter

of 2023, represented a decrease of $0.7 million, or 21%, from $3.1

million in the same period of 2022, primarily as a result of the

decreased spot employment for our MR’s from 132 days in the first

quarter in 2022 to 76 days in the first quarter in 2023 and the

sales of “Northsea Alpha” and “Northsea Beta” which occurred during

the first quarter of 2022. Under spot charters, all voyage expenses

are typically borne by us rather than the charterer and a decrease

in spot employment results in decreased voyage related costs and

commissions.

Vessel operating expenses: Vessel operating

expenses of $3.3 million for the three month period ended March 31,

2023, remained stable compared to 2022, as a result of slightly

higher operating expenses for our MR’s fully offset of lower

operating expenses due to the sales of “Northsea Alpha” and

“Northsea Beta” during the first quarter of 2022.

General and administrative expenses: General and

administrative expenses of $1.3 million for the first quarter,

2023, increased by $0.7 million or 115% compared to $0.6 million in

the same period of 2022. The increase was attributable mainly to

the higher administration fees that were adjusted by 9.65% to

reflect the 2022 inflation rate in Greece and a performance bonus

of $0.6 million to our ship management company, Pyxis Maritime

Corp. (“Maritime”), an entity affiliated with our Chairman and

Chief Executive Officer, Mr. Valentis.

Management fees: For the three months ended

March 31, 2023, management fees charged by Maritime and to

International Tanker Management Ltd. (“ITM”), our fleet’s technical

manager, decreased by $0.1 million to $0.4 million compared to $0.5

million in the same period of 2022. The decrease was the result of

the sales of “Northsea Alpha” and “Northsea Beta,” which occurred

during the first quarter of 2022, partially offset by the fact that

ship management fees to Maritime for the three months ended March

31, 2023 were adjusted upwards to reflect the 9.65% annual 2022

inflation rate in Greece.

Amortization of special survey costs:

Amortization of special survey costs of $0.1 million for the

quarter ended March 31, 2023, remained flat compared to the same

period in 2022.

Depreciation: Depreciation of $1.4 million for

the quarter ended March 31, 2023, decreased by $0.1 million or 7%

compared to $1.5 million in the same period of 2022. The decrease

was attributed to ceasing of depreciation due to the sale of vessel

“Pyxis Malou” during the first quarter of 2023 and the sales of

“Northsea Alpha” and “Northsea Beta” during the first quarter of

2022.

Gain/(Loss) from the sale of vessels, net:

During the three months ended March 31, 2023, we recorded a net

gain of $8.0 million related to the sale of our oldest MR tanker,

the “Pyxis Malou”. In the comparable quarter in 2022, we recorded

$0.5 million loss related to repositioning costs for the delivery

of the “Northsea Alpha” and “Northsea Beta” to their buyer.

Loss from debt extinguishment: During the three

months ended March 31, 2023, we recorded a loss from debt

extinguishment of approximately $0.3 million reflecting the

write-off of the remaining unamortized balance of deferred

financing costs associated with the loan repayments of the “Pyxis

Malou,” which was sold on March 23, 2023, and “Pyxis Karteria,”

which was refinanced during the quarter. During the three months

ended March 31, 2022, we recorded a loss from debt extinguishment

of approximately $0.03 million reflecting the write-off of the

remaining unamortized balance of deferred financing costs, which

were associated with the repayment of the “Northsea Alpha” and

“Northsea Beta” loans.

Interest and finance costs, net: Interest and

finance costs, net, for the quarter ended March 31, 2023, were

$1.4 million, compared to $0.9 million in the comparable

period in 2022, an increase of $0.6 million, or 64%. Despite lower

average debt levels, this increase was primarily attributable to

higher LIBOR rates paid on all the floating rate bank debt. In

addition to scheduled loan amortization, we prepaid the $6.0

million 7.5% Promissory Note in full during the first quarter,

2023. On March 13, 2023, the Company completed the debt

refinancing of the “Pyxis Karteria”, our 2013 built vessel with a

$15.5 million five year secured loan from a new lender. The

loan is priced at SOFR plus 2.7%.

Interim Consolidated Statements of Comprehensive Net

Income/(Loss)

For the three months ended March 31, 2022 and 2023(Expressed in

thousands of U.S. dollars, except for share and per share data)

| |

|

|

Three months ended March 31, |

|

|

|

|

2022 |

|

2023 |

|

|

|

|

|

|

|

|

Revenues, net |

|

$ |

6,906 |

$ |

11,616 |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

| Voyage related

costs and commissions |

|

|

(3,057) |

|

(2,400) |

| Vessel operating

expenses |

|

|

(3,372) |

|

(3,337) |

| General and

administrative expenses |

|

|

(608) |

|

(1,305) |

| Management fees,

related parties |

|

|

(211) |

|

(166) |

| Management fees,

other |

|

|

(310) |

|

(248) |

| Amortization of

special survey costs |

|

|

(85) |

|

(85) |

|

Depreciation |

|

|

(1,503) |

|

(1,402) |

| Bad debt

provisions |

|

|

(50) |

|

— |

| Gain/(Loss) from

the sale of vessels, net |

|

|

(466) |

|

8,018 |

|

Operating income/(loss) |

|

|

(2,756) |

|

10,691 |

|

|

|

|

|

|

|

| Other

expenses, net: |

|

|

|

|

|

| Loss from debt

extinguishment |

|

|

(34) |

|

(287) |

| Gain/(loss) from

financial derivative instruments |

|

|

234 |

|

(59) |

| Interest and

finance costs, net |

|

|

(874) |

|

(1,430) |

| Total

other expenses, net |

|

|

(674) |

|

(1,776) |

|

|

|

|

|

|

|

| Net

income/(loss) |

|

$ |

(3,430) |

$ |

8,915 |

| |

|

|

|

|

|

| Dividend Series

A Convertible Preferred Stock |

|

|

(231) |

|

(219) |

| |

|

|

|

|

|

| Net

income/(loss) attributable to common shareholders |

|

$ |

(3,661) |

$ |

8,696 |

| |

|

|

|

|

|

| Income/(loss)

per common share, basic |

|

$ |

(0.34) |

$ |

0.81 |

| Income/(loss)

per common share, diluted |

|

$ |

(0.34) |

$ |

0.71 |

|

|

|

|

|

|

|

| Weighted average

number of common shares, basic |

|

|

10,613,424 |

|

10,706,972 |

| Weighted average

number of common shares, diluted |

|

|

10,613,424 |

|

12,602,547 |

Consolidated Balance SheetsAs of December 31,

2022 and March 31 2023(Expressed in thousands of U.S. dollars,

except for share and per share data)

| |

|

|

December 31, |

|

March 31, |

|

|

|

|

2022 |

|

2023 |

| ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

7,563 |

$ |

28,145 |

| Restricted cash, current portion |

|

|

376 |

|

400 |

| Inventories |

|

|

1,911 |

|

894 |

| Trade accounts receivable, net |

|

|

10,469 |

|

4,987 |

| Prepayments and other current assets |

|

|

204 |

|

657 |

| Insurance claim receivable |

|

|

608 |

|

288 |

| Total current assets |

|

|

21,131 |

|

35,371 |

| |

|

|

|

|

|

| FIXED ASSETS, NET: |

|

|

|

|

|

| Vessels, net |

|

|

114,185 |

|

96,677 |

| Total fixed assets,

net |

|

|

114,185 |

|

96,677 |

| |

|

|

|

|

|

| OTHER NON-CURRENT

ASSETS: |

|

|

|

|

|

| Restricted cash, net of current

portion |

|

|

2,250 |

|

2,000 |

| Financial derivative instrument |

|

|

619 |

|

— |

| Deferred dry dock and special survey

costs, net |

|

|

794 |

|

800 |

| Total other non-current

assets |

|

|

3,663 |

|

2,800 |

| Total assets |

|

$ |

138,979 |

$ |

134,848 |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

| Current portion of long-term debt, net of

deferred financing costs |

|

$ |

5,829 |

$ |

5,704 |

| Trade accounts payable |

|

|

2,604 |

|

2,676 |

| Due to related parties |

|

|

1,028 |

|

1,107 |

| Hire collected in advance |

|

|

2,133 |

|

—

|

| Accrued and other liabilities |

|

|

967 |

|

613 |

| Total current

liabilities |

|

|

12,561 |

|

10,100 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

| Long-term debt, net of current portion and

deferred financing costs |

|

|

59,047 |

|

54,668 |

| Promissory note |

|

|

6,000 |

|

— |

| Total non-current

liabilities |

|

|

65,047 |

|

54,668 |

| |

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

— |

|

— |

| |

|

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

| Preferred stock ($0.001 par value;

50,000,000 shares authorized; of which 1,000,000 authorized Series

A Convertible Preferred Shares; 449,473 Series A Convertible

Preferred Shares issued and outstanding as at December 31,

2022 and 420,085 at March 31, 2023) |

|

|

— |

|

— |

| Common stock ($0.001 par value;

450,000,000 shares authorized; 10,614,319 shares issued and

outstanding as at December 31, 2022 and 10,745,654 at March

31, 2023, respectively) |

|

|

11 |

|

11 |

| Additional paid-in capital |

|

|

111,869 |

|

111,869 |

| Accumulated deficit |

|

|

(50,509) |

|

(41,800) |

| Total stockholders'

equity |

|

|

61,371 |

|

70,080 |

| Total liabilities and

stockholders' equity |

|

$ |

138,979 |

$ |

134,848 |

Interim Consolidated Statements of Cash

FlowsFor the three months ended March 31, 2022 and

2023(Expressed in thousands of U.S. dollars)

| |

|

|

|

Three months ended March 31, |

| |

|

|

|

2022 |

|

2023 |

| Cash

flows from operating activities: |

|

|

|

|

|

|

| Net

income/(loss) |

|

|

$ |

(3,430) |

$ |

8,915 |

|

Adjustments to reconcile net loss to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

|

|

1,503 |

|

1,402 |

| Amortization and

write-off of special survey costs |

|

|

|

85 |

|

85 |

| Amortization and

write-off of financing costs |

|

|

|

81 |

|

69 |

| Loss from debt

extinguishment |

|

|

|

34 |

|

287 |

| Loss/(Gain) from

financial derivative instrument |

|

|

|

(234) |

|

59 |

| Gain on sale of

vessel, net |

|

|

|

— |

|

(8,018) |

| Bad debt

provisions |

|

|

|

50 |

|

— |

| Changes

in assets and liabilities: |

|

|

|

|

|

|

| Inventories |

|

|

|

(750) |

|

1,017 |

| Due from related

parties |

|

|

|

854 |

|

79 |

| Trade accounts

receivable, net |

|

|

|

(947) |

|

5,482 |

| Prepayments and

other assets |

|

|

|

(113) |

|

(453) |

| Insurance claim

receivable |

|

|

|

(1,601) |

|

320 |

| Special survey

cost |

|

|

|

(370) |

|

(260) |

| Trade accounts

payable |

|

|

|

2,175 |

|

72 |

| Hire collected

in advance |

|

|

|

— |

|

(2,133) |

| Accrued and

other liabilities |

|

|

|

(223) |

|

(354) |

| Net cash

provided by/(used in) operating activities |

|

|

$ |

(2,886) |

$ |

6,569 |

|

|

|

|

|

|

|

|

| Cash

flow from investing activities: |

|

|

|

|

|

|

| Proceeds from

the sale of vessel, net |

|

|

|

8,509 |

|

24,292 |

| Payments for

vessel acquisition |

|

|

|

(2,995) |

|

— |

| Ballast water

treatment system installation |

|

|

|

(437) |

|

— |

| Net cash

provided by investing activities |

|

|

$ |

5,077 |

$ |

24,292 |

|

|

|

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

|

| Proceeds from

long-term debt |

|

|

|

— |

|

15,500 |

| Repayment of

long-term debt |

|

|

|

(7,355) |

|

(20,215) |

| Repayment of

promissory note |

|

|

|

— |

|

(6,000) |

| Financial

derivative instrument |

|

|

|

— |

|

561 |

| Payment of

financing costs |

|

|

|

— |

|

(144) |

| Preferred stock

dividends paid |

|

|

|

(218) |

|

(207) |

| Net cash

used in financing activities |

|

|

$ |

(7,573) |

$ |

(10,505) |

| |

|

|

|

|

|

|

| Net

(decrease)/increase in cash and cash equivalents and restricted

cash |

|

|

(5,382) |

|

20,356 |

| Cash

and cash equivalents and restricted cash at the beginning of the

period |

|

|

9,874 |

|

10,189 |

| Cash and

cash equivalents and restricted cash at the end of the

period |

|

|

$ |

4,492 |

$ |

30,545 |

Liquidity, Debt and Capital Structure

Pursuant to our loan agreements, as of March 31,

2023, we were required to maintain a minimum liquidity of $2.4

million. Total cash and cash equivalents, including the minimum

liquidity, aggregated $30.6 million as of March 31, 2023.

Total funded debt (in thousands of U.S.

dollars), net of deferred financing costs:

|

|

|

|

December 31,

2022 |

|

March 31,

2023 |

| Funded debt, net of deferred financing

costs |

|

$ |

64,876 |

$ |

60,372 |

| Promissory Note - related party |

|

|

6,000 |

|

— |

| Total funded debt |

|

$ |

70,876 |

$ |

60,372 |

Our weighted average interest rates on our total

funded debt for the three month period ended March 31, 2023 was

8.15%.

During February and March, 2023, the Company

completed the repayment of the outstanding $6.0 million 7.5%

Promissory Note.

On March 13, 2023, the Company completed the

debt refinancing of the “Pyxis Karteria”, our 2013 built vessel

with a $15.5 million five year secured loan from a new lender,

Piraeus Bank, S.A. Loan principal is repayable over 5 years with

quarterly amortization. The loan is priced at SOFR plus 2.7% with

standard terms and conditions.

On March 23, 2023, pursuant to the sale

agreement that we entered into on March 1, 2023, the “Pyxis Malou”

was delivered to her buyer. The aggregate gross sale price was

$24.8 million from which $6.4 million was used for the prepayment

of the respective loan facility and $0.75 million to prepay the

outstanding loan for the “Pyxis Lamda”.

On March 31, 2023, we had a total of 10,745,654

common shares issued and outstanding of which Mr. Valentis

beneficially owned 53.3%, 420,085 Series A Preferred Shares

(trading symbol - PXSAP), which have a conversion price of $5.60,

and 1,590,540 warrants (PXSAW), which have an exercise price of

$5.60, (excluding non-tradeable underwriter’s common stock purchase

warrants of which 428,571 and 16,000 have exercise prices of $8.75

and $5.60, respectively, and 2,000 and 2,683 Series A Preferred

Shares purchase warrants which have an exercise price of $24.92 and

$25.00 per share, respectively).

Results of Annual Meeting of

Shareholders of May 11, 2023

At the scheduled annual 2023 shareholder

meeting, the Company’s shareholders re-elected Mr. Basil Mavroleon

and Mr. Robin Das as Class III Directors to serve for a term of

three years until the 2026 annual meeting.

Non-GAAP Measures and Definitions

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) represents the sum of net

income/(loss), interest and finance costs, depreciation and

amortization and, if any, income taxes during a period. Adjusted

EBITDA represents EBITDA before certain non-operating or

non-recurring charges, such as loss from debt extinguishment, loss

or gain from financial derivative instrument and gain or loss from

sale of vessel. EBITDA and Adjusted EBITDA are not recognized

measurements under U.S. GAAP.

EBITDA and Adjusted EBITDA are presented in this

press release as we believe that they provide investors with means

of evaluating and understanding how our management evaluates

operating performance. These non-GAAP measures have limitations as

analytical tools, and should not be considered in isolation from,

as a substitute for, or superior to financial measures prepared in

accordance with U.S. GAAP. EBITDA and Adjusted EBITDA do not

reflect:

- our cash expenditures, or future requirements for capital

expenditures or contractual commitments;

- changes in, or cash requirements for, our working capital

needs; and

- cash requirements necessary to service interest and

principal payments on our funded debt.

In addition, these non-GAAP measures do not have

standardized meanings and are therefore unlikely to be comparable

to similar measures presented by other companies. The following

table reconciles net income/(loss), as reflected in the

Consolidated Statements of Comprehensive Net Income/(loss) to

EBITDA and Adjusted EBITDA:

| |

|

Three months ended March 31, |

|

(Amounts in thousands of U.S. dollars) |

|

2022 |

|

2023 |

| Reconciliation of Net loss to Adjusted

EBITDA |

|

|

|

|

| |

|

|

|

|

| Net income/(loss) |

$ |

(3,430) |

$ |

8,915 |

|

|

|

|

|

|

| Depreciation |

|

1,503 |

|

1,402 |

|

|

|

|

|

|

| Amortization of special survey costs |

|

85 |

|

85 |

|

|

|

|

|

|

| Interest and finance costs, net |

|

874 |

|

1,430 |

| |

|

|

|

|

| EBITDA |

$ |

(968) |

$ |

11,832 |

| |

|

|

|

|

| Loss from debt extinguishment |

|

34 |

|

287 |

| |

|

|

|

|

| Loss/(Gain) from financial derivative

instrument |

|

(234) |

|

59 |

| |

|

|

|

|

| (Gain)/Loss from the sale of vessels,

net |

|

466 |

|

(8,018) |

| |

|

|

|

|

| Adjusted EBITDA |

$ |

(702) |

$ |

4,160 |

Daily TCE is a shipping industry performance

measure of the average daily revenue performance of a vessel on a

per voyage basis. Daily TCE is not calculated in accordance with

U.S. GAAP. We utilize daily TCE because we believe it is a

meaningful measure to compare period-to-period changes in our

performance despite changes in the mix of charter types (i.e., spot

charters, time charters and bareboat charters) under which our

vessels may be employed between the periods. Our management also

utilizes daily TCE to assist them in making decisions regarding

employment of the vessels. We calculate daily TCE by dividing

Revenues, net after deducting Voyage related costs and commissions,

by operating days for the relevant period. Voyage related costs and

commissions primarily consist of brokerage commissions, port, canal

and fuel costs that are unique to a particular voyage, which would

otherwise be paid by the charterer under a time charter

contract.

Vessel operating expenses (“Opex”) per day are

our vessel operating expenses for a vessel, which primarily consist

of crew wages and related costs, insurance, lube oils,

communications, spares and consumables, tonnage taxes as well as

repairs and maintenance, divided by the ownership days in the

applicable period.

We calculate utilization (“Utilization”) by

dividing the number of operating days during a period by the number

of available days during the same period. We use fleet utilization

to measure our efficiency in finding suitable employment for our

vessels and minimize the number of days that our vessels are

off-hire for reasons other than scheduled repairs or repairs under

guarantee, vessel upgrades, special surveys and intermediate

dry-dockings or vessel positioning. Ownership days are the total

number of days in a period during which we owned each of the

vessels in our fleet. Available days are the number of ownership

days in a period, less the aggregate number of days that our

vessels were off-hire due to scheduled repairs or repairs under

guarantee, vessel upgrades or special surveys and intermediate

dry-dockings and the aggregate number of days that we spent

positioning our vessels during the respective period for such

repairs, upgrades and surveys. Operating days are the number of

available days in a period, less the aggregate number of days that

our vessels were off-hire or out of service due to any reason,

including technical breakdowns and unforeseen circumstances.

EBITDA, Adjusted EBITDA, Opex and daily TCE are

not recognized measures under U.S. GAAP and should not be regarded

as substitutes for Revenues, net and Net income. Our presentation

of EBITDA, Adjusted EBITDA, Opex and daily TCE does not imply, and

should not be construed as an inference, that our future results

will be unaffected by unusual or non-recurring items and should not

be considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

Recent Daily Fleet Data:

|

(Amounts in U.S. dollars per day) |

|

Three months ended March 31, |

|

|

|

2022 |

|

2023 |

| Eco-Efficient

MR2: (2023: 4

vessels) |

|

|

|

|

|

(2022: 4 vessels) |

Daily TCE : |

11,356 |

|

24,809 |

| |

Opex per day: |

6,801 |

|

7,281 |

| |

Utilization % : |

74.6% |

|

91.9% |

| Eco-Modified

MR2: (1 vessel) |

|

|

|

|

| |

Daily TCE : |

10,722 |

|

16,965 |

| |

Opex per day: |

7,749 |

|

8,751 |

|

|

Utilization % : |

73.3% |

|

79.3% |

| MR Fleet:

(2023: 5 vessels) * |

|

|

|

|

|

(2022: 5 vessels) * |

Daily TCE : |

11,227 |

|

23,508 |

| |

Opex per day: |

6,991 |

|

7,554 |

|

|

Utilization % : |

74.3% |

|

89.5% |

As of May 15, 2023 our fleet consisted of four

eco-efficient MR2 tankers, “Pyxis Lamda”, “Pyxis Theta”, “Pyxis

Karteria” and “Pyxis Epsilon”. During 2022 and 2023, the vessels in

our fleet were employed under time and spot charters.

*a) Our two small tankers “Northsea Alpha” and

“Northsea Beta” were sold on January 28, and March 1, 2022,

respectively. Both vessels had been under spot employment for

approximately 7 and 36 days, respectively, in 2022 as of the

delivery date to their buyer. The small tankers have been excluded

in the above table calculations. b) In February 2022, the “Pyxis

Epsilon” experienced a brief grounding at port which resulted in

minor damages to the vessel. The vessel was off-hire for 43

days including shipyard repairs and returned to commercial

employment at the end of March 2022.c) The Eco-Modified

“Pyxis Malou” was sold to an unaffiliated buyer on March 23,

2023.

Conference Call and Webcast

Today, Monday, May 15, 2023, at 4:30 p.m.

Eastern Time, the Company’s management will host a conference call

to discuss the results.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: +1

877 405 1226 (US Toll-Free Dial In) or +1 201 689 7823 (US and

Standard International Dial In). Please quote "Pyxis Tankers” to

the operator and/or conference ID 13738633. Click here for

additional International Toll-Free access numbers.

Alternatively, participants can register for the

call using the call me option for a faster connection to join the

conference call. You can enter your phone number and let the system

call you right away. Click here for the call me option.

A webcast of the conference call will be

available through our website (http://www.pyxistankers.com) under

our Events Presentations page. A telephonic replay of the

conference and accompanying slides will be available following the

completion of the call and will remain available until Monday, May

22, 2023.

Webcast participants of the live conference call

should register on the website approximately 10 minutes prior to

the start of the webcast and can also access it through the

following link:

https://www.webcaster4.com/Webcast/Page/2976/48353

The information discussed on the conference call, or that can be

accessed through, Pyxis Tankers Inc.’s website is

not incorporated into, and does not constitute

part of this report.

About Pyxis Tankers Inc.

We own a modern fleet of four tankers engaged in

seaborne transportation of refined petroleum products and other

bulk liquids. We are focused on selectively growing our fleet of

medium range product tankers, which provide operational flexibility

and enhanced earnings potential due to their "eco" features. We are

positioned to opportunistically expand and maximize our fleet due

to competitive cost structure, solid financial condition, strong

customer relationships and an experienced management team whose

interests are aligned with those of its shareholders. For more

information, visit: http://www.pyxistankers.com. The information

discussed, contained in, or that can be accessed through, Pyxis

Tankers Inc.’s website, is not incorporated into, and does not

constitute part of this report.

Pyxis Tankers Fleet (as of May 11, 2023)

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity (dwt) |

Year Built |

Type of charter |

Charter(1) Rate (per day) |

Anticipated Earliest Redelivery Date |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

| Pyxis Lamda (2) |

SPP / S. Korea |

MR |

50,145 |

2017 |

Time |

$

40,000 |

May

2023 |

|

| Pyxis Epsilon (3) |

SPP / S. Korea |

MR |

50,295 |

2015 |

Time |

30,000 |

Sep

2023 |

|

| Pyxis Theta (4) |

SPP / S. Korea |

MR |

51,795 |

2013 |

Time |

22,500 |

Jun

2023 |

|

| Pyxis Karteria (5) |

Hyundai / S. Korea |

MR |

46,652 |

2013 |

Time |

30,000 |

May

2023 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

198,887 |

|

|

|

|

|

- Charter rates are gross in U.S.$ and do not reflect any

commissions payable.

- “Pyxis Lamda” is fixed on a time charter for 6 months, +/- 15

days at $40,000 per day.

- “Pyxis Epsilon” is fixed on a time charter for 12 months, +/-

30 days at $30,000 per day.

- “Pyxis Theta” is fixed on a time charter for min 120 days

and max 180 days. 0-30 days at $13,500 per day, 31-60 days at

$18,500 per day, 61-120 days at $22,500 and 121-180 days at $26,000

per day.

- “Pyxis Karteria” was fixed on a time charter for min 4, max 6

months at $16,000 per day. Charterer declared his option of an

additional min 45 max 90 days at $30,000 after the vessel completed

her second special survey in Mid-April, 2023.

Forward Looking Statements

This press release includes “forward-looking

statements” intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

in order to encourage companies to provide prospective information

about their business. These statements include statements about our

plans, strategies, goals financial performance, prospects or future

events or performance and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance

or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expects,” “seeks,” “predict,” “schedule,”

“projects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “targets,” “continue,” “contemplate,” “possible,”

“likely,” “might,” “will, “should,” “would,” “potential,” and

variations of these terms and similar expressions, or the negative

of these terms or similar expressions. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of COVID-19 or any variant thereof,

or the war in the Ukraine, on our financial condition and

operations and the product tanker industry, in general, are

forward-looking statements. Such forward-looking statements are

necessarily based upon estimates and assumptions. Although the

Company believes that these assumptions were reasonable when made,

because these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond the Company’s control, the Company cannot

assure you that it will achieve or accomplish these expectations,

beliefs or projections. The Company’s actual results may differ,

possibly materially, from those anticipated in these

forward-looking statements as a result of certain factors,

including changes in the Company’s financial resources and

operational capabilities and as a result of certain other factors

listed from time to time in the Company’s filings with the U.S.

Securities and Exchange Commission. For more information about

risks and uncertainties associated with our business, please refer

to our filings with the U.S. Securities and Exchange Commission,

including without limitation, under the caption “Risk Factors” in

our Annual Report on Form 20-F for the fiscal year ended December

31, 2022. We caution you not to place undue reliance on any

forward-looking statements, which are made as of the date of this

press release. We undertake no obligation to update publicly any in

information in this press release, including forward-looking

statements, to reflect actual results, new information or future

events, changes in assumptions or changes in other factors

affecting forward-looking statements, except to the extent required

by applicable laws.

Company

Pyxis Tankers Inc.59 K. Karamanli StreetMaroussi 15125

Greeceinfo@pyxistankers.com

Visit our website at www.pyxistankers.com

Company Contact

Henry WilliamsChief Financial OfficerTel: +30 (210) 638 0200 /

+1 (516) 455-0106Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

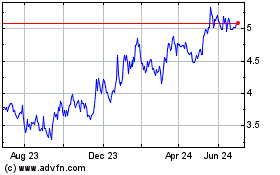

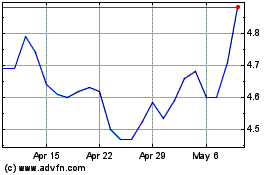

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Apr 2023 to Apr 2024