Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the

“Company”) (NASDAQ: DYAI), a global biotechnology company focused

on building innovative microbial platforms to address the growing

demand for global protein production and unmet clinical needs for

effective and affordable biopharmaceutical products for human and

animal health, today announced its financial results for the third

quarter of 2022, and highlighted recent company developments.

“The approval of our first-in-human clinical

trial application with the South African Health Products Regulatory

Authority (SAHPRA) to initiate a Phase 1 clinical trial is a

significant milestone for Dyadic which further supports the C1-cell

protein production platform as a potentially transformational

technology for use in developing and manufacturing

biopharmaceuticals,” said Mark Emalfarb, President and Chief

Executive Officer of Dyadic. “In addition to establishing a safety

record with regulatory agencies for proteins produced from C1-cells

we continually strive to improve productivity and quality and, in

some cases efficacy, of those proteins. These efforts led to

several scientific breakthroughs this quarter, including increased

protein expression levels through the application of our new

genetic approaches in engineering C1- cells.

“In our Alternative Proteins vertical, our

Dapibus™ microbial cell line continues to gain traction in several

areas, including the cultured meat industry where we have initiated

efforts in the production of media components to support scale up

and commercialization in this rapidly growing market. We signed new

and expanded animal health collaborations this quarter with top

animal health companies. We are accelerating our efforts in the

Animal Health vertical based upon recent positive data we received

with a livestock antigen in the vaccine market as well as our

success in demonstrating the ability for C1-cells to express

ferritin nanoparticle antigens. In the Human Health vertical, we

are focusing on the initiation of the Phase 1 clinical trial for

DYAI-100 and continued progress on programs with our pharmaceutical

partners,” Mr. Emalfarb concluded.

Recent Company

Developments

- DYAI-100, C1-SARS-CoV-2 RBD (Receptor Binding Domain) Booster

Vaccine Candidate

- On October 27, 2022, the Company announced receipt of

regulatory approval of its Clinical Trial Application (CTA) from

the South African Health Products Regulatory Authority (SAHPRA) to

initiate a Phase 1 clinical trial of the DYAI-100 COVID-19 Receptor

Binding Domain (RBD) booster vaccine.

- The Phase 1 randomized, double blind, placebo-controlled trial

is designed to demonstrate clinical safety and preliminary efficacy

of the DYAI-100, COVID- 19 recombinant protein RBD booster vaccine

candidate. Preparations are now underway to initiate the Phase 1

clinical trial to evaluate the safety and immunogenicity of the

vaccine, with a plan to commence enrollment of subjects later this

year in South Africa.

- Multiple Ongoing Research Projects:

- Third Party C1 Produced COVID-19 Antibody – A

non-human primate challenge study completed dosing of a C1 produced

COVID-19 monoclonal antibody (mAb) that had previously demonstrated

broad neutralization and protection against Omicron (BA.1 and BA.2)

and the other earlier variants of concern in hamsters.

- Preliminary results obtained from a challenge study with the

SARS-CoV-2 Delta virus on non-human primates demonstrated potential

high protection.

- No SARS-CoV-2 RNA in throat and nasal swab samples were

obtained in animals pre-treated with the C1 produced neutralizing

monoclonal antibody (mAb), demonstrating potential for preventative

effects.

- Pre-clinical safety and efficacy data from animal studies,

including hamsters and non-human primates, demonstrates C1 produced

antigens and antibodies are as effective as those produced by

reference platforms.

- At the World Vaccine Congress Europe, Dr. Albert Osterhaus

(University of Veterinary Medicine Hannover Germany), who has been

collaborating with Dyadic for over 5 years, presented pre-clinical

safety and efficacy data from animal studies, including hamsters

and non- human primates, demonstrating C1 produced antigens and

antibodies are as effective as those produced by reference

platforms. Dr. Osterhaus’s video presentation can be found on

Dyadic’s website under Media Center, Video Gallery.

- CEO Mark Emalfarb presented data that demonstrated, in addition

to C1-cells producing even higher levels of productivity to date

across different classes and types of proteins for both animal and

human health, innovative approaches and designs to C1 produced

proteins which generated higher neutralizing antibody activity in

pre-clinical animal studies with the potential to improve vaccines

for influenza, COVID-19 and other disease areas.

- Influenza and COVID-19 Vaccines – Additional

preclinical studies are ongoing with C1 produced antigens for

potential seasonal and/or pandemic influenza and/or an influenza /

SARS-CoV-2 combined vaccine.

- Mono and

Multi-Valent RBD-based

Blended Vaccine – Based on the

RBD antigen cell lines that we have constructed to express Wuhan,

Alpha, Beta, Gamma, Delta, and Omicron BA.1 and BA.5 CoV-2

variants, additional animal data is being generated through several

preclinical trials using mono and multi-valent blends of C1

produced SARS-CoV-2 RBD variants of concern. Research is ongoing

with various collaborators who are conducting animal trials on mono

and multi-valent RBD-based blended COVID-19 vaccines for potential

next generation pan-coronavirus vaccine candidates that may provide

broader protection and longer lasting prevention against a wide

variety of corona viruses than what is presently available in the

market.

- Influenza Neuraminidase

(NA) Protein – Dyadic developed a

C1-cell line capable of achieving high titers of neuraminidase

(“NA”). NA in combination with Hemagglutinin (“HA”) is expected to

play an important role in providing broader influenza

vaccine-induced protection. Mice trials conducted by Oslo

university for NA, like the previously reported HA produced from

C1-cells, generated high neutralizing antibody levels. Additional

animal trials are ongoing.

- Scientific Updates

- Dyadic recently developed innovative cell engineering

approaches which have resulted in the achievement of higher titers

across different classes and types of proteins.

- We have successfully expressed the following variants: Alpha,

Beta, Gamma, Delta, and Omicron B.1.1.529 and BA.5 at 0.5-2.5 g/L

levels, in addition to DYAI-100.

- A nine-fold (9x) improvement in the expression yield for

Nivolumab, a potential monoclonal antibody for oncology expressed

from a C1-cell at 22.3 g/l in a seven-day fermentation.

- A biologically active neuraminidase (NA) has been expressed at

0.8 g/L in 7 days for potential use in combination with

Hemagglutinin (HA) to play an important role in providing broader

influenza vaccine-induced protection. Mice trials conducted by Oslo

University for NA, like the previously reported HA produced from

C1-cells, generate high neutralizing antibody levels.

- A non-human primate study completed dosing of a C1 produced

COVID-19 monoclonal antibody (mAb) that has demonstrated broad

neutralization and protection against Omicron (BA.1 & BA.2) and

other earlier variants of concern in hamsters. Full data readout is

anticipated later this year.

- Potential next generation pan coronavirus vaccine candidates:

- Successful production of Wuhan and Omicron Ferritin gRBD

nanoparticle antigens.

- The Wuhan S gRBD nanoparticle has been expressed at greater

than 3 g/L in five days.

- The new data presented by Dr. Albert Osterhaus came from three

pre-clinical studies which demonstrated the potential positive

preventative effects of two C1-cell produced proteins being as

effective as those produced by reference platforms, including CHO

(Chinese Hamster Ovary) cells.

- Third Party

Collaborations – Several on-going fully funded

research collaborations are on track as we continue to optimize our

C1-cell protein production platform and increase productivity,

including collaborations with Janssen, NIIMBL, Jiangsu Hengrui,

Epygen Biotech, and other partners.

- Animal Health

- The Company has successfully expressed a recombinant livestock

antigen at titers up to 10 g/L in 7 days.

- The Company expanded its research projects in animal health for

the development of animal vaccines for livestock.

- In October, the Company commenced a new proof of concept

project with a top animal health company for the treatment of a

targeted disease.

- The Company has initiated two (2) additional recombinant

protein projects to support vaccine research and development.

- Alternative Proteins

- Dyadic has launched its Dapibus™ platform, a filamentous fungal

based microbial gene expression and protein production platform,

which is further designed and customized to enable the rapid

development and large-scale manufacture of low-cost enzymes,

proteins, metabolites, and other biologic products for use in

non-pharmaceutical applications such as food, nutrition, and

wellness.

- The Company initiated an animal free recombinant serum albumin

and other projects related to cell culture media to support the

Dapibus™ platform, which is being developed, among other

applications, to meet the growing demand and unmet needs of

alternative proteins in emerging market such as cultured meat.

Third Quarter

2022 Financial

Results

Cash Position: As of September

30, 2022, cash, cash equivalents, and the carrying value of

investment grade securities, including accrued interest were

approximately $14.2 million compared to $20.4 million as of

December 31, 2021. Based on current plans, the Company expects that

its existing cash, cash equivalents, and investment securities will

be sufficient to enable it to fund Phase 1 clinical trials of

DYAI-100 and its operating expenses into 2024.

Revenue: Research and

development revenue and license revenue for the quarter ended

September 30, 2022, increased to approximately $880,000 compared to

$693,000 for the same period a year ago. Research and development

revenue and license revenue for the nine months ended September 30,

2022, increased to approximately $2,187,000 compared to $2,091,000

for the same period a year ago.

Cost of

Revenue: Cost of research and development revenue

for the quarter ended September 30, 2022, increased to

approximately $603,000 compared to $393,000 for the same period a

year ago. Cost of research and development revenue for the nine

months ended September 30, 2022, decreased to approximately

$1,419,000 compared to $1,613,000 for the same period a year

ago.

R&D

Expenses: Research and development expenses for

the quarter ended September 30, 2022, decreased to approximately

$744,000 compared to $1,902,000 for the same period a year ago.

Research and development expenses for the nine months ended

September 30, 2022, decreased to approximately $3,917,000 compared

to $5,919,000 for the same period a year ago.

The decrease in research and development

expenses was due to the winding down of activities of contract

research organization and pharmaceutical quality and regulatory

consultants to manage and support the pre-clinical and clinical

development as well as a decrease in cGMP manufacturing costs as

the Company moves towards its anticipated Phase 1 clinical trial of

its DYAI-100 RBD COVID-19 booster vaccine candidate.

G&A

Expenses: General and administrative expenses for

the quarter ended September 30, 2022, decreased to approximately

$1,383,000 compared to $1,693,000 for the same period a year ago.

General and administrative expenses for the nine months ended

September 30, 2022, decreased to approximately $4,753,000 compared

to $4,994,000 for the same period a year ago.

Net Loss: Net

loss for the quarter ended September 30, 2022, was approximately

$1,809,000 or $(0.06) per share compared to $1,715,000 or $(0.06)

per share for the same period a year ago. Net loss for the nine

months ended September 30, 2022, was approximately $7,589,000 or

$(0.27) per share compared to $8,856,000 or $(0.32) per share for

the same period a year ago.

Conference Call

Information

Date: Thursday, November 10, 2022Time: 5:00 p.m. Eastern

TimeDial-in numbers: Toll Free 1-877-407-0784 International

1-202-689-8560Conference ID: 13731917Webcast Link:

https://viavid.webcasts.com/starthere.jsp?ei=1561607&tp_key=84d3d19ead

An archive of the webcast will be available within 24 hours

after completion of the live event and will be accessible on the

Investor Relations section of the Company’s website at

www.dyadic.com. To access the replay of the webcast, please follow

the webcast link above.

About

DYAI-100

DYAI-100, also known as C1-SARS-CoV-2 RBD

vaccine, is a novel receptor-binding domain (RBD) recombinant

booster vaccine candidate, highly expressed in Dyadic’s proprietary

C1-cell protein production platform for the prevention of COVID-19.

The C1-SARS-CoV-2 RBD vaccine drug product consists of the

SARS-CoV-2 RBD-C-tag adjuvanted with alum Alhydrogel 85® 2%.

DYAI-100 is expected to start a Phase 1 clinical trial in South

Africa in late 2022 to assess the safety, reactogenicity, and

immunogenicity of the C1-SARS-CoV-2 RBD vaccine, administered as a

booster, in healthy volunteers.

About C1-cell

Protein Production

Platform

C1-cell protein production platform is Dyadic’s

platform technology, which is based on an industrially proven

microorganism (named C1). The C1-cell protein production platform

is a robust and versatile thermophilic filamentous fungal

expression system for the development and production of biologic

products, including enzymes, antigens, antibodies, and other

therapeutic proteins. The C1 technology is currently used to speed

development, lower production costs, and improve performance of

biologic vaccines and drugs at flexible commercial scales for the

human and animal health markets.

About Dapibus™

Protein Production

Platform

Dapibus™ is Dyadic’s newly developed filamentous

fungal based microbial gene expression and protein production

platform, which is being further designed and customized to enable

the rapid development and large-scale manufacture of low-cost

enzymes, proteins, metabolites, and other biologic products for use

in non- pharmaceutical applications, such as food, nutrition, and

wellness.

About Dyadic International,

Inc.

Dyadic International, Inc. is a global

biotechnology company committed to building disruptive microbial

platforms to address the growing demand for global protein

bioproduction and unmet clinical needs for effective, affordable,

and accessible biopharmaceutical products for human and animal

health.

Dyadic’s lead technology, its C1-cell gene

expression and protein production platform, C1 gene expression and

protein production platform is based on the highly productive and

scalable industrially proven fungus Thermothelomyces heterothallica

(formerly Myceliophthora thermophila). is currently used to speed

development, lower production costs, and improve performance of

biologic vaccines and drugs at flexible commercial scales for the

human and animal health markets.

Dyadic is also developing the Dapibus™

filamentous fungal based microbial protein production platform to

enable the rapid development and large-scale manufacture of

low-cost proteins, metabolites, and other biologic products for use

in non-pharmaceutical applications, such as food, nutrition, and

wellness.

With a passion to enable our partners and

collaborators to develop effective preventative and therapeutic

treatments in both developed and emerging countries, Dyadic is

building an active pipeline by advancing its proprietary microbial

platform technologies, including our lead product DYAI-100 COVID-19

vaccine candidate, as well as other biologic vaccines, antibodies,

and other biological products.

To learn more about Dyadic and our commitment to

helping bring vaccines and other biologic products to market

faster, in greater volumes and at lower cost, please visit

www.dyadic.com.

Safe Harbor

Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including those regarding Dyadic International’s expectations,

intentions, strategies, and beliefs pertaining to future events or

future financial performance, such as the success of our clinical

trial our research projects and third-party collaborations, as well

as the availability of necessary funding. Actual events or results

may differ materially from those in the forward-looking statements

because of various important factors, including those described in

the Company’s most recent filings with the SEC. Dyadic assumes no

obligation to update publicly any such forward-looking statements,

whether because of new information, future events or otherwise. For

a more complete description of the risks that could cause our

actual results to differ from our current expectations, please see

the section entitled “Risk Factors” in Dyadic’s annual reports on

Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as

such factors may be updated from time to time in Dyadic’s periodic

filings with the SEC, which are accessible on the SEC’s website and

at www.dyadic.com.

Contact:

Dyadic International, Inc.Ping W. RawsonChief Financial

Officer561-743-8333Email: ir@dyadic.com

DYADIC

INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS

OF OPERATIONS

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

| |

2022 |

2021 |

2022 |

2021 |

| Revenues: |

|

|

|

|

|

Research and development revenue |

$ |

835,480 |

|

$ |

692,929 |

|

$ |

1,983,636 |

|

$ |

2,090,541 |

|

| License revenue |

|

44,117 |

|

|

— |

|

|

202,941 |

|

|

— |

|

|

Total revenue |

|

879,597 |

|

|

692,929 |

|

|

2,186,577 |

|

|

2,090,541 |

|

| |

|

|

|

|

|

Costs and expenses: |

|

|

|

|

| Costs of research and development

revenue |

|

602,847 |

|

|

392,544 |

|

|

1,418,702 |

|

|

1,612,810 |

|

| Research and development |

|

743,585 |

|

|

1,901,548 |

|

|

3,917,245 |

|

|

5,918,888 |

|

| General and administrative |

|

1,383,433 |

|

|

1,692,837 |

|

|

4,753,162 |

|

|

4,994,458 |

|

| Foreign currency exchange loss,

net |

|

13,205 |

|

|

30,002 |

|

|

23,578 |

|

|

76,080 |

|

|

Total costs and expenses |

|

2,743,070 |

|

|

4,016,931 |

|

|

10,112,687 |

|

|

12,602,236 |

|

| |

|

|

|

|

| Loss

from operations |

|

(1,863,473 |

) |

|

(3,324,002 |

) |

|

(7,926,110 |

) |

|

(10,511,695 |

) |

| |

|

|

|

|

|

Other income: |

|

|

|

|

| Interest income |

|

54,300 |

|

|

3,202 |

|

|

87,277 |

|

|

49,772 |

|

| Other income |

|

— |

|

|

1,605,532 |

|

|

250,000 |

|

|

1,605,532 |

|

| Total

other income |

|

54,300 |

|

|

1,608,734 |

|

|

337,277 |

|

|

1,655,304 |

|

| |

|

|

|

|

|

Net loss |

$ |

(1,809,173 |

) |

$ |

(1,715,268 |

) |

$ |

(7,588,833 |

) |

$ |

(8,856,391 |

) |

| |

|

|

|

|

| Basic and diluted net loss per

common share |

$ |

(0.06 |

) |

$ |

(0.06 |

) |

$ |

(0.27 |

) |

$ |

(0.32 |

) |

| |

|

|

|

|

| Basic and diluted

weighted-average common shares outstanding |

|

28,391,894 |

|

|

28,079,157 |

|

|

28,302,332 |

|

|

27,754,597 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 10, 2022.

DYADIC

INTERNATIONAL, INC.

AND

SUBSIDIARIESCONSOLIDATED

BALANCE SHEETS

| |

September 30,

2022 |

|

December 31,

2021 |

| |

(Unaudited) |

|

(Audited) |

|

Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

6,739,117 |

|

|

$ |

15,748,480 |

|

| Short-term investment

securities |

|

7,461,884 |

|

|

|

4,511,780 |

|

| Interest receivable |

|

43,873 |

|

|

|

94,375 |

|

| Accounts receivable |

|

235,368 |

|

|

|

277,831 |

|

| Prepaid expenses and other

current assets |

|

448,208 |

|

|

|

375,830 |

|

| Total current assets |

|

14,928,450 |

|

|

|

21,008,296 |

|

| |

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

| Investment in Alphazyme |

|

284,709 |

|

|

|

284,709 |

|

| Other assets |

|

6,003 |

|

|

|

6,117 |

|

| Total

assets |

$ |

15,219,162 |

|

|

$ |

21,299,122 |

|

| |

|

|

|

|

|

|

|

| Liabilities

and stockholders’

equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Accounts payable |

$ |

777,238 |

|

|

$ |

1,547,953 |

|

| Accrued expenses |

|

987,891 |

|

|

|

709,560 |

|

| Deferred research and development

obligations |

|

445,044 |

|

|

|

151,147 |

|

| Deferred license revenue, current

portion |

|

176,471 |

|

|

|

147,059 |

|

| Total current liabilities |

|

2,386,644 |

|

|

|

2,555,719 |

|

| |

|

|

|

|

|

|

|

| Deferred license revenue, net of

current portion |

|

220,588 |

|

|

|

352,941 |

|

| Total liabilities |

|

2,607,232 |

|

|

|

2,908,660 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 4) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value: |

|

|

|

|

|

|

|

|

Authorized shares - 5,000,000; none issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $.001 par value: |

|

|

|

|

|

|

|

| Authorized shares -

100,000,000; issued shares - 40,716,602 and 40,482,659, outstanding

shares - 28,463,100 and 28,229,157 as of September 30, 2022, and

December 31, 2021, respectively |

|

40,717 |

|

|

|

40,483 |

|

| Additional paid-in

capital |

|

102,836,563 |

|

|

|

101,026,496 |

|

| Treasury stock,

shares held at cost - 12,253,502 |

|

(18,929,915 |

) |

|

|

(18,929,915 |

) |

| Accumulated

deficit |

|

(71,335,435 |

) |

|

|

(63,746,602 |

) |

| Total stockholders’

equity |

|

12,611,930 |

|

|

|

18,390,462 |

|

|

Total liabilities

and stockholders’

equity |

$ |

15,219,162 |

|

|

$ |

21,299,122 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 10, 2022.

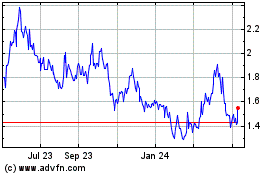

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Aug 2024 to Sep 2024

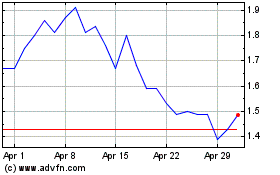

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Sep 2023 to Sep 2024