Current Report Filing (8-k)

October 11 2022 - 8:47AM

Edgar (US Regulatory)

8-K0001365916FALSE00013659162022-10-112022-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): October 11, 2022

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | AMRS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 11, 2022, Amyris, Inc. (the “Company”), certain of the Company’s subsidiaries (the “Subsidiary Guarantors”) and DSM Finance B.V. (“DSM”), as lender, entered into a Loan and Security Agreement (the “Loan Agreement”) to make available to the Company a secured term loan facility in an aggregate principal amount of up to $75 million (the “Loan Facility”), consisting of two tranches: a $50 million tranche to be drawn in full by the Company on October 11, 2022 and a $25 million tranche to be drawn in full by the Company on or before December 31, 2022, subject to certain conditions set forth in the Loan Agreement (collectively, the "Term Loan"). The Loan Agreement also includes a provision for a third tranche of $25 million on terms to be mutually agreed by the parties. The net proceeds will be used for general corporate purposes.

The obligations under the Loan Facility are (i) guaranteed by the Subsidiary Guarantors, and (ii) secured by a perfected security interest in certain payment obligations ("Earn-Outs") due and owing to the Company from DSM Nutritional Products Ltd. ("DSM Nutritional") under that certain Asset Purchase Agreement dated as of March 31, 2021 by and among the Company and DSM Nutritional.

The Term Loan will amortize as follows: (a) $25 million on October 11, 2023, (b) $25 million on October 11, 2024, and (c) any outstanding principal balance of the Term Loan on October 11, 2025 (the "Maturity Date"); provided that the total amortization amount on any of the foregoing dates shall be reduced by the amount of any Earn-Outs due and owing to the Company from DSM Nutritional during the one-year period prior to such dates. Term Loans under the Loan Facility will accrue interest at a rate of 9% per annum, with quarterly cash interest payments due in cash. An additional 3% interest applies if the Company fails to pay the principal when due. The Company paid an upfront structuring fee of $5.125 million to DSM in connection with the execution of the Loan Agreement on October 11, 2022.

Prepayment of the outstanding amounts under the Loan Facility will be required upon any Earn-Outs becoming due and payable from DSM Nutritional to the Company and, after prepayment of $30 million of the Company’s existing indebtedness with Foris Ventures, LLC, on a pro rata basis concurrently with any prepayments of outstanding indebtedness with Foris Ventures, LLC, upon the occurrence of a Change of Control and certain other prepayment events. In addition, the Company may at its option prepay the outstanding principal amount of the Term Loans before the Maturity Date without the incurrence of a prepayment fee.

The Loan Agreement includes customary representations, affirmative and negative covenants and events of default, and also contains financial covenants, including covenants related to minimum revenue and minimum liquidity.

Each of DSM and DSM Nutritional is an affiliate of DSM International B.V., which is a shareholder of the Company and affiliated with Mr. Philip Eykerman, a member of the Company’s Board of Directors.

The foregoing description of the Loan Agreement is a summary and is qualified in its entirety by reference to the Loan Agreement, which is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 above is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: October 11, 2022 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | | Chief Financial Officer |

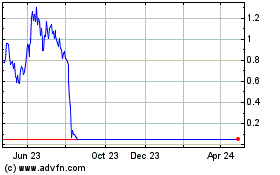

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024