Current Report Filing (8-k)

September 13 2022 - 5:15PM

Edgar (US Regulatory)

8-K0001365916FALSE00013659162022-09-132022-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): September 13, 2022

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | AMRS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 13, 2022, Amyris, Inc. (the “Company”), certain of the Company’s subsidiaries (the “Subsidiary Guarantors”) and Foris Ventures, LLC (“Foris”), as lender, entered into a Loan and Security Agreement (the “Loan Agreement”) to make available to the Company a secured term loan facility in an aggregate principal amount of up to $80 million (the “Loan Facility”), consisting of two tranches: a $30 million tranche drawn in full by the Company on September 13, 2022 (“Tranche A”) and a $50 million tranche to be drawn in full by the Company by or before September 30, 2022 (“Tranche B”). The net proceeds will be used for general corporate purposes.

Tranche A has a maturity date of April 15, 2023 and Tranche B has a maturity date of January 15, 2024 for the first $20 million principal amount and June 15, 2024 for the remaining $30 million principal amount (the “Maturity Date”). Loans under the Loan Facility will accrue interest at a rate of 7% per annum. Interest is due on the first business day of each month beginning with the month after the initial funding of the loan. All interest payments will be capitalized and added to the principal amount of the loan on each interest payment date. In lieu of upfront, exit, administration and prepayment fees, the Company will issue a warrant to Foris with a value equivalent to 10% of the principal of the Loan Facility as further described in Item 3.02 below. The warrants are priced with a 30% premium over the 15-day VWAP as of September 8, 2022.

The obligations under the Loan Facility are (i) guaranteed by the Subsidiary Guarantors, and (ii) secured by a perfected security interest in substantially all of the assets of the Company and the Subsidiary Guarantors, in each case subject to certain limitations and exceptions.

Prepayment of the outstanding amounts under the Loan Facility will be required upon the occurrence of a Change of Control and to the extent that the Borrowing Base (both as defined in the Loan Agreement) exceeds the outstanding principal amount of the loans under the Loan Facility. In addition, the Company may at its option prepay the outstanding principal amount of the loans under the Loan Facility before the Maturity Date without the incurrence of a prepayment fee.

The representations, covenants, and events of default in the Loan Agreement are customary for financing transactions of this nature. An additional 3% interest applies if the Company fails to pay the principal when due. The Loan Agreement includes customary affirmative and negative covenants and also contains financial covenants, including covenants related to minimum revenue, liquidity and asset coverage.

The foregoing description of the Loan Agreement is a summary and is qualified in its entirety by reference to the Loan Agreement, which is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 above is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

In connection with the entry into the Loan Agreement as described in Item 1.01 above, on September 13, 2022, the Company issued to Foris a warrant to purchase up to 2,046,036 shares of Common Stock at an exercise price of $3.91 per share, with an exercise term of three years from issuance (the “Foris Warrant”). The Foris Warrant was issued in a private placement pursuant to the exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

The foregoing description of the Foris Warrant is a summary and is qualified in its entirety by reference to the Foris Warrant, which is filed as Exhibit 4.1 hereto and is incorporated herein by reference.

The information contained in Item 8.01 below is incorporated herein by reference.

Item 8.01. Other Events.

On September 13, 2022 Amyris, Inc. (the “Company”) sold and issued 1,420,456 shares of the Company’s common stock (the “Unregistered Securities”) to WeMedia Shopping Network Holdings Co., Limited. (the “Selling Stockholder”) pursuant to a negotiated agreement (the “Agreement”) for equity of the Selling Stockholder. The issuance was made as a private placement pursuant to the exemption from registration under Section 4(a)(2) of the Securities Act.

Pursuant to the terms and conditions of the Agreement, the Company agreed to file a prospectus supplement, which supplements the Prospectus filed with the SEC on April 7, 2021 together with a Registration Statement on Form S-3ASR (File No. 333-255105), to register the resale of the Unregistered Securities (the “Offering”), under which the Selling Stockholder may sell its Unregistered Securities. The Company will not receive any proceeds from the Offering.

A copy of the opinion of Fenwick & West LLP, relating to the validity of certain of the shares in connection with the Offering, is filed with this Current Report on Form 8-K as Exhibit 5.1.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 4.1 | | |

| 5.1 | | |

| 10.1 | | |

| 23.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: September 13, 2022 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | | Chief Financial Officer |

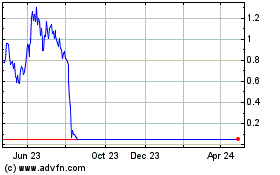

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024