Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 09 2022 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2022

Commission

File Number: 001-39803

Meiwu

Technology Company Limited

(Translation

of registrant’s name into English)

1602,

Building C, Shenye Century Industrial Center

No.

743 Zhoushi Road, Bao’an District Shenzhen, People’s Republic of China

Telephone:

+86-755-85250400

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Entry

into Material Definitive Agreements

Closing

of Private Placement

As

disclosed on Meiwu Technology Company Limited’s (the “Company”) Form 6-K filed with the Securities and Exchange Commission

on April 29, 2022, the Company entered into certain securities purchase agreement on April 28, 2022 (the “SPA”) with five

“accredited investors” (the “Purchasers”) as defined in Rule 501(a) of Regulation D as promulgated under the

Securities Act of 1933, as amended (the “Securities Act”), pursuant to which the Company agreed to sell to such Purchasers

unsecured convertible notes with an aggregate principal amount of $5,500,000 (the “Notes”) and accompanying warrants (the

“Warrants”) to purchase an aggregate of 10,000,000 ordinary shares of the Company (the “Offering”). The Notes

bear an interest of 10% per annum and a maturity date of 18 months from the date of issuance. The Warrants will be exercisable immediately

upon the date of issuance, have an initial exercise price of $0.60 and expire twenty-four months from the date of issuance.

On

September 9, 2022 (Beijing Time), the Offering closed as all the conditions of the SPA have been satisfied and the Company issued the

Notes and Warrants to the Purchasers. The gross proceeds to the Company from the Offering was US$5 million.

Each

of the Notes include an original issue discount along with $4,000.00 for Purchasers’ fees, costs and other transaction expenses

incurred in connection with the purchase and sale of the Notes. The Company may prepay all or a portion of the Notes at any time by paying

120% of the outstanding balance elected for pre-payment. Each of the Purchasers can convert his or her Note at any time after the six-month

anniversary of the issuance date at a conversion price of the lower of (i) $0.50 or (ii) 80% of the lowest daily volume-weighted average

price in the 20 trading days prior to the date on which the conversion price is measured (the “Market Price”). In addition,

the Purchasers agreed that in any given calendar week (being from Sunday to Saturday of that week), the number of Ordinary Shares sold

by it in the open market will not be more than fifteen percent (15%) of the weekly trading volume for the Ordinary Shares during such

week.

The

Notes, the Ordinary Shares underlying the Notes, the Warrants, and Ordinary Shares issuable upon exercise of the Warrants, are exempt

from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D.

The

proceeds of this Offering will be used for working capital and general corporate purposes.

The

SPA also contains customary representation and warranties of the Company and the Purchasers, indemnification obligations of the Company,

termination provisions, and other obligations and rights of the parties.

The

Form of the SPA, the form of the Note, the form of the Warrants are filed as Exhibits 10.1, 10.2 and 4.1 to this Current Report on Form

6-K, respectively; and such documents are incorporated herein by reference. The foregoing is only a brief description of the material

terms of the SPA, the Note, and the Warrants, and does not purport to be a complete description of the rights and obligations of the

parties thereunder and are qualified in their entirety by reference to such exhibits.

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Meiwu Technology Co. Ltd. |

| |

|

|

| |

By: |

/s/ Xinliang

Zhang |

| |

|

Xinliang Zhang |

| |

|

Chief Executive Officer |

| |

|

|

| Date: September 9, 2022 |

|

|

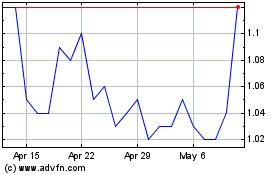

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

From Aug 2024 to Sep 2024

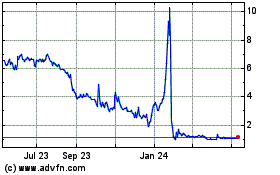

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

From Sep 2023 to Sep 2024