Amended Current Report Filing (8-k/a)

August 11 2022 - 5:09PM

Edgar (US Regulatory)

0001522860

true

NASDAQ

0001522860

2022-06-30

2022-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K/A

Amendment No.

1 to

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): August 11, 2022 (June 30, 2022)

Acutus

Medical, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

001-39430 |

45-1306615 |

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

2210 Faraday Ave., Suite 100

Carlsbad, CA

|

|

92008 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (442) 232-6080

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 |

AFIB |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

This Amendment No. 1 to Form

8-K (“Form 8-K/A”) amends the Current Report on Form 8-K filed by Acutus Medical, Inc. (the “Company”), with the

Securities and Exchange Commission (“SEC”) on July 1, 2022 (the “Original Filing”). As disclosed in the Original

Filing, on June 30, 2022, the Company completed the first of two closings in connection with the previously disclosed sale of its AcQCross®

line of sheath-compatible septal crossing devices, AcQGuide® MINI integrated crossing device and sheath, AcQGuide® FLEX Steerable

Introducer with integrated transseptal dilator and needle, and AcQGuide® VUE steerable sheaths (the “Seller Products”)

to Medtronic, Inc. pursuant to an asset purchase agreement dated April 26, 2022 (the “Transaction”). This Form 8-K/A is being

filed solely for the purposes of updating the unaudited pro forma financial information relating to the sale of the Seller Products to

include the unaudited pro forma consolidated statement of operations for the six months ended June 30, 2022, giving pro forma effect

to the sale of the Seller Products. This Form 8-K/A does not change any of the other information contained in the Original Filing except

as specifically set forth herein. This Form 8-K/A continues to speak as of the date of the Original Filing and we have not updated or

amended any disclosures, except as specifically set forth herein, contained in the Original Filing to reflect events that have occurred

since the time of the Original Filing.

Item 8.01 Other Events

The Company’s unaudited pro forma consolidated

balance sheet as of March 31, 2022 and unaudited pro forma consolidated statements of operations for the three months ended March 31,

2022 and fiscal year ended December 31, 2021, in each case giving pro forma effect to the sale of the Seller Products, and the notes related

thereto, are filed as Exhibit 99.1 to this Form 8-K/A and incorporated herein by reference. The Company’s unaudited pro forma consolidated

statement of operations for the six months ended June 30, 2022, and the notes related thereto, are filed as Exhibit 99.2 to this Form

8-K/A and incorporated herein by reference. The Transaction is reflected in the Company’s condensed consolidated balance sheet as

of June 30, 2022 included in the Company’s Quarterly Report on Form 10-Q, filed with the SEC on August 11, 2022. Accordingly, the

Company has not included an unaudited pro forma consolidated balance sheet as of June 30, 2022 in this Form 8-K/A.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on

Form 8-K and certain information incorporated by reference herein contain forward-looking statements within the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. All

statements included or incorporated by reference in this Current Report, other than statements that are purely historical, are forward-looking

statements. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,”

“seek,” “estimate,” “will,” “should,” “would,” “could,” “may”

and similar expressions also identify forward-looking statements. The forward-looking statements include, without limitation, statements

regarding whether and when the transactions contemplated by the Sale Agreement (including the Second Closing (as defined in the Original

8-K) and earnout payments thereunder), the Warrants (as defined in the Original 8-K) (including exercise thereof) and ancillary agreements

will be consummated.

Our expectations, beliefs,

objectives, intentions and strategies regarding future results are not guarantees of future performance and are subject to risks and uncertainties

that could cause actual results to differ materially from results contemplated by our forward-looking statements. Factors that may affect

the actual results achieved by the Company include, without limitation, the parties’ ability to consummate the transactions; satisfaction

of conditions in connection with the transactions described herein; the parties’ ability to meet expectations regarding the timing

and completion of the transactions; and the risk factors listed from time to time in the Company’s filings with the SEC, as further described below.

We urge you to carefully

consider risks and uncertainties and review the additional disclosures we make concerning risks and uncertainties that may materially

affect the outcome of our forward-looking statements and our future business and operating results, including those made under the captions

“Risk Factors” contained in our most recently filed Form 10-K and Form 10-Q and subsequent filings with the SEC. We assume no obligation to update any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by applicable law. You are cautioned not to place undue reliance on forward-looking statements,

which speak only as of the date of the filing of this Current Report on Form 8-K.

(b) Pro forma financial information.

Attached as Exhibit 99.1

hereto and incorporated by reference are an unaudited pro forma consolidated balance sheet as of March 31, 2022 and unaudited pro forma

consolidated statements of operation for the three months ended March 31, 2022 and fiscal year ended December 31, 2021, in each case giving

pro forma effect to the sale of the Seller Products.

Attached as Exhibit

99.2 hereto and incorporated by reference is an unaudited pro forma consolidated statement of operation for the six months ended

June 30, 2022, giving pro forma effect to the sale of the Seller Products.

| Exhibit Number |

Description |

| |

|

| 2.1*^ |

Asset Purchase Agreement dated April 26, 2022, by and among Medtronic, Inc. and Acutus Medical, Inc. |

| |

|

| 10.1*^ |

Amended and Restated Credit Agreement dated June 30, 2022, by and among Acutus Medical, Inc., the lenders from time to time party thereto, and Wilmington Trust, National Association, as Administrative Agent |

| |

|

| 10.2*^ |

Warrant Purchase Agreement dated June 30, 2022, by and among Acutus Medical, Inc. and the purchasers named therein |

| |

|

| 10.3*^ |

Form of Warrant for the issuance of warrants dated June 30, 2022 |

| |

|

| 10.4*^ |

Registration Rights Agreement dated June 30, 2022, by and among Acutus Medical, Inc., Deerfield Partners, L.P. and Deerfield Private Design Fund III, L.P. |

| |

|

| 99.1^ |

Unaudited pro forma consolidated balance sheet as of March 31, 2022 and unaudited pro forma consolidated statements of operation for the three months ended March 31, 2022 and fiscal year ended December 31, 2021 |

| |

|

| 99.2 |

Unaudited pro forma consolidated statement of operation for the six months ended June 30, 2022, giving pro forma effect to the sale of the Seller Products |

| |

|

| 99.3**^ |

Press Release dated July 1, 2022 |

| |

|

| 104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

* The schedules and exhibits

to the exhibited agreements have been omitted from this filing pursuant to Item 601(b)(2) of Regulation S-K. The Company will furnish

copies of any such schedules and exhibits to the Securities and Exchange Commission upon request.

** Furnished herewith, not filed.

^ Previously filed.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: August 11, 2022

| |

|

|

| |

Acutus Medical, Inc. |

| |

|

|

| |

By: |

/s/ David Roman |

| |

|

David Roman |

| |

|

President, Chief Executive Officer, Chief Financial Officer and Director |

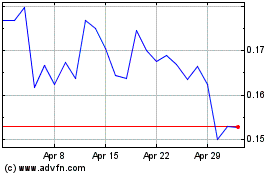

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

From Aug 2024 to Sep 2024

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

From Sep 2023 to Sep 2024