Smith Micro Software, Inc. (NASDAQ: SMSI) (“Smith Micro” or the

“Company”) today reported financial results for its second quarter

ended June 30, 2022.

“During the second quarter, we made significant progress on

several key milestones related to the integration of our prior

acquisitions of our two largest competitors. The consolidation of

the best features and functionality of each solution into our

Digital Family Lifestyle™ Platform has required a substantial

investment since their respective acquisitions. I am very pleased

that we are quickly approaching the completion of this mission,”

said William W. Smith, Jr., President, CEO and Chairman of the

Board of Smith Micro.

“With these efforts nearing completion, we expect to move

forward with significant reductions in our operating expenses,

starting in the third quarter, and accelerating through the

remainder of the fiscal year, as we streamline our expenses to

return back to more historical levels.”

“We see the enormous opportunity in front of us, not only with

the Big 3 Tier 1 mobile operators in the US, but other Tier 1

operators in Europe, and elsewhere around the world, as we move to

our next phase of growth on a single platform,” concluded Mr.

Smith.

Second Quarter 2022 Financial

Results

Smith Micro reported revenue of $12.7 million for the quarter

ended June 30, 2022, compared to $15.9 million reported in the

quarter ended June 30, 2021.

Gross profit for the quarter ended June 30, 2022 was $9.1

million, compared to $12.6 million for the quarter ended June 30,

2021.

Gross profit as a percentage of revenue was 71 percent for the

quarter ended June 30, 2022, compared to 79 percent for the quarter

ended June 30, 2021.

GAAP net loss for the quarter ended June 30, 2022 was $8.5

million, or $0.15 loss per share, compared to GAAP net loss of $5.2

million, or $0.10 loss per share, for the same period in 2021.

Non-GAAP net loss for the quarter ended June 30, 2022 was $5.1

million, or $0.09 loss per share, compared to non-GAAP net loss of

$0.3 million, or $0.01 loss per share, for the quarter ended June

30, 2021. Non-GAAP net loss excludes stock-based compensation,

amortization of intangible assets, personnel severance and

reorganization activities, and acquisition costs.

Second Quarter Year-to-Date 2022 Financial

Results

Smith Micro reported revenue of $25.4 million for the six months

ended June 30, 2022, compared to $27.3 million reported in the six

months ended June 30, 2021.

Gross profit for the six months ended June 30, 2022 was $18.2

million compared to $22.4 million reported for the same period in

2021.

Gross profit as a percentage of revenue was 71 percent for the

six months ended June 30, 2022 compared to 82 percent for the six

months ended June 30, 2021.

GAAP net loss for the six months ended June 30, 2022 was $15.5

million, or $0.28 loss per share, compared to GAAP net loss of $8.4

million, or $0.17 loss per share, for the same period in 2021.

Non-GAAP net loss (which excludes stock-based compensation,

amortization of intangible assets, personnel severance and

reorganization activities, and acquisition costs) for the six

months ended June 30, 2022 was $9.4 million, or $0.17 diluted loss

per share, compared to non-GAAP net income of $0.4 million, or

$0.01 earnings per share, for the six months ended June 30,

2021.

Total cash and cash equivalents as of June 30, 2022 were $5.4

million and available borrowing capacity under the Company’s

revolving credit facility was $7.0 million.

To supplement our financial information presented in accordance

with GAAP, the Company considers, and has included in this press

release, certain non-GAAP financial measures and a non-GAAP

reconciliation from GAAP gross profit, net (loss) income before

taxes, and net (loss) income to the following non-GAAP metrics:

non-GAAP net (loss) income, and non-GAAP diluted earnings (loss)

per share in the presentation of financial results in this press

release. Management believes this non-GAAP presentation may be more

meaningful in analyzing our income generation and has therefore

excluded the following items from GAAP earnings calculations:

stock-based compensation, amortization of intangible assets,

personnel severance and reorganization activities, and acquisition

costs. Additionally, since the Company currently has federal and

state net operating loss carryforwards that can be utilized to

reduce future cash payments for income taxes, these non-GAAP

adjustments have not been tax effected, and the resulting income

tax expense reflects actual taxes paid or accrued during each

period. This presentation may be considered more indicative of our

ongoing operational performance. The table below presents the

differences between non-GAAP net (loss) income and net (loss)

income on an absolute and per-share basis. Non-GAAP financial

measures should not be considered in isolation from, or as a

substitute for, financial information presented in compliance with

GAAP, and the non-GAAP financial measures as reported by Smith

Micro may not be comparable to similarly titled amounts reported by

other companies.

Investor Conference Call

Smith Micro will hold an investor conference call today, August

11, 2022, at 4:30 p.m. ET, to discuss the Company’s second quarter

2022 financial results. To access the call, dial 1-844-701-1164;

international participants can call 1-412-317-5492. A passcode is

not required to join the call; ask the operator to be placed into

the Smith Micro conference. Participants are asked to call the

assigned number approximately 10 minutes before the conference call

begins. An internet webcast is available at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=Gxhhaskc.

In addition, the conference call will be available on the Smith

Micro website in the Investor Relations section.

About Smith Micro Software, Inc.

Smith Micro develops software to simplify and enhance the mobile

experience, providing solutions to some of the leading wireless

service providers and cable MSOs around the world. From enabling

the family digital lifestyle to providing powerful voice messaging

capabilities, our solutions enrich today’s connected lifestyles

while creating new opportunities to engage consumers via

smartphones and consumer IoT devices. The Smith Micro portfolio

also includes a wide range of products for creating, sharing, and

monetizing rich content, such as visual voice messaging, optimizing

retail content display and performing analytics on any product set.

For more information, visit www.smithmicro.com.

Smith Micro, the Smith Micro logo and SafePath are registered

trademarks or trademarks of Smith Micro Software, Inc. All other

trademarks and product names are the property of their respective

owners.

Forward-Looking Statements

Certain statements in this press release are, and certain

statements on the related conference call may be, forward-looking

statements regarding future events or results within the meaning of

the Private Securities Litigation Reform Act, including statements

related to our financial prospects and other projections of our

outlook or performance and our future business plans, and

statements using such words as “expect,” “anticipate,” “believe,”

“plan,” “intend,” “could,” “will” and other similar expressions.

Forward-looking statements involve risks and uncertainties, which

could cause actual results to differ materially from those

expressed or implied in the forward-looking statements. Among the

important factors that could cause or contribute to such

differences are customer concentration, given that the majority of

our sales depend on a few large customer relationships, delay or

failure of our customers to accept and deploy our products and

services or new or upgraded versions thereof, delay or failure of

our customers’ end users to adopt our products and services or new

or upgraded versions thereof, the impact of the COVID-19 pandemic

on our business and financial results, changes in demand for our

products from our customers and their end users, changes in

requirements for our products imposed by our customers or by the

third party providers of software and/or platforms that we use, our

ability to effectively integrate, market and sell acquired product

lines, new and changing technologies and customer acceptance and

timing of deployment of those technologies, our ability to compete

effectively with other software and technology companies, and the

existence and terms of our convertible notes and related

agreements, including that they may restrict our ability to obtain

additional financing, and adversely affect our business, financial

condition and cash flows from operations in the future. These and

other factors discussed in our filings with the Securities and

Exchange Commission, including our filings on Forms 10-K and 10-Q,

could cause actual results to differ materially from those

expressed or implied in any forward-looking statements. The

forward-looking statements contained in this release are made on

the basis of the views and assumptions of management, and we do not

undertake any obligation to update these statements to reflect

events or circumstances occurring after the date of this

release.

Smith Micro Software, Inc.

Consolidated Balance Sheets

(in thousands except share and par value

data)

June 30, 2022

December 31,

2021

(unaudited)

(audited)

Assets

Current assets:

Cash and cash equivalents

$

5,357

$

16,078

Accounts receivable, net of allowance for

doubtful accounts and other adjustments of $3 and $2 (2022 and

2021, respectively)

11,562

10,590

Prepaid expenses and other current

assets

2,514

1,988

Total current assets

19,433

28,656

Equipment and improvements, net

2,129

2,698

Right-of-use assets

4,291

4,866

Other assets

541

620

Intangible assets, net

39,410

42,631

Goodwill

35,041

35,041

Total assets

$

100,845

$

114,512

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

3,774

$

3,301

Accrued payroll and benefits

3,759

4,055

Current operating lease liabilities

1,400

1,400

Other accrued liabilities

1,227

612

Total current liabilities

10,160

9,368

Non-current liabilities:

Operating lease liabilities

3,640

4,467

Deferred tax liabilities, net

117

117

Total non-current liabilities

3,757

4,584

Commitments and contingencies

Stockholders' equity:

Common stock, par value $0.001 per share;

100,000,000 shares authorized; 55,121,767 and 54,259,390 shares

issued and outstanding (2022 and 2021, respectively)

55

54

Additional paid-in capital

354,641

352,779

Accumulated comprehensive deficit

(267,768

)

(252,273

)

Total stockholders’ equity

86,928

100,560

Total liabilities and stockholders'

equity

$

100,845

$

114,512

Smith Micro Software Inc.

Consolidated Statement of

Operations

(in thousands except share data)

For the Three Months Ended

June 30,

For the Six Months Ended

June 30,

2022

2021

2022

2021

Revenues

$

12,674

$

15,919

$

25,409

$

27,300

Cost of revenues

3,617

3,358

7,253

4,903

Gross profit

9,057

12,561

18,156

22,397

Operating expenses:

Selling and marketing

3,720

3,117

6,706

5,361

Research and development

8,213

7,063

15,615

11,936

General and administrative

4,026

4,946

8,073

8,604

Amortization of intangible assets

1,577

2,645

3,221

4,943

Total operating expenses

17,536

17,771

33,615

30,844

Operating loss

(8,479

)

(5,210

)

(15,459

)

(8,447

)

Other income (expense):

Interest income (expense), net

2

16

(2

)

24

Other income, net

15

5

15

9

Loss before provision for income taxes

(8,462

)

(5,189

)

(15,446

)

(8,414

)

Provision for income tax expense

31

14.00

50

14

Net loss

$

(8,493

)

$

(5,203

)

$

(15,496

)

$

(8,428

)

Loss per share:

Basic and diluted

$

(0.15

)

$

(0.10

)

$

(0.28

)

$

(0.17

)

Weighted average shares outstanding:

Basic and diluted

55,183

53,017

55,844

48,219

Smith Micro Software, Inc.

Consolidated Statements of Cash

Flows

(in thousands)

For the Three Months Ended

June 30,

For the Six Months Ended

June 30,

2022

2021

2022

2021

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Operating activities:

Net loss

$

(8,493

)

$

(5,203

)

$

(15,496

)

$

(8,428

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation and amortization

1,904

2,984

3,902

5,481

Non-cash lease expense

335

311

673

618

Provision for doubtful accounts

(5

)

—

—

(3

)

Provision for excess and obsolete

inventory

—

—

—

(97

)

Stock based compensation

1,688

1,279

2,754

2,295

Changes in operating accounts:

Accounts receivable

497

(378

)

(975

)

3,640

Prepaid expenses and other assets

(309

)

(606

)

(527

)

(225

)

Accounts payable and accrued

liabilities

(640

)

(428

)

(1,812

)

(1,077

)

Deferred revenue

(15

)

(163

)

(146

)

(708

)

Net cash (used in) provided by operating

activities

(5,038

)

(2,204

)

(11,627

)

1,496

Investing activities:

Acquisitions, net

—

(56,865

)

—

(56,865

)

Capital expenditures

(49

)

(146

)

(112

)

(336

)

Other investing activities

71

58

83

69

Net cash provided by (used in) investing

activities

22

(56,953

)

(29

)

(57,132

)

Financing activities:

Proceeds from common stock offering, net

of offering expenses

—

(187

)

—

59,711

Proceeds from exercise of common stock

warrants

—

—

—

40

Proceeds from financing arrangements

750

—

1,291

—

Repayments of financing arrangements

(210

)

—

(391

)

—

Other financing activities

2

33

35

67

Net cash provided by (used in) financing

activities

542

(154

)

935

59,818

Net (decrease) increase in cash and cash

equivalents

(4,474

)

(59,311

)

(10,721

)

4,182

Cash and cash equivalents, beginning of

period

$

9,831

$

89,247

$

16,078

$

25,754

Cash and cash equivalents, end of

period

$

5,357

$

29,936

$

5,357

$

29,936

Smith Micro Software, Inc.

Reconciliation of GAAP to Non-GAAP

Results

(in thousands, except per share data) -

unaudited

GAAP

Stock Compensation

Intangibles

Amortization

Personnel Severance and

Reorganization Activities

Acquisition Costs

Non-GAAP

Three Months Ended June 30,

2022

Gross profit

$

9,057

$

(1

)

$

—

$

—

$

—

$

9,057

Selling and marketing expenses

3,720

(73

)

—

(721

)

—

2,926

Research and development expenses

8,213

(268

)

—

—

—

7,945

General and administrative expenses

4,026

(767

)

—

—

—

3,259

Amortization of intangible assets

1,577

—

(1,577

)

—

—

—

Total operating expenses

17,536

(1,108

)

(1,577

)

(721

)

—

14,130

(Loss) income before provision for income

taxes

(8,462

)

1,109

1,577

721

—

(5,055

)

Net (loss) income

(8,493

)

1,109

1,577

721

—

(5,086

)

(Loss) earnings per share: basic and

diluted

(0.15

)

0.02

0.03

0.01

—

(0.09

)

Three Months Ended June 30,

2021

Gross profit

$

12,561

$

—

$

—

$

—

$

—

$

12,561

Selling and marketing expenses

3,117

(236

)

—

—

—

2,881

Research and development expenses

7,063

(241

)

—

—

—

6,822

General and administrative expenses

4,946

(802

)

—

—

(972

)

3,172

Amortization of intangible assets

2,645

—

(2,645

)

—

—

—

Total operating expenses

17,771

(1,279

)

(2,645

)

—

(972

)

12,875

—

(Loss) income before provision for income

taxes

(5,189

)

1,279

2,645

—

972

(293

)

Net (loss) income

(5,203

)

1,279

2,645

—

972

(307

)

(Loss) earnings per share: basic and

diluted

(0.10

)

0.02

0.05

—

0.02

(0.01

)

Note: (Loss) earnings per share: basic and

diluted - may be impacted by rounding to allow rows to

calculate.

Smith Micro Software, Inc.

Reconciliation of GAAP to Non-GAAP

Results

(in thousands, except per share data) -

unaudited

GAAP

Stock Compensation

Intangibles

Amortization

Personnel Severance and

Reorganization Activities

Acquisition Costs

Non-GAAP

Six Months Ended June 30, 2022

Gross profit

$

18,156

$

(1

)

$

—

$

—

$

—

$

18,155

Selling and marketing expenses

6,706

(157

)

—

(721

)

—

5,828

Research and development expenses

15,615

(529

)

—

—

—

15,086

General and administrative expenses

8,073

(1,488

)

—

—

—

6,585

Amortization of intangible assets

3,221

—

(3,221

)

—

—

—

Total operating expenses

33,615

(2,174

)

(3,221

)

(721

)

—

27,499

(Loss) income before provision for income

taxes

(15,446

)

2,175

3,221

721

—

(9,329

)

Net (loss) income

(15,496

)

2,175

3,221

721

—

(9,329

)

(Loss) earnings per share: basic and

diluted

(0.28

)

0.04

0.06

0.01

—

(0.17

)

Six Months Ended June 30, 2021

Gross profit

$

22,397

$

—

$

—

$

—

$

—

$

22,397

Selling and marketing expenses

5,361

(426

)

—

—

—

4,935

Research and development expenses

11,936

(434

)

—

—

—

11,502

General and administrative expenses

8,604

(1,435

)

—

—

(1,583

)

5,586

Amortization of intangible assets

4,943

—

(4,943

)

—

—

—

Total operating expenses

30,844

(2,295

)

(4,943

)

—

(1,583

)

22,023

—

(Loss) income before provision for income

taxes

(8,414

)

2,295

4,943

—

1,583

407

Net (loss) income

(8,428

)

2,295

4,943

—

1,583

393

(Loss) earnings per share: basic and

diluted

(0.17

)

0.04

0.09

—

0.03

0.01

Note: (Loss) earnings per share: basic and

diluted - may be impacted by rounding to allow rows to

calculate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005118/en/

IR INQUIRIES: Charles Messman Investor Relations

949-362-5800 IR@smithmicro.com

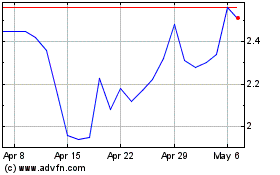

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Sep 2023 to Sep 2024