Eneti Inc. (NYSE: NETI) (“Eneti” or the “Company”), today reported

its results for the three months ended June 30, 2022.

The Company also announced that on August 3,

2022 its Board of Directors declared a quarterly cash dividend of

$0.01 per share on the Company’s common shares.

The Company’s results for the three and six

months ended June 30, 2022 include the impact of Seajacks

International Limited’s (“Seajacks”) earnings, which was acquired

on August 12, 2021. Since the completion of the acquisition, the

operations of the Company are primarily those of Seajacks as the

Company completed its exit from the dry bulk sector of the shipping

industry in July 2021.

Results for the Three and Six Months

Ended June 30, 2022 and 2021

- For the

second quarter of 2022, the Company’s GAAP net income was $52.7

million, or $1.36 per diluted share, including a gain of

approximately $28.3 million and cash dividend income of $0.2

million, or $0.73 per diluted share, from the Company’s equity

investment in Scorpio Tankers Inc. (NYSE: STNG).

- Total revenues for the second

quarter of 2022 were $61.3 million, compared to $37.7 million for

the same period in 2021. Second quarter 2022 revenues consisted

primarily of revenues generated by the Seajacks Scylla which was

continuing its transportation and installation services for an

offshore wind farm project in Taiwan, the Seajacks Zaratan which

commenced work on the Akita project, the performance of maintenance

on offshore gas production platforms in the North Sea by all three

of the NG2500Xs as well as the recognition claims made on projects

which were completed in 2021, and consultancy revenue.

- Vessel operating costs and project

costs were driven by increased fuel costs, as well as crewing and

catering due to higher utilization rates. Fuel and catering costs

are typically recharged to clients but reported gross in both

revenues and vessel operating costs.

- For the second quarter of 2021, the

Company’s GAAP net income was $13.0 million, or $1.19 per diluted

share, including (i) a gain on vessels sold of approximately $6.5

million, or $0.59 per diluted share, which was primarily the result

of an increase in the fair value of common shares of Star Bulk

Carriers Corp. (“Star Bulk”) (NASDAQ: SBLK) and Eagle Bulk Shipping

Inc. (“Eagle”) (NASDAQ: EGLE) received as a portion of the

compensation for the purchase of certain of our vessels; (ii) the

write-off of $3.3 million, or $0.30 per diluted share, of deferred

financing costs on repaid credit facilities related to certain

vessels that have been sold; and (iii) a gain of approximately

$13.0 million and cash dividend income of $0.2 million, or $1.21

per diluted share, from the Company’s equity investment in Scorpio

Tankers Inc. and the sale of the Eagle and Star Bulk shares

received as part of the consideration for the sales of vessels to

these counterparties.

- Earnings

before interest, taxes, depreciation and amortization (“EBITDA”)

for the second quarter of 2022 was $60.2 million and EBITDA for the

second quarter of 2021 was $19.7 million (see Non-GAAP Financial

Measures below).

- For the

first half of 2022, the Company’s GAAP net income was $56.9

million, or $1.46 per diluted share, including a gain of

approximately $46.8 million and cash dividend income of $0.4

million, or $1.22 per diluted share, from the Company’s equity

investment in Scorpio Tankers Inc.

- Total revenues for the first half

of 2022 were $83.7 million compared to $97.5 million for the

same period in 2021. First half 2022 revenues were generated by the

same projects as in the second quarter of 2022.

- For the first half of 2021, the

Company’s GAAP net income was $54.9 million, or $5.03 per diluted

share, including (i) a gain on vessels sold of approximately $22.0

million, or $2.01 per diluted share, which was primarily the result

of an increase in the fair value of common shares of Star Bulk and

Eagle received as a portion of the consideration for the sale of

certain of our vessels to Star Bulk and Eagle; (ii) the write-off

of $7.0 million, or $0.64 per diluted share, of deferred financing

costs on repaid credit facilities related to certain vessels that

have been sold; and (iii) a gain of approximately $28.8 million and

cash dividend income of $0.4 million, or $2.68 per diluted share,

from the Company’s equity investment in Scorpio Tankers Inc. and

the sale of the Eagle and Star Bulk shares received as a portion of

the consideration for the vessel sales to these

counterparties.

- EBITDA

for the first half of 2022 was $74.4 million and EBITDA for the

first half of 2021 was $71.7 million (see Non-GAAP Financial

Measures below).

Liquidity

As of July 29, 2022, the Company had

approximately $45.3 million of unrestricted cash and $14.5 million

of restricted cash. The Company also continues to hold

approximately 2.16 million common shares of Scorpio Tankers Inc.

(NYSE: STNG).

Newbuildings

The Company is currently under contract with

Daewoo Shipbuilding and Marine Engineering (“DSME”) for the

construction of two next-generation offshore wind turbine

installation vessels (“WTIV”). The aggregate contract price is

approximately $654.8 million, of which $65.4 million has been paid.

The vessels are expected to be delivered in the third quarter of

2024 and second quarter of 2025. The estimated future payment dates

and amounts are as follows (1) (dollars in thousands):

| |

DSME1 |

|

DSME2 |

|

Q3 2022 (2) |

$ |

— |

|

$ |

— |

| Q4 2022 |

|

33,036 |

|

|

— |

| Q1 2023 |

|

— |

|

|

— |

| Q2 2023 |

|

— |

|

|

— |

| Q3 2023 |

|

33,036 |

|

|

32,441 |

| Q4 2023 |

|

33,036 |

|

|

— |

| Q1 2024 |

|

— |

|

|

— |

| Q2 2024 |

|

— |

|

|

32,441 |

| Q3 2024 |

|

198,217 |

|

|

32,441 |

| Q4 2024 |

|

— |

|

|

— |

| Q1 2025 |

|

— |

|

|

— |

| Q2 2025 |

|

— |

|

|

194,644 |

| Total |

$ |

297,325 |

|

$ |

291,967 |

(1) These are estimates only and are subject to

change as construction progresses.(2) Relates to payments expected

to be made from August 4, 2022 to September 30, 2022.

Fleet

The Company has identified the NG 2500Xs as non-core assets and

is initiating a process through which it determines how to best

monetize these assets.

Debt Overview

The Company’s outstanding debt balances, gross

of unamortized deferred financing costs as of June 30, 2022

and July 29, 2022, are as follows (dollars in thousands):

| |

|

As of June 30, 2022 |

|

As of July 29, 2022 |

| Credit

Facility |

|

Amount Outstanding |

|

$175.0 Million Credit Facility |

|

$ |

71,875 |

|

$ |

71,875 |

| Total |

|

$ |

71,875 |

|

$ |

71,875 |

| |

|

|

|

|

|

|

$175.0 Million Credit Facility

In May 2022, the Company closed the previously

announced $175.0 Million Credit Facility and drew down the entire

$75.0 million term loan and approximately $30.0 million under the

revolving loans. The $30.0 million under the revolving loans was

subsequently repaid in June 2022.

Approximately $16.2 million of performance bonds

were issued under the letter of credits available under this

facility.

Simultaneous to the drawdown in May 2022, the

Company repaid the amounts outstanding under the $60.0 Million ING

Revolving Credit Facility and the $70.7 Million Redeemable

Notes.

$60.0 Million ING Revolving Credit Facility

In May 2022, the Company repaid the $25.0

million outstanding and cash collateralized the performance bonds

issued under this facility and terminated this facility.

$70.7 Million Redeemable Notes

In May 2022, the Company repaid the $53.0 million outstanding

and terminated this facility.

Performance Bonds

As of July 29, 2022, performance bonds were

issued on behalf of the Company for $16.2 million, under the $175.0

Million Credit Facility, and approximately $14.5 million, which was

cash collateralized.

Quarterly Cash Dividend

In the second quarter of 2022, the Company’s

Board of Directors declared, and the Company paid, a quarterly cash

dividend of $0.01 per share totaling approximately $0.4

million.

On August 3, 2022, the Company’s Board of

Directors declared a quarterly cash dividend of $0.01 per share,

payable on or about September 15, 2022, to all shareholders of

record as of August 19, 2022. As of August 3, 2022, 40,738,704

common shares were outstanding.

COVID-19

Since the beginning of the calendar year 2020,

the ongoing outbreak of the novel coronavirus (COVID-19) that

originated in China in December 2019 and that has spread to most

developed nations of the world has resulted in numerous actions

taken by governments and governmental agencies in an attempt to

mitigate the spread of the virus. These measures have resulted in a

significant reduction in global economic activity and extreme

volatility in the global financial and commodities markets.

Although by 2021, many of these measures were relaxed, we cannot

predict whether and to what degree emergency public health and

other measures will be reinstituted in the event of any resurgence

in the COVID-19 virus or any variants thereof. If the COVID-19

pandemic continues on a prolonged basis or becomes more severe, the

adverse impact on the global economy may continue and our

operations and cash flows may be negatively impacted. The COVID-19

outbreak continues to rapidly evolve, with periods of improvement

followed by periods of higher infection rates, along with the

development of new disease variants, such as the Delta and Omicron

variants, in various geographical areas throughout the world. As a

result, the extent to which COVID-19 will impact the Company’s

results of operations and financial condition will depend on future

developments, which are highly uncertain and cannot be

predicted.

Conflict in Ukraine

As a result of the conflict between Russia and

Ukraine which commenced in February 2022, the United States, the

European Union, and others have announced unprecedented levels of

sanctions and other measures against Russia and certain Russian

entities and nationals. The ongoing conflict has disrupted supply

chains and caused instability and significant volatility in the

global economy. Much uncertainty remains regarding the global

impact of the conflict in Ukraine and it is possible that such

instability, uncertainty and resulting volatility could

significantly increase our costs and adversely affect our business.

These uncertainties could also adversely affect our ability to

obtain additional financing or, if we are able to obtain additional

financing, to do so on terms favorable to us. We will continue to

monitor the situation to assess whether the conflict could have any

material impact on our operations or financial performance.

| |

Unaudited |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Revenue: |

|

|

|

|

|

|

|

|

Revenue |

$ |

61,282 |

|

|

$ |

37,651 |

|

|

$ |

83,720 |

|

|

$ |

97,480 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Voyage expenses |

|

— |

|

|

|

8,502 |

|

|

|

— |

|

|

|

14,582 |

|

|

Vessel operating and project costs |

|

18,800 |

|

|

|

8,240 |

|

|

|

36,852 |

|

|

|

23,850 |

|

|

Charterhire expense |

|

— |

|

|

|

17,366 |

|

|

|

— |

|

|

|

29,346 |

|

|

Vessel depreciation |

|

6,226 |

|

|

|

— |

|

|

|

12,460 |

|

|

|

— |

|

|

General and administrative expenses |

|

11,041 |

|

|

|

5,134 |

|

|

|

21,056 |

|

|

|

12,719 |

|

|

Gain on vessels sold |

|

— |

|

|

|

(6,452 |

) |

|

|

— |

|

|

|

(21,984 |

) |

| Total operating

expenses |

|

36,067 |

|

|

|

32,790 |

|

|

|

70,368 |

|

|

|

58,513 |

|

| Operating

income |

|

25,215 |

|

|

|

4,861 |

|

|

|

13,352 |

|

|

|

38,967 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest income |

|

12 |

|

|

|

31 |

|

|

|

11 |

|

|

|

39 |

|

|

Income from equity investments |

|

28,512 |

|

|

|

13,246 |

|

|

|

47,197 |

|

|

|

29,217 |

|

|

Foreign exchange (loss) income |

|

(1,931 |

) |

|

|

(68 |

) |

|

|

(2,321 |

) |

|

|

3 |

|

|

Financial expense, net |

|

(679 |

) |

|

|

(5,057 |

) |

|

|

(1,952 |

) |

|

|

(13,350 |

) |

| Total other income,

net |

|

25,914 |

|

|

|

8,152 |

|

|

|

42,935 |

|

|

|

15,909 |

|

| Income before income

tax provision |

|

51,129 |

|

|

|

13,013 |

|

|

|

56,287 |

|

|

|

54,876 |

|

|

Income tax benefit |

|

(1,599 |

) |

|

|

— |

|

|

|

(589 |

) |

|

|

— |

|

| Net

income |

$ |

52,728 |

|

|

$ |

13,013 |

|

|

$ |

56,876 |

|

|

$ |

54,876 |

|

| |

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.36 |

|

|

$ |

1.22 |

|

|

$ |

1.47 |

|

|

$ |

5.16 |

|

| Diluted |

$ |

1.36 |

|

|

$ |

1.19 |

|

|

$ |

1.46 |

|

|

$ |

5.03 |

|

| |

|

|

|

|

|

|

|

|

Basic weighted average number of common shares outstanding |

|

38,825 |

|

|

|

10,626 |

|

|

|

38,811 |

|

|

|

10,628 |

|

|

Diluted weighted average number of common shares outstanding |

|

38,844 |

|

|

|

10,921 |

|

|

|

38,827 |

|

|

|

10,907 |

|

| |

Unaudited |

| |

June 30, 2022 |

|

December 31, 2021 |

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

26,038 |

|

|

$ |

153,977 |

|

|

Restricted cash |

|

15,008 |

|

|

|

— |

|

|

Accounts receivable |

|

52,183 |

|

|

|

21,603 |

|

|

Inventories |

|

5,093 |

|

|

|

5,846 |

|

|

Prepaid expenses and other current assets |

|

5,798 |

|

|

|

4,769 |

|

|

Contract fulfillment costs |

|

8,505 |

|

|

|

3,835 |

|

| Total current assets |

|

112,625 |

|

|

|

190,030 |

|

| Non-current assets |

|

|

|

|

Vessels, net |

|

532,316 |

|

|

|

544,515 |

|

|

Vessels under construction |

|

71,629 |

|

|

|

36,054 |

|

|

Equity investments |

|

74,374 |

|

|

|

27,607 |

|

|

Intangible assets |

|

4,518 |

|

|

|

4,518 |

|

|

Other assets |

|

4,623 |

|

|

|

4,549 |

|

|

Total non-current assets |

|

687,460 |

|

|

|

617,243 |

|

| Total

assets |

$ |

800,085 |

|

|

$ |

807,273 |

|

| |

|

|

|

| Liabilities and shareholders’

equity |

|

|

|

| Current liabilities |

|

|

|

|

Bank loans, net |

$ |

11,975 |

|

|

$ |

87,650 |

|

|

Contract liabilities |

|

23,079 |

|

|

|

12,275 |

|

|

Corporate income tax payable |

|

1,300 |

|

|

|

4,058 |

|

|

Accounts payable and accrued expenses |

|

21,473 |

|

|

|

27,180 |

|

| Total current liabilities |

|

57,827 |

|

|

|

131,163 |

|

| Non-current liabilities |

|

|

|

|

Bank loans, net |

|

58,275 |

|

|

|

— |

|

|

Redeemable notes |

|

— |

|

|

|

53,015 |

|

|

Other liabilities |

|

3,849 |

|

|

|

2,751 |

|

| Total non-current

liabilities |

|

62,124 |

|

|

|

55,766 |

|

| Total liabilities |

|

119,951 |

|

|

|

186,929 |

|

| Shareholders’ equity |

|

|

|

|

Preferred shares, $0.01 par value per share; 50,000,000 shares

authorized; no shares issued or outstanding |

|

— |

|

|

|

— |

|

|

Common shares, $0.01 par value per share; authorized 81,875,000

shares as of June 30, 2022 and December 31, 2021; outstanding

40,738,704 shares and 39,741,204 shares as of June 30, 2022 and

December 31, 2021, respectively |

|

1,134 |

|

|

|

1,124 |

|

|

Paid-in capital |

|

2,060,862 |

|

|

|

2,057,958 |

|

|

Common shares held in treasury, at cost; 35,869 shares at June 30,

2022 and December 31, 2021 |

|

(717 |

) |

|

|

(717 |

) |

|

Accumulated deficit |

|

(1,381,145 |

) |

|

|

(1,438,021 |

) |

| Total shareholders’

equity |

|

680,134 |

|

|

|

620,344 |

|

| Total liabilities and

shareholders’ equity |

$ |

800,085 |

|

|

$ |

807,273 |

|

| |

Six Months Ended June 30, |

|

|

2022 |

|

2021 |

| Operating

activities |

|

|

|

|

Net income |

$ |

56,876 |

|

|

$ |

54,876 |

|

| Adjustment to

reconcile net income to net cash (used in) provided

by |

|

|

|

|

operating activities: |

|

|

|

|

Restricted share amortization |

|

3,713 |

|

|

|

3,526 |

|

|

Vessel depreciation |

|

12,460 |

|

|

|

— |

|

|

Amortization of deferred financing costs |

|

132 |

|

|

|

652 |

|

|

Write-off of deferred financing costs |

|

— |

|

|

|

7,028 |

|

|

Loss (gain) on asset disposal / vessels sold |

|

896 |

|

|

|

(19,598 |

) |

|

Net unrealized gains on investments |

|

(46,767 |

) |

|

|

(28,786 |

) |

|

Dividend income on equity investment |

|

(431 |

) |

|

|

(431 |

) |

|

Drydocking expenditure |

|

(504 |

) |

|

|

(3,443 |

) |

| Changes in operating

assets and liabilities: |

|

|

|

|

(Decrease) increase in accounts receivable |

|

(30,580 |

) |

|

|

8,614 |

|

|

Decrease in inventories |

|

753 |

|

|

|

— |

|

|

(Increase) decrease in prepaid expenses and other assets |

|

(4,687 |

) |

|

|

24,610 |

|

|

Increase (decrease) in accounts payable and accrued expenses |

|

6,195 |

|

|

|

(27,163 |

) |

|

Decrease in taxes payable |

|

(2,758 |

) |

|

|

— |

|

| Net cash (used in)

provided by operating activities |

|

(4,702 |

) |

|

|

19,885 |

|

| Investing

activities |

|

|

|

|

Sale of equity investment |

|

— |

|

|

|

63,377 |

|

|

Dividend income on equity investment |

|

431 |

|

|

|

431 |

|

|

Proceeds from sale of assets held for sale |

|

— |

|

|

|

482,039 |

|

|

Payments on vessels under construction |

|

(35,836 |

) |

|

|

(9,311 |

) |

| Net cash (used in)

provided by investing activities |

|

(35,405 |

) |

|

|

536,536 |

|

| Financing

activities |

|

|

|

|

Proceeds from issuance of long-term debt |

|

130,000 |

|

|

|

— |

|

|

Repayments of long-term debt |

|

(198,790 |

) |

|

|

(367,105 |

) |

|

Common shares repurchased |

|

— |

|

|

|

(1,407 |

) |

|

Debt issuance costs paid |

|

(3,235 |

) |

|

|

— |

|

|

Dividends paid |

|

(799 |

) |

|

|

(1,124 |

) |

| Net cash used in

financing activities |

|

(72,824 |

) |

|

|

(369,636 |

) |

| (Decrease) increase in cash

and cash equivalents |

|

(112,931 |

) |

|

|

186,785 |

|

| Cash and cash equivalents,

beginning of period |

|

153,977 |

|

|

|

84,002 |

|

| Cash and cash

equivalents and restricted cash, end of period |

$ |

41,046 |

|

|

$ |

270,787 |

|

Conference Call on Results:

A conference call to discuss the Company’s

results will be held at 11:00 AM Eastern Daylight Time / 5:00 PM

Central European Summer Time on August 3, 2022. Those wishing to

listen to the call should dial 1 (877) 513-1694 (U.S.) or 1 (412)

902-4269 (International) at least 10 minutes prior to the start of

the call to ensure connection. The conference participant passcode

is 10169504. The information provided on the teleconference is only

accurate at the time of the conference call, and the Company will

take no responsibility for providing updated information.

There will also be a simultaneous live webcast over the

internet, through the Eneti Inc. website www.eneti-inc.com.

Participants to the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

Webcast URL: https://edge.media-server.com/mmc/p/tbt2xx5p

About Eneti Inc.

Eneti Inc. is a leading provider of installation

and maintenance vessels to the offshore wind sector and has

invested in the next generation of wind turbine installation

vessels. The Company is listed on the New York Stock Exchange under

the ticker symbol NETI. Additional information about the Company is

available on the Company’s website: www.eneti-inc.com, which is not

a part of this press release.

Non-GAAP Financial Measures

To supplement the Company’s financial

information presented in accordance with accounting principles

generally accepted in the U.S. (“GAAP”) management uses certain

“non-GAAP financial measures” as such term is defined in Regulation

G promulgated by the U.S. Securities and Exchange Commission (the

“SEC”). Generally, a non-GAAP financial measure is a numerical

measure of a company’s operating performance, financial position or

cash flows that excludes or includes amounts that are included in,

or excluded from, the most directly comparable measure calculated

and presented in accordance with GAAP. Management believes the

presentation of these measures provides investors with greater

transparency and supplemental data relating to the Company’s

financial condition and results of operations, and therefore a more

complete understanding of factors affecting its business than GAAP

measures alone. In addition, management believes the

presentation of these matters is useful to investors for

period-to-period comparison of results as the items may reflect

certain unique and/or non-operating items such as asset sales,

write-offs, contract termination costs or items outside of

management’s control.

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) is a non-GAAP financial measure that

the Company believes provide investors with a means of evaluating

and understanding how the Company’s management evaluates the

Company’s operating performance. This non-GAAP financial measure

should not be considered in isolation from, as substitutes for, nor

superior to financial measures prepared in accordance with GAAP.

Please see below for reconciliation of EBITDA.

EBITDA (unaudited)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| In thousands |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Net income |

|

52,728 |

|

|

13,013 |

|

$ |

56,876 |

|

|

$ |

54,876 |

| Add Back: |

|

|

|

|

|

|

|

|

Net interest expense |

|

535 |

|

|

1,574 |

|

|

1,809 |

|

|

|

5,630 |

|

Depreciation and amortization (1) |

|

8,523 |

|

|

5,087 |

|

|

16,305 |

|

|

|

11,206 |

|

Income tax benefit |

|

(1,599 |

) |

|

— |

|

|

(589 |

) |

|

|

— |

| EBITDA |

$ |

60,187 |

|

|

19,674 |

|

$ |

74,401 |

|

|

$ |

71,712 |

(1) Includes depreciation, amortization of deferred financing

costs and restricted share amortization.

Forward-Looking

Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The Company desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words “believe,” “anticipate,” “intend,” “estimate,” “forecast,”

“project,” “plan,” “potential,” “may,” “should,” “expect,”

“pending” and similar expressions identify forward-looking

statements. We undertake no obligation, and specifically decline

any obligation, except as required by law, to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, our management’s examination of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include the failure of counterparties to fully perform

their contracts with us, the strength of world economies and

currencies, general market conditions, including fluctuations in

charter rates and asset values, changes in demand for Wind Turbine

Installation Vessel (“WTIV”) capacity, the length and severity of

the ongoing novel coronavirus (COVID-19) outbreak, including its

effects on demand for WTIVs and the installation of offshore

windfarms, changes in our operating expenses, including fuel costs,

drydocking and insurance costs, the market for our WTIVs,

availability of financing and refinancing, counterparty

performance, ability to obtain financing and the availability of

capital resources (including for capital expenditures) and comply

with covenants in such financing arrangements, planned capital

expenditures, our ability to successfully identify, consummate,

integrate and realize the expected benefits from acquisitions and

changes to our business strategy, fluctuations in the value of our

investments, changes in governmental rules and regulations or

actions taken by regulatory authorities, potential liability from

pending or future litigation, general domestic and international

political conditions, potential disruption due to accidents or

political events, vessel breakdowns and instances of off-hires and

other factors.

Please see our filings with the Securities and Exchange

Commission for a more complete discussion of these and other risks

and uncertainties.

Contact Information:

Eneti Inc.James Doyle – Head of Corporate

Development & Investor RelationsTel: +1 646-432-1678Email:

Investor.Relations@Eneti-inc.com https://www.eneti-inc.com

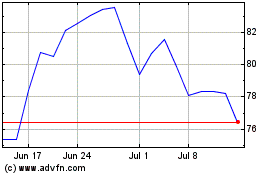

Scorpio Tankers (NYSE:STNG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Scorpio Tankers (NYSE:STNG)

Historical Stock Chart

From Sep 2023 to Sep 2024