Ultralife Corporation (NASDAQ: ULBI) reported GAAP EPS of $0.13,

Adjusted EPS of $0.17 and operating income of $1.2 million on

revenue of $29.0 million for the fourth quarter ended December 31,

2020 compared to GAAP EPS of $0.10, Adjusted EPS of $0.13 and

operating income of $2.5 million on revenue of $31.0 million for

the fourth quarter of 2019.

For fiscal 2020, Ultralife produced GAAP EPS of

$0.33, Adjusted EPS of $0.41 and operating income of $5.7 million

on revenue of $107.7 million compared to GAAP EPS of $0.32,

Adjusted EPS of $0.40 and operating income of $7.4 million on

revenue of $106.8 million for 2019. In addition, during 2020, the

Company reduced the debt related to its May 2019 acquisition of

Southwest Electronic Energy Corporation by $15.8 million, or 91.5%,

to $1.5 million as of December 31, 2020 while increasing its

year-end cash-on-hand by $3.2 million, or 43.9%, to $10.7

million.

“Fourth quarter operating results were in line

with our internal expectations and reflect the continuing negative

economic impact of the global pandemic, including oil & gas

market sluggishness. Battery & Energy Products medical sales

were up 94% and government/defense sales were up 19%, yet these

were offset by reductions in oil & gas and Communications

Systems sales. During the quarter, we also recognized a $1.6

million gain upon resolution of Ultralife’s claim in a class action

lawsuit,” said Michael D. Popielec, President and Chief Executive

Officer.

“Notwithstanding the unprecedented challenges we

faced during 2020, results for the year demonstrate the resiliency

of our business model, the efficacy of our end-market

diversification strategy and the strength of our balance sheet. We

grew total year sales to the highest level in nine years, sustained

profitability, generated operating cash flow and repaid nearly all

of the SWE acquisition-related debt,” added Popielec. “While the

outlook for demand in our end markets is less visible than we would

like, we will remain focused on what we can control: organic growth

initiatives, including completing transformational new product

development projects and investments in strategic capital

expenditure, and synergistic acquisitions.”

Fourth Quarter 2020 Financial Results

Revenue was $29.0 million, a decrease of $2.0

million or 6.6%, compared to $31.0 million for the fourth quarter

of 2019, as a 25.7% increase in core battery sales across

diversified end markets was offset by lower oil & gas market

and Communications Systems sales. Battery & Energy

Products revenues increased 0.7% to $25.3 million, compared to

$25.1 million last year, as a 94.3% increase in medical battery

sales, especially those used in ventilators, respirators and

infusion pumps, and an 18.8% increase in government/defense sales,

were offset by a 67.4% decline in oil & gas market sales.

Communications Systems sales decreased 37.6% to $3.7 million

compared to $5.9 million for the same period last year, primarily

reflecting 2019 shipments of vehicle amplifier-adaptor systems to

support the U.S. Army’s Network Modernization initiatives under the

delivery orders announced in October 2018. These orders were

completed in the second quarter of 2020. The net adverse impact of

COVID-19 on revenues for the 2020 fourth quarter was approximately

$2.6 million as a substantial increase in demand for medical

batteries was more than offset primarily by weakened demand in the

oil & gas and international industrial markets.

Gross profit was $7.4 million, or 25.4% of

revenue, compared to $9.4 million, or 30.2% of revenue, for the

same quarter a year ago. Battery & Energy Products’

gross margin was 25.2%, compared to 26.4% last year, primarily

reflecting lower volume for oil & gas market batteries.

Communications Systems gross margin was 26.3% compared to 46.1%

last year, due to sales mix and lower volume in 2020.

Operating expenses were $6.1 million compared to

$6.9 million last year, a reduction of 10.9%.

Operating expenses were 21.2% of revenue compared to 22.2% for the

year-earlier period.

Operating income was $1.2 million compared to

$2.5 million last year, and operating margin was 4.2% compared to

8.0% last year. The net adverse impact of COVID-19 on

operating income for the 2020 fourth quarter was approximately $1.2

million.

Other income of $1.6 million compared to other

expense of $0.3 million last year, primarily reflecting a $1.6

million gain realized during the fourth quarter upon favorable

resolution of Ultralife’s claim in a class action lawsuit.

Net income was $2.1 million or $0.13 per diluted

share on a GAAP basis using the U.S. statutory tax rate, compared

to net income of $1.6 million, or $0.10 per diluted share for the

fourth quarter of 2019. Adjusted EPS was $0.17 on a diluted basis

for the fourth quarter of 2020, compared to $0.13 for the 2019

period. Adjusted EPS excludes the provision for deferred taxes of

$0.6 million which primarily represents non-cash charges for U.S.

taxes which we expect will be fully offset by net operating loss

carryforwards and other tax credits for the foreseeable future. The

net adverse impact of COVID-19 on Adjusted EPS for the 2020 fourth

quarter was approximately $0.07.

Adjusted EBITDA, defined as EBITDA including

non-cash, stock-based compensation expense and excluding the $1.6

million gain on the class action settlement, for the fourth quarter

was $2.2 million or 7.6% of sales and for the 2020 trailing

twelve-month period was $9.7 million or 9.0% of sales.

See the “Non-GAAP Financial Measures” section of

this release for a reconciliation of Adjusted EPS to EPS and

Adjusted EBITDA to Net Income Attributable to Ultralife

Corporation.

About Ultralife Corporation

Ultralife Corporation serves its markets with products and

services ranging from power solutions to communications and

electronics systems. Through its engineering and collaborative

approach to problem solving, Ultralife serves government, defense

and commercial customers across the globe.

Headquartered in Newark, New York, the Company's business

segments include Battery & Energy Products and Communications

Systems. Ultralife has operations in North America, Europe and

Asia. For more information, visit www.ultralifecorporation.com.

Conference Call Information

Ultralife will hold its fourth quarter earnings conference call

today at 8:30 AM ET. To participate in the live call, please dial

(800) 915-4836 at least ten minutes before the scheduled start

time, identify yourself and ask for the Ultralife call. A live

webcast of the conference call will be available to investors in

the Events & Presentations section of the Company's website at

http://investor.ultralifecorporation.com. For those who cannot

listen to the live broadcast, a replay of the webcast will be

available shortly after the call at the same location.

This press release may contain forward-looking statements based

on current expectations that involve a number of risks and

uncertainties. The potential risks and uncertainties that could

cause actual results to differ materially include the impact of

COVID-19, potential reductions in revenues from key customers,

acceptance of our new products on a global basis and uncertain

global economic conditions. The Company cautions investors not to

place undue reliance on forward-looking statements, which reflect

the Company's analysis only as of today's date. The Company

undertakes no obligation to publicly update forward-looking

statements to reflect subsequent events or circumstances. Further

information on these factors and other factors that could affect

Ultralife’s financial results is included in Ultralife’s Securities

and Exchange Commission (SEC) filings, including the latest Annual

Report on Form 10-K.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS(Dollars in

Thousands) |

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

December 31, 2020 |

|

December 31,2019 |

|

| Current

Assets: |

|

|

|

|

|

Cash |

$ |

10,653 |

|

|

$ |

7,405 |

|

|

|

Trade Accounts Receivable, Net |

|

21,054 |

|

|

|

30,106 |

|

|

|

Inventories, Net |

|

28,193 |

|

|

|

29,759 |

|

|

|

Prepaid Expenses and Other Current Assets |

|

4,596 |

|

|

|

3,103 |

|

|

|

Total Current Assets |

|

64,496 |

|

|

|

70,373 |

|

|

| |

|

|

|

|

| Property,

Equipment and Improvements, Net |

|

22,850 |

|

|

|

22,525 |

|

|

| Goodwill |

|

27,018 |

|

|

|

26,753 |

|

|

| Other Intangible

Assets, Net |

|

9,209 |

|

|

|

9,721 |

|

|

| Deferred Income

Taxes, Net |

|

11,836 |

|

|

|

13,222 |

|

|

| Other Non-Current

Assets |

|

2,292 |

|

|

|

1,963 |

|

|

|

Total Assets |

$ |

137,701 |

|

|

$ |

144,557 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current Liabilities: |

|

|

|

|

|

|

Accounts Payable |

$ |

10,839 |

|

|

$ |

9,388 |

|

|

|

Current Portion of Long-Term Debt, Net |

|

1,361 |

|

|

|

1,372 |

|

|

|

Accrued Compensation and Related Benefits |

|

1,748 |

|

|

|

1,655 |

|

|

|

Accrued Expenses and Other Current Liabilities |

|

4,758 |

|

|

|

4,775 |

|

|

|

Total Current Liabilities |

|

18,706 |

|

|

|

17,190 |

|

|

| Long-Term

Debt |

|

- |

|

|

|

15,780 |

|

|

| Deferred Income

Taxes |

|

515 |

|

|

|

559 |

|

|

| Other Non-Current

Liabilities |

|

1,557 |

|

|

|

1,278 |

|

|

|

Total Liabilities |

|

20,778 |

|

|

|

34,807 |

|

|

| |

|

|

|

|

| Shareholders'

Equity: |

|

|

|

|

|

Common Stock |

|

2,037 |

|

|

|

2,026 |

|

|

|

Capital in Excess of Par Value |

|

185,464 |

|

|

|

184,292 |

|

|

|

Accumulated Deficit |

|

(47,598 |

) |

|

|

(52,830 |

) |

|

|

Accumulated Other Comprehensive Loss |

|

(1,782 |

) |

|

|

(2,531 |

) |

|

|

Treasury Stock |

|

(21,321 |

) |

|

|

(21,231 |

) |

|

|

Total Ultralife Equity |

|

116,800 |

|

|

|

109,726 |

|

|

| Non-Controlling

Interest |

|

123 |

|

|

|

24 |

|

|

|

Total Shareholders’ Equity |

|

116,923 |

|

|

|

109,750 |

|

|

| |

|

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

137,701 |

|

|

$ |

144,557 |

|

|

|

ULTRALIFE CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

(In Thousands Except Per Share Amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three-Month Period Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

2020 |

|

|

|

2019 |

|

|

2020 |

|

|

|

2019 |

|

Revenues: |

|

|

|

|

|

|

|

|

Battery & Energy Products |

$ |

25,291 |

|

|

$ |

25,120 |

|

$ |

91,907 |

|

|

$ |

83,996 |

|

Communications Systems |

|

3,685 |

|

|

|

5,903 |

|

|

15,805 |

|

|

|

22,799 |

|

Total Revenues |

|

28,976 |

|

|

|

31,023 |

|

|

107,712 |

|

|

|

106,795 |

| |

|

|

|

|

|

|

|

| Cost of Products

Sold: |

|

|

|

|

|

|

|

|

Battery & Energy Products |

|

18,910 |

|

|

|

18,489 |

|

|

68,507 |

|

|

|

61,183 |

|

Communications Systems |

|

2,715 |

|

|

|

3,179 |

|

|

10,046 |

|

|

|

14,447 |

|

Total Cost of Products Sold |

|

21,625 |

|

|

|

21,668 |

|

|

78,553 |

|

|

|

75,630 |

| |

|

|

|

|

|

|

|

|

Gross Profit |

|

7,351 |

|

|

|

9,355 |

|

|

29,159 |

|

|

|

31,165 |

| |

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

Research and Development |

|

1,518 |

|

|

|

2,153 |

|

|

5,947 |

|

|

|

6,805 |

|

Selling, General and Administrative |

|

4,618 |

|

|

|

4,730 |

|

|

17,511 |

|

|

|

16,992 |

|

Total Operating Expenses |

|

6,136 |

|

|

|

6,883 |

|

|

23,458 |

|

|

|

23,797 |

| |

|

|

|

|

|

|

|

| Operating

Income |

|

1,215 |

|

|

|

2,472 |

|

|

5,701 |

|

|

|

7,368 |

| |

|

|

|

|

|

|

|

| Other (Income)

Expense: |

|

|

|

|

|

|

|

| Gain on Litigation

Settlement |

|

(1,593 |

) |

|

|

- |

|

|

(1,593 |

) |

|

|

- |

| Other Expense, Net |

|

9 |

|

|

|

296 |

|

|

271 |

|

|

|

597 |

|

Total Other (Income) Expense |

|

(1,584 |

) |

|

|

296 |

|

|

(1,322 |

) |

|

|

597 |

| |

|

|

|

|

|

|

|

| Income Before Income

Taxes |

|

2,799 |

|

|

|

2,176 |

|

|

7,023 |

|

|

|

6,771 |

| Income Tax Provision |

|

682 |

|

|

|

515 |

|

|

1,692 |

|

|

|

1,457 |

| |

|

|

|

|

|

|

|

| Net

Income |

|

2,117 |

|

|

|

1,661 |

|

|

5,331 |

|

|

|

5,314 |

| |

|

|

|

|

|

|

|

| Net Income Attributable to

Non-Controlling Interest |

|

9 |

|

|

|

35 |

|

|

99 |

|

|

|

109 |

| |

|

|

|

|

|

|

|

| Net Income

Attributable to Ultralife Corporation |

$ |

2,108 |

|

|

$ |

1,626 |

|

$ |

5,232 |

|

|

$ |

5,205 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net Income Per Share

Attributable to Ultralife Common Shareholders – Basic |

$ |

.13 |

|

|

$ |

.10 |

|

$ |

.33 |

|

|

$ |

.33 |

| |

|

|

|

|

|

|

|

| Net Income Per Share

Attributable to Ultralife Common Shareholders –

Diluted |

$ |

.13 |

|

|

$ |

.10 |

|

$ |

.33 |

|

|

$ |

.32 |

| |

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding – Basic |

|

15,940 |

|

|

|

15,861 |

|

|

15,902 |

|

|

|

15,783 |

| |

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding – Diluted |

|

16,122 |

|

|

|

16,205 |

|

|

16,096 |

|

|

|

16,179 |

Non-GAAP Financial Measures:

Adjusted Earnings Per Share

In evaluating our business, we consider and use

Adjusted EPS, a non-GAAP financial measure, as a supplemental

measure of our business performance in addition to GAAP financial

measures. We define Adjusted EPS as net income attributable to

Ultralife Corporation excluding the provision for deferred taxes

divided by our weighted average shares outstanding on both a basic

and diluted basis. We believe that this information is useful in

providing period-to-period comparisons of our results by reflecting

the portion of our tax provision that we expect will be offset by

our U.S. net operating loss carryforwards and other tax credits for

the foreseeable future. We reconcile Adjusted EPS to EPS, the most

comparable financial measure under GAAP. Neither current nor

potential investors in our securities should rely on Adjusted EPS

as a substitute for any GAAP measures and we encourage investors to

review the following reconciliation of Adjusted EPS to EPS and net

income attributable to Ultralife Corporation.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES |

|

CALCULATION OF ADJUSTED EPS |

|

(In Thousands Except Per Share Amounts) |

|

(Unaudited) |

| |

Three-Month Period Ended |

| |

December 31, 2020 |

|

December 31, 2019 |

| |

Amount |

|

Per Basic Share |

|

Per Diluted Share |

|

Amount |

|

Per Basic Share |

|

Per Diluted Share |

| Net Income Attributable to

Ultralife Corporation |

$2,108 |

|

$.13 |

|

$.13 |

|

$1,626 |

|

$.10 |

|

$.10 |

| Deferred Tax Provision |

565 |

|

.04 |

|

.04 |

|

|

410 |

|

.03 |

|

.03 |

| Adjusted Net Income |

$2,673 |

|

$.17 |

|

$.17 |

|

$2,036 |

|

$.13 |

|

$.13 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Shares

Outstanding |

|

|

15,940 |

|

16,122 |

|

|

|

15,861 |

|

16,205 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Year Ended |

| |

December 31, 2020 |

|

December 31, 2019 |

| |

Amount |

|

Per Basic Share |

|

Per Diluted Share |

|

Amount |

|

Per Basic Share |

|

Per Diluted Share |

| Net Income Attributable to

Ultralife Corporation |

$5,232 |

|

$.33 |

|

$.33 |

|

$5,205 |

|

$.33 |

|

$.32 |

| Deferred Tax Provision |

|

1,386 |

|

.09 |

|

.08 |

|

|

1,211 |

|

.08 |

|

.08 |

| Adjusted Net Income |

$6,618 |

|

$.42 |

|

$.41 |

|

$6,416 |

|

$.41 |

|

$.40 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Shares

Outstanding |

|

|

15,902 |

|

16,096 |

|

|

|

15,783 |

|

16,179 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

In evaluating our business, we consider and use Adjusted EBITDA,

a non-GAAP financial measure, as a supplemental measure of our

operating performance in addition to GAAP financial measures. We

define Adjusted EBITDA as net income attributable to Ultralife

Corporation before net interest expense, provision (benefit) for

income taxes, depreciation and amortization, and stock-based

compensation expense, plus/minus expense/income that we do not

consider reflective of our ongoing continuing operations. We

reconcile Adjusted EBITDA to net income attributable to Ultralife

Corporation, the most comparable financial measure under GAAP.

Neither current nor potential investors in our securities should

rely on Adjusted EBITDA as a substitute for any GAAP measures and

we encourage investors to review the following reconciliation of

Adjusted EBITDA to net income attributable to Ultralife

Corporation.

|

ULTRALIFE CORPORATION AND SUBSIDIARIES |

|

CALCULATION OF ADJUSTED EBITDA |

|

(Dollars in Thousands) |

|

(Unaudited) |

|

|

Three-Month Period Ended |

|

Year Ended |

|

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

|

|

|

|

|

|

|

|

| Net Income Attributable to

Ultralife Corporation |

$ |

2,108 |

|

|

$ |

1,626 |

|

$ |

5,232 |

|

|

$ |

5,205 |

| Adjustments: |

|

|

|

|

|

|

|

|

Interest and Financing Expense, Net |

|

64 |

|

|

|

200 |

|

|

436 |

|

|

|

539 |

|

Income Tax Provision |

|

682 |

|

|

|

515 |

|

|

1,692 |

|

|

|

1,457 |

|

Depreciation Expense |

|

597 |

|

|

|

672 |

|

|

2,340 |

|

|

|

2,220 |

|

Amortization of Intangible Assets and Financing Fees |

|

166 |

|

|

|

165 |

|

|

646 |

|

|

|

569 |

|

Stock-Based Compensation Expense |

|

187 |

|

|

|

235 |

|

|

943 |

|

|

|

753 |

|

Gain on Litigation Settlement |

|

(1,593 |

) |

|

|

- |

|

|

(1,593 |

) |

|

|

- |

|

Non-Cash Purchase Accounting Adjustments |

|

- |

|

|

|

- |

|

|

- |

|

|

|

264 |

| Adjusted EBITDA |

$ |

2,211 |

|

|

$ |

3,413 |

|

$ |

9,696 |

|

|

$ |

11,007 |

| Company

Contact: |

|

Investor

Relations Contact: |

| Ultralife Corporation |

|

LHA |

| Philip A.

Fain |

|

Jody

Burfening |

| (315)

210-6110 |

|

(212)

838-3777 |

| pfain@ulbi.com |

|

jburfening@lhai.com |

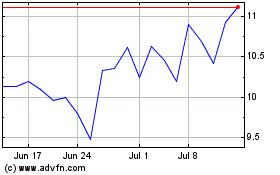

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

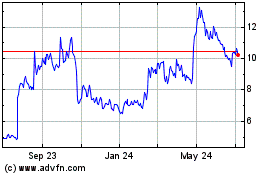

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Apr 2023 to Apr 2024