Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 17 2020 - 8:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2020

Commission File Number: 001-36515

Materialise NV

Technologielaan 15

3001

Leuven

Belgium

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

At the request of Ailanthus NV (a company fully owned by Wilfried Vancraen and Hilde Ingelaere, hereafter

“Ailanthus”), of Wilfried Vancraen and of Hilde Ingelaere, the board of directors of Materialise NV (“Materialise” or the “Company”) has filed with the court registrar in Belgium a proposal to merge Ailanthus into

Materialise. The merger proposal was reviewed by the audit committee and approved by the board of directors of Materialise, with Hilde Ingelaere, Wilfried Vancraen and Sander Vancraen not participating in the deliberations. The closing of the

merger is subject to the Belgian tax authorities providing a positive ruling on the tax neutrality of the transaction, which is expected to be received before year end 2020. The merger is also subject to approval by an extraordinary

shareholders’ meeting of Materialise, which is expected to take place in the last week of December 2020.

At the time of the merger, Ailanthus will

have no assets or liabilities other than 13,428,688 ordinary shares of Materialise. Upon consummation of the merger, Wilfried Vancraen and Hilde Ingelaere will receive, in their capacity of shareholders of Ailanthus, 13,428,688 new ordinary shares

of Materialise (with the same rights and obligations as the other outstanding shares of Materialise). Immediately following the merger, Materialise will annul the 13,428,688 Materialise shares that it will have acquired in the merger. As a result,

the same amount of Materialise shares will be outstanding after the merger as before the transaction. Also, no other changes will be made to the organizational documents of Materialise in connection with the merger and all existing ordinary shares

of Materialise (other than the shares formerly held by Ailanthus that will be annulled by Materialise) will remain outstanding with the same rights that currently apply.

This transaction constitutes part of the restructuring of the family assets held by the family Vancraen-Ingelaere. Wilfried Vancraen and Hilde Ingelaere have

issued explicit directions that the proposed transaction should be neutral for Materialise and its shareholders, and have agreed to compensate the Company for any adverse effects (including reimbursement of all expenses incurred in connection with

the transaction).

Later this month, at the time of the convocation of the extraordinary shareholders’ meeting to approve the transaction, the board

of directors will provide more detailed information about the proposed merger.

Attached as Exhibit 2.1 hereto is an unofficial English translation of the

proposal for the merger that was filed with the court registrar in Belgium.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

MATERIALISE NV

|

|

By:

|

|

/s/ Wilfried Vancraen

|

|

Name:

|

|

Wilfried Vancraen

|

|

Title:

|

|

Chief Executive Officer

|

Date: November 17, 2020

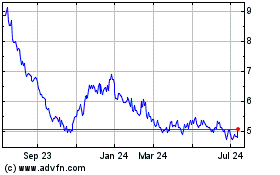

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Aug 2024 to Sep 2024

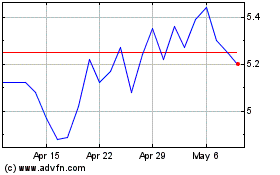

Materialise NV (NASDAQ:MTLS)

Historical Stock Chart

From Sep 2023 to Sep 2024