ConocoPhillips to Buy Concho Resources in $9.7 Billion All-Stock Transaction

October 19 2020 - 7:58AM

Dow Jones News

By Dave Sebastian

ConocoPhillips is buying Concho Resources Inc. in an all-stock

transaction valued at $9.7 billion, at a time when the American

shale-drilling industry is facing a downturn after a historic crash

in oil prices amid the Covid-19 pandemic.

ConocoPhillips said the transaction would improve its

competitive position in the Midland basin.

The companies said each share of Concho Resources will be

exchanged for 1.46 shares of ConocoPhillips stock, reflecting a 15%

premium over closing share prices on Oct. 13, when Bloomberg News

reported on the impending deal.

The acquisition combines a resource base of about 23 billion

barrels of oil equivalent with less than $40 a barrel West Texas

Intermediate cost of supply and an average cost of supply below $30

a barrel WTI, the companies said.

The companies said they would have $500 million in annual cost

and capital savings by 2022. The transaction is expected to close

in the first quarter of 2021.

Concho Chairman and Chief Executive Tim Leach will join

ConocoPhillips' board and leadership team.

Shares of Concho, which closed at $48.60 Friday, rose 11.1% in

premarket trading. Shares of ConocoPhillips, which closed at $33.77

Friday, rose 0.5% in premarket trading.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 19, 2020 07:43 ET (11:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

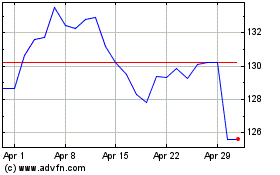

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2024 to May 2024

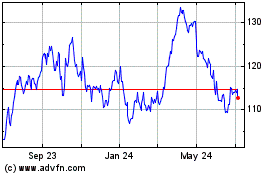

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From May 2023 to May 2024