Charles Schwab's 2Q Profit Falls

July 16 2020 - 9:43AM

Dow Jones News

By Dave Sebastian

Charles Schwab Corp. said its profit for the second quarter fell

as net interest revenue declined due to the Federal Reserve's

monetary easing in March and compression in asset returns.

The company posted net income of $671 million, or 48 cents a

share, compared with $937 million, or 66 cents a share, in the

year-ago period. Adjusted earnings were 54 cents a share.

Analysts polled by FactSet were expecting earnings of 53 cents a

share, or 54 cents on an adjusted basis. The company said the

quarter's results include certain acquisition and

integration-related costs.

Revenue was $2.45 billion, down 8.6% from the year-ago period.

Analysts were expecting $2.48 billion.

Net interest revenue fell to $1.39 billion from $1.61

billion.

"During the second quarter, we remained intent on maintaining an

all-weather balance sheet with healthy liquidity and capital

levels," Finance Chief Peter Crawford said. "The sharp

pandemic-driven increase in client sweep deposits during the first

quarter was followed by more modest balance sheet expansion over

the past three months."

Expenses, not including interest, rose 8.1% to $1.56

billion.

Total client assets rose 11% to $4.11 trillion as of June 30,

driven by renewed strength in equity valuations, Chief Executive

Walt Bettinger said.

The company last month said the U.S. Justice Department's

antitrust division closed its investigation of Schwab's proposed

acquisition of TD Ameritrade Holding Corp., clearing the path for

the $26 billion combination that would cement Schwab's role as a

dominant player in the discount-brokerage market.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

July 16, 2020 09:28 ET (13:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

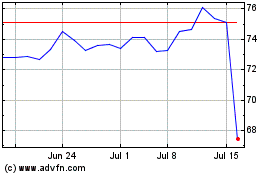

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

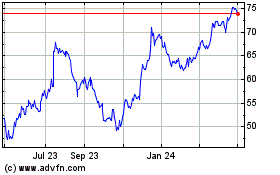

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024