|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Merger Agreement

On September 15, 2019, Energy Transfer LP, a Delaware limited partnership (“ET”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Nautilus Merger Sub LLC, a Delaware limited liability company and a newly formed, wholly owned subsidiary of ET (“Merger Sub”), and SemGroup Corporation, a Delaware corporation (“SemGroup”). Upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into SemGroup (the “Merger”), with SemGroup continuing as the surviving entity and a subsidiary of ET. On September 15, 2019, the board of directors of ET’s general partner, and the board of directors of SemGroup unanimously approved the Merger Agreement.

At the effective time of the Merger (the “Effective Time”), each share of Class A Common Stock, par value $0.01 per share, of SemGroup (such shares, collectively, the “SemGroup Common Stock” and each, a “Share”) issued and outstanding as of immediately prior to the Effective Time will be converted into the right to receive the following merger consideration: (i) $6.80 in cash, without interest (the “Per Share Cash Amount”), and (ii) 0.7275 (the “Exchange Ratio”) common units representing limited partner interests in ET (the “ET Common Units” and such consideration collectively, the “Merger Consideration”). In accordance with that certain Certificate of Designations of Series A Cumulative Perpetual Convertible Preferred Stock of SemGroup Corporation, filed with the Secretary of State of the State of Delaware on January 19, 2018 (the “Certificate of Designations”), each share of Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share, of SemGroup (the “SemGroup Preferred Stock”) that is issued and outstanding as of immediately prior to the Effective Time will, at the election of the holders of a majority of such shares, either (i) convert into Shares immediately prior to the Effective Time and receive the Merger Consideration, (ii) be exchanged for a “Substantially Equivalent Security” (as defined in the Certificate of Designations) or (iii) be redeemed by SemGroup for cash at a price per share equal to 101% of the Liquidation Preference (as defined in the Certificate of Designations).

Each award of restricted share units, restricted shares and performance share units of SemGroup will be treated as follows:

|

|

•

|

each award of restricted share units, vested or unvested (other than those held by non-employee directors of SemGroup) (each, a “SemGroup RSU Award”), that is outstanding immediately prior to the Effective Time will be assumed by ET and converted into a restricted unit award to receive a number of ET Common Units equal to the number of Shares subject to such SemGroup RSU Award immediately prior to the Effective Time multiplied by a ratio equal to the Per Share Cash Amount divided by the closing price of one ET Common Unit on the New York Stock Exchange (the “NYSE”) on the day prior to the closing date plus the Exchange Ratio (such ratio, the “Equity Exchange Ratio”), rounded up or down to the nearest whole Common Unit;

|

|

|

•

|

each restricted stock award (other than those held by non-employee directors of SemGroup) (each, a “SemGroup Assumed Restricted Stock Award”) will be assumed by ET and converted into a restricted stock award with respect to a number of ET Common Units equal to the product obtained by multiplying (x) the number of Shares subject to such SemGroup Assumed Restricted Stock Award immediately prior to the Effective Time by (y) the Equity Exchange Ratio, rounded up or down to the nearest whole Common Unit;

|

|

|

•

|

each award of performance share units that corresponds to Shares (each, a “SemGroup PSU Award”), that is outstanding and vested as of the Effective Time, will be cancelled in exchange for the payment of the Merger Consideration with respect to the number of Shares equal to the total number of Shares with respect to which such SemGroup PSU Award has vested prior to the Effective Time, and each SemGroup PSU Award that is outstanding and unvested as of the Effective Time shall automatically, and without any required action of the holder thereof, be cancelled without consideration; and

|

|

|

•

|

each restricted stock and restricted share units that is outstanding immediately prior to the Effective Time that is held by a non-employee director of SemGroup (each, a “Director Restricted Share Award”) will, as of the Effective Time, become fully vested and will be cancelled in exchange for the payment of the Merger Consideration with respect to the total number of Shares subject to such Director Restricted Share Award.

|

SemGroup has agreed, subject to certain exceptions with respect to unsolicited proposals, not to directly or indirectly solicit competing acquisition proposals or to enter into discussions concerning, or provide confidential information in connection with, any unsolicited alternative acquisition proposals. However, if SemGroup receives an unsolicited, written and bona fide acquisition proposal that did not result from a material breach of the non-solicitation provisions of the Merger Agreement and that SemGroup’s board of directors, or any committee thereof, concludes in good faith, after consultation with its financial advisors and outside legal counsel, that such unsolicited, written and bona fide acquisition proposal constitutes, or could reasonably be expected to result in, a superior offer, SemGroup may furnish non-public information regarding SemGroup or any of its subsidiaries to any person and engage in discussions and negotiations with any person in response to an unsolicited, written and bona fide acquisition proposal; provided that SemGroup provides notice and furnishes any non-public information provided to the maker of the acquisition proposal to ET substantially concurrently with providing such non-public information to the maker of the acquisition proposal.

The completion of the Merger is subject to the satisfaction or waiver of customary closing conditions, including: (i) adoption of the Merger Agreement by holders of a majority of the outstanding shares of SemGroup Common Stock and SemGroup Preferred Stock (on an as-converted basis), voting as a single class, entitled to vote thereon, (ii) absence of any court order or regulatory injunction prohibiting completion of the Merger, (iii) expiration or termination of review under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (iv) effectiveness of ET’s registration statement on Form S-4 to register the ET Common Units to be issued in the Merger, (v) subject to specified materiality standards, the accuracy of the representations and warranties of the other party, (vi) the authorization for listing of ET Common Units to be issued in the Merger on the NYSE, and (vii) compliance by the other party in all material respects with its covenants.

ET and SemGroup have made customary representations and warranties in the Merger Agreement. The Merger Agreement also contains customary covenants and agreements, including covenants and agreements relating to (i) the conduct of each of ET’s and SemGroup’s business between the date of the signing of the Merger Agreement and the closing date of the Merger and (ii) the efforts of the parties to cause the Merger to be completed, including actions which may be necessary to cause the expiration or termination of the waiting period under the HSR Act. Pursuant to the terms of the Merger Agreement, ET must take any and all steps necessary to obtain antitrust clearance in order to facilitate closing of the Merger, including by agreeing to divest assets, modify contracts or restrict operations, in each case in order to obtain any approvals, consents, clearances, expirations or terminations of waiting periods, registrations, permits, authorizations or other confirmations or to avoid the commencement of any action to prohibit the Merger, or to avoid the entry of, or to effect the dissolution of, any injunction, temporary restraining order or other order in any action or proceeding seeking to prohibit the Merger or delay the Closing beyond June 30, 2020 (or, if the HSR clearance has not yet been received, September 30, 2020).

The Merger Agreement contains certain termination rights for ET and SemGroup. The Merger Agreement further provides that, upon termination of the Merger Agreement under certain circumstances, SemGroup may be required to reimburse ET’s expenses up to $27.25 million or pay ET a termination fee equal to $54.5 million.

The Merger Agreement is attached hereto as Exhibit 2.1 and is incorporated by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Merger Agreement and is qualified in its entirety by the terms and conditions of the Merger Agreement. It is not intended to provide any other factual information about ET, SemGroup or their respective subsidiaries and affiliates. The Merger Agreement contains representations and warranties by each of the parties to the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specified dates. The representations, warranties and covenants in the Merger Agreement were made solely for the benefit of the parties to the Merger Agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of ET, SemGroup or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in ET’s or SemGroup’s public disclosures.

Support Agreement

Contemporaneously with the execution of the Merger Agreement, ET, Merger Sub, SemGroup and WP SemGroup Holdco, LLC, a holder of approximately 85.72% of the issued and outstanding shares of SemGroup Preferred Stock (the “Stockholder”), entered into a support agreement (the “Support Agreement”). Pursuant to the Support Agreement, the Stockholder agreed to, among other things, vote all of its shares in SemGroup that it owns as of the record date for the SemGroup stockholder meeting (i) in favor of the adoption of the Merger Agreement, (ii) against any acquisition proposal, and (iii) against any action, agreement, transaction or proposal that is intended, would reasonably be expected or the result of which would reasonably be expected, to materially impede, interfere with, delay, postpone, discourage, frustrate the purposes of or adversely affect the Merger or the other transactions contemplated by the Merger Agreement. In addition, the Stockholder and the Company agreed to amend the Certificate of Designations related to the Company Preferred Stock to provide for the redemption in cash of all of the shares of Company Preferred Stock in connection with the closing of the Merger at a price of 101% of the Liquidation Preference (as defined in the Certificate of Designations), and the Stockholder has agreed to make an election to have the shares of Company Preferred Stock redeemed at such price.

The Support Agreement is attached hereto as Exhibit 10.1 and is incorporated into this Item 1.01 by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Support Agreement and is qualified in its entirety by the terms and conditions of the Support Agreement. It is not intended to provide any other factual information about the parties or their respective subsidiaries and affiliates. The Support Agreement contains representations and warranties by each of the parties to the Support Agreement, which were made only for purposes of the Support Agreement and as of a specified date. The representations, warranties and covenants in the Support Agreement were made solely for the benefit of the parties to the Support Agreement; may be subject to limitations agreed upon by the contracting parties; and may be subject to standards of

materiality, applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Support Agreement, which subsequent information may or may not be fully reflected in ET’s or SemGroup’s public disclosures.

Cautionary Statement Regarding Forward-Looking Statements

This report includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. ET and SemGroup cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and stockholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achieve revenue, DCF and EBITDA growth, and volatility in the price of oil, natural gas, and natural gas liquids. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by ET and SemGroup with the U.S. Securities Exchange Commission (the “SEC”), which are available to the public. ET and SemGroup undertake no obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other documents filed by ET and SemGroup with the SEC, may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus by phone, e-mail or written request by contacting the investor relations department of ET or SemGroup at the numbers and addresses set forth below:

|

|

|

|

|

Energy Transfer LP

8111 Westchester Drive, Suite 600

Dallas, Texas 75225

Attention: Investor Relations

Phone: (214) 981-0795

Email: InvestorRelations@energytransfer.com

|

|

SemGroup Corporation

6120 South Yale Avenue Suite 1500

Tulsa, OK 74136

Attention: Investor Relations

Phone: (918) 524-8100

Email: investor.relations@semgroup.com

|

Participants in the Solicitation

ET, SemGroup and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed Merger. Information regarding the directors and executive officers of ET is contained in ET’s Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 22, 2019. Information regarding the directors and executive

officers of SemGroup is contained in SemGroup’s proxy statement relating to its 2019 Annual Meeting of Stockholders, which was filed with the SEC on April 12, 2019. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed merger will be included in the proxy statement/prospectus.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

2.1*

|

|

|

Agreement and Plan of Merger, dated as of September 15, 2019, by and among Energy Transfer LP, Nautilus Merger Sub LLC and SemGroup Corporation

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Support Agreement, dated as of September 15, 2019, by and among Energy Transfer LP, Nautilus Merger Sub LLC, SemGroup Corporation and WP SemGroup Holdco, LLC

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

*

|

Schedules and exhibits to this Exhibit omitted pursuant to Regulation S-K Item 601(b)(2). ET agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY TRANSFER LP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

LE GP, LLC,

|

|

|

|

|

|

|

|

its general partner.

|

|

|

|

|

|

|

|

|

|

Date: September 16, 2019

|

|

|

|

By:

|

|

/s/ Thomas E. Long

|

|

|

|

|

|

Name:

|

|

Thomas E. Long

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

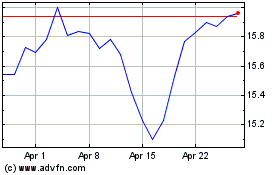

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Apr 2023 to Apr 2024