Integer Holdings Corporation (NYSE:ITGR), a leading medical device

outsource manufacturer, today announced results for the three and

six months ended June 28, 2019.

Second Quarter 2019 Highlights (compared to Second

Quarter 2018)

- GAAP and Non-GAAP sales from continuing operations were $314

million, flat with prior year.

- GAAP income from continuing operations increased $5 million to

$28 million, an increase of 22%. Non-GAAP adjusted income

from continuing operations increased $6 million to $41 million, an

increase of 17%.

- Adjusted EBITDA from continuing operations increased $4 million

to $75 million, an increase of 6%.

- GAAP diluted EPS from continuing operations increased $0.15 per

share to $0.85 per share, an increase of 21%. Non-GAAP

adjusted diluted EPS from continuing operations increased $0.17 per

share to $1.23 per share, an increase of 16%.

- Paid down $50 million of debt, reducing total outstanding debt

to $863 million, achieving a leverage ratio of 3.1x adjusted

EBITDA.

Revised 2019 Full Year Financial Guidance

- Increased adjusted EBITDA guidance to a range of $277 million

to $285 million.

- Increased GAAP diluted EPS guidance to a range of $2.89 to

$3.09. Increased non-GAAP adjusted diluted EPS guidance to a range

of $4.25 to $4.45.

“Integer delivered strong profit growth in the second quarter,

on flat revenue which was in line with our expectations,” said

Joseph Dziedzic, Integer’s president and chief executive officer.

“Strong cash flow generation enabled continued debt leverage

reduction to 3.1 times adjusted EBITDA. We continue to

execute our operational strategy and have increased our full year

profit outlook,” Mr. Dziedzic continued.

Discussion of Product Line Second Quarter 2019 Sales

(compared to Second Quarter 2018)

- Cardio & Vascular sales increased 1% with strong peripheral

vascular and structural heart growth, offset by the expected impact

of an electrophysiology program maturing life cycle and a supplier

quality related delay.

- Cardiac & Neuromodulation sales decreased 1% due to

difficult prior year comparables and lower growth in

Neuromodulation.

- Advanced Surgical, Orthopedics & Portable Medical includes

sales to the acquirer of our AS&O product line, Viant, under

supply agreements entered into as part of the divestiture. GAAP

sales declined 6%, and non-GAAP sales declined 2% as portable

medical growth is offset by a decline in advanced surgical and

orthopedics products.

- Electrochem sales increased 11% due to energy market demand and

increased customer market penetration.

2019 Outlook(a)(dollars in millions, except per

share amounts)

| |

|

GAAP |

|

Non-GAAP(b) |

|

Continuing Operations: |

|

As Reported |

|

Growth |

|

Adjusted |

|

Growth |

| Sales |

|

$1,265 to $1,280 |

|

4% to 5% |

|

$1,265 to $1,280 |

|

4% to 6% |

| Income |

|

$95 to $102 |

|

102% to 117% |

|

$140 to $147 |

|

13% to 18% |

| EBITDA |

|

N/A |

|

N/A |

|

$277 to $285 |

|

7% to 10% |

| Earnings per Diluted

Share |

|

$2.89 to $3.09 |

|

101% to 115% |

|

$4.25 to $4.45 |

|

12% to 17% |

(a) Except as described below, further

reconciliations by line item to the closest corresponding GAAP

financial measure for Adjusted Sales, Adjusted Income, Adjusted

EBITDA, and Adjusted Earnings per Diluted Share (“EPS”), all from

continuing operations, included in our “2019 Outlook” above, are

not available without unreasonable efforts on a forward-looking

basis due to the high variability, complexity and visibility of the

charges excluded from these non-GAAP financial measures.

(b) Adjusted Income and diluted EPS, both from

continuing operations, for 2019 are expected to consist of GAAP

income from continuing operations and diluted EPS from continuing

operations, excluding items such as intangible amortization,

IP-related litigation costs, consolidation and realignment costs,

asset dispositions, severance and loss on extinguishment of debt

totaling approximately $57 million, pre-tax. The after-tax impact

of these items is estimated to be approximately $45 million, or

approximately $1.36 per diluted share.Adjusted EBITDA from

continuing operations is expected to consist of Adjusted income

from continuing operations, excluding items such as depreciation,

interest, stock-based compensation and taxes totaling approximately

$138 million.

Summary of Financial and Product Line Results from

Continuing Operations

| (dollars in thousands, except

per share data) |

Three Months Ended |

| GAAP |

June 28, 2019 |

|

June 29, 2018 |

|

Change |

|

OrganicGrowth(a) |

| Medical Sales |

|

|

|

|

|

|

|

|

Cardio & Vascular |

$ |

150,397 |

|

|

$ |

148,766 |

|

|

1.1 |

% |

|

1.6 |

% |

|

Cardiac & Neuromodulation |

114,488 |

|

|

115,941 |

|

|

(1.3 |

)% |

|

(1.3 |

)% |

|

Advanced Surgical, Orthopedics & Portable Medical |

32,646 |

|

|

34,751 |

|

|

(6.1 |

)% |

|

(2.3 |

)% |

|

Total Medical Sales |

297,531 |

|

|

299,458 |

|

|

(0.6 |

)% |

|

— |

% |

| Non-Medical Sales |

16,663 |

|

|

15,006 |

|

|

11.0 |

% |

|

11.0 |

% |

|

Total Sales |

$ |

314,194 |

|

|

$ |

314,464 |

|

|

(0.1 |

)% |

|

0.6 |

% |

| |

|

|

|

|

|

|

|

| Income from continuing

operations |

$ |

28,222 |

|

|

$ |

23,056 |

|

|

22.4 |

% |

|

|

| Diluted EPS from continuing

operations |

$ |

0.85 |

|

|

$ |

0.70 |

|

|

21.4 |

% |

|

|

| |

|

|

|

|

|

|

|

| |

Six Months Ended |

| GAAP |

June 28, 2019 |

|

June 29, 2018 |

|

Change |

|

OrganicGrowth(a) |

| Medical Sales |

|

|

|

|

|

|

|

|

Cardio & Vascular |

$ |

302,971 |

|

|

$ |

285,629 |

|

|

6.1 |

% |

|

6.6 |

% |

|

Cardiac & Neuromodulation |

231,399 |

|

|

224,851 |

|

|

2.9 |

% |

|

2.9 |

% |

|

Advanced Surgical, Orthopedics & Portable Medical |

64,234 |

|

|

68,692 |

|

|

(6.5 |

)% |

|

(3.6 |

)% |

|

Total Medical Sales |

598,604 |

|

|

579,172 |

|

|

3.4 |

% |

|

4.0 |

% |

| Non-Medical Sales |

30,266 |

|

|

27,718 |

|

|

9.2 |

% |

|

9.2 |

% |

|

Total Sales |

$ |

628,870 |

|

|

$ |

606,890 |

|

|

3.6 |

% |

|

4.2 |

% |

| |

|

|

|

|

|

|

|

| Income from continuing

operations |

$ |

49,588 |

|

|

$ |

36,140 |

|

|

37.2 |

% |

|

|

| Diluted EPS from continuing

operations |

$ |

1.50 |

|

|

$ |

1.11 |

|

|

35.1 |

% |

|

|

(a) Organic Growth for sales is a Non-GAAP

measure, which excludes foreign currency exchange impact reported

in other income, net and is primarily non-cash and includes the

impact of the long-term supply agreements (“LSAs”) entered into

between the Company and Viant as of the closing of the divestiture

of the AS&O product line. These LSAs govern the sale of

products supplied by Viant to the Company for further resale to

customers and by the Company to Viant for further resale to

customers. Refer to Table C at the end of this release for a

reconciliation of these amounts.

| |

Three Months Ended |

|

Non-GAAP(a) |

June 28, 2019 |

|

June 29, 2018 |

|

Change |

|

OrganicGrowth(b) |

|

Adjusted EBITDA from continuing operations |

$ |

75,393 |

|

|

$ |

71,354 |

|

|

5.7 |

% |

|

8.6 |

% |

| Adjusted income from

continuing operations |

$ |

40,632 |

|

|

$ |

34,744 |

|

|

16.9 |

% |

|

22.4 |

% |

| Adjusted diluted EPS from

continuing operations |

$ |

1.23 |

|

|

$ |

1.06 |

|

|

16.0 |

% |

|

21.8 |

% |

| |

|

|

|

|

|

|

|

| |

Six Months Ended |

|

Non-GAAP(a) |

June 28, 2019 |

|

June 29, 2018 |

|

YTDChange |

|

OrganicGrowth(b) |

| Adjusted EBITDA from

continuing operations |

$ |

141,053 |

|

|

$ |

125,301 |

|

|

12.6 |

% |

|

13.3 |

% |

| Adjusted income from

continuing operations |

$ |

73,472 |

|

|

$ |

55,163 |

|

|

33.2 |

% |

|

34.6 |

% |

| Adjusted diluted EPS from

continuing operations |

$ |

2.23 |

|

|

$ |

1.69 |

|

|

32.0 |

% |

|

32.7 |

% |

(a) Refer to Tables A and B at the end of this

release for reconciliations of adjusted amounts to the closest

corresponding GAAP financial measures.

(b) Organic Growth for Adjusted EBITDA from

continuing operations, Adjusted income from continuing operations,

and Adjusted diluted EPS from continuing operations are Non-GAAP

measures, which exclude the foreign currency exchange impact

reported in other income, net and is primarily non-cash.

Refer to Table D at the end of this release for a reconciliation of

these amounts.

Conference Call InformationThe

Company will host a conference call on Thursday, August 1, 2019, at

9:00 a.m. ET / 8:00 a.m. CT to discuss these results. The

scheduled conference call will be webcast live and is accessible

through our website at investor.integer.net or by dialing

(833) 236-5762 (U.S.) or (647) 689-4190 (outside U.S.) and the

conference ID is 8118977. The call will be archived on the

Company’s website. An earnings call slide presentation

containing supplemental information about the Company’s results

will be posted to our website at investor.integer.net prior to the

conference call and will be referenced during the conference

call.

About Integer™Integer Holdings

Corporation (NYSE: ITGR) is one of the largest medical device

outsource (MDO) manufacturers in the world serving the cardiac,

neuromodulation, vascular, portable medical and orthopedics

markets. The Company provides innovative, high-quality medical

technologies that enhance the lives of patients worldwide. In

addition, it develops batteries for high-end niche applications in

energy, military, and environmental markets. The Company's brands

include GreatbatchTM Medical, Lake Region MedicalTM and

ElectrochemTM. Additional information is available

at www.integer.net.

Contact InformationTony

BorowiczSVP, Strategy, Business Development & Investor

Relations716.759.5809tony.borowicz@integer.net

Notes Regarding Non-GAAP Financial

InformationIn addition to our results reported in

accordance with generally accepted accounting principles (“GAAP”),

we provide adjusted sales, adjusted income, adjusted earnings per

diluted share, earnings before interest, taxes, depreciation and

amortization (“EBITDA”), adjusted EBITDA, adjusted EBITDA margin,

and organic growth rates, all from continuing operations.

Adjusted income and adjusted earnings per diluted share from

continuing operations consist of GAAP amounts adjusted for the

following to the extent occurring during the period: (i)

acquisition and integration related charges and expenses, (ii)

amortization of intangible assets, (iii) facility consolidation,

optimization, manufacturing transfer and system integration

charges, (iv) asset write-down and disposition charges, (v) charges

in connection with corporate realignments or a reduction in force,

(vi) certain legal expenses, charges and gains, (vii) unusual or

infrequently occurring items, (viii) gain (loss) on equity

investments, (ix) extinguishment of debt charges, (x) the net

impact of the LSAs entered into as of the closing of the

divestiture of the AS&O product line, (xi) the income tax

(benefit) related to these adjustments and (xii) certain tax items

that are outside the normal provision for the period.

Adjusted earnings per diluted share from continuing operations are

calculated by dividing adjusted income from continuing operations

by diluted weighted average shares outstanding. EBITDA from

continuing operations is calculated by adding back interest

expense, GAAP provision (benefit) for income taxes, depreciation

and amortization expense, to income from continuing operations,

which is the most directly comparable GAAP measure. Adjusted

EBITDA from continuing operations consists of EBITDA from

continuing operations plus GAAP stock-based compensation and the

same adjustments as listed above except for items (ii), (ix), (xi)

and (xii).

Adjusted EBITDA margin is adjusted EBITDA as a

percentage of adjusted sales, all from continuing operations.

To calculate organic sales growth rates, we convert current period

sales from local currency to U.S. dollars using the previous

period’s foreign currency exchange rates and exclude the amount of

sales acquired/divested during the period from the current/previous

period amounts, respectively. Adjusted sales from continuing

operations consist of GAAP sales adjusted for item (x) above.

Organic growth rates for Adjusted EBITDA from continuing

operations, Adjusted income from continuing operations and Adjusted

Diluted EPS from continuing operations exclude the impact of

foreign currency exchange gains and losses included in other

(income) loss, net. We believe that the presentation of adjusted

sales, adjusted income, adjusted diluted earnings per share,

EBITDA, adjusted EBITDA, adjusted EBITDA margin, and organic growth

rates, all from continuing operations, provides important

supplemental information to management and investors seeking to

understand the financial and business trends relating to our

financial condition and results of operations.

Forward-Looking StatementsSome

of the statements contained in this press release and other written

and oral statements made from time to time by us and our

representatives are not statements of historical or current fact.

As such, they are “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as

amended. We have based these forward-looking statements on our

current expectations, and these statements are subject to known and

unknown risks, uncertainties and assumptions. Forward-looking

statements include statements relating to:

- future sales, expenses, and profitability;

- future development and expected growth of our business and

industry;

- our ability to execute our business model and our business

strategy;

- our ability to identify trends within our industries and to

offer products and services that meet the changing needs of those

markets;

- our ability to remain in compliance with our debt covenants;

and

- projected capital expenditures.

You can identify forward-looking statements by

terminology such as “may,” “will,” “should,” “could,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or “variations” or the

negative of these terms or other comparable terminology. These

statements are only predictions. Actual events or results may

differ materially from those stated or implied by these

forward-looking statements. In evaluating these statements and our

prospects, you should carefully consider the factors set forth

below. All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these cautionary factors and to others contained throughout this

release.

Although it is not possible to create a

comprehensive list of all factors that may cause actual results to

differ from the results expressed or implied by our forward-looking

statements or that may affect our future results, some of these

factors include the following: our indebtedness, our inability to

pay principal and interest on this outstanding indebtedness or to

remain in compliance with financial and other covenants under our

senior secured credit facilities, and the risk that this

indebtedness limits our ability to invest in our business and

overall financial flexibility; our dependence upon a limited number

of customers; customer ordering patterns; product obsolescence; our

inability to market current or future products; pricing pressure

from customers; our ability to timely and successfully implement

cost reduction and plant consolidation initiatives; our reliance on

third-party suppliers for raw materials, products and

subcomponents; fluctuating operating results; our inability to

maintain high quality standards for our products; challenges to our

intellectual property rights; product liability claims; product

field actions or recalls; our inability to successfully consummate

and integrate acquisitions and to realize synergies and benefits

from these acquisitions and to operate these acquired businesses in

accordance with expectations; our unsuccessful expansion into new

markets; our failure to develop new products including system and

device products; the timing, progress and ultimate success of

pending regulatory actions and approvals; our inability to obtain

licenses to key technology; regulatory changes, including health

care reform, or consolidation in the healthcare industry; global

economic factors including foreign currency exchange rates and

interest rates; the resolution of various legal actions brought

against the Company; enactment related and ongoing impacts related

to the Tax Reform Act, including the GILTI tax; and other risks and

uncertainties that arise from time to time and are described in

Item 1A “Risk Factors” of our Annual Report on Form 10-K and

in our other periodic filings with the SEC. Except as may be

required by law, we assume no obligation to update forward-looking

statements in this press release whether to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results, financial conditions or prospects, or

otherwise.

| Condensed

Consolidated Statements of Operations - Unaudited |

|

|

|

|

| (in thousands except per share

data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2019 |

|

June 29, 2018 |

|

June 28, 2019 |

|

June 29, 2018 |

|

Sales |

$ |

314,194 |

|

|

$ |

314,464 |

|

|

$ |

628,870 |

|

|

$ |

606,890 |

|

| Cost of sales |

217,210 |

|

|

215,699 |

|

|

443,276 |

|

|

424,593 |

|

|

Gross profit |

96,984 |

|

|

98,765 |

|

|

185,594 |

|

|

182,297 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses (SG&A) |

33,143 |

|

|

36,780 |

|

|

68,099 |

|

|

73,209 |

|

|

Research, development and engineering costs (RD&E) |

11,396 |

|

|

12,935 |

|

|

22,991 |

|

|

26,211 |

|

|

Other operating expenses (OOE) |

3,108 |

|

|

4,692 |

|

|

5,998 |

|

|

8,476 |

|

|

Total operating expenses |

47,647 |

|

|

54,407 |

|

|

97,088 |

|

|

107,896 |

|

|

Operating income |

49,337 |

|

|

44,358 |

|

|

88,506 |

|

|

74,401 |

|

| Interest expense |

13,612 |

|

|

15,234 |

|

|

27,442 |

|

|

30,829 |

|

| (Gain) loss on equity

investments, net |

1,611 |

|

|

(284 |

) |

|

1,652 |

|

|

(5,254 |

) |

| Other income, net |

(718 |

) |

|

(2,387 |

) |

|

(552 |

) |

|

(1,427 |

) |

| Income from continuing

operations before taxes |

34,832 |

|

|

31,795 |

|

|

59,964 |

|

|

50,253 |

|

| Provision for income

taxes |

6,610 |

|

|

8,739 |

|

|

10,376 |

|

|

14,113 |

|

|

Income from continuing operations |

$ |

28,222 |

|

|

$ |

23,056 |

|

|

$ |

49,588 |

|

|

$ |

36,140 |

|

|

|

|

|

|

|

|

|

|

| Discontinued operations: |

|

|

|

|

|

|

|

| Income (loss) from

discontinued operations before taxes |

4,930 |

|

|

(1,374 |

) |

|

5,316 |

|

|

(7,623 |

) |

| Provision for income

taxes |

95 |

|

|

1,660 |

|

|

178 |

|

|

377 |

|

|

Income (loss) from discontinued operations |

$ |

4,835 |

|

|

$ |

(3,034 |

) |

|

$ |

5,138 |

|

|

$ |

(8,000 |

) |

| |

|

|

|

|

|

|

|

| Net income |

$ |

33,057 |

|

|

$ |

20,022 |

|

|

$ |

54,726 |

|

|

$ |

28,140 |

|

| |

|

|

|

|

|

|

|

| Basic earnings (loss) per

share: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

0.87 |

|

|

$ |

0.72 |

|

|

$ |

1.52 |

|

|

$ |

1.13 |

|

|

Income (loss) from discontinued operations |

$ |

0.15 |

|

|

$ |

(0.09 |

) |

|

$ |

0.16 |

|

|

$ |

(0.25 |

) |

|

Basic earnings per share |

$ |

1.01 |

|

|

$ |

0.62 |

|

|

$ |

1.68 |

|

|

$ |

0.88 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings (loss) per

share: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

0.85 |

|

|

$ |

0.70 |

|

|

$ |

1.50 |

|

|

$ |

1.11 |

|

|

Income (loss) from discontinued operations |

$ |

0.15 |

|

|

$ |

(0.09 |

) |

|

$ |

0.16 |

|

|

$ |

(0.25 |

) |

|

Diluted earnings per share |

$ |

1.00 |

|

|

$ |

0.61 |

|

|

$ |

1.66 |

|

|

$ |

0.86 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

32,621 |

|

|

32,038 |

|

|

32,579 |

|

|

31,970 |

|

|

Diluted |

33,009 |

|

|

32,720 |

|

|

32,995 |

|

|

32,572 |

|

| Condensed

Consolidated Balance Sheets - Unaudited |

| (in

thousands) |

| |

|

| |

June 28, 2019 |

|

December 28,2018 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

15,922 |

|

|

$ |

25,569 |

|

|

Accounts receivable, net |

217,732 |

|

|

185,501 |

|

|

Inventories |

187,154 |

|

|

190,076 |

|

|

Prepaid expenses and other current assets |

24,978 |

|

|

15,104 |

|

|

Total current assets |

445,786 |

|

|

416,250 |

|

| Property, plant and equipment,

net |

229,209 |

|

|

231,269 |

|

| Goodwill |

831,368 |

|

|

832,338 |

|

| Other intangible assets,

net |

791,472 |

|

|

812,338 |

|

| Deferred income taxes |

4,099 |

|

|

3,937 |

|

| Operating lease assets |

44,793 |

|

|

— |

|

| Other long-term assets |

26,926 |

|

|

30,549 |

|

|

Total assets |

$ |

2,373,653 |

|

|

$ |

2,326,681 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current portion of long-term debt |

$ |

37,500 |

|

|

$ |

37,500 |

|

|

Accounts payable |

73,120 |

|

|

57,187 |

|

|

Income taxes payable |

12,034 |

|

|

9,393 |

|

|

Accrued expenses and other current liabilities |

61,288 |

|

|

60,490 |

|

|

Total current liabilities |

183,942 |

|

|

164,570 |

|

| Long-term debt |

825,438 |

|

|

888,007 |

|

| Deferred income taxes |

201,350 |

|

|

203,910 |

|

| Operating lease

liabilities |

39,788 |

|

|

— |

|

| Other long-term

liabilities |

11,440 |

|

|

9,701 |

|

|

Total liabilities |

1,261,958 |

|

|

1,266,188 |

|

| Stockholders’ equity: |

|

|

|

|

Common stock |

33 |

|

|

33 |

|

|

Additional paid-in capital |

697,648 |

|

|

691,083 |

|

|

Treasury stock |

(10,565 |

) |

|

(8,125 |

) |

|

Retained earnings |

398,648 |

|

|

344,498 |

|

|

Accumulated other comprehensive income |

25,931 |

|

|

33,004 |

|

|

Total stockholders’ equity |

1,111,695 |

|

|

1,060,493 |

|

|

Total liabilities and stockholders’ equity |

$ |

2,373,653 |

|

|

$ |

2,326,681 |

|

| Condensed

Consolidated Statements of Cash Flows - Unaudited (a) |

| (in

thousands) |

| |

|

| |

Six Months Ended |

| |

June 28, 2019 |

|

June 29, 2018 |

| Cash flows from

operating activities: |

|

|

|

|

Net income |

$ |

54,726 |

|

|

$ |

28,140 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

Depreciation and amortization |

38,535 |

|

|

48,591 |

|

|

Debt related charges included in interest expense |

3,676 |

|

|

5,083 |

|

|

Stock-based compensation |

5,433 |

|

|

6,107 |

|

|

Non-cash (gain) loss on equity investments |

1,652 |

|

|

(763 |

) |

|

Other non-cash gains |

(311 |

) |

|

(2,307 |

) |

|

Deferred income taxes |

(1,126 |

) |

|

8,894 |

|

|

Gain on sale of discontinued operations |

(4,974 |

) |

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

Accounts receivable |

(30,545 |

) |

|

(11,306 |

) |

|

Inventories |

2,846 |

|

|

(20,948 |

) |

|

Prepaid expenses and other assets |

(12,942 |

) |

|

3,306 |

|

|

Accounts payable |

16,289 |

|

|

8,898 |

|

|

Accrued expenses and other liabilities |

(8,593 |

) |

|

(3,929 |

) |

|

Income taxes payable |

2,884 |

|

|

(2,547 |

) |

|

Net cash provided by operating activities |

67,550 |

|

|

67,219 |

|

| Cash flows from

investing activities: |

|

|

|

| Acquisition of property, plant

and equipment |

(15,506 |

) |

|

(19,224 |

) |

| Proceeds from sale of

property, plant and equipment |

5 |

|

|

960 |

|

| Purchase of equity

investments |

(327 |

) |

|

(831 |

) |

| Proceeds from sale of

discontinued operations |

4,734 |

|

|

— |

|

|

Net cash used in investing activities |

(11,094 |

) |

|

(19,095 |

) |

| Cash flows from

financing activities: |

|

|

|

| Principal payments of

long-term debt |

(80,750 |

) |

|

(75,062 |

) |

| Proceeds from issuance of

long-term debt |

15,000 |

|

|

— |

|

| Proceeds from the exercise of

stock options |

1,600 |

|

|

3,625 |

|

| Payment of debt issuance and

redemption costs |

— |

|

|

(688 |

) |

| Tax withholdings related to

net share settlements of restricted stock unit awards |

(2,123 |

) |

|

(2,206 |

) |

| Other financing

activities |

— |

|

|

(192 |

) |

|

Net cash used in financing activities |

(66,273 |

) |

|

(74,523 |

) |

| Effect of foreign currency

exchange rates on cash and cash equivalents |

170 |

|

|

2,363 |

|

| Net decrease in cash and cash

equivalents |

(9,647 |

) |

|

(24,036 |

) |

| Cash and cash equivalents,

beginning of period |

25,569 |

|

|

44,096 |

|

| Cash and cash equivalents, end

of period |

$ |

15,922 |

|

|

$ |

20,060 |

|

(a) Condensed Consolidated Statements of

Cash Flows - Unaudited includes cash flows related to discontinued

operations.

Reconciliations of Non-GAAP Measures from Continuing

Operations

Table A: Income (Loss) from Continuing Operations and

Diluted EPS Reconciliations(in thousands except per share

amounts)

| |

Three Months Ended |

| |

June 28, 2019 |

|

June 29, 2018 |

| |

Pre-Tax |

|

Net ofTax |

|

PerDilutedShare |

|

Pre-Tax |

|

Net ofTax |

|

PerDilutedShare |

|

As reported income from continuing operations (GAAP) |

$ |

34,832 |

|

|

$ |

28,222 |

|

|

$ |

0.85 |

|

|

$ |

31,795 |

|

|

$ |

23,056 |

|

|

$ |

0.70 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles(a) |

9,831 |

|

|

7,778 |

|

|

0.24 |

|

|

10,519 |

|

|

8,296 |

|

|

0.25 |

|

|

Certain legal expenses (SG&A)(a)(b) |

680 |

|

|

537 |

|

|

0.02 |

|

|

476 |

|

|

376 |

|

|

0.01 |

|

|

Strategic reorganization and alignment (OOE)(a)(c) |

1,656 |

|

|

1,287 |

|

|

0.04 |

|

|

3,727 |

|

|

2,950 |

|

|

0.09 |

|

|

Manufacturing alignment to support growth (OOE)(a)(d) |

561 |

|

|

393 |

|

|

0.01 |

|

|

1,103 |

|

|

815 |

|

|

0.02 |

|

|

Consolidation and optimization expenses (OOE)(a)(e) |

— |

|

|

— |

|

|

— |

|

|

(14 |

) |

|

(10 |

) |

|

— |

|

|

Asset dispositions, severance and other (OOE)(a)(f) |

891 |

|

|

699 |

|

|

0.02 |

|

|

(124 |

) |

|

(106 |

) |

|

— |

|

|

(Gain) loss on equity investments, net(a) |

1,611 |

|

|

1,273 |

|

|

0.04 |

|

|

(284 |

) |

|

(225 |

) |

|

(0.01 |

) |

|

Loss on extinguishment of debt(a)(g) |

562 |

|

|

443 |

|

|

0.01 |

|

|

417 |

|

|

329 |

|

|

0.01 |

|

|

LSA adjustments(a)(h) |

— |

|

|

— |

|

|

— |

|

|

(3,283 |

) |

|

(2,594 |

) |

|

(0.08 |

) |

|

Tax adjustments(i) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,857 |

|

|

0.06 |

|

| Adjusted income from

continuing operations (Non-GAAP) |

$ |

50,624 |

|

|

$ |

40,632 |

|

|

$ |

1.23 |

|

|

$ |

44,332 |

|

|

$ |

34,744 |

|

|

$ |

1.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average

shares for adjusted EPS |

|

|

33,009 |

|

|

|

|

|

|

32,720 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended |

| |

June 28, 2019 |

|

June 29, 2018 |

| |

Pre-Tax |

|

Net ofTax |

|

PerDilutedShare |

|

Pre-Tax |

|

Net ofTax |

|

PerDilutedShare |

| As reported income from

continuing operations (GAAP) |

$ |

59,964 |

|

|

$ |

49,588 |

|

|

$ |

1.50 |

|

|

$ |

50,253 |

|

|

$ |

36,140 |

|

|

$ |

1.11 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles(a) |

19,685 |

|

|

15,574 |

|

|

0.47 |

|

|

21,172 |

|

|

16,693 |

|

|

0.51 |

|

|

Certain legal expenses (SG&A)(a)(b) |

2,076 |

|

|

1,640 |

|

|

0.05 |

|

|

797 |

|

|

630 |

|

|

0.02 |

|

|

Strategic reorganization and alignment (OOE)(a)(c) |

3,390 |

|

|

2,637 |

|

|

0.08 |

|

|

5,781 |

|

|

4,577 |

|

|

0.14 |

|

|

Manufacturing alignment to support growth (OOE)(a)(d) |

1,146 |

|

|

807 |

|

|

0.02 |

|

|

1,616 |

|

|

1,184 |

|

|

0.04 |

|

|

Consolidation and optimization expenses (OOE)(a)(e) |

— |

|

|

— |

|

|

— |

|

|

561 |

|

|

445 |

|

|

0.01 |

|

|

Asset dispositions, severance and other (OOE)(a)(f) |

1,462 |

|

|

1,152 |

|

|

0.03 |

|

|

518 |

|

|

364 |

|

|

0.01 |

|

|

(Gain) loss on equity investments, net(a) |

1,652 |

|

|

1,305 |

|

|

0.04 |

|

|

(5,254 |

) |

|

(4,151 |

) |

|

(0.13 |

) |

|

Loss on extinguishment of debt(a)(g) |

974 |

|

|

769 |

|

|

0.02 |

|

|

1,474 |

|

|

1,164 |

|

|

0.04 |

|

|

LSA adjustments(a)(h) |

— |

|

|

— |

|

|

— |

|

|

(6,119 |

) |

|

(4,834 |

) |

|

(0.15 |

) |

|

Tax adjustments(i) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,951 |

|

|

0.09 |

|

| Adjusted income from

continuing operations (Non-GAAP) |

$ |

90,349 |

|

|

$ |

73,472 |

|

|

$ |

2.23 |

|

|

$ |

70,799 |

|

|

$ |

55,163 |

|

|

$ |

1.69 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average

shares for adjusted EPS |

|

|

32,995 |

|

|

|

|

|

|

32,572 |

|

|

|

(a) The difference between pre-tax and net of

tax amounts is the estimated tax impact related to the respective

adjustment. Net of tax amounts are computed using a 21% U.S.

tax rate, and the statutory tax rates in Mexico, Netherlands,

Uruguay, Ireland and Switzerland, as adjusted for the existence of

net operating losses (“NOLs”). Amortization of intangibles

and other operating expense for 2018 have also been adjusted to

reflect the estimated impact relating to our disallowed deduction

of the GILTI tax, as described in footnote (i) below.

Expenses that are not deductible for tax purposes (i.e. permanent

tax differences) are added back at 100%.

(b) In 2013, we filed suit against AVX

Corporation alleging they were infringing our intellectual

property. Given the complexity and significant costs incurred

pursuing this litigation, we are excluding these litigation

expenses from adjusted amounts. This matter proceeded to trial

during the first quarter of 2016 and again in the third quarter of

2017 that resulted in a jury awarding damages in the amount of

$37.5 million. In March 2018, the court vacated that damage

award and ordered a new trial on damages. In the January 2019

retrial on damages, the jury awarded damages in the amount of $22.2

million. On July 31, 2019, the U. S. District Court for the

District of Delaware entered an order in the AVX litigation denying

AVX’s post-trial motion to overturn the jury verdict in our

favor. This proceeding is subject to post-trial

proceedings. To date, no gains have been recognized in

connection with this litigation. The second quarter 2019 also

includes costs associated with responding to a subpoena in

connection with a legal matter to which we are a non-party

witness.

(c) Amounts include expenses related to

implementing our strategy that is designed to better align our

resources in order to invest to grow, protect, preserve and to

enhance the profitability of our portfolio of products, including

focusing our investment in RD&E and manufacturing, improving

our business processes and redirecting investments away from

projects where the market does not justify the investment.

During 2019 and 2018, we incurred charges related to this strategy,

which primarily consisted of severance costs and fees for

professional services.

(d) Includes expenses related to several

initiatives designed to reduce costs, improve operating

efficiencies and increase manufacturing capacity to accommodate

growth. The plan involves the relocation of certain

manufacturing operations and expansion of certain of our

facilities.

(e) During 2018, we incurred costs primarily

related to the closure of our Clarence, NY facility.

(f) Amounts include expenses related to other

initiatives not described above, which relate primarily to

integration and operational initiatives to reduce costs and improve

operational efficiencies.

(g) Represents debt extinguishment charges in

connection with pre-payments made on our Term Loan B Facility,

which are included in interest expense.

(h) Reflects the net impact of the LSAs entered

into as of the closing of the divestiture of the AS&O product

line. These LSAs govern the sale of products supplied by

Viant to the Company for further resale to customers and by the

Company to Viant for further resale to customers.

(i) The tax adjustment for 2018 represents the

estimated impact relating to our disallowed deduction of the GILTI

tax, as mandated by the Tax Reform Act. This disallowed

deduction of the GILTI tax (approximately 50% of the total GILTI

tax) is due to the Company making use of its U.S. NOLs during

2018. This adjustment makes our Adjusted Diluted EPS from

continuing operations more comparable with other global companies

that are not subject to this disallowed GILTI tax deduction and

more comparable to the Company’s results following the full

utilization of its U.S. NOLs.

Table B: EBITDA and Sales Reconciliations(in

thousands)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2019 |

|

June 29, 2018 |

|

June 28, 2019 |

|

June 29, 2018 |

|

Income from continuing operations (GAAP) |

$ |

28,222 |

|

|

$ |

23,056 |

|

|

$ |

49,588 |

|

|

$ |

36,140 |

|

| |

|

|

|

|

|

|

|

| Interest expense |

13,612 |

|

|

15,234 |

|

|

27,442 |

|

|

30,829 |

|

| Provision for income

taxes |

6,610 |

|

|

8,739 |

|

|

10,376 |

|

|

14,113 |

|

| Depreciation |

9,046 |

|

|

10,006 |

|

|

18,850 |

|

|

19,969 |

|

| Amortization of intangibles

(excluding OOE) |

9,831 |

|

|

10,519 |

|

|

19,685 |

|

|

21,172 |

|

|

EBITDA from continuing operations (Non-GAAP) |

67,321 |

|

|

67,554 |

|

|

125,941 |

|

|

122,223 |

|

| Certain legal expenses |

680 |

|

|

476 |

|

|

2,076 |

|

|

797 |

|

| Stock-based compensation

(excluding OOE) |

2,673 |

|

|

2,199 |

|

|

5,386 |

|

|

5,178 |

|

| Strategic reorganization and

alignment |

1,656 |

|

|

3,727 |

|

|

3,390 |

|

|

5,781 |

|

| Manufacturing alignment to

support growth |

561 |

|

|

1,103 |

|

|

1,146 |

|

|

1,616 |

|

| Consolidation and optimization

expenses |

— |

|

|

(14 |

) |

|

— |

|

|

561 |

|

| Asset dispositions, severance

and other |

891 |

|

|

(124 |

) |

|

1,462 |

|

|

518 |

|

| (Gain) loss on equity

investments, net |

1,611 |

|

|

(284 |

) |

|

1,652 |

|

|

(5,254 |

) |

| LSA adjustments |

— |

|

|

(3,283 |

) |

|

— |

|

|

(6,119 |

) |

| Adjusted EBITDA from

continuing operations (Non-GAAP) |

$ |

75,393 |

|

|

$ |

71,354 |

|

|

$ |

141,053 |

|

|

$ |

125,301 |

|

| |

|

|

|

|

|

|

|

| Total Sales (GAAP) |

$ |

314,194 |

|

|

$ |

314,464 |

|

|

$ |

628,870 |

|

|

$ |

606,890 |

|

|

LSA adjustments |

— |

|

|

(1,308 |

) |

|

— |

|

|

(2,003 |

) |

| Adjusted sales from continuing

operations (Non-GAAP) |

$ |

314,194 |

|

|

$ |

313,156 |

|

|

$ |

628,870 |

|

|

$ |

604,887 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

24 |

% |

|

23 |

% |

|

22 |

% |

|

21 |

% |

Table C: Organic Sales from Continuing Operations Growth

Rate Reconciliation (% Change)

| |

GAAPReportedGrowth |

|

Impact ofLSAs(a) |

|

Impact ofForeignCurrency(b) |

|

Non-GAAPOrganicGrowth |

| QTD Change (2Q 2019

vs. 2Q 2018) |

|

|

|

|

|

|

|

| Medical

Sales |

|

|

|

|

|

|

|

|

Cardio & Vascular |

1.1 |

% |

|

— |

% |

|

0.5 |

% |

|

1.6 |

% |

|

Cardiac & Neuromodulation |

(1.3 |

)% |

|

— |

|

|

— |

|

|

(1.3 |

)% |

|

Advanced Surgical, Orthopedics & Portable Medical |

(6.1 |

)% |

|

3.7 |

% |

|

0.1 |

% |

|

(2.3 |

)% |

|

Total Medical Sales |

(0.6 |

)% |

|

0.4 |

% |

|

0.2 |

% |

|

— |

% |

| Non-Medical

Sales |

11.0 |

% |

|

— |

|

|

— |

|

|

11.0 |

% |

|

Total Sales |

(0.1 |

)% |

|

0.4 |

% |

|

0.3 |

% |

|

0.6 |

% |

| |

|

|

|

|

|

|

|

| YTD Change (6M 2019

vs. 6M 2018) |

|

|

|

|

|

|

|

| Medical

Sales |

|

|

|

|

|

|

|

|

Cardio & Vascular |

6.1 |

% |

|

— |

% |

|

0.5 |

% |

|

6.6 |

% |

|

Cardiac & Neuromodulation |

2.9 |

% |

|

— |

|

|

— |

|

|

2.9 |

% |

|

Advanced Surgical, Orthopedics & Portable Medical |

(6.5 |

)% |

|

2.8 |

% |

|

0.1 |

% |

|

(3.6 |

)% |

|

Total Medical Sales |

3.4 |

% |

|

0.3 |

% |

|

0.3 |

% |

|

4.0 |

% |

| Non-Medical

Sales |

9.2 |

% |

|

— |

|

|

— |

|

|

9.2 |

% |

|

Total Sales |

3.6 |

% |

|

0.4 |

% |

|

0.2 |

% |

|

4.2 |

% |

(a) Reflects the net impact of the LSAs entered

into as of the closing of the divestiture of the AS&O product

line.

(b) Second quarter and year-to-date 2019 GAAP

sales were negatively impacted by $0.7 million and $1.6 million,

respectively, due to foreign currency exchange rate

fluctuations, primarily in our Cardio & Vascular product

line.

Table D: Non-GAAP Organic Growth Rate Reconciliation (%

Change)

| |

GAAPReportedGrowth(a) |

|

Impact

ofNon-GAAPAdjustment(b) |

|

Impact ofForeignCurrency(c) |

|

Non-GAAPOrganicGrowth |

| QTD Change (2Q 2019

vs. 2Q 2018) |

|

|

|

|

|

|

|

|

EBITDA from continuing operations |

(0.3 |

)% |

|

6.0 |

% |

|

2.9 |

% |

|

8.6 |

% |

| Income from continuing

operations |

22.4 |

% |

|

(5.5 |

)% |

|

5.5 |

% |

|

22.4 |

% |

| Diluted EPS from continuing

operations |

21.4 |

% |

|

(5.4 |

)% |

|

5.8 |

% |

|

21.8 |

% |

|

|

|

|

|

|

|

|

|

| YTD Change (6M 2019

vs. 6M 2018) |

|

|

|

|

|

|

|

| EBITDA from continuing

operations |

3.0 |

% |

|

9.6 |

% |

|

0.7 |

% |

|

13.3 |

% |

| Income from continuing

operations |

37.2 |

% |

|

(4.0 |

)% |

|

1.4 |

% |

|

34.6 |

% |

| Diluted EPS from continuing

operations |

35.1 |

% |

|

(3.1 |

)% |

|

0.7 |

% |

|

32.7 |

% |

(a) EBITDA from continuing operations is a non-GAAP

measure. See Table B for a reconciliation to the most

comparable GAAP measure.

(b) Represents the impact to our growth rate from our Non-GAAP

adjustments. See Tables A and B for further detail on these

items.

(c) Represents the impact to our growth rate due to changes in

foreign currency exchange rates realized in income and reported in

other income, net in the consolidated statements of operations.

Table E: Supplemental Financial Items Affecting Cash

Flow(dollars in millions)

| |

|

2019Outlook |

|

2018Actual |

|

|

Capital Expenditures |

|

$50 - $55 |

|

$44 |

|

|

| Depreciation and

Amortization |

|

$75 - $85 |

|

$82 |

|

|

| Stock-Based Compensation |

|

$10 - $12 |

|

$10 |

|

|

| Other Operating Expense |

|

$10 - $15 |

|

$16 |

|

|

| Adjusted Effective Tax

Rate |

|

17.5% - 19.5% |

|

$18.5 |

% |

|

| Cash Tax Payments |

|

$30 - $35 |

|

$23 |

|

|

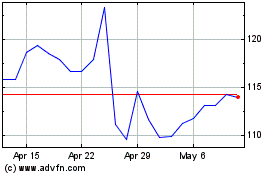

Integer (NYSE:ITGR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Sep 2023 to Sep 2024