PCTEL, Inc. (Nasdaq: PCTI) announced its results for the first

quarter ended March 31, 2019.

Highlights

- Revenue of $20.6 million in the

quarter, 5% lower compared to the prior year. Compared to the

first quarter 2018, the first quarter revenue was higher by 38% for

the test and measurement product line and lower by 15% for the

antenna product line.

- Gross profit margin of 42.0% in the

quarter, up 5.8% compared to gross profit margin in the prior

year. The increase in the quarter is a result of improved

profitability for scanning receivers and antennas.

- GAAP net loss per share of $0.02 in

the quarter compared to a GAAP loss of $0.05 per share in the

quarter last year.

- Non-GAAP net income and adjusted

EBITDA are measures the Company uses to reflect the results of its

core earnings. A reconciliation of those non-GAAP measures to

our financial statements is provided later in the press

release.

- Non-GAAP net income per share of

$0.04 in the quarter compared to a net loss of $0.01 in the

first quarter last year.

- Adjusted EBITDA margin as a percent

of revenue of 7% in the quarter compared to 2% in the prior

year.

- $35.0 million of cash and short-term

investments at March 31, 2019 and no debt.

“We are pleased that early demand for 5G test and measurement

tools continues to drive revenue growth and profitability for

scanning receivers. We expect this to continue as wireless

operators deploy 5G networks in the US, Europe and Asia,” said

David Neumann, PCTEL’s CEO. “In addition, 5G and enterprise Wi-Fi

networks require engineered antenna and radio systems to enable

industrial IoT for both public and private applications. We are

positioned well to provide our antenna solutions for these

applications in enterprise wireless, intelligent transportation and

industrial IoT markets.”

CONFERENCE CALL / WEBCAST

PCTEL’s management team will discuss the Company’s results today

at 4:30 p.m. ET. The call can be accessed by dialing (888) 782-2072

(U.S. / Canada) or (706) 679-6397 (International), conference ID:

1689797. The call will also be webcast at

http://investor.pctel.com/news-events/webcasts-presentations.

REPLAY: A replay will be available for two weeks after the call

on either the website listed above or by calling (855) 859-2056

(U.S./Canada), or International (404) 537-3406, conference ID:

1689797.

About PCTEL

PCTEL, Inc. is a leading global supplier of antennas and

wireless network testing solutions. Founded in 1994, we are

currently celebrating our 25th anniversary. PCTEL’s precision

antennas are deployed in small cells, enterprise Wi-Fi access

points, fleet management and transit systems, and in equipment and

devices for the Industrial Internet of Things (IIoT). We offer

in-house design, testing, radio integration, and manufacturing

capabilities for our customers. PCTEL’s test and measurement tools

improve the performance of wireless networks globally, with a focus

on LTE, public safety, and emerging 5G technologies. Network

operators, neutral hosts, and equipment manufacturers rely on our

scanning receivers and testing solutions to analyze, design, and

optimize their networks.

For more information, please visit our website at

https://www.pctel.com/.

PCTEL Safe Harbor Statement

This press release and our related comments in our earnings

conference call contain “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995. Specifically,

the statements regarding our future financial performance, growth

of our antenna solutions and test and measurement businesses, the

impact of our redefined market segments and our 2018 cost reduction

actions, the anticipated demand for certain products including

those related to antennas, the industrial IoT and the rollout of

5G, the impact of tariffs on certain imports from China, and the

anticipated growth of public and private wireless systems are

forward-looking statements within the meaning of the safe harbor.

These statements are based on management’s current expectations and

actual results may differ materially from those projected as a

result of certain risks and uncertainties, including the impact of

data densification and IoT on capacity and coverage demand, impact

of 5G, customer demand for these types of products and services

generally including demand from customers in China, growth and

continuity in PCTEL’s defined market segments, and PCTEL’s ability

to grow its wireless products business and create, protect and

implement new technologies and solutions. These and other risks and

uncertainties are detailed in PCTEL's Securities and Exchange

Commission filings. These forward-looking statements are made only

as of the date hereof, and PCTEL disclaims any obligation to update

or revise the information contained in any forward-looking

statement, whether as a result of new information, future events or

otherwise.

PCTEL is a registered trademark of PCTEL, Inc. ©

2019 PCTEL, Inc. All rights reserved.

PCTEL, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except share data) March

31, December 31, 2019 2018 ASSETS

Cash and cash equivalents $ 4,455 $ 4,329 Short-term investment

securities 30,586 30,870 Accounts receivable, net of allowances of

$86 and $63 at March 31, 2019 and December 31, 2018, respectively

16,427 15,864 Inventories, net 12,919 12,848 Prepaid expenses and

other assets 1,541 1,416 Total current

assets 65,928 65,327 Property and equipment, net 11,740

12,138 Goodwill 3,332 3,332 Intangible assets, net 789 1,029 Other

noncurrent assets 1,531 45

TOTAL

ASSETS $ 83,320 $ 81,871

LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable

$ 6,881 $ 6,083 Accrued liabilities 6,668

5,801 Total current liabilities 13,549 11,884 Long-term

liabilities 868 381 Total liabilities

14,417 12,265 Stockholders’ equity:

Common stock, $0.001 par value, 100,000,000 shares authorized,

18,417,701 and 18,271,249 shares issued and outstanding at March

31, 2019 and December 31, 2018, respectively 18 18 Additional

paid-in capital 133,320 133,859 Accumulated deficit (64,372 )

(64,055 ) Accumulated other comprehensive loss (63 )

(216 ) Total stockholders’ equity 68,903

69,606

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$ 83,320 $ 81,871

PCTEL, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited) (in thousands, except per share

data) Three Months Ended March 31,

2019 2018

REVENUES $ 20,590 $ 21,731

COST OF REVENUES

11,932 13,867

GROSS PROFIT 8,658

7,864

OPERATING EXPENSES: Research and

development 3,003 2,940 Sales and marketing 2,798 3,028 General and

administrative 3,253 2,993 Amortization of intangible assets

73 124 Total operating expenses 9,127

9,085

OPERATING LOSS (469 ) (1,221 )

Other income, net 162 51

LOSS BEFORE

INCOME TAXES (307 ) (1,170 ) Expense (benefit) for income taxes

10 (312 )

NET LOSS $ (317 ) $ (858 )

Net Loss per Share: Basic $ (0.02 ) $ (0.05 ) Diluted

$ (0.02 ) $ (0.05 )

Weighted Average Shares: Basic 17,617

17,056 Diluted 17,617 17,056

Cash dividend per share

$ 0.055 $ 0.055

PCTEL, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, in

thousands) Three Months Ended March 31, .

2019 2018 Operating Activities: Net

loss $ (317 ) $ (858 ) Adjustments to reconcile net loss to net

cash provided by (used in) operating activities: Depreciation 711

674 Intangible asset amortization 240 290 Stock-based compensation

882 668 Loss on disposal of property and equipment 0 10

Restructuring costs (3 ) (11 ) Bad debt provision 7 15 Deferred tax

provision 0 (236 ) Changes in operating assets and liabilities:

Accounts receivable (512 ) (350 ) Inventories 38 321 Prepaid

expenses and other assets 23 (250 ) Accounts payable 554 (64 )

Income taxes payable (22 ) (3 ) Other accrued liabilities (39 )

(1,808 ) Deferred revenue (23 ) 14 Net cash

provided by (used in) operating activities 1,539

(1,588 )

Investing Activities: Capital expenditures

(311 ) (884 ) Proceeds from disposal of property and equipment 0 14

Purchases of investments (13,893 ) (7,266 ) Redemptions/maturities

of short-term investments 14,177 17,480

Net cash (used in) provided by investing activities (27 )

9,344

Financing Activities: Proceeds from

issuance of common stock 338 364 Payment of withholding tax on

stock-based compensation (743 ) (289 ) Principle payments on

capital leases (26 ) (24 ) Cash dividends (1,016 )

(995 ) Net cash used in financing activities (1,447 )

(944 ) Net increase in cash and cash equivalents 65 6,812

Effect of exchange rate changes on cash 61 81 Cash and cash

equivalents, beginning of period 4,329 5,559

Cash and Cash Equivalents, End of Period $ 4,455

$ 12,452

PCTEL, INC. REVENUE

AND GROSS PROFIT BY PRODUCT LINE (unaudited) (in

thousands) Three Months

Ended March 31, 2019 Test & Antenna

Measurement Products Products Corporate

Total REVENUES $15,088 $5,535 ($33 ) $20,590

GROSS PROFIT $4,861 $3,785 $12 $8,658

GROSS PROFIT

% 32.2 % 68.4 % 42.0 %

Three Months Ended March 31,

2018 Test & Antenna Measurement

Products Products Corporate Total

REVENUES $17,764 $3,999 ($32 ) $21,731

GROSS

PROFIT $5,198 $2,670 ($4 ) $7,864

GROSS PROFIT %

29.3 % 66.8 % 36.2 %

Reconciliation of

GAAP to non-GAAP Results (unaudited)

(in thousands except per share information)

Reconciliation of

GAAP operating loss to non-GAAP operating income

(loss)

Three Months Ended March 31, 2019

2018 Operating Loss ($469

) ($1,221 ) (a)

Add: Amortization of intangible

assets -Cost of revenues 167 167 -Operating expenses 73 124 Stock

Compensation: -Cost of revenues 103 88 -Engineering 172 138 -Sales

& marketing 180 131 -General & administrative 427

311 1,122 959

Non-GAAP Operating Income

(Loss) $654 ($262 ) % of revenue 3.2 % -1.2 %

Reconciliation of

GAAP net loss to non-GAAP net income (loss)

Three Months Ended March 31, 2019

2018 Net Loss ($317 ) ($858 )

Adjustments: (a) Non-GAAP adjustment to operating

loss 1,122 959 Income Taxes (56 ) (295 ) 1,067 664

Non-GAAP Net (Loss) Income $750 ($194 )

Non-GAAP (Loss) Income per Share: Basic $0.04 ($0.01 )

Diluted $0.04 ($0.01 )

Weighed Average Shares: Basic

17,617 17,056 Diluted 17,660 17,056 This schedule reconciles

the Company's GAAP operating loss to its non-GAAP operating income

(loss). The Company believes that presentation of this schedule

provides meaningful supplemental information to both management and

investors that is indicative of the Company's core operating

results and facilitates comparison of operating results across

reporting periods. The Company uses these non-GAAP measures when

evaluating its financial results as well as for internal planning

and forecasting purposes. These non-GAAP measures should not be

viewed as a substitute for the Company's GAAP results. The

adjustments to GAAP operating loss (a) consist of stock

compensation expense and amortization of intangible assets. The

adjustments to GAAP net loss include the non-GAAP adjustments to

operating loss as well as adjustments for (b) non-cash income tax

expense.

PCTEL,

Inc.

Reconciliation of

GAAP operating loss to Adjusted EBITDA

(unaudited, in thousands) Three

Months Ended March 31, 2019

2018 Operating Loss ($469)

($1,221)

Add: Depreciation and amortization 711 674

Intangible amortization 240 291 Stock compensation expenses 882 668

Adjusted EBITDA $1,365 $412

% of revenue 6.6% 1.9%

This schedule reconciles the Company's GAAP operating loss

to Adjusted EBITDA. The Company believes that this schedule

provides meaningful supplemental information to both management and

investors that is indicative of the Company's core operating

results and facilitates comparison of operating results across

reporting periods. The Company uses Adjusted EBITDA when evaluating

its financial results as well as for internal planning and

forecasting purposes. Adjusted EBITDA should not be viewed as a

substitute for the Company's GAAP results. Adjusted EBITDA

is defined as net income before interest, income taxes,

depreciation and amortization. The adjustments on this schedule

consist of depreciation, amortization of intangible assets, and

stock compensation expenses

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190507005883/en/

For further information contact:Kevin McGowanCFOPCTEL,

Inc.(630) 372-6800Michael RosenbergDirector of MarketingPCTEL,

Inc.(301) 444-2046public.relations@pctel.com

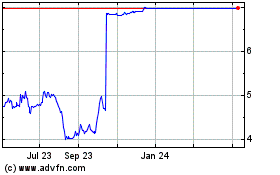

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Sep 2023 to Sep 2024