Crypto mass adoption is coming soon: Fidelity to offer Bitcoin and Ethereum trading services to institutional customers

October 16 2018 - 6:06AM

ADVFN Crypto NewsWire

- Fidelity Investments announced the launch of a crypto

focused division.

- This step is touted as a significant move towards

crypto adoption.

One of the world's largest asset management companies Fidelity

Investments announced the launch of a new division that will focus

on Bitcoin and Ethereum trading and custody services for

institutional clients, The Financial Times reports.

The new company, Fidelity Digital Assets, will go live in early

2019, while Michael Novogratz’s Galaxy Digital will become one of

its first clients.

It’s a significant move for the crypto industry towards

institutional adoption and a bold decision for a cautious,

regulated company with $7.2 trillion in client assets under

management.

Security considerations, high volatility and lack of confidence

in cryptocurrency assets held large institutions back from getting

involved in trading cryptocurrencies; however, new services offered

by Fidelity Digital Assets may change this trend.

Fidelity has become one of the first large financial

institutions to get involved bitcoin, but offered no crypto-related products

to customers, lagging behind such startups as Robinhood and Square

’s Cash that already provide direct crypto trading to retail

customers.

Now the company is focused on institutional clients, citing a

lot of demand in the market that is still evolving rapidly.

“Our goal is to make digitally-native assets, such

as bitcoin, more accessible to investors. We expect to continue

investing and experimenting, over the long-term, with ways to make

this emerging asset class easier for our clients to understand and

use,” Abigail Johnson, chairman, and chief executive of Fidelity

Investments, said in a statement.

The crypto industry and crypto asset managers met the news with

enthusiasm, noting that this step will clear the significant hurdle

for cryptocurrency mass and institutional adoption.

“For many institutional investors, a trusted custodian like

Fidelity entering the space removes a huge obstacle to investing in

crypto assets. I think we’ll look back on 2018, and particularly

this moment, as the time that crypto became cemented as a new asset

class,” a crypto asset manager Hunter Horsley of Bitwise Asset

Management commented.

Source:

Tanya

Abrosimova FXStreet

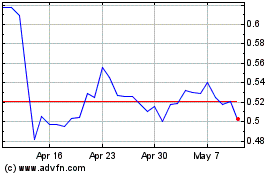

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2024 to May 2024

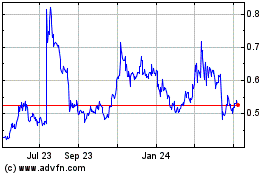

Ripple (COIN:XRPUSD)

Historical Stock Chart

From May 2023 to May 2024