Current Report Filing (8-k)

September 17 2018 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 11, 2018

Trinseo S.A.

(Exact name of registrant as specified in its charter)

|

Luxembourg

|

001-36473

|

N/A

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

1000 Chesterbrook Boulevard, Suite 300,

Berwyn, Pennsylvania 19312

(Address of principal executive offices, including zip code)

(610) 240-3200

(Telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITEM 5.07

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

(e)

On September 14, 2018, both Timothy Stedman and Hayati Yarkadas, each a Senior Vice President and Business President, were granted an equity retention award approved by the compensation committee of the board of directors of Trinseo S.A., a public limited liability company (

société anonyme

) existing under the laws of Luxembourg (the “Company”). The equity retention award for each executive has a grant value of $1.3 million and consists of 50% performance award stock units (“PSUs”) and 50% restricted stock units (“RSUs”).

The RSUs will vest in full on the third anniversary of the grant date, generally subject to the executive’s continued employment with the Company. The PSUs will vest on the third anniversary of the grant date, subject generally to the executive’s continued employment and to the Company’s relative total shareholder return (“TSR”) performance, assuming the reinvestment of dividends, against the performance of 49 other chemical companies with shares traded on a major U.S. stock exchange and that have a market capitalization exceeding $500 million dollars at the time the award is granted. The threshold, target and maximum payout, which represents the 25

th

, 50

th

, and 75

th

percentile of TSR performance relative to peers, would be 50%, 100%, and 200% of the PSU award’s target amount, respectively. The number of PSUs ultimately vested will be interpolated between the 25

th

and 50

th

percentiles and between the 50

th

and 75

th

percentiles. Regardless of the foregoing targets, vesting of the PSUs is capped at 100% of target if the Company’s TSR is negative for the three-year performance period. Additionally, the total value of the awards delivered at vesting is capped at three times the target shares multiplied by the grant date share price. Because the Company assumes reinvestment of dividends, dividend equivalents accrue during the performance period. However, dividend equivalents will be paid only if, and to the extent, the PSUs vest.

The foregoing is a description of the executives’ equity retention award and does not purport to be a complete description of all the terms set forth in the applicable award agreements and, therefore, is qualified in its entirety by reference to Exhibits 10.1 and 10.2 incorporated into this Current Report.

ITEM 9.01.

Financial Statements and Exhibits

(d) Exhibits

|

oror

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Form of Restricted Stock Unit Award Agreement for Executives (incorporated herein by reference to Exhibit 10.5 to the Quarterly Report filed on Form 10-Q, File No. 001-36473, filed on May 3, 2018)

|

|

|

|

|

|

10.2

|

|

Form of Performance Award Stock Unit Agreement for Executives for 2018 Executive Retention Awards

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRINSEO S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Angelo N. Chaclas

|

|

|

Name:

|

Angelo N. Chaclas

|

|

|

Title:

|

Senior Vice President, Chief Legal Officer,

Chief Compliance Officer & Corporate Secretary

|

|

|

|

|

|

Date: September 17, 2018

|

|

|

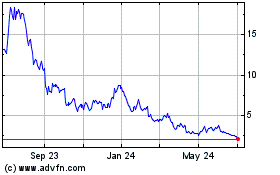

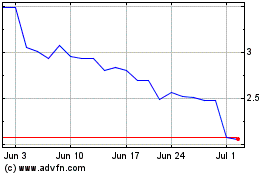

Trinseo (NYSE:TSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinseo (NYSE:TSE)

Historical Stock Chart

From Apr 2023 to Apr 2024