Goldman Sachs BDC, Inc. Amends Its Revolving Credit Facility In Connection with Its Reduced Asset Coverage Requirement

September 17 2018 - 4:50PM

Business Wire

Goldman Sachs BDC, Inc. (the “Company”, “GS BDC”) (NYSE:GSBD)

announced today that it has amended its senior secured revolving

credit agreement (the “Revolving Credit Facility”) to, among other

things, reduce the Company’s minimum asset coverage ratio financial

covenant from 200% to 150% as further described in the Revolving

Credit Facility. There was no fee or change in borrowing cost under

the Revolving Credit Facility in connection with the amendment.

This amendment follows the passage of the Small Business Credit

Availability Act (“SBCA Act”) in March, 2018, which seeks to

increase the availability of funding to middle market U.S.

companies by increasing capital available to business development

companies, such as GS BDC.

“Since the passage of the SBCA Act approximately six months ago,

we have worked diligently to secure the necessary approvals from

our various stakeholders to position the Company to benefit from

the increased flexibility resulting from the change in law. This

amendment to our credit facility marks the last necessary approval

in that process, and we look forward to continuing to execute our

core strategy of direct lending to middle market businesses, but

with the added benefit of a broader product set for borrowers,”

said Brendan McGovern, CEO of the Company.

Jonathan Lamm, the Company’s Chief Financial Officer, remarked,

“We appreciate the thought leadership from our lending syndicate as

we executed on this important amendment to our borrowing facility.

We expect to continue to finance the Company in a prudent manner,

which includes seeking to further diversify our sources of funding,

and endeavoring to maintain a meaningful cushion to the asset

coverage limitation.”

For further information, please see the Company’s current report

on Form 8-K filed with the Securities and Exchange Commission on

September 17, 2018.

ABOUT GOLDMAN SACHS BDC, INC.

Goldman Sachs BDC, Inc. is a specialty finance company that has

elected to be regulated as a business development company under the

Investment Company Act of 1940. GS BDC was formed by The Goldman

Sachs Group, Inc. (“Goldman Sachs”) to invest primarily in

middle-market companies in the United States, and is externally

managed by Goldman Sachs Asset Management, L.P., an SEC-registered

investment adviser and a wholly-owned subsidiary of Goldman Sachs.

GS BDC seeks to generate current income and, to a lesser extent,

capital appreciation primarily through direct originations of

secured debt, including first lien, first lien/last-out unitranche

and second lien debt, and unsecured debt, including mezzanine debt,

as well as through select equity investments. For more information,

visit www.goldmansachsbdc.com. Information on the website is not

incorporated by reference into this press release and is provided

merely for convenience.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that

involve substantial risks and uncertainties. You can identify these

statements by the use of forward-looking terminology such as “may,”

“will,” “should,” “expect,” “anticipate,” “project,” “target,”

“estimate,” “intend,” “continue,” or “believe” or the negatives

thereof or other variations thereon or comparable terminology. You

should read statements that contain these words carefully because

they discuss our plans, strategies, prospects and expectations

concerning our business, operating results, financial condition and

other similar matters. These statements represent the Company’s

belief regarding future events that, by their nature, are uncertain

and outside of the Company’s control. We believe that it is

important to communicate our future expectations to our investors.

There are likely to be events in the future, however, that we are

not able to predict accurately or control. Any forward-looking

statement made by us in this press release speaks only as of the

date on which we make it. Factors or events that could cause our

actual results to differ, possibly materially from our

expectations, include, but are not limited to, the risks,

uncertainties and other factors we identify in the sections

entitled “Risk Factors” and “Cautionary Statement Regarding

Forward-Looking Statements” in filings we make with the Securities

and Exchange Commission, and it is not possible for us to predict

or identify all of them. We undertake no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180917005772/en/

Goldman Sachs BDC, Inc.Investors:Katherine Schneider,

212-902-3122orMedia:Patrick Scanlan, 212-902-6164

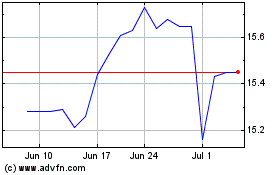

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Aug 2024 to Sep 2024

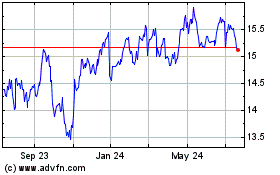

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Sep 2023 to Sep 2024