Hecla Mining Company (NYSE:HL) today announced second quarter

2018 financial and operating results.

HIGHLIGHTS

- Net income applicable to common

shareholders of $11.9 million, or $0.03 per share.

- Adjusted net income applicable to

common shareholders of $3.0 million, or $0.01 per share. 1

- Sales of $147.3 million.

- Adjusted EBITDA of $57.7 million and

net debt/adjusted EBITDA (last 12 months) of 1.2x. 2,3

- Operating cash flow of $30.6 million

compared to $7.5 million in the second quarter of 2017.

- Cost of sales and other direct

production costs and depreciation, depletion and amortization

("cost of sales") of $112.3 million.

- Cash cost, after by-product credits, of

$(0.57) per silver ounce, a 319% decrease compared to the second

quarter of 2017. 4

- All in sustaining cost (AISC), after

by-product credits, of $11.40 per silver ounce. 5

- Cash and cash equivalents and

short-term investments of $245 million at June 30.

- The acquisition of Klondex Mines Ltd.,

and its high-grade gold mines in Nevada, is now closed, and the

integration and optimization of the assets has now begun.

- Credit rating upgrade by S&P Global

to B+ from B, with a stable outlook.

"In the second quarter Hecla performed strongly, reflecting the

investments we are making in our mines and exploration programs,"

said Phillips S. Baker, Jr., President and CEO. "The significant

decline in our silver cash cost, after by-product credits per

ounce, is a function of strong base metals prices and improved

treatment charges. The decline in gold cash cost per ounce is due

to higher throughput at Casa Berardi. Additionally, our exploration

program continues to discover high-grade material at our operations

as well as advance our exploration properties."

"We have now closed the acquisition of the high-grade Nevada

mines, and are beginning their integration into Hecla," Mr. Baker

added. "Our plan is to operate the mines and mill as one unit,

allocating the workforce and capital to generate margins and focus

on profitability, not just on production for production's sake.

Fire Creek has the best margin of the 3 mines by a considerable

amount, so ramping it up is our priority. We are also focused on

the exceptional exploration opportunities in the 110 square mile

land package. "

FINANCIAL OVERVIEW

Second Quarter Ended Six Months Ended

HIGHLIGHTS June 30, 2018 June 30, 2017

June 30, 2018 June 30, 2017

FINANCIAL

DATA

Sales (000)

$ 147,259 $ 134,279

$

286,968 $ 276,823 Gross profit (000)

$

35,002 $ 31,207

$ 73,788 $ 66,123 Income

(loss) applicable to common shareholders (000)

$

11,936 $ (24,154 )

$ 20,038 $ 2,542 Basic and

diluted income (loss) per common share

$ 0.03 $ (0.06

)

$ 0.05 $ 0.01 Net income (loss) (000)

$

12,074 $ (24,016 )

$ 20,314 $ 2,818 Cash

provided by operating activities (000)

$ 30,635 $

7,536

$ 47,018 $ 45,821

Net income applicable to common shareholders for the second

quarter 2018 was $11.9 million, or $0.03 per share, compared to a

net loss applicable to common shareholders of $24.2 million, or

$0.06 per share, for the same period in 2017. The second quarter

result was mainly due to the following items:

- Gain on base metal derivative contracts

of $16.8 million compared to a gain of $2.5 million in the second

quarter of 2017.

- Net foreign exchange gain of $2.5

million recorded in the second quarter of 2018 compared to a loss

of $3.9 million in the same period of 2017.

- Income tax provision of $0.4 million

compared to $16.1 million in the second quarter of 2017, with the

variance due to impacts of U.S. tax reform and lower foreign

taxes.

Operating cash flow was $30.6 million compared to $7.5 million

in the second quarter of 2017, with the increase mainly due to

higher gold and base metals prices and production, partially offset

by higher research and development investment.

Adjusted EBITDA was $57.7 million compared to $48.5 million in

the second quarter of 2017, with the increase mainly due to higher

gold and base metals prices.

Capital expenditures (excluding capitalized interest) at the

operations totaled $26.8 million for the second quarter, similar to

2017. Greens Creek and Lucky Friday expenditures increased by $2.7

million and $0.3 million, respectively, offset by decreased

expenditures at Casa Berardi of $2.3 million and San Sebastian of

$0.7 million. Expenditures at Greens Creek, Casa Berardi, San

Sebastian and Lucky Friday were $14.2 million, $9.8 million, $1.7

million, and $1.1 million respectively.

Metals Prices

The average realized silver price in the second quarter was

$16.61 per ounce, 3% lower than the $17.14 average realized silver

price in the second quarter of 2017. Average realized gold, lead

and zinc prices increased 3%, 19% and 13%, respectively.

Base Metals Forward Sales Contracts

The following table summarizes the quantities of base metals

committed under financially settled forward sales contracts at

June 30, 2018:

Pounds Under Contract(in

thousands)

Average Price per Pound Zinc

Lead Zinc Lead Contracts on forecasted

sales 2018 settlements 9,039 5,787 $ 1.34 $ 1.09 2019

settlements 48,502 20,283 $ 1.40 $ 1.10 2020 settlements 42,329

19,401 $ 1.40 $ 1.13 2021 settlements — 4,409 N/A $ 1.07

The contracts represent 44% of the forecasted payable zinc

production for the 36-month period ended June 30, 2021 at an

average price of $1.39 per pound and 51% of the forecasted payable

lead production for the same period ended June 30, 2021 at an

average price of $1.11 per pound.

OPERATIONS OVERVIEW

Overview

The following table provides the production summary on a

consolidated basis for the second quarter and six months ended

June 30, 2018 and 2017:

Second Quarter Ended Six Months

Ended June 30, 2018

June 30, 2017

June 30, 2018 June 30, 2017

PRODUCTION SUMMARY

Silver - Ounces produced

2,596,423 2,807,474

5,130,518 6,176,901 Payable ounces sold

2,313,753 2,688,721

4,405,217 5,557,835 Gold - Ounces

produced

60,313 52,561

118,121 108,674 Payable ounces

sold

59,643 53,170

114,482 104,541 Lead - Tons

produced

5,522 4,420

11,149 13,056 Payable tons sold

4,745 4,250

8,613 10,676 Zinc - Tons produced

14,299 12,966

29,510 28,503 Payable tons sold

10,686 8,978

20,790 20,825

The following tables provide a summary of the final production,

cost of sales, cash cost, after by-product credits, per silver and

gold ounce, and AISC, after by-product credits, per silver and gold

ounce for the second quarter and six months ended June 30, 2018,

with comparisons to the prior year period:

Second Quarter Ended Greens

Creek Lucky Friday Casa Berardi

San Sebastian

Silver Gold Silver

Gold Silver Gold

Silver Silver Gold Production

(ounces) June 30, 2018 2,596,423

60,313 1,999,791

13,719 24,687 42,722

12,298 559,647

3,872

Increase/(decrease) (211,051 )

7,752 67,744 1,015 24,687

9,461 3,821 (307,303 )

(2,724

)

Cost of sales and other direct production costs and

depreciation, depletion and amortization (000) June

30, 2018 $ 60,562 $

51,695 $ 47,742

$ — $ 1,744 $

51,695 $ — $

11,076

$

— Increase/(decrease) $

1,170 $ 8,015 $ (6,576 ) $ —

$ 1,744 $ 8,015 $ — $ 6,002

$ —

Cash costs, after by-product credits,

per silver or gold ounce 4, 6

June 30, 2018 $ (0.57 )

$ 775 $ (3.47

) $ — $ —

$ 775 $ — $

9.79 $ —

Increase/(decrease) $ (0.83 ) $

(197 ) $ (5.33 ) $ — $ — $ (197 )

$ — $ 13.10 $ —

AISC, after

by-product credits per silver or gold ounce5

June 30, 2018 $ 11.40

$ 1,039 $ 4.43

$ — $ — $

1,039 $ — $

17.15 $ —

Increase/(decrease) $ 1.43

$ (334 ) $ (4.28 ) $ — $ — $

(334 ) $ — $ 17.09 $ —

Six Months Ended

Greens Creek Lucky Friday Casa

Berardi San Sebastian

Silver Gold Silver

Gold Silver Gold

Silver Silver Gold Production

(ounces) June 30, 2018 5,130,518

118,121 3,913,023

26,837 124,467

82,899 21,189 1,071,839

8,385 Increase/(decrease)

(1,046,383 ) 9,447 51,679

111 (556,315 ) 13,831 4,167

(545,914 ) (4,495 )

Cost of sales and other direct

production costs and depreciation, depletion and amortization

(000) June 30, 2018 $

112,298 $ 100,882

$ 89,602 $ —

$ 5,844 $ 100,882

$ — $ 16,852

$ — Increase/(decrease)

$ (12,255 ) $ 14,735 $ (8,712 )

$ — $ (8,698 ) $ 14,735 $ —

$ 5,155 $ —

Cash costs, after by-product credits,

per silver or gold ounce 4, 6

June 30, 2018 $ (1.92 )

$ 800 $ (4.22

) $ — $ —

$ 800 $ —

$ 6.46 $ —

Increase/(decrease) $ (2.50 ) $

(127 ) $ (5.48 ) $ — $ — $ (127

) $ — $ 9.75 $ —

AISC, after

by-product credits per silver or gold ounce5

June 30, 2018 $ 8.61

$ 1,062 $ 2.56

$ — $ —

$ 1,062 $ —

$ 12.95 $ —

Increase/(decrease) $ (0.22 ) $

(250 ) $ (3.72 ) $ — $ — $ (250

) $ — $ 12.71 $ —

Greens Creek Mine - Alaska

At the Greens Creek mine, 2.0 million ounces of silver and

13,719 ounces of gold were produced in the second quarter, compared

to 1.9 million ounces and 12,704 ounces, respectively, in the

second quarter of 2017. The increased silver production was due to

higher grades compared to the second quarter of 2017. The mill

operated at an average of 2,290 tons per day (tpd) in the second

quarter, which was slightly lower than the second quarter of

2017.

The cost of sales for the second quarter was $47.7 million, and

the cash cost, after by-product credits, per silver ounce, was

$(3.47), compared to $54.3 million and $1.86, respectively, for the

second quarter of 2017.4 The AISC, after by-product credits, was

$4.43 per silver ounce for the second quarter compared to $8.71 in

the second quarter of 2017.5 The per ounce silver costs were lower

primarily due to higher gold and base metals prices and production.

Approximately 5% of production is coming from automated headings.

Higher by-product credits in the second quarter 2018, along with

lower exploration expenditures, contributed to lower AISC,

partially offset by higher capital spending. Estimates for cash

cost, after by-product credits, per silver ounce have declined to

$(0.50) from $0.50, and AISC, after by-product credits, declined

per silver ounce to $7.00 from $7.75.

Lucky Friday Mine - Idaho

Preparations for the introduction of the Remote Vein Miner

(RVM), expected in late 2019, continued to be a major focus at

Lucky Friday in the second quarter. The RVM project is proceeding

as expected and has the potential to revolutionize how the Lucky

Friday is mined, making it a safer and more efficient operation. In

addition, limited production and capital improvements continue to

be performed by salaried staff.

Production has been limited since March 13, 2017 due to the

ongoing strike and now the focus is completing the development

necessary to accommodate the RVM in 2019. Costs related to

care-and-maintenance of the mine are reported in a separate line

item in our condensed consolidated statement of operations and are

excluded from the calculation of cost of sales, cash cost, after

by-product credits, per silver ounce and AISC, after by-product

credits, per silver ounce.

Casa Berardi - Quebec

At the Casa Berardi mine, 42,722 ounces of gold were produced in

the second quarter, including 8,979 ounces from the East Mine Crown

Pillar (EMCP) pit, compared to 33,261 ounces in the prior year

period, with the increase primarily due to higher grades. The mill

operated at an average of 3,845 tpd in the second quarter, an

increase of 6% over the second quarter of 2017.

The cost of sales was $51.7 million for the second quarter and

the cash cost, after by-product credits, per gold ounce was $775,

compared to $43.7 million and $972, respectively, in the prior year

period.4,6 The decrease in cash cost, after by-product credits, per

gold ounce is partly due to higher gold production and reduced

costs related to stripping of the EMCP pit. The AISC, after

by-product credits, was $1,039 per gold ounce for the second

quarter compared to $1,373 in the second quarter of 2017, with the

decrease primarily due to higher gold production and lower capital

spending.5

The automated 985 drift project is working well, with the

autonomous haul truck running better and with higher availability

than originally anticipated. The second 40-ton Sandvik autonomous

haul truck is expected to be delivered later this year. Operating

two autonomous trucks is expected to result in operating savings of

several million dollars a year.

San Sebastian - Mexico

At the San Sebastian mine, 559,647 ounces of silver and 3,872

ounces of gold were produced in the second quarter, compared to

866,950 ounces and 6,596 ounces, respectively, in the prior year

period. Although silver and gold production were lower compared to

the second quarter of 2017, both still exceeded our estimates for

the quarter due to the amount of higher-grade stockpile material

processed. The mill operated at an average of 415 tpd in the second

quarter, which was slightly lower than the second quarter of

2017.

The cost of sales was $11.1 million for the second quarter and

the cash cost, after by-product credits, was $9.79 per silver

ounce, compared to $5.1 million and $(3.31), respectively, in the

second quarter of 2017. The cash cost, after by-product credits,

increased as expected, due to lower silver production and higher

mining costs, resulting from the transition of production from the

high grade, shallow open pits to underground. The AISC, after

by-product credits, was $17.15 per silver ounce for the second

quarter compared to $0.06 in the second quarter of 2017,

principally due to the same factors, including increased investment

in development. A reduction in per ounce costs is expected in the

second half of the year as underground production continues to ramp

up.

The Company plans to collect a bulk sample of the Hugh Zone

material from the Francine Vein in the fourth quarter and plans to

process it to determine the viability of processing the material on

a larger scale.

Nevada Operations

Hecla took control of the Nevada assets previously belonging to

Klondex on July 20, 2018. Hecla is quickly moving forward with

multiple initiatives aimed at improving the operations.

Key focus for the integrated Nevada operations:

- All operations now report to a single

Vice President and General Manager, Kevin Shiell.

- Work is underway to create a unified

mine plan including Fire Creek, Midas, Hollister and Hatter Graben,

all feeding the Midas Mill.

- Priority will be given to ramping up

production at Fire Creek and beginning development of Hatter

Graben. Midas is being ramped down, with personnel and machines

moving to Hollister and Fire Creek.

Key focus for the Midas mill:

- Completion of the Carbon-In-Leach (CIL)

circuit to improve recoveries for processing Hollister ore.

- Installation of new sampling equipment

to better reconcile mill and mine reporting.

- Construction of the new tailings

facility.

Key focus for Fire Creek:

- Rehabilitating existing mine access,

increasing development to allow increased throughput from 350 tpd

to 550 tpd.

- Rehabilitation includes improving road

conditions with an engineered roadbase and introducing in-cycle

shotcreting to improve development and better manage ground

conditions.

- Improving mine to mill

reconciliation.

CAPITAL

Expectations for capital investment in 2018 have increased to

$140-$145 million from $95-$105 million, reflecting approximately

$20 million of investments to be made in the Nevada operations,

including $11 million for Fire Creek development and definition

drilling, $5 million for the new tailings facility at the Midas

mill, and $2 million for completion of the CIL plant. The remaining

change in capital estimates is due to the re-allocation of $10

million of costs relating to the RVM that is now being assembled in

Sweden and is no longer a Research and Development expense and an

additional $4 million of capital spending at each of Greens Creek

and San Sebastian.

EXPLORATION

Exploration (including corporate development) expenses for the

second quarter were $7.8 million, an increase of $2.0 million

compared to the prior year period. Full year exploration (including

corporate development) expenses are expected to be $34-37 million,

reflecting $10 million for the Nevada properties and more drilling

at San Sebastian.

A complete summary of exploration for the second quarter can be

found in the exploration news release entitled "Hecla Reports

Continued Discoveries at the Mines, Integrates Nevada, and Advances

Key Projects" issued on August 7, 2018.

PRE-DEVELOPMENT

Pre-development spending was $1.4 million for the quarter,

slightly higher than the $1.1 million for the prior year

period, principally to advance the permitting of Rock Creek and

Montanore.

RESEARCH AND DEVELOPMENT

Research and Development spending was $2.3 million for the

quarter, with completion of the design and procurement phase of the

RVM project. Fabrication of the machine started at the end of the

second quarter and is expected to be complete in the fourth quarter

of 2018, and a testing phase in Sweden during the first half of

2019 is planned. The machine is expected to be delivered to Lucky

Friday in late 2019. Expectations for 2018 Research and Development

spending have declined to $6-$10 million from $12-$16 million, as

investment in the RVM project are expected to be capitalized going

forwards.

2018 ESTIMATES7

The following revised estimates include the expected impact from

the addition of Nevada operations through the acquisition of

Klondex for the 5-month period from August 1 to December 31,

2018.

2018 Production Outlook

Silver Production

(Moz)

Gold Production

(Koz)

Silver Equivalent

(Moz)

Gold Equivalent

(Koz)

Original(if revised)

Current

Original(if revised)

Current

Original(if revised)

Current

Original(if revised)

Current Greens Creek 7.5-8.0

7.5-8.1 50-55 21.0-22.5

300-313 300-315

Lucky Friday

San Sebastian

2.0-2.5 13-17 15-17 3.0-3.5

2.9-3.7 40-52 41-52

Casa Berardi

155-160 157-162

11.0-11.5 155-160 157-162

Nevada

Operations 0.1-0.2

40-50 2.9-3.8 41-52

Total 9.5-10.5 9.6-10.8

218-232 262-284 35.0-37.5

37.8-41.5 495-525 539-581

2018 Cost Outlook

Costs of Sales (million) Cash

cost, after by-product credits, per silver/gold ounce2,5

AISC, after by-product credits, per produced silver/gold

ounce3

Original(if revised)

Current

Original(if revised)

Current

Original(if revised)

Current Greens Creek $198

$0.50 $(0.50) $7.75 $7.00

Lucky Friday

San

Sebastian $44 $8.50

$12.50

Total Silver $242

$2.25 $1.50 $12.75 $12.25

Casa Berardi $185 $800

$1,100

Nevada Operations

$68 $800

$1,100

Total Gold $253

$800 $1,100

2018 Capital and Exploration

Outlook

Original(if revised)

Current 2018E Capital expenditures (excluding

capitalized interest) $95-$105 million

$140-$145 million

2018E Exploration expenditures (includes Corporate

Development) $30-$37 million $34-$37 million

2018E Pre-development expenditures $5

million

2018E Research and Development expenditures

$12-$16 million

$6-$10 million

DIVIDENDS

Common

The Board of Directors elected to declare a quarterly cash

dividend of $0.0025 per share of common stock, payable on or about

August 31, 2018, to shareholders of record on

August 24, 2018. The realized silver price was $16.61 in

the second quarter and therefore did not satisfy the criteria for a

larger dividend under the Company's dividend policy.

The Board of Directors also declared the regular quarterly

dividend of $0.875 per share on the 157,816 outstanding shares of

Series B Cumulative Convertible Preferred Stock. This represents a

total amount to be paid of approximately $138,000. The cash

dividend is payable October 1, 2018, to shareholders of record on

September 14, 2018.

CONFERENCE CALL AND WEBCAST

A conference call and webcast will be held Thursday, August 9,

at 10:00 a.m. Eastern Time to discuss these results. You may join

the conference call by dialing toll-free 1-855-760-8158 or for

international dialing 1-720-634-2922. The participant passcode is

HECLA. Hecla's live and archived webcast can be accessed at

www.hecla-mining.com under Investors or via Thomson StreetEvents

Network.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska,

Idaho, and Mexico and is a gold producer with operating mines in

Quebec, Canada and Nevada. The Company also has exploration and

pre-development properties in eight world-class silver and gold

mining districts in the U.S., Canada and Mexico.

NOTES

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional

information only and do not have any standard meaning prescribed by

generally accepted accounting principles in the United States

(GAAP). These measures should not be considered in isolation or as

a substitute for measures of performance prepared in accordance

with GAAP.

(1) Adjusted net income (loss) applicable to common stockholders

is a non-GAAP measurement, a reconciliation of which to net income

(loss) applicable to common stockholders, the most comparable GAAP

measure, can be found at the end of the release. Adjusted net

income (loss) is a measure used by management to evaluate the

Company's operating performance but should not be considered an

alternative to net income (loss), or cash provided by operating

activities as those terms are defined by GAAP, and does not

necessarily indicate whether cash flows will be sufficient to fund

cash needs. In addition, the Company may use it when formulating

performance goals and targets under its incentive program.

(2) Adjusted EBITDA is a non-GAAP measurement, a reconciliation

of which to net income (loss), the most comparable GAAP measure,

can be found at the end of the release. Adjusted EBITDA is a

measure used by management to evaluate the Company's operating

performance but should not be considered an alternative to net

income (loss), or cash provided by operating activities as those

terms are defined by GAAP, and does not necessarily indicate

whether cash flows will be sufficient to fund cash needs. In

addition, the Company may use it when formulating performance goals

and targets under its incentive program.

(3) Net debt to adjusted EBITDA is a non-GAAP measurement, a

reconciliation of which to debt and net income (loss), the most

comparable GAAP measurements, can be found at the end of the

release. It is an important measure for management to measure

relative indebtedness and the ability to service the debt relative

to its peers. It is calculated as total debt outstanding less total

cash on hand divided by adjusted EBITDA.

(4) Cash cost, after by-product credits, per silver or gold

ounce is a non-GAAP measurement, a reconciliation of which to cost

of sales and other direct production costs and depreciation,

depletion and amortization (sometimes referred to as "cost of

sales" in this release), can be found at the end of the release. It

is an important operating statistic that management utilizes to

measure each mine's operating performance. It also allows the

benchmarking of performance of each mine versus those of our

competitors. As a primary silver mining company, management also

uses the statistic on an aggregate basis - aggregating the Greens

Creek, Lucky Friday and San Sebastian mines - to compare

performance with that of other primary silver mining companies.

With regard to Casa Berardi and the Nevada operations, management

uses cash cost, after by-product credits, per gold ounce to compare

its performance with other gold mines. Similarly, the statistic is

useful in identifying acquisition and investment opportunities as

it provides a common tool for measuring the financial performance

of other mines with varying geologic, metallurgical and operating

characteristics. In addition, the Company may use it when

formulating performance goals and targets under its incentive

program. Cash cost, after by-product credits, per silver ounce is

not presented for Lucky Friday for the second quarters of 2018 and

2017 and the first half of 2018, as production was limited due to

the strike and results are not comparable to those from prior

periods and are not indicative of future operating results under

full production. The estimated fair value of the stockpile acquired

at Hollister has been removed from the cash cost, after by-product

credits calculation.

(5) All in sustaining cost (AISC), after by-product credits, is

a non-GAAP measurement, a reconciliation of which to cost of sales

and other direct production costs and depreciation, depletion and

amortization, the closest GAAP measurement, can be found in the end

of the release. AISC, after by-product credits, includes cost of

sales and other direct production costs, expenses for reclamation

and exploration at the mines sites, corporate exploration related

to sustaining operations, and all site sustaining capital costs.

AISC, after by-product credits, is calculated net of depreciation,

depletion, and amortization and by-product credits. AISC, after

by-product credits, per silver ounce is not presented for Lucky

Friday for the second quarters of 2018 and 2017 and the first half

of 2018, as production was limited due to the strike and results

are not comparable to those from prior periods and are not

indicative of future operating results under full production. 2018

AISC, after by-product credits, per gold ounce for the Nevada

operations excludes $5 million of capital as it distorts the AISC

estimates for the remainder part of the year. The estimated fair

value of the stockpile acquired at Hollister has been removed from

the AISC, after by-product credits calculation.

Current GAAP measures used in the mining industry, such as cost

of goods sold, do not capture all the expenditures incurred to

discover, develop and sustain silver and gold production.

Management believes that all in sustaining costs is a non-GAAP

measure that provides additional information to management,

investors and analysts to help in the understanding of the

economics of our operations and performance compared to other

producers and in the investor's visibility by better defining the

total costs associated with production. Similarly, the statistic is

useful in identifying acquisition and investment opportunities as

it provides a common tool for measuring the financial performance

of other mines with varying geologic, metallurgical and operating

characteristics. In addition, the Company may use it when

formulating performance goals and targets under its incentive

program.

(6) Cash cost, after by-product credits, per gold ounce is only

applicable to Casa Berardi production. Gold produced from Greens

Creek and San Sebastian is treated as a by-product credit against

the silver cash cost.

Other

(7) Expectations for 2018 includes silver, gold, lead and zinc

production from Greens Creek, San Sebastian, Casa Berardi and

Nevada operations converted using Au $1,225/oz, Ag $17.25/oz, Zn

$1.30/lb, and Pb $1.00/lb. Lucky Friday expectations are currently

suspended as there is currently a strike. Numbers may be

rounded.

Cautionary Statements to Investors on Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, including

Canadian securities laws. Such forward-looking statements may

include, without limitation: (i) estimates of future production and

sales; (ii) the impact of the Klondex acquisition on Hecla's

operations and results; (iii) expectations regarding the

development, growth potential, financial performance of the

Company’s projects; (iv) ability to complete construction of the

remote vein miner and for it to operate successfully; (v) impact of

the Lucky Friday strike on production and cash flow; (vi) ability

to generate value from innovations being introduced into the mines;

and (vii) impact of metals prices on cash costs, after by-product

credits. Estimates or expectations of future events or results are

based upon certain assumptions, which may prove to be incorrect.

Such assumptions, include, but are not limited to: (i) there being

no significant change to current geotechnical, metallurgical,

hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of the Company’s projects

being consistent with current expectations and mine plans; (iii)

political/regulatory developments in any jurisdiction in which the

Company operates being consistent with its current expectations;

(iv) the exchange rates for the Canadian dollar and Mexican peso to

the U.S. dollar, being approximately consistent with current

levels; (v) certain price assumptions for gold, silver, lead and

zinc; (vi) prices for key supplies being approximately consistent

with current levels; (vii) the accuracy of our current mineral

reserve and mineral resource estimates; and (viii) the Company’s

plans for development and production will proceed as expected and

will not require revision as a result of risks or uncertainties,

whether known, unknown or unanticipated. Where the Company

expresses or implies an expectation or belief as to future events

or results, such expectation or belief is expressed in good faith

and believed to have a reasonable basis. However, such statements

are subject to risks, uncertainties and other factors, which could

cause actual results to differ materially from future results

expressed, projected or implied by the “forward-looking

statements.” Such risks include, but are not limited to gold,

silver and other metals price volatility, operating risks, currency

fluctuations, increased production costs and variances in ore grade

or recovery rates from those assumed in mining plans, community

relations, conflict resolution and outcome of projects or

oppositions, litigation, political, regulatory, labor and

environmental risks, and exploration risks and results, including

that mineral resources are not mineral reserves, they do not have

demonstrated economic viability and there is no certainty that they

can be upgraded to mineral reserves through continued exploration.

For a more detailed discussion of such risks and other factors, see

the Company’s 2017 Form 10-K, filed on February 15, 2018, and Forms

10-Q filed on May 10, 2018 and August 9, 2018, with the Securities

and Exchange Commission (SEC), as well as the Company’s other SEC

filings. The Company does not undertake any obligation to publicly

release revisions to any “forward-looking statement,” including,

without limitation, outlook, to reflect events or circumstances

after the date of this news release, or to reflect the occurrence

of unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors’ own risk.

HECLA MINING COMPANY

Condensed Consolidated Statements of

Income (Loss)

(dollars and shares in thousands, except

per share amounts - unaudited)

Second Quarter Ended Six Months Ended

June

30, 2018 June 30, 2017

June 30, 2018 June

30, 2017 Sales of products

$ 147,259 $ 134,279

$ 286,968 $ 276,823 Cost of

sales and other direct production costs

80,440 77,503

153,309 156,179 Depreciation, depletion and amortization

31,817 25,569

59,871 54,521

112,257 103,072

213,180

210,700 Gross profit

35,002 31,207

73,788 66,123 Other operating expenses:

General and administrative

9,787 10,309

17,522 19,515

Exploration

7,838 5,853

15,198 10,367 Pre-development

1,415 1,052

2,420 2,304 Research and development

2,337 312

3,773 995 Other operating expense

638 699

1,153 1,362 Provision for closed operations

and environmental matters

1,420 985

2,682 2,104 Lucky

Friday suspension-related costs

6,801 8,024

11,818

9,605 Acquisition costs

1,010 (2 )

3,517

25

31,246 27,232

58,083

46,277 Income from operations

3,756

3,975

15,705 19,846 Other income

(expense): Loss on disposition of investments

— —

—

(167 ) Unrealized (loss) gain on investments

(564 )

(276 )

(254 ) 51 Gain (loss) on derivative contracts

16,804 2,487

20,811 (5,322 ) Interest and other

income

108 319

52 644 Net foreign exchange gain

(loss)

2,476 (3,883 )

5,068 (6,145 ) Interest

expense, net of amount capitalized

(10,079 ) (10,543

)

(19,873 ) (19,065 )

8,745 (11,896 )

5,804 (30,004 ) Income (loss) before income taxes

12,501 (7,921 )

21,509 (10,158 ) Income tax

(provision) benefit

(427 ) (16,095 )

(1,195

) 12,976 Net income (loss)

12,074 (24,016 )

20,314 2,818 Preferred stock dividends

(138 )

(138 )

(276 ) (276 ) Income (loss) applicable to

common shareholders

$ 11,936 $ (24,154 )

$ 20,038 $ 2,542 Basic and diluted

income (loss) per common share after preferred dividends

$

0.03 $ (0.06 )

$ 0.05 $ 0.01

Weighted average number of common shares outstanding - basic

400,619 396,178

399,972 395,774

Weighted average number of common shares outstanding -

diluted

403,610 396,178

402,873

399,236

HECLA MINING COMPANY

Condensed Consolidated Balance Sheets

(dollars and shares in thousands -

unaudited)

June 30, 2018 December 31, 2017

ASSETS Current assets:

Cash and cash equivalents

$ 239,722 $ 186,107

Short-term investments and securities

5,556 33,758 Accounts

receivable: Trade

9,717 14,805 Other, net

19,307

17,385 Inventories

61,054 54,555 Other current assets

17,006 13,715 Total current assets

352,362 320,325 Non-current investments

7,449 7,561

Non-current restricted cash and investments

1,005 1,032

Properties, plants, equipment and mineral interests, net

2,006,592 2,020,021 Non-current deferred income taxes

1,179 1,509 Other non-current assets and deferred charges

24,007 14,509

Total assets $

2,392,594 $ 2,364,957

LIABILITIES

Current liabilities: Accounts payable and accrued liabilities

$ 53,835 $ 46,549 Accrued payroll and related

benefits

23,661 31,259 Accrued taxes

6,143 5,919

Current portion of capital leases

6,015 5,608 Current

portion of debt

— — Other current liabilities

7,364

16,116 Current portion of accrued reclamation and closure costs

8,315 6,679 Total current liabilities

105,333 112,130 Capital leases

8,757 6,193 Accrued

reclamation and closure costs

78,102 79,366 Long-term debt

533,230 502,229 Non-current deferred tax liability

112,462 121,546 Non-current pension liability

48,973

46,628 Other non-current liabilities

4,438 12,983

Total liabilities 891,295 881,075

SHAREHOLDERS’

EQUITY Preferred stock

39 39

Common stock

101,643 100,926 Capital surplus

1,628,440 1,619,816 Accumulated deficit

(176,158

) (195,484 ) Accumulated other comprehensive loss

(31,929 ) (23,373 ) Treasury stock

(20,736

) (18,042 )

Total shareholders’ equity

1,501,299 1,483,882

Total liabilities and

shareholders’ equity $ 2,392,594 $

2,364,957 Common shares outstanding

401,322

399,176

HECLA MINING COMPANY

Condensed Consolidated Statements of Cash

Flows

(dollars in thousands - unaudited)

Six Months Ended

June 30, 2018

June 30, 2017

OPERATING ACTIVITIES

Net income

$ 20,314 $ 2,818

Non-cash elements included in net income: Depreciation, depletion

and amortization

62,852 56,908 Unrealized loss on

investments

254 117 Gain on disposition of properties,

plants, equipment and mineral interests

(166 ) (94 )

Provision for reclamation and closure costs

2,640 2,247

Stock compensation

2,441 2,831 Deferred income taxes

(2,977 ) (22,113 ) Amortization of loan origination

fees

898 967 (Gain) loss on derivative contracts

(30,236 ) 5,386 Foreign exchange (gain) loss

(5,348 ) 5,201 Other non-cash items, net

(35

) 2 Change in assets and liabilities: Accounts receivable

2,471 (1,150 ) Inventories

(6,865 ) 1,594

Other current and non-current assets

(2,507 ) 3,896

Accounts payable and accrued liabilities

8,701 (10,937 )

Accrued payroll and related benefits

(337 ) (4,901 )

Accrued taxes

(672 ) 4,408 Accrued reclamation and

closure costs and other non-current liabilities

(4,410

) (1,359 )

Cash provided by operating

activities 47,018 45,821

INVESTING ACTIVITIES

Additions to properties, plants,

equipment and mineral interests

(43,304 ) (45,964 )

Proceeds from disposition of properties, plants and equipment

463 142 Purchases of investments

(31,682 )

(23,280 ) Maturities of investments

59,336

14,356

Net cash used in investing activities

(15,187 ) (54,746 )

FINANCING ACTIVITIES

Proceeds from issuance of stock, net of

related costs

— 9,610 Acquisition of treasury shares

(2,694 ) (2,474 ) Dividends paid to common

shareholders

(2,000 ) (1,981 ) Dividends paid to

preferred shareholders

(276 ) (276 ) Credit

availability and debt issuance fees paid

(3 ) (91 )

Repayments of debt

— (470 ) Issuance of debt

31,024 —

Repayments of capital leases

(3,762 ) (3,245 )

Net cash provided by financing activities 22,289

1,073 Effect of exchange rates on cash

(532 ) 1,086 Net increase (decrease) in cash, cash

equivalents and restricted cash

53,588 (6,766 ) Cash, cash

equivalents and restricted cash at beginning of period

187,139 171,977 Cash, cash equivalents

and restricted cash at end of period

$ 240,727

$ 165,211

HECLA MINING COMPANY

Production Data

Three Months Ended Six Months Ended

June 30, 2018 June 30, 2017

June 30,

2018 June 30, 2017

GREENS CREEK UNIT

Tons of ore milled

208,409 210,788

419,839 407,917

Mining cost per ton of ore

$ 69.83 $ 68.17

$

69.41 $ 69.74 Milling cost per ton of ore

$

33.59 $ 32.56

$ 33.11 $ 33.12 Ore grade milled

- Silver (oz./ton)

12.46 12.11

12.08 12.40 Ore grade

milled - Gold (oz./ton)

0.100 0.097

0.097 0.099 Ore

grade milled - Lead (%)

3.17 2.68

3.06 2.86 Ore grade

milled - Zinc (%)

7.84 7.20

7.95 7.50 Silver produced

(oz.)

1,999,791 1,932,047

3,913,023 3,861,344 Gold

produced (oz.)

13,719 12,704

26,837 26,726 Lead

produced (tons)

5,305 4,420

10,326 9,229 Zinc

produced (tons)

14,179 12,966

28,978 26,372 Cash

cost, after by-product credits, per silver ounce (1)

$

(3.47 ) $ 1.86

$ (4.22 ) $ 1.26

AISC, after by-product credits, per silver ounce (1)

$

4.43 $ 8.71

$ 2.56 $ 6.28 Capital additions

(in thousands)

$ 14,183 $ 11,451

$ 23,665 $ 16,685

LUCKY FRIDAY UNIT

Tons of ore milled

3,447 —

13,006

57,069 Mining cost per ton of ore

$ 89.54 $ —

$ 108.08 $ 104.72 Milling cost per ton of ore

$ 6.15 $ —

$ 17.56 $ 27.16 Ore grade

milled - Silver (oz./ton)

10.63 —

10.98 12.39 Ore

grade milled - Lead (%)

7.28 —

7.01 7.05 Ore grade

milled - Zinc (%)

3.43 —

4.43 3.99 Silver produced

(oz.)

24,687 —

124,467 680,782 Lead produced (tons)

217 —

823 3,827 Zinc produced (tons)

120 —

532 2,131 Cash cost, after by-product credits, per silver

ounce (1)

$ — $ —

$ — 5.93 AISC, after

by-product credits, per silver ounce (1)

$ — $ —

$ — $ 12.06 Capital additions (in thousands)

$

1,061 $ 805

$ 2,049 $ 4,792

Three Months Ended Six Months Ended

June

30, 2018 June 30, 2017

June 30, 2018

June 30, 2017

CASA BERARDI UNIT

Tons of ore milled - underground

184,373 195,039

375,706 399,992

Tons of ore milled - surface pit

165,564 135,070

322,780 223,809 Tons of ore milled - total

349,937

330,109

698,486 623,801 Surface tons mined - ore and waste

1,961,171 2,106,308

3,637,605 4,416,543 Mining cost

per ton of ore - underground

$ 106.75 $ 99.01

$ 106.28 $ 99.23 Mining cost per ton - combined

$ 73.61 $ 76.83

$ 75.28 $ 81.42 Mining

cost per ton of ore and waste - surface tons mined

$

3.10 $ 2.53

$ 3.48 $ 2.58 Milling cost per ton

of ore

$ 16.71 $ 15.50

$ 16.34 $ 16.33

Ore grade milled - Gold (oz./ton) - underground

0.209 0.148

0.195 0.155 Ore grade milled - Gold (oz./ton) - surface pit

0.062 0.078

0.070 0.082 Ore grade milled - Gold

(oz./ton) - combined

0.140 0.119

0.137 0.129 Ore

grade milled - Silver (oz./ton)

0.04 0.03

0.03 0.03

Gold produced (oz.) - underground

33,743 23,780

63,265 52,430 Gold produced (oz.) - surface pit

8,979

9,481

19,634 16,638 Gold produced (oz.) - total

42,722 33,261

82,899 69,068 Silver produced (oz.)

12,298 8,477

21,189 17,022 Cash cost, after

by-product credits, per gold ounce (1)

$ 775 $ 972

$ 800 $ 927 AISC, after by-product credits, per gold

ounce (1)

$ 1,039 $ 1,373

$ 1,062 $

1,312 Capital additions (in thousands)

$ 9,809

$ 12,063

$ 18,876

$ 24,474

SAN SEBASTIAN

Tons of ore milled

37,780

38,478

72,177 75,141 Mining cost per ton of ore

$

180.12 $ 41.63

$ 149.14 $ 40.16 Milling cost

per ton of ore

$ 65.46 $ 66.97

$ 66.25

$ 65.29 Ore grade milled - Silver (oz./ton)

15.93 23.87

16.01 22.85 Ore grade milled - Gold (oz./ton)

0.115

0.182

0.127 0.182 Silver produced (oz.)

559,647

866,950

1,071,839 1,617,753 Gold produced (oz.)

3,872

6,596

8,385 12,880 Cash cost, after by-product credits, per

silver ounce (1)

$ 9.79 $ (3.31 )

$

6.46 $ (3.29 ) AISC, after by-product credits, per silver

ounce (1)

$ 17.15 $ 0.06

$ 12.95 $ 0.24

Capital additions (in thousands)

$ 1,680

$ 2,423

$ 2,110

$ 4,130 (1) Cash cost, after by-product

credits, per ounce and AISC, after by-product credits. per ounce

represent non-U.S. Generally Accepted Accounting Principles (GAAP)

measurements. A reconciliation of cost of sales and other direct

production costs and depreciation, depletion and amortization

(GAAP) to cash cost, after by-product credits can be found in the

cash cost per ounce reconciliation section of this news release.

Gold, lead and zinc produced have been treated as by-product

credits in calculating silver costs per ounce. The primary metal

produced at Casa Berardi is gold, with a by-product credit for the

value of silver production.

Non-GAAP Measures(Unaudited)

Reconciliation of Cost of Sales and Other Direct Production

Costs and Depreciation, Depletion and Amortization (GAAP) to Cash

Cost, Before By-product Credits and Cash Cost, After By-product

Credits (non-GAAP) and All-In Sustaining Cost, Before By-product

Credits and All-In Sustaining Cost, After By-product Credits

(non-GAAP)

The tables below present reconciliations between the most

comparable GAAP measure of cost of sales and other direct

production costs and depreciation, depletion and amortization to

the non-GAAP measures of Cash Cost, Before By-product Credits, Cash

Cost, After By-product Credits, AISC, Before By-product Credits and

AISC, After By-product Credits for our operations at the Greens

Creek, Lucky Friday, San Sebastian and Casa Berardi units for the

three- and six-month periods ended June 30, 2018 and 2017 and

for estimated result for the full-year of 2018.

Cash Cost, After By-product Credits, per Ounce is an important

operating statistic that we utilize to measure each mine's

operating performance. AISC, After By-product Credits, per Ounce is

an important operating statistic that we utilize as a measures of

our mines' net cash flow after costs for exploration,

pre-development, reclamation, and sustaining capital. Current GAAP

measures used in the mining industry, such as cost of goods sold,

do not capture all the expenditures incurred to discover, develop

and sustain silver and gold production. Cash Cost, After By-product

Credits, per Ounce and AISC, After By-product Credits, per Ounce

also allow us to benchmark the performance of each of our mines

versus those of our competitors. As a primary silver mining

company, we also use these statistics on an aggregate basis -

aggregating the Greens Creek, Lucky Friday and San Sebastian mines

- to compare our performance with that of other primary silver

mining companies. With regard to Casa Berardi, we use Cash Cost,

After By-product Credits, per Gold Ounce AISC, After By-product

Credits, per Gold Ounce to compare its performance with other gold

mines. Similarly, these statistics are useful in identifying

acquisition and investment opportunities as they provide a common

tool for measuring the financial performance of other mines with

varying geologic, metallurgical and operating characteristics.

Cash Cost, Before By-product Credits and AISC, Before By-product

Credits include all direct and indirect operating cash costs

related directly to the physical activities of producing metals,

including mining, processing and other plant costs, third-party

refining expense, on-site general and administrative costs,

royalties and mining production taxes. AISC, Before By-product

Credits for each mine also includes on-site exploration,

reclamation, and sustaining capital costs. AISC, Before By-product

Credits for our consolidated silver properties also includes

corporate costs for general and administrative expense,

reclamation, exploration, and pre-development. By-product credits

include revenues earned from all metals other than the primary

metal produced at each unit. As depicted in the tables below,

by-product credits comprise an essential element of our silver unit

cost structure, distinguishing our silver operations due to the

polymetallic nature of their orebodies. Cash Cost, After By-product

Credits, per Ounce and AISC, After By-product Credits, per Ounce

provide management and investors an indication of operating cash

flow, after consideration of the average price, received from

production. We also use these measurements for the comparative

monitoring of performance of our mining operations period-to-period

from a cash flow perspective. Cash Cost, After By-product Credits,

per Ounce is a measure developed by precious metals companies

(including the Silver Institute) in an effort to provide a uniform

standard for comparison purposes. There can be no assurance,

however, that our reporting of these non-GAAP measures are the same

as those reported by other mining companies.

The Casa Berardi section below reports Cash Cost, After

By-product Credits, per Gold Ounce and AISC, After By-product

Credits, per Gold Ounce for the production of gold, its primary

product, and by-product revenues earned from silver, which is a

by-product at Casa Berardi. Only costs and ounces produced relating

to units with the same primary product are combined to represent

Cash Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce. Thus, the gold produced at our Casa

Berardi unit is not included as a by-product credit when

calculating Cash Cost, After By-product Credits, per Silver Ounce

and AISC, After By-product Credits, per Silver Ounce for the total

of Greens Creek, Lucky Friday and San Sebastian, our combined

silver properties.

In thousands (except per ounce amounts) Three Months Ended

June 30, 2018 Greens Creek Lucky Friday(2) San

Sebastian Corporate(3) Total Silver Casa

Berardi (Gold) Total Cost of sales and other direct

production costs and depreciation, depletion and amortization $

47,742 1,744 $ 11,076 $ 60,562 $ 51,695 $ 112,257 Depreciation,

depletion and amortization (11,813 ) (182 ) (1,107 ) (13,102 )

(18,715 ) (31,817 ) Treatment costs 9,481 55 116 9,652 559 10,211

Change in product inventory 321 (1,160 ) 769 (70 ) (78 ) (148 )

Reclamation and other costs (449 ) (58 ) (319 ) (826 ) (139 ) (965

) Exclusion of Lucky Friday cash costs — (399 ) —

(399 ) — (399 ) Cash Cost, Before By-product Credits (1)

45,282 — 10,535 55,817 33,322 89,139 Reclamation and other costs

850 103 953 140 1,093 Exploration 778 2,334 434 3,546 1,330 4,876

Sustaining capital 14,183 1,680 517 16,380 9,809 26,189 General and

administrative 9,787 9,787 9,787

AISC, Before By-product Credits (1) 61,093 — 14,652 86,483

44,601 131,084 By-product credits: Zinc (27,492 ) — (27,492 )

(27,492 ) Gold (15,716 ) — (5,057 ) (20,773 ) (20,773 ) Lead (9,022

) — (9,022 ) (9,022 ) Silver (201 )

(201 ) Total By-product credits (52,230 ) — (5,057 ) (57,287

) (201 ) (57,488 ) Cash Cost, After By-product Credits $ (6,948 ) $

— $ 5,478 $ (1,470 ) $ 33,121 $ 31,651

AISC, After By-product Credits $ 8,863 $ — $ 9,595

$ 29,196 $ 44,400 $ 73,596 Divided by

ounces produced 2,000 — 560 2,560 43 Cash Cost, Before By-product

Credits, per Ounce $ 22.65 $ — $ 18.82 $ 21.81 $ 779.96 By-product

credits per ounce (26.12 ) — (9.03 ) (22.38 ) (4.70 ) Cash

Cost, After By-product Credits, per Ounce $ (3.47 ) $ — $

9.79 $ (0.57 ) $ 775.26 AISC, Before By-product

Credits, per Ounce $ 30.55 $ — $ 26.18 $ 33.78 $ 1,043.97

By-product credits per ounce (26.12 ) — (9.03 ) (22.38 )

(4.70 ) AISC, After By-product Credits, per Ounce $ 4.43 $ —

$ 17.15 $ 11.40 $ 1,039.27 In

thousands (except per ounce amounts) Three Months Ended June

30, 2017 Greens Creek Lucky Friday(2) San Sebastian

Corporate(3) Total Silver Casa Berardi (Gold)

Total Cost of sales and other direct production costs and

depreciation, depletion and amortization $ 54,318 $ — $ 5,074 $

59,392 $ 43,680 $ 103,072 Depreciation, depletion and amortization

(13,503 ) — (722 ) (14,225 ) (11,344 ) (25,569 ) Treatment costs

11,423 — 259 11,682 554 12,236 Change in product inventory (5,542 )

— 815 (4,727 ) (212 ) (4,939 ) Reclamation and other costs (694 ) —

(5 ) (699 ) (212 ) (911 ) Cash Cost, Before By-product

Credits (1) 46,002 — 5,421 51,423 32,466 83,889 Reclamation and

other costs 667 — 117 784 213 997 Exploration 1,117 — 1,957 452

3,526 1,071 4,597 Sustaining capital 11,451 — 845 256 12,552 12,059

24,611 General and administrative 10,309

10,309 10,309 AISC, Before By-product Credits

(1) 59,237 — 8,340 78,594 45,809 124,403 By-product credits: Zinc

(21,647 ) — (21,647 ) (21,647 ) Gold (13,917 ) (8,287 ) (22,204 )

(22,204 ) Lead (6,847 ) — (6,847 ) (6,847 ) Silver

(142 ) (142 ) Total By-product credits (42,411 ) —

(8,287 ) (50,698 ) (142 ) (50,840 ) Cash Cost, After

By-product Credits $ 3,591 $ — $ (2,866 ) $ 725

$ 32,324 $ 33,049 AISC, After By-product

Credits $ 16,826 $ — $ 53 $ 27,896 $

45,667 $ 73,563 Divided by ounces produced 1,932 —

867 2,799 33 Cash Cost, Before By-product Credits, per Ounce $

23.81 $ — $ 6.25 $ 18.37 $ 976.07 By-product credits per ounce

(21.95 ) — (9.56 ) (18.11 ) (4.25 ) Cash Cost, After

By-product Credits, per Ounce $ 1.86 $ — $ (3.31 ) $

0.26 $ 971.82 AISC, Before By-product Credits, per

Ounce $ 30.66 $ — $ 9.62 $ 28.08 $ 1,377.21 By-product credits per

ounce (21.95 ) — (9.56 ) (18.11 ) (4.25 ) AISC, After

By-product Credits, per Ounce $ 8.71 $ — $ 0.06

$ 9.97 $ 1,372.96 In thousands (except

per ounce amounts) Six Months Ended June 30, 2018 Greens

Creek Lucky Friday(2) San Sebastian

Corporate(3) Total Silver Casa Berardi (Gold)

Total Cost of sales and other direct production costs and

depreciation, depletion and amortization $ 89,602 $ 5,844 $ 16,852

$ 112,298 $ 100,882 $ 213,180 Depreciation, depletion and

amortization (22,452 ) (803 ) (1,791 ) (25,046 ) (34,825 ) (59,871

) Treatment costs 20,869 627 320 21,816 1,094 22,910 Change in

product inventory 5,475 (2,182 ) 3,407 6,700 (179 ) 6,521

Reclamation and other costs (1,360 ) (103 ) (814 ) (2,277 ) (281 )

(2,558 ) Exclusion of Lucky Friday cash costs — (3,383 ) —

(3,383 ) — (3,383 ) Cash Cost, Before By-product

Credits (1) 92,134 — 17,974 110,108 66,691 176,799 Reclamation and

other costs 1,699 — 209 1,908 283 2,191 Exploration 1,138 — 4,646

878 6,662 2,520 9,182 Sustaining capital 23,665 — 2,110 634 26,409

18,876 45,285 General and administrative

17,522 17,522 17,522 AISC, Before By-product

Credits (1) 118,636 — 24,939 162,609 88,370 250,979 By-product

credits: Zinc (59,634 ) — (59,634 ) (59,634 ) Gold (31,008 )

(11,055 ) (42,063 ) (42,063 ) Lead (17,996 ) — (17,996 ) (17,996 )

Silver (349 ) (349 ) Total By-product

credits (108,638 ) — (11,055 ) (119,693 ) (349 ) (120,042 )

Cash Cost, After By-product Credits $ (16,504 ) $ — $ 6,919

$ (9,585 ) $ 66,342 $ 56,757 AISC, After

By-product Credits $ 9,998 $ — $ 13,884 $

42,916 $ 88,021 $ 130,937 Divided by ounces

produced 3,913 — 1,072 4,985 83 Cash Cost, Before By-product

Credits, per Ounce $ 23.54 $ — $ 16.77 $ 22.09 $ 804.44 By-product

credits per ounce (27.76 ) — (10.31 ) (24.01 ) (4.17 ) Cash

Cost, After By-product Credits, per Ounce $ (4.22 ) $ — $

6.46 $ (1.92 ) $ 800.27 AISC, Before By-product

Credits, per Ounce $ 30.32 $ — $ 23.26 $ 32.62 $ 1,065.95

By-product credits per ounce (27.76 ) — (10.31 ) (24.01 )

(4.17 ) AISC, After By-product Credits, per Ounce $ 2.56 $ —

$ 12.95 $ 8.61 $ 1,061.78 In

thousands (except per ounce amounts) Six Months Ended June

30, 2017 Greens Creek Lucky Friday(2) San Sebastian

Corporate(3) Total Silver Casa Berardi (Gold)

Total Cost of sales and other direct production costs and

depreciation, depletion and amortization $ 98,314 $ 14,542 $ 11,697

$ 124,553 $ 86,147 $ 210,700 Depreciation, depletion and

amortization (26,835 ) (2,433 ) (1,395 ) (30,663 ) (23,858 )

(54,521 ) Treatment costs 25,554 3,817 484 29,855 1,092 30,947

Change in product inventory (2,277 ) (149 ) 435 (1,991 ) 1,169 (822

) Reclamation and other costs (1,080 ) (181 ) (595 ) (1,856 ) (230

) (2,086 ) Cash Cost, Before By-product Credits (1) 93,676 15,596

10,626 119,898 64,320 184,218 Reclamation and other costs 1,333 179

234 1,746 230 1,976 Exploration 1,395 1 3,489 830 5,715 1,868 7,583

Sustaining capital 16,685 3,990 1,977 1,170 23,822 24,470 48,292

General and administrative 19,515 19,515

19,515 AISC, Before By-product Credits (1)

113,089 19,766 16,326 170,696 90,888 261,584 By-product credits:

Zinc (45,426 ) (4,060 ) (49,486 ) (49,486 ) Gold (28,769 ) (15,944

) (44,713 ) (44,713 ) Lead (14,629 ) (7,496 ) (22,125 ) (22,125 )

Silver (289 ) (289 ) Total By-product

credits (88,824 ) (11,556 ) (15,944 ) (116,324 ) (289 ) (116,613 )

Cash Cost, After By-product Credits $ 4,852 $ 4,040 $

(5,318 ) $ 3,574 $ 64,031 $ 67,605 AISC, After

By-product Credits $ 24,265 $ 8,210 $ 382 $

54,372 $ 90,599 $ 144,971 Divided by ounces

produced 3,861 681 1,618 6,160 69 Cash Cost, Before By-product

Credits, per Ounce $ 24.27 $ 22.90 $ 6.56 $ 19.46 $ 931.26

By-product credits per ounce (23.01 ) (16.97 ) (9.85 ) (18.88 )

(4.18 ) Cash Cost, After By-product Credits, per Ounce $ 1.26

$ 5.93 $ (3.29 ) $ 0.58 $ 927.08 AISC,

Before By-product Credits, per Ounce $ 29.29 $ 29.03 $ 10.09 $

27.71 $ 1,315.92 By-product credits per ounce (23.01 ) (16.97 )

(9.85 ) (18.88 ) (4.18 ) AISC, After By-product Credits, per Ounce

$ 6.28 $ 12.06 $ 0.24 $ 8.83 $ 1,311.74

In thousands (except per ounce amounts) Current

Estimate for Twelve Months Ended December 31, 2018

Greens

Creek

Lucky

Friday(2)

San

Sebastian

Corporate(3)

Total

Silver

Casa

Berardi

Nevada(4)

Total

Gold

Cost of sales and other direct production costs and depreciation,

depletion and amortization $ 198,000 $ 44,000 $ 242,000 $ 185,000 $

68,000 $ 253,000 Depreciation, depletion and amortization

(50,000 ) (6,000 ) (56,000 ) (58,000 ) (16,000 ) (74,000 )

Treatment costs 44,000 550 44,550 400 — 400 Adjustment for

inventory acquired (14,000 ) Change in product inventory — (1,000 )

(1,000 ) — — — Reclamation and other costs (2,900 ) (500 )

(3,400 ) (800 ) — (800 ) Cash Cost, Before By-product

Credits (1) 189,100 37,050 226,150 126,600 38,000 178,600

Reclamation and other costs 2,500 240 2,740 450 — 450 Exploration

3,500 4,800 2,500 10,800 5,000 5,000 10,000 Sustaining capital

51,000 3,700 2,000 56,700 45,000 18,000 63,000 General and

administrative 35,000 35,000

AISC, Before By-product Credits (1) 246,100

45,790 331,390 177,050 61,000

252,050 By-product credits (193,000 ) (18,000 ) (211,000 )

(800 ) (3,000 ) (3,800 ) Cash Cost, After By-product Credits $

(3,900 ) $ 19,050 $ 15,150 $ 125,800 $

35,000 $ 174,800 AISC, After By-product

Credits $ 53,100 $ 27,790 $ 120,390 $

176,250 $ 58,000 $ 248,250 Divided by

ounces produced 7,800 2,250 10,050 160 50 210 Cash Cost, Before

By-product Credits, per Ounce $ 24.24 $ 16.47 $ 22.50 $ 791 $ 760 $

850 By-product credits per ounce (24.74 ) (8.00 ) (21.00 )

(5 ) (60 ) (18 ) Cash Cost, After By-product Credits, per Ounce $

(0.50 ) $ 8.47 $ 1.50 $ 786 $ 700

$ 832 AISC, Before By-product Credits, per Ounce $

31.55 $ 20.35 $ 32.97 $ 1,107 $ 1,220 $ 1,200 By-product credits

per ounce (24.74 ) (8.00 ) (21.00 ) (5 ) (60 ) (18 ) AISC,

After By-product Credits, per Ounce $ 6.81 $ 12.35

$ 11.97 $ 1,102 $ 1,160 $ 1,182

In thousands (except per ounce amounts) Original Estimate

for Twelve Months Ended December 31, 2018

Greens

Creek

San

Sebastian

Corporate(3)

Total

Silver

Casa

Berardi

Cost of sales and other direct production costs and depreciation,

depletion and amortization $ 198,000 $ 44,000 $ 242,000 $ 185,000

Depreciation, depletion and amortization (50,000 ) (6,000 ) (56,000

) (58,000 ) Treatment costs 44,000 550 44,550 400 Change in product

inventory — (1,000 ) (1,000 ) — Reclamation and other costs (2,900

) (500 ) (3,400 ) (800 ) Cash Cost, Before By-product Credits (1)

189,100 37,050 226,150 126,600 Reclamation and other costs 2,500

240 2,740 450 Exploration 3,500 4,800 2,500 10,800 5,000 Sustaining

capital 51,000 3,700 2,000 56,700 45,000 General and administrative

35,000 35,000 — AISC, Before By-product

Credits (1) 246,100 45,790 331,390 177,050

By-product credits (186,000 ) (18,000 ) (204,000 ) (800 )

Cash Cost, After By-product Credits $ 3,100 $ 19,050

$ 22,150 $ 125,800 AISC, After By-product Credits $

60,100 $ 27,790 $ 127,390 $ 176,250

Divided by ounces produced 7,750 2,250 10,000 158 Cash Cost, Before

By-product Credits, per Ounce $ 24.40 $ 16.47 $ 22.62 $ 801

By-product credits per ounce (24.00 ) (8.00 ) (20.40 ) (5 ) Cash

Cost, After By-product Credits, per Ounce $ 0.40 $ 8.47

$ 2.22 $ 796 AISC, Before By-product Credits,

per Ounce $ 31.75 $ 20.35 $ 33.14 $ 1,121 By-product credits per

ounce (24.00 ) (8.00 ) (20.40 ) (5 ) AISC, After By-product

Credits, per Ounce $ 7.75 $ 12.35 $ 12.74 $

1,116 (1) Includes all direct and indirect

operating costs related to the physical activities of producing

metals, including mining, processing and other plant costs,

third-party refining and marketing expense, on-site general and

administrative costs, royalties and mining production taxes, before

by-product revenues earned from all metals other than the primary

metal produced at each unit. AISC, Before By-product Credits also

includes on-site exploration, reclamation, and sustaining capital

costs. (2) The unionized employees at Lucky Friday have been

on strike since March 13, 2017, and production at Lucky Friday has

been limited since that time. As a result, for the first quarter of

2018 and 2017 and the first half of 2018 Cash Cost, Before

By-product Credits, Cash Cost, After By-product Credits, AISC,

Before By-product Credits, and AISC, After By-product Credits are

not presented for Lucky Friday, and costs related to the limited

production at Lucky Friday are excluded from the calculation of

Cash Cost, Before By-product Credits, Cash Cost, After By-product

Credits, AISC, Before By-product Credits, and AISC, After

By-product Credits for our combined silver operations. (3)

AISC, Before By-product Credits for our consolidated silver

properties includes corporate costs for general and administrative

expense, exploration and sustaining capital.

(4)

Nevada 2018 estimate is for the time

period July 20 to December 31, 2018.

Reconciliation of Net Income (Loss) Applicable to Common

Shareholders (GAAP) to Adjusted Net Income (Loss) Applicable to

Common Stockholders (non-GAAP)

This release refers to a non-GAAP measure of adjusted net income

(loss) applicable to common stockholders and adjusted net income

(loss) per share, which are indicators of our performance. They

exclude certain impacts which are of a nature which we believe are

not reflective of our underlying performance. Management believes

that adjusted net income (loss) per common share provides investors

with the ability to better evaluate our underlying operating

performance.

Dollars are in thousands (except per share amounts) Three

Months Ended June 30, Six Months Ended June 30,

2018

2017

2018 2017 Net income (loss)

applicable to common shareholders (GAAP)

$ 11,936

$ (24,154 )

$ 20,038 $ 2,542

Adjusting items: (Gains) losses on derivatives contracts

(16,804 ) (2,487 )

(20,811 ) 5,322

Provisional price losses

2,517 1,308

2,582 680

Foreign exchange (gain) loss

(2,476 ) 3,883

(5,068 ) 6,145 Lucky Friday suspension-related costs

6,801 8,024

11,818 9,605 Acquisition costs

1,010 (2 )

3,517 25 Bond offering costs

—

1,050

— 1,050 Nonrecurring deferred income tax adjustments

— —

— (17,486 ) Adjusted net

income (loss) applicable to common shareholders

$

2,984 $ (12,378 )

$ 12,076 $

7,883 Weighted average shares - basic

400,619 396,178

399,972 395,774 Weighted average shares - diluted

403,610 396,178

402,873 399,236 Basic adjusted net

income (loss) per common share

$ 0.01 $ (0.03 )

$ 0.03 $ 0.02 Diluted adjusted net income (loss) per

common share

$ 0.01 $ (0.03 )

$ 0.03 $

0.02

Reconciliation of Net Income (Loss) (GAAP) and Debt (GAAP) to

Adjusted EBITDA (non-GAAP) and Net Debt (non-GAAP)

This release refers to the non-GAAP measures of adjusted

earnings before interest, taxes, depreciation and amortization

("Adjusted EBITDA"), which is a measure of our operating

performance, and net debt to adjusted EBITDA for the last 12 months

(or "LTM adjusted EBITDA"), which is a measure of our ability to

service our debt. Adjusted EBITDA is calculated as net income

(loss) before the following items: interest expense, income tax

provision, depreciation, depletion, and amortization expense,

exploration expense, pre-development expense, acquisition costs,

foreign exchange gains and losses, gains and losses on derivative

contracts, Lucky Friday suspension-related costs, provisional price

gains and losses, stock-based compensation, unrealized gains on

investments, provisions for closed operations, and interest and

other income (expense). Net debt is calculated as total debt, which

consists of the liability balances for our Senior Notes, capital

leases, and other notes payable, less the total of our cash and

cash equivalents and short-term investments. Management believes

that, when presented in conjunction with comparable GAAP measures,

Adjusted EBITDA and net debt to LTM adjusted EBITDA are useful to

investors in evaluating our operating performance and ability to

meet our debt obligations. The following table reconciles net

income (loss) and debt to Adjusted EBITDA and net debt:

Dollars are in thousands

Three Months EndedJune 30,

Six Months EndedJune 30,

Twelve Months EndedJune 30,

2018 2017

2018 2017

2018

2017 Net income (loss)

$ 12,074 $ (24,016 )

$

20,314 $ 2,818

$ (6,023 ) $ 48,867

Plus: Interest expense, net of amount capitalized

10,079

10,543

19,873 19,065

38,820 29,780 Plus/(Less):

Income taxes

427 16,095

1,195 (12,976 )

34,050

1,302 Plus: Depreciation, depletion and amortization

31,817

25,569

59,871 54,521

121,412 114,217 Plus:

Exploration expense

7,838 5,853

15,198 10,367

28,341 18,775 Plus: Pre-development expense

1,415

1,052

2,420 2,304

5,564 4,516 Plus/(Less): Foreign

exchange (gain) loss

(2,476 ) 3,883

(5,068

) 6,145

(913 ) (1,017 ) Plus: Lucky Friday

suspension-related costs

6,801 8,024

11,818 9,605

23,514 9,605 Plus/(Less): (Gains) losses on disposition of

properties, plants, equipment and mineral interests

(36

) —

(166 ) —

— — Plus: Acquisition

costs

1,010 (2 )

3,517 25

3,517 2,318 Plus:

Stock-based compensation

1,314 1,482

2,404 2,831

5,904 5,549 Plus/(Less): (Gains) losses on derivative

contracts

(16,804 ) (2,487 )

(20,811 )

5,322

(4,883 ) 893 Plus: Provisional price loss

2,517 1,308

2,582 680

1,160 3,115 Plus:

Provision for closed operations and environmental matters

1,317 1,221

2,640 2,247

4,901 5,055

Plus/(Less): Unrealized loss (gain) on investments

564 276

254 (51 )

552 565 Other

(108 ) (319 )

(52 ) (644 )

(934 ) (1,116 ) Adjusted

EBITDA

$ 57,749 $ 48,482

$

115,989 $ 102,259

$ 254,982

$ 242,424 Total debt

$ 548,002 $

514,702 Less: Cash, cash equivalents and short-term investments

$ (245,278 ) $ (201,929 ) Net debt

$

302,724 $ 312,773 Net debt/LTM adjusted EBITDA

(non-GAAP)

1.2 1.3

Reconciliation of Cash Provided by Operating Activities

(GAAP) to Free Cash Flow (non-GAAP)

This release refers to a non-GAAP measure of free cash flow,

calculated as cash provided by operating activities, less additions

to properties, plants, equipment and mineral interests. Management

believes that, when presented in conjunction with comparable GAAP

measures, free cash flow is useful to investors in evaluating our

operating performance. The following table reconciles cash provided

by operating activities to free cash flow:

Dollars are in thousands

Three Months EndedJune 30,

2018 2017 Cash provided by operating activities

$ 30,635 $ 7,536 Less: Additions to properties,

plants equipment and mineral interests

(25,669 )

(24,306 ) Free cash flow

$ 4,966 $ (16,770 )

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180809005207/en/

Hecla Mining CompanyMike Westerlund, 800-HECLA91

(800-432-5291)Vice President - Investor

Relationshmc-info@hecla-mining.comwww.hecla-mining.com

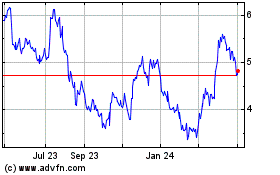

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Sep 2023 to Sep 2024