Highlights

Kornit Digital Ltd. (NASDAQ: KRNT), a leading provider of digital

printing solutions for the global printed textile industry, today

reported results for the second quarter ended June 30, 2018.

Non-GAAP figures in today’s press release are

presented using a different methodology compared to previous

periods as a result of comments from the US Securities and Exchange

Commission. These changes also impact the Company's guidance

methodology. Details of which can be found at the end of today's

press release.

Kornit reported second quarter 2018 revenue

increased 25.5% to $35.9 million, net of $1.5 million attributed to

the non-cash impact of warrants, compared to the prior year period

of $28.6 million, net of $1.4 million attributed to the non-cash

impact of warrants. Higher revenue in the quarter was attributable

to widespread growth across geographies and customers, and the

delivery of systems on a large customer program.

GAAP operating income increased to $1.6 million,

compared to the prior year period operating loss of $62 thousand.

Non-GAAP operating income increased 138.3% to $3.2 million, or 8.8%

of revenues, compared to the prior year period of $1.3 million or

4.7% of sales. Increased operating income was the result of

increased sales, gross margin expansion, and higher operating

leverage as a result of higher sales.

Ronen Samuel, Kornit Digital’s Chief Executive

Officer, commented, “I am very pleased with our results for the

quarter which included a robust top line growth rate of 25.5% with

revenues and operating margins coming in at above the high end of

our guidance. These achievements were driven by strong demand for

our market leading technology. The recent introduction of the

Avalanche HD 6 System with its significant reduction in cost per

print, improved hand-feel and improved print quality combined with

the continued shift towards print on demand have created excellent

business momentum. The retail shift towards shorter run production

and the benefits offered by the HD6 are driving migration of more

screen printers to our digital solution. To that end, we are well

positioned to capture increased growth opportunities as our

addressable market expands. Having spent the last 7 weeks on the

road meeting customers and employees in all our regions, I was

pleased to see the strong business momentum enjoyed by existing and

new customers as well as the level of trust and depth of relations

our employees have built over the years.”

Second Quarter Results of

Operations Kornit reported second quarter revenues, net of

the non-cash impact of warrants, of $35.9 million, compared with

the prior-year period level of $28.6 million. The total non-cash

impact of the warrants deducted from revenues was $1.5 million in

the second quarter of 2018 and $1.4 million in the second quarter

of 2017.

On a GAAP basis, second quarter gross profit was

$17.4 million, compared with $13.2 million, in the prior-year

period. Non-GAAP gross profit in the second quarter was $17.6

million, or 49.2% gross margin compared with $13.3 million, or

46.6% gross margin in the second quarter of 2017. Higher gross

margins primarily reflected a favorable product mix compared to the

prior year period.

On a GAAP basis, total operating expenses in the

second quarter were $15.8 million, compared to $13.2 million in the

prior year period. Non-GAAP operating expenses in the second

quarter increased to $14.5 million, or 40.3% of revenues, compared

to $12.0 million, or 42% of revenues in the prior year period.

Second quarter GAAP research and development

expenses were $5.3 million, compared to the prior-year period of

$4.6 million. Second quarter non-GAAP research and development

expenses were $5.1 million, or 14.2% of revenues, compared to $4.4

million, or 15.3% of revenues in the prior-year period.

Second quarter GAAP selling and marketing

expenses were $6.4 million, compared to the prior-year period of

$5.3 million. Second quarter non-GAAP selling and marketing

expenses were $5.9 million, or 16.3% of revenues, compared to $4.8

million, or 16.8% of revenues in the prior-year period.

Second quarter GAAP general and administrative

expenses were $4.0 million, compared to the prior-year period of

$3.3 million. Second quarter non-GAAP general and administrative

expenses were $3.5 million, or 9.8% of revenues, compared to $2.8

million, or 9.9% of revenues in the prior-year period.

On a GAAP basis, second quarter operating income

was $1.6 million, compared to the prior year period operating loss

of $62 thousand. Non-GAAP operating income in the second quarter

increased to $3.2 million, compared to $1.3 million in the prior

year period. As a percent of revenues, Non-GAAP operating margin

for the second quarter was 8.8% of revenues, compared with 4.7% of

revenues in the second quarter of 2017.

On a GAAP basis, the Company reported net income

of $1.8 million, or $0.05 per diluted share, compared to a net

income of $0.2 million, in the second quarter of 2017. Non-GAAP net

income for the second quarter of 2018 was $3.2 million, or $0.09

per diluted share, compared to net income of $1.5 million, or $0.04

per diluted share in the prior year period.

Balance Sheet and Cash FlowAt

June 30, 2018, the Company had cash and marketable securities of

$102.7 million, and no long-term debt. Cash flow used in operations

for the second quarter of 2018 was $4.9 million, attributable to

operation and reduction of inventory.

Third Quarter 2018 Guidance The

Company will discuss the details of its guidance live during its

earnings conference call, which will be available for replay via

webcast at ir.kornit.com.

Conference Call InformationThe

Company will host a conference call on the today at 5:00 p.m. ET,

or 0:00 a.m. Israel time, to discuss the results, followed by a

question and answer session for the investment community. A

live webcast of the call can be accessed at ir.kornit.com. To

access the call, participants may dial toll-free at 1-866-548-4713

or +1-323-794-2093. The toll-free Israeli number is 1 80 921 2883.

The confirmation code is 8206507.

To listen to a telephonic replay of the

conference call, dial toll-free 1-844-512-2921 or +1-412-317-6671

(international) and enter confirmation code 8206507. The telephonic

replay will be available beginning at 8:00 p.m. ET on Monday,

August 6, 2018, and will last through 11:59 p.m. ET on Monday,

August 20, 2018. The call will also be available for replay

via the webcast link on Kornit’s Investor Relations website.

Forward Looking

StatementsCertain statements in this press release are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and other U.S. securities

laws. Forward-looking statements are characterized by the use of

forward-looking terminology such as "will," "expects,"

"anticipates," "continue," "believes," "should," "intended,"

"guidance," "preliminary," "future," "planned," or other words.

These forward-looking statements include, but are not limited to,

statements relating to the company's objectives, plans and

strategies, statements of preliminary or projected results of

operations or of financial condition and all statements that

address activities, events or developments that the company

intends, expects, projects, believes or anticipates will or may

occur in the future. Forward-looking statements are not guarantees

of future performance and are subject to risks and uncertainties.

The company has based these forward-looking statements on

assumptions and assessments made by its management in light of

their experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Important factors that could cause

actual results, developments and business decisions to differ

materially from those anticipated in these forward-looking

statements include, among other things: our success in developing,

introducing and selling new or improved products and product

enhancements, our ability to consummate sales to large accounts

with multi-system delivery plans, our ability to fill orders for

our systems, our ability to continue to increase sales of our

systems and ink and consumables, our ability to leverage our global

infrastructure build-out, the development of the market for digital

textile printing, availability of alternative ink, competition,

sales concentration, changes to our relationships with suppliers,

our success in marketing, and those factors referred to under "Risk

Factors" in the company's Annual Report on Form 20-F filed with the

U.S. Securities and Exchange Commission on March 30, 2018. Any

forward-looking statements in this press release are made as of the

date hereof, and the company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Non-GAAP Discussion

DisclosureNon-GAAP financial measures consist of GAAP

financial measures adjusted to exclude the impact of share-based

compensation expenses, amortization of acquired intangible assets

and restructuring expenses and their tax effect. The purpose of

such adjustments is to give an indication of our performance

exclusive of non-cash charges and other items that are considered

by management to be outside of our core operating results. These

non-GAAP measures are among the primary factors management uses in

planning for and forecasting future periods. Furthermore, the

non-GAAP measures are regularly used internally to understand,

manage and evaluate our business and make operating decisions, and

we believe that they are useful to investors as a consistent and

comparable measure of the ongoing performance of our business.

However, our non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Additionally, these non-GAAP financial measures may differ

materially from the non-GAAP financial measures used by other

companies.

About KornitKornit Digital

(NASDAQ:KRNT) develops, manufactures and markets industrial digital

printing technologies for the garment, apparel and textile

industries. Kornit delivers complete solutions, including digital

printing systems, inks, consumables, software and after-sales

support. Leading the digital direct-to-garment printing market with

its exclusive eco-friendly NeoPigment printing process, Kornit

caters directly to the changing needs of the textile printing value

chain. Kornit’s technology enables innovative business models based

on web-to-print, on-demand and mass customization concepts. With

its immense experience in the direct-to-garment market, Kornit also

offers a revolutionary approach to the roll-to-roll textile

printing industry: digitally printing with a single ink set onto

multiple types of fabric with no additional finishing processes.

Founded in 2003, Kornit Digital is a global company, headquartered

in Israel with offices in the USA, Europe and Asia Pacific, and

serves customers in more than 100 countries worldwide.

| |

| KORNIT DIGITAL LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (U.S. dollars in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

| |

Six Months Ended |

|

Three Months Ended |

|

|

June 30, |

|

June 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

Products |

$ |

58,850 |

|

$ |

50,406 |

|

|

$ |

32,092 |

|

$ |

25,776 |

|

|

Services |

|

8,146 |

|

|

5,285 |

|

|

|

3,784 |

|

|

2,813 |

|

| Total revenues |

|

66,996 |

|

|

55,691 |

|

|

|

35,876 |

|

|

28,589 |

|

| |

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

Products |

|

25,232 |

|

|

24,075 |

|

|

|

14,193 |

|

|

11,992 |

|

|

Services |

|

8,947 |

|

|

6,556 |

|

|

|

4,255 |

|

|

3,432 |

|

| Total cost of

revenues |

|

34,179 |

|

|

30,631 |

|

|

|

18,448 |

|

|

15,424 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

32,817 |

|

|

25,060 |

|

|

|

17,428 |

|

|

13,165 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research and

development |

|

10,589 |

|

|

9,342 |

|

|

|

5,317 |

|

|

4,562 |

|

| Selling and

marketing |

|

12,201 |

|

|

10,829 |

|

|

|

6,352 |

|

|

5,271 |

|

| General and

administrative |

|

8,054 |

|

|

6,138 |

|

|

|

4,026 |

|

|

3,301 |

|

| Restructuring

expenses |

|

266 |

|

|

93 |

|

|

|

118 |

|

|

93 |

|

| Total operating

expenses |

|

31,110 |

|

|

26,402 |

|

|

|

15,813 |

|

|

13,227 |

|

| Operating income

(loss) |

|

1,707 |

|

|

(1,342 |

) |

|

|

1,615 |

|

|

(62 |

) |

|

Financial income, net |

|

828 |

|

|

93 |

|

|

|

295 |

|

|

389 |

|

| Income

(loss) before taxes on income |

|

2,535 |

|

|

(1,249 |

) |

|

|

1,910 |

|

|

327 |

|

|

|

|

|

|

|

|

|

|

| Taxes on income |

|

196 |

|

|

273 |

|

|

|

136 |

|

|

112 |

|

| Net income (loss) |

|

2,339 |

|

|

(1,522 |

) |

|

|

1,774 |

|

|

215 |

|

| |

|

|

|

|

|

|

|

|

Basic net income (loss) per share |

$ |

0.07 |

|

$ |

(0.05 |

) |

|

$ |

0.05 |

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

| Weighted average number

of shares |

|

|

|

|

|

|

|

| used in computing basic

net |

|

|

|

|

|

|

|

| income

(loss) per share |

|

34,295,752 |

|

|

33,151,633 |

|

|

34,321,995 |

|

33,658,867 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Diluted net

income (loss) per share |

$ |

0.07 |

|

$ |

(0.05 |

) |

|

$ |

0.05 |

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

| Weighted average number

of shares |

|

|

|

|

|

|

|

| used in computing

diluted |

|

|

|

|

|

|

|

| net

income (loss) per share |

|

34,885,393 |

|

|

33,151,633 |

|

|

35,047,817 |

|

34,719,784 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| KORNIT DIGITAL LTD. |

| AND ITS SUBSIDIARIES |

| RECONCILIATION OF GAAP TO

NON-GAAP

CONSOLIDATED

STATEMENTS

OF

OPERATIONS |

| (U.S. dollars in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

|

|

Three Months Ended |

| |

|

June 30, |

|

|

|

June 30, |

| |

` |

2018 |

|

2017 |

|

|

|

2018 |

|

2017 |

| |

|

(Unaudited) |

|

|

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP cost of revenues |

$ |

34,179 |

|

|

$ |

30,631 |

|

|

|

|

$ |

18,448 |

|

|

$ |

15,424 |

|

| Share-based

compensation (1) |

|

(341 |

) |

|

|

(287 |

) |

|

|

|

|

(193 |

) |

|

|

(143 |

) |

| Intangible

assets amortization (2) |

|

(50 |

) |

|

|

(50 |

) |

|

|

|

|

(25 |

) |

|

|

(25 |

) |

| Non-GAAP cost of revenues |

$ |

33,788 |

|

|

$ |

30,294 |

|

|

|

|

$ |

18,230 |

|

|

$ |

15,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP gross

profit |

$ |

32,817 |

|

|

$ |

25,060 |

|

|

|

|

$ |

17,428 |

|

|

$ |

13,165 |

|

| Gross

profit adjustments |

|

391 |

|

|

|

337 |

|

|

|

|

|

218 |

|

|

|

168 |

|

| Non-GAAP

gross profit |

$ |

33,208 |

|

|

$ |

25,397 |

|

|

|

|

$ |

17,646 |

|

|

$ |

13,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP operating expenses |

$ |

31,110 |

|

|

$ |

26,402 |

|

|

|

|

$ |

15,813 |

|

|

$ |

13,227 |

|

| Share-based

compensation (1) |

|

(2,039 |

) |

|

|

(1,661 |

) |

|

|

|

|

(982 |

) |

|

|

(867 |

) |

| Intangible

assets amortization (2) |

|

(482 |

) |

|

|

(677 |

) |

|

|

|

|

(241 |

) |

|

|

(266 |

) |

|

Restructuring expenses |

|

(266 |

) |

|

|

(93 |

) |

|

|

|

|

(118 |

) |

|

|

(93 |

) |

| Non-GAAP operating expenses |

$ |

28,323 |

|

|

$ |

23,971 |

|

|

|

|

$ |

14,472 |

|

|

$ |

12,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Taxes

on income |

$ |

196 |

|

|

$ |

273 |

|

|

|

|

$ |

136 |

|

|

$ |

112 |

|

| Tax effect

on to the above non-GAAP adjustments |

|

181 |

|

|

|

306 |

|

|

|

|

|

93 |

|

|

|

122 |

|

| Non-GAAP

Taxes on income |

$ |

377 |

|

|

$ |

579 |

|

|

|

|

$ |

229 |

|

|

$ |

234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income (loss) |

$ |

2,339 |

|

|

$ |

(1,522 |

) |

|

|

|

$ |

1,774 |

|

|

$ |

215 |

|

| Share-based

compensation (1) |

|

2,380 |

|

|

|

1,948 |

|

|

|

|

|

1,175 |

|

|

|

1,010 |

|

| Intangible

assets amortization (2) |

|

532 |

|

|

|

727 |

|

|

|

|

|

266 |

|

|

|

291 |

|

|

Restructuring expenses |

|

266 |

|

|

|

93 |

|

|

|

|

|

118 |

|

|

|

93 |

|

| Tax effect

on to the above non-GAAP adjustments |

|

(181 |

) |

|

|

(306 |

) |

|

|

|

|

(93 |

) |

|

|

(122 |

) |

| Non-GAAP net income (*) |

$ |

5,336 |

|

|

$ |

940 |

|

|

|

|

$ |

3,240 |

|

|

$ |

1,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted earning (loss) per share |

$ |

0.07 |

|

|

$ |

(0.05 |

) |

|

|

|

$ |

0.05 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted earning per share |

$ |

0.15 |

|

|

$ |

0.03 |

|

|

|

|

$ |

0.09 |

|

|

$ |

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in computing diluted |

|

|

|

|

|

|

|

|

|

| GAAP net

earning (loss) per share |

|

34,885,393 |

|

|

|

33,151,633 |

|

|

|

|

|

35,047,817 |

|

|

|

34,719,784 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in computing diluted |

|

|

|

|

|

|

|

|

|

| non GAAP

net earning per share |

|

35,176,284 |

|

|

|

34,702,588 |

|

|

|

|

|

35,346,599 |

|

|

|

35,235,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Share-based compensation |

|

|

|

|

|

|

|

|

|

| |

Cost of

product |

|

189 |

|

|

|

204 |

|

|

|

|

|

104 |

|

|

|

101 |

|

| |

Cost of

service |

|

152 |

|

|

|

83 |

|

|

|

|

|

89 |

|

|

|

42 |

|

| |

Research and

development |

|

402 |

|

|

|

297 |

|

|

|

|

|

228 |

|

|

|

180 |

|

| |

Selling and

marketing |

|

476 |

|

|

|

430 |

|

|

|

|

|

248 |

|

|

|

210 |

|

| |

General and

administrative |

|

1,161 |

|

|

|

934 |

|

|

|

|

|

506 |

|

|

|

477 |

|

| |

|

|

2,380 |

|

|

|

1,948 |

|

|

|

|

|

1,175 |

|

|

|

1,010 |

|

| (2)

Intangible assets amortization |

|

|

|

|

|

|

|

|

|

| |

Cost of

product |

|

50 |

|

|

|

50 |

|

|

|

|

|

25 |

|

|

|

25 |

|

| |

Selling

and marketing |

|

482 |

|

|

|

677 |

|

|

|

|

|

241 |

|

|

|

266 |

|

| |

|

|

532 |

|

|

|

727 |

|

|

|

|

|

266 |

|

|

|

291 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(*) |

Non-GAAP net income has been updated from prior reports (a) to

remove the adjustment for the non-cash impact of the warrants

deducted from revenues, and (b) to reflect the tax effect of the

non-GAAP adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| KORNIT DIGITAL LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED

BALANCE

SHEETS |

| (U.S. dollars in thousands) |

| |

|

June 30, |

|

December 31, |

| |

|

2018 |

|

2017 |

| |

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

17,223 |

|

$ |

18,629 |

| Short-term bank

deposit |

|

|

7,500 |

|

|

4,500 |

| Marketable

securities |

|

|

10,657 |

|

|

5,537 |

| Trade receivables,

net |

|

|

33,162 |

|

|

23,245 |

| Inventory |

|

|

25,123 |

|

|

34,855 |

| Other accounts

receivable and prepaid expenses |

|

|

3,153 |

|

|

2,661 |

| Total current

assets |

|

|

96,818 |

|

|

89,427 |

| |

|

|

|

|

| LONG-TERM ASSETS: |

|

|

|

|

| Marketable

securities |

|

|

67,341 |

|

|

68,835 |

| Deposits and other

long-term assets |

|

|

722 |

|

|

627 |

| Severance pay fund |

|

|

537 |

|

|

523 |

| Deferred tax asset |

|

|

805 |

|

|

564 |

| Property and equipment,

net |

|

|

10,994 |

|

|

11,230 |

| Intangible assets,

net |

|

|

1,543 |

|

|

2,076 |

| Goodwill |

|

|

5,092 |

|

|

5,092 |

| Total long-term

assets |

|

|

87,034 |

|

|

88,947 |

| |

|

|

|

|

| Total assets |

|

$ |

183,852 |

|

$ |

178,374 |

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

| Trade payables |

|

$ |

10,014 |

|

$ |

12,439 |

| Employees and payroll

accruals |

|

|

7,081 |

|

|

6,338 |

| Deferred revenues and

advances from customers |

|

|

2,096 |

|

|

1,697 |

| Other payables and

accrued expenses |

|

|

4,740 |

|

|

5,046 |

| Total current

liabilities |

|

|

23,931 |

|

|

25,520 |

| |

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

| Accrued severance

pay |

|

|

1,355 |

|

|

1,232 |

| Payment obligation

related to acquisition |

|

|

- |

|

|

334 |

| Other long-term

liabilities |

|

|

764 |

|

|

589 |

| Total long-term

liabilities |

|

|

2,119 |

|

|

2,155 |

| |

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

157,802 |

|

|

150,699 |

| |

|

|

|

|

| Total liabilities and

shareholders' equity |

|

$ |

183,852 |

|

$ |

178,374 |

|

|

|

|

|

|

| |

| KORNIT DIGITAL LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (U.S. dollars in thousands) |

| |

|

|

|

|

|

Six Months Ended |

|

Three Months Ended |

| |

June 30, |

|

June 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net Income (loss) |

$ |

2,339 |

|

|

$ |

(1,522 |

) |

|

$ |

1,774 |

|

|

$ |

215 |

|

| Adjustments to

reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

2,367 |

|

|

|

2,427 |

|

|

|

1,200 |

|

|

|

1,154 |

|

| Fair value of warrants

deducted from revenues |

|

1,533 |

|

|

|

2,353 |

|

|

|

1,491 |

|

|

|

1,415 |

|

| Share-based

compensation |

|

2,380 |

|

|

|

1,948 |

|

|

|

1,175 |

|

|

|

1,010 |

|

| Amortization of premium

on marketable securities |

|

241 |

|

|

|

277 |

|

|

|

124 |

|

|

|

145 |

|

| Realized gain on sale

of marketable securities |

|

- |

|

|

|

(29 |

) |

|

|

- |

|

|

|

(29 |

) |

| Decrease (increase) in

trade receivables |

|

(10,141 |

) |

|

|

2,894 |

|

|

|

(7,871 |

) |

|

|

(4,332 |

) |

| Decrease (increase) in

other receivables and prepaid expenses |

|

(522 |

) |

|

|

747 |

|

|

|

(939 |

) |

|

|

1,016 |

|

| Decrease (increase) in

inventory |

|

9,044 |

|

|

|

(8,652 |

) |

|

|

4,129 |

|

|

|

(2,716 |

) |

| Decrease (increase) in

deferred taxes, net |

|

(219 |

) |

|

|

(183 |

) |

|

|

90 |

|

|

|

(19 |

) |

| Decrease (increase) in

other long term assets |

|

(97 |

) |

|

|

194 |

|

|

|

(52 |

) |

|

|

45 |

|

| Increase (decrease) in

trade payables |

|

(2,192 |

) |

|

|

(2,060 |

) |

|

|

2,954 |

|

|

|

(1,851 |

) |

| Increase (decrease) in

employees and payroll accruals |

|

759 |

|

|

|

(833 |

) |

|

|

417 |

|

|

|

(1,087 |

) |

| Increase (decrease) in

deferred revenues and advances from customers |

|

412 |

|

|

|

(692 |

) |

|

|

108 |

|

|

|

390 |

|

| Increase (decrease) in

other payables and accrued expenses |

|

203 |

|

|

|

122 |

|

|

|

(684 |

) |

|

|

(755 |

) |

| Increase (decrease) in

accrued severance pay, net |

|

109 |

|

|

|

28 |

|

|

|

189 |

|

|

|

(4 |

) |

| Increase in other long

term liabilities |

|

175 |

|

|

|

369 |

|

|

|

141 |

|

|

|

133 |

|

| Loss from sale of

property and Equipment |

|

- |

|

|

|

29 |

|

|

|

- |

|

|

|

29 |

|

| Foreign currency

translation loss on inter company balances with foreign

subsidiaries |

|

293 |

|

|

|

(595 |

) |

|

|

632 |

|

|

|

(482 |

) |

| |

|

|

|

|

|

|

|

| Net cash provided by

(used in) operating activities |

|

6,684 |

|

|

|

(3,178 |

) |

|

|

4,878 |

|

|

|

(5,723 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Purchase of property

and equipment |

|

(1,244 |

) |

|

|

(3,431 |

) |

|

|

(762 |

) |

|

|

(2,536 |

) |

| Investment in bank

deposits |

|

(3,000 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Proceeds from sale of

marketable securities |

|

- |

|

|

|

38,312 |

|

|

|

- |

|

|

|

38,312 |

|

| Proceeds from maturity

of marketable securities |

|

2,150 |

|

|

|

6,740 |

|

|

|

1,650 |

|

|

|

2,000 |

|

| Purchase of marketable

securities |

|

(6,130 |

) |

|

|

(70,648 |

) |

|

|

(3,781 |

) |

|

|

(22,520 |

) |

| Net cash provided by

(used in) investing activities |

|

(8,224 |

) |

|

|

(29,027 |

) |

|

|

(2,893 |

) |

|

|

15,256 |

|

| |

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Proceeds from follow on

offering |

|

- |

|

|

|

36,058 |

|

|

|

- |

|

|

|

428 |

|

| Exercise of employee

stock options |

|

1,067 |

|

|

|

1,347 |

|

|

|

536 |

|

|

|

872 |

|

| Payment of deferred

issuance cost |

|

- |

|

|

|

(981 |

) |

|

|

- |

|

|

|

(981 |

) |

| Payment of contingent

consideration |

|

(900 |

) |

|

|

(1,400 |

) |

|

|

- |

|

|

|

- |

|

| Net cash provided by

financing activities |

|

167 |

|

|

|

35,024 |

|

|

|

536 |

|

|

|

319 |

|

| |

|

|

|

|

|

|

|

| Foreign currency

translation adjustments on cash and cash equivalents |

|

(33 |

) |

|

|

99 |

|

|

|

(80 |

) |

|

|

85 |

|

| Increase (decrease) in

cash and cash equivalents |

|

(1,373 |

) |

|

|

2,819 |

|

|

|

2,521 |

|

|

|

9,852 |

|

| Cash and cash

equivalents at the beginning of the period |

|

18,629 |

|

|

|

22,789 |

|

|

|

14,782 |

|

|

|

15,770 |

|

| Cash and cash

equivalents at the end of the period |

|

17,223 |

|

|

|

25,707 |

|

|

|

17,223 |

|

|

|

25,707 |

|

| |

|

|

|

|

|

|

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Purchase of property

and equipment on credit |

|

200 |

|

|

|

863 |

|

|

|

200 |

|

|

|

863 |

|

| Inventory transferred

to be used as property and equipment |

|

591 |

|

|

|

167 |

|

|

|

- |

|

|

|

167 |

|

| Receipt on account of

shares |

|

20 |

|

|

|

- |

|

|

|

20 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

Investor Contact:Michael Callahan, ICR(203)

682-8311Michael.Callahan@icrinc.com

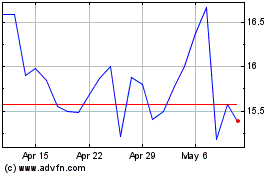

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Aug 2024 to Sep 2024

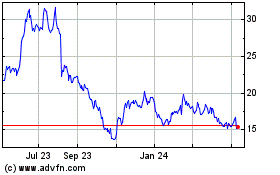

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Sep 2023 to Sep 2024