Initial Statement of Beneficial Ownership (3)

July 02 2018 - 6:51PM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

KKR Group Holdings Corp.

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

7/1/2018

|

3. Issuer Name

and

Ticker or Trading Symbol

GoDaddy Inc. [GDDY]

|

|

(Last)

(First)

(Middle)

C/O KOHLBERG KRAVIS ROBERTS & CO. L.P., 9 WEST 57TH STREET, SUITE 4200

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

___

X

___ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Street)

NEW YORK, NY 10019

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Class A Common Stock

|

2227477

|

I

|

See footnotes

(1)

(2)

(8)

(9)

(10)

|

|

Class A Common Stock

|

1001846

|

I

|

See footnotes

(1)

(3)

(8)

(9)

(10)

|

|

Class A Common Stock

|

374147

|

I

|

See footnotes

(1)

(4)

(8)

(9)

(10)

|

|

Class A Common Stock

|

36864

|

I

|

See footnotes

(1)

(5)

(10)

|

|

Class A Common Stock

|

8050

|

I

|

See footnotes

(1)

(6)

(9)

(10)

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Units of Desert Newco, LLC

(7)

|

(7)

|

(7)

|

Class A Common Stock

|

2839708

|

(7)

|

I

|

See footnotes

(1)

(4)

(8)

(9)

(10)

|

|

Units of Desert Newco, LLC

(7)

|

(7)

|

(7)

|

Class A Common Stock

|

312562

|

(7)

|

I

|

See footnotes

(1)

(5)

(10)

|

|

Units of Desert Newco, LLC

(7)

|

(7)

|

(7)

|

Class A Common Stock

|

68254

|

(7)

|

I

|

See footnotes

(1)

(6)

(9)

(10)

|

|

Explanation of Responses:

|

|

(1)

|

Pursuant to an internal reorganization in connection with the conversion of KKR & Co. L.P., a Delaware limited partnership, into a Delaware corporation named KKR & Co. Inc., which became effective on July 1, 2018, KKR & Co. L.P. contributed all of its interests in two wholly-owned subsidiaries, KKR Group Holdings L.P. and KKR Group Limited, to a newly formed and wholly-owned subsidiary, KKR Group Holdings Corp., and KKR Group Holdings L.P. and KKR Group Limited were liquidated. KKR Group Holdings Corp. is now a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP Limited and KKR Management Holdings Corp. and may be deemed to be the beneficial owner of all or a portion of the securities reported herein. Each of KKR Group Holdings L.P. and KKR Group Limited are separately filing an "exit" Form 4 to reflect the above. This internal reorganization did not involve any purchase or sale of securities of GoDaddy Inc. (the "Issuer").

|

|

(2)

|

Shares of Class A Common Stock of the Issuer are held by KKR 2006 GDG Blocker L.P. ("KKR 2006 GDG").

|

|

(3)

|

Shares of Class A Common Stock of the Issuer are held by GDG Co-Invest Blocker L.P. ("GDG Co-Invest"). GDG Co-Invest GP LLC is the general partner of GDG Co-Invest.

|

|

(4)

|

Securities are held by KKR 2006 Fund (GDG) L.P. ("KKR 2006 Fund"). KKR Associates 2006 AIV L.P. ("KKR Associates 2006") is the general partner of KKR 2006 Fund.

|

|

(5)

|

Securities are held by KKR Partners III, L.P. ("KKR Partners III"). KKR III GP LLC is the general partner of KKR Partners III. Messrs. Henry R. Kravis and George R. Roberts are the managers of KKR III GP LLC.

|

|

(6)

|

Securities are held by OPERF Co-Investment LLC ("OPERF"). KKR Associates 2006 L.P. is the manager of OPERF. KKR 2006 GP LLC is the general partner of KKR Associates 2006 L.P. KKR Fund Holdings L.P. is the designated member of KKR 2006 GP LLC. KKR Fund Holdings GP Limited is a general partner of KKR Funds Holdings L.P. KKR Group Holdings Corp. is a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP Limited.

|

|

(7)

|

Pursuant to an exchange agreement, Units of Desert Newco, LLC are exchangeable on a one-on-one basis for shares of Class A Common Stock at the discretion of the holder. The exchange rights under this exchange agreement do not expire.

|

|

(8)

|

KKR 2006 AIV GP LLC is the general partner of KKR 2006 GDG, the sole member of GDG Co-Invest GP LLC and the general partner of KKR Associates 2006. KKR Management Holdings L.P. is the sole member of KKR 2006 AIV GP LLC. KKR Management Holdings Corp. is the general partner of KKR Management Holdings L.P. KKR Group Holdings Corp. is the sole shareholder of KKR Management Holdings Corp.

|

|

(9)

|

KKR & Co. Inc. is the sole shareholder of KKR Group Holdings Corp. KKR Management LLC is the controlling shareholder of KKR & Co. Inc. Messrs. Henry R. Kravis and George R. Roberts are the designated members of KKR Management LLC.

|

|

(10)

|

The Reporting Person may be deemed to be the beneficial owner of all or a portion of the securities reported herein. The filing of this statement shall not be deemed to be an admission that, for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise, the Reporting Person is the beneficial owner of any securities reported herein, and the Reporting Person disclaims beneficial ownership of such securities except to the extent of its pecuniary interest therein.

|

Remarks:

The acquisition of beneficial ownership is exempt from Section 16 of the Exchange Act, pursuant to Section 16(b) of the Exchange Act and Rule 16a-2(c) thereunder. Exhibit List: Exhibit 24 - Power of Attorney.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

KKR Group Holdings Corp.

C/O KOHLBERG KRAVIS ROBERTS & CO. L.P.

9 WEST 57TH STREET, SUITE 4200

NEW YORK, NY 10019

|

|

X

|

|

|

Signatures

|

|

KKR GROUP HOLDINGS CORP. By: /s/ Terence Gallagher Name: Terence Gallagher Title: Attorney-in-fact for William J. Janetschek, Chief Financial Officer

|

|

7/2/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

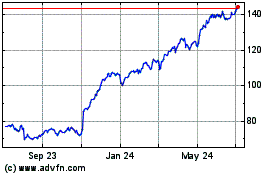

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Aug 2024 to Sep 2024

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Sep 2023 to Sep 2024