UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

SEC File Number: 001-33135

CUSIP Number: 75903M101

NOTIFICATION OF LATE FILING

|

(Check One)

|

|

☐

Form 10-K

☐

Form 20-F

☐

Form 11-K

☒

Form 10-Q

☐

Form 10-D

☐

Form N-SAR

☐

Form N-CSR

|

|

|

|

|

|

|

For Period Ended: March 31, 2018

|

|

|

|

|

|

|

☐

Transition Report on Form 10-K

|

|

|

|

☐

Transition Report on Form 20-F

|

|

|

|

☐

Transition Report on Form 11-K

|

|

|

|

☐

Transition Report on Form 10-Q

|

|

|

|

☐

Transition Report on Form N-SAR

|

|

|

|

|

|

|

For the Transition Period Ended:

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

Regional Health Properties, Inc.

(Full Name of Registrant)

(Former Name if Applicable)

454 Satellite Boulevard NW, Suite 100

(Address of Principal Executive Office (

Street and Number

))

Suwanee, Georgia 30024

(City, State and Zip Code)

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

☒

|

|

(a)

|

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Regional Health Properties, Inc. (the “Company”) has determined that it is unable to file its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 (the “Quarterly Report”) within the prescribed time period without unreasonable effort or expense because, for the reasons discussed below, additional time is needed to finalize the Quarterly Report and furnish the XBRL Interactive Data File exhibits required by Item 601(b)(101) of Regulation S-K.

On February 15, 2018, the Company entered into a debt refinancing (“Pinecone Credit Facility”) with Pinecone Realty Partners II, LLC (“Pinecone”), with an aggregate principal amount of $16.25 million, which refinanced existing mortgage debt in an aggregate amount of $8.7 million on three skilled nursing properties. The Company is currently negotiating with Pinecone to obtain a waiver of a debt covenant fixed coverage ratio violation under the Pinecone Credit Facility, with respect to the quarter ended March 31, 2018, and to enter into a forbearance agreement to address such violation and other events of default under such facility. The Company’s negotiations are ongoing and will impact the Company’s conclusion with respect to whether there is substantial doubt about its ability to continue as a going concern (as such term is used in FASB Accounting Standards Codification Subtopic No. 205-40,

Presentation of Financial Statements–Going Concern

) and the related disclosures to be included in the Quarterly Report. The Company is actively working to complete these negotiations and its liquidity assessment and intends to file the Quarterly Report within the grace period prescribed in Rule 12b-25 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

PART IV — OTHER INFORMATION

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

Brent Morrison

|

|

678

|

|

869-5116

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

☒

Yes

☐

No

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

☒

Yes

☐

No

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

Interest Expense, Net

—Interest expense increased by $0.2 million, or 23.5%, to $1.3 million for the three months ended March 31, 2018, compared with $1.0 million for the same period in 2017. The increase is mainly due the net increase of debt principal year over year of approximately $6.3 million and approximately $1.0 million in capitalized deferred financing. The $16.25 million Pinecone

Credit Facility increased debt by approximately $7.5 million from Febru

ary 15, 2018, which was partially offset by the repayment of $6.7 million in convertible debt in the prior year and $1.5 million repayment of convertible debt during the current quarter. The increase in interest is approximately $0.1 million for amortizati

on of deferred financing and approximately $0.1 million due to interest.

Loss from Discontinued Operations

—The loss from discontinued operations decreased by $0.3 million, or 86.7%, to $0.1 million for the three months ended March 31, 2018, compared with $0.4 million for the same period in 2017. The decrease is primarily due to lower bad debt expense, professional and general legal expenses and collection activity expenses.

Provision for doubtful accounts

—On April 24, 2018, the Company received written notices from five of its facility tenants stating that: (i) due to current business conditions, the tenants can no longer operate the five facilities of the Company located in Ohio (collectively, the “Ohio Facilities”); and (ii) each such tenant will surrender the possession of the applicable Ohio Facility to the Company on June 30, 2018. Each such tenant: (a) is affiliated with Beacon Health Management LLC; and (b) operates the applicable Ohio Facility under a separate Sublease Agreement with the Company dated August 1, 2015 (collectively, the “Sublease Agreements”). The provisions of each of the Sublease Agreements provide for a lease term which expires in 2025. Consequently, the Company has recorded a $1.5 million provision.

In addition, the Company has also recorded an allowance of approximately $0.5 million on a $3.0 million promissory note issued to the Company in connection with its sale in October 2016 of nine facilities in Arkansas to Skyline Healthcare LLC.

Forward Looking Statements

This Form 12b-25 contains forward-looking statements within the meaning Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, including, without limitation, the Company’s expectations as to the outcome of its negotiations with Pinecone and the filing of the Quarterly Report. These forward-looking statements involve risks and uncertainties, and actual results could vary materially from these forward-looking statements. Factors that may cause future results to differ materially from management’s current expectations include the Company’s ability to obtain from Pinecone the waiver and forbearance discussed herein, the risk that the completion and filing of the Quarterly Report will take longer than expected, and the risk that the Company will be unable to file the Quarterly Report within the extension period of 5 calendar days provided under Rule 12b-25 of the Exchange Act. The Company disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise, except as required by law.

Regional Health Properties, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date

|

May 16, 2018

|

|

By:

|

/s/ Brent Morrison

|

|

|

|

|

Name:

|

Brent Morrison

|

|

|

|

|

Title:

|

Interim Chief Executive Officer (principal executive officer)

|

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

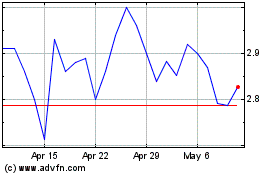

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Aug 2024 to Sep 2024

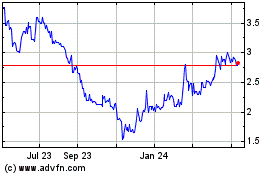

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Sep 2023 to Sep 2024