Possible New Roles For Two Murdochs -- WSJ

May 09 2018 - 3:02AM

Dow Jones News

By Keach Hagey and Joe Flint

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 9, 2018).

James Murdoch, the 21st Century Fox chief executive, is planning

to strike out on his own if Fox's pending deal to sell much of the

company to Walt Disney Co. closes, most likely by starting a

venture-capital fund to invest in digital and international media

businesses, according to people familiar with the matter.

Lachlan Murdoch, James's older brother, is expected to become

chief executive of the remaining Fox company, so-called New Fox,

according to people familiar with the matter.

After Disney last December announced an agreement to purchase

the bulk of Fox for $52.4 billion, people close to the deal said

James Murdoch could wind up taking a senior position at Disney.

On an earnings call in December, CEO Robert Iger said that James

Murdoch would help integrate the companies "and during that period

of time, he and I will continue to discuss whether there is a role

for him here or not." Inside Disney, a role for him was always seen

as uncertain, according to people familiar with the matter.

In recent weeks James Murdoch has begun to tell associates that

he isn't going to Disney, according to people familiar with the

matter.

Disney in March announced a reorganization that positions two

top executives as potential successors to Mr. Iger: Kevin Mayer,

who was named chairman of a new direct-to-consumer and

international segment, and parks chief Robert Chapek, who added

consumer products to his portfolio.

A Disney spokeswoman couldn't immediately be reached to

comment.

A venture fund is one of several new opportunities James Murdoch

has been considering, some of the people said. "He views himself as

an operator," said one friend of James Murdoch. "Picking

businesses, mentoring business, and running businesses is what he

does."

The decision to sell marked the end of an era for 21st Century

Fox Executive Chairman Rupert Murdoch and his family, which have a

39% voting interest in Fox. The all-stock Disney deal involves the

sale of the Twentieth Century Fox TV and film studio, cable

networks including FX and National Geographic, international

businesses including Fox's 39% stake in European pay TV company Sky

PLC, and a stake in the streaming business Hulu.

The takeover drama may not be over. Cable giant Comcast Corp. is

making preparations to potentially pursue a hostile, all-cash bid

for these assets, and has lined up the necessary financing, people

familiar with the matter say.

Before the Disney deal was reached, Comcast had submitted an

offer for the Fox assets that was 16% higher, but Fox turned it

down partly over fears that it wouldn't pass muster with antitrust

regulators, according to a regulatory filing last month and people

familiar with the situation.

The notion of James Murdoch having a possible role at Disney

wasn't a factor in Fox's final decision to opt for Disney's offer

over Comcast's, according to people familiar with Fox's

thinking.

If a sale of the Fox entertainment assets goes through, Lachlan

Murdoch would oversee the assets Fox isn't selling -- including the

Fox broadcast network, Fox News cable channel and Fox Sports 1.

Lachlan Murdoch currently serves as executive co-chairman of

21st Century Fox. He is also executive co-chairman of Wall Street

Journal-parent News Corp, in which the Murdoch family holds a 39%

voting stake.

John Nallen, currently the chief financial officer of 21st

Century Fox, is expected to become the chief operating officer of

the so-called New Fox, the people said.

Write to Keach Hagey at keach.hagey@wsj.com and Joe Flint at

joe.flint@wsj.com

(END) Dow Jones Newswires

May 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

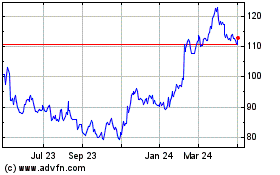

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Aug 2024 to Sep 2024

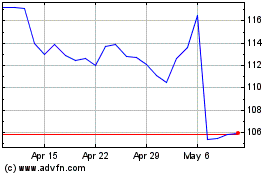

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Sep 2023 to Sep 2024