Additional Proxy Soliciting Materials (definitive) (defa14a)

April 18 2018 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

CRISPR THERAPEUTICS AG

(Name of Registrant as Specified in Its certificate of incorporation)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

CRISPR Therapeutics AG

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on May 30, 2018

This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all

of the important information contained in the proxy materials before voting. To view the proxy statement and annual report, go to

www.proxydocs.com/crsp

. To submit your proxy while visiting this site, you will need the 12 digit control number

in the box below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under United States Securities and Exchange Commission rules, proxy materials do not have to be delivered in paper. Proxy materials can be

distributed by making them available on the Internet. We have chosen to use these procedures for our Annual Meeting and need YOUR

participation.

If you

want to receive a paper or e-mail copy of the proxy materials, you must request one. There is no charge to you for requesting a copy. In order to receive a paper package in time for this year’s annual meeting, please make this request on or

before May 18, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For a Convenient Way to VIEW Proxy Materials

|

|

|

|

|

–

and

–

|

|

|

|

VOTE Online go to:

www.proxydocs.com/CRSP

|

|

Printed materials may be requested by one of the following methods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERNET

www.investorelections.com/crsp

|

|

|

|

TELEPHONE

(866) 648-8133

|

|

|

|

*E-MAIL

paper@investorelections.com

|

|

|

|

|

|

You must use the 12 digit control number

located in the shaded gray box below.

|

|

*

|

|

If requesting material by e-mail, please send a blank e-mail with the 12 digit control number (located below) in the subject line. No other requests, instructions or other inquiries should be included with your e-mail

requesting material.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISPR Therapeutics AG

Notice of Annual General Meeting of Shareholders

|

|

|

|

|

|

Date:

|

|

Wednesday, May 30, 2018

|

|

|

|

|

Time:

|

|

2:00 p.m. Central European Time (8:00 a.m. Eastern Daylight Time)

|

|

|

|

|

Place:

|

|

VISCHER AG, Schützengasse 1, Postfach 5090, 8001, Zurich, Switzerland

|

|

Board of Directors Recommends a Vote FOR proposals

1 through 11.

See Proposals on the reverse side of this notice.

|

Vote In-Person Instructions:

While we encourage shareholders to vote by the means indicated above, a

shareholder is entitled to vote in person at the Annual General Meeting. If you wish to vote your shares at the Annual General Meeting, please register with the Inspector of Elections at the desk marked “Shareholder Registration” at the

entrance to receive a ballot. Proper photo ID is required. Ballots should be returned to the Inspector of Elections in order to be counted. Additionally, a shareholder who has submitted a proxy before the meeting, may revoke that proxy in person at

the Annual General Meeting.

|

|

|

|

|

|

|

|

|

1. The approval of the annual report, the consolidated financial statements and the

statutory financial statements of the Company for the year ended December 31, 2017.

The Board of Directors proposes that shareholders approve the annual report, the

consolidated financial statements and the statutory financial statements of the Company for the year ended December 31, 2017 and to take note of the reports of the auditors. Copies of these documents are available for download at

www.proxydocs.com/CRSP.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

2. The approval of the appropriation of financial results.

The Board of

Directors proposes to carry forward the net loss resulting from the appropriation of financial results as follows:

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

|

|

|

|

Proposed Appropriation of net loss: in Swiss Francs (“CHF”)

|

|

|

|

|

|

Balance brought forward from previous years

|

|

(35,208,469)

|

|

Net loss for the period (on a stand-alone

unconsolidated basis):

|

|

(67,928,423)

|

|

Total accumulated net loss:

|

|

|

|

(103,136,892)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. The discharge of the members of the Board of Directors and Executive

Committee.

The Board of Directors proposes that the members of the Board of Directors and

the Executive Committee of the Company be discharged from personal liability for their activities during the year ended December 31, 2017.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

4. The election and re-election of the members to the Board of

Directors.

The Board of Directors proposes that Rodger Novak, M.D. be re-elected as member

of the Board of Directors and Chairman of the Board of Directors and that each of Samarth Kulkarni, Ph.D., Bradley Bolzon, Ph.D., Ali Behbahani, M.D., Pablo Cagnoni, M.D., Kurt von Emster, Simeon J. George, M.D., and Thomas Woiwode, Ph.D. be elected

or re-elected, as appropriate, as directors, each for a term extending until completion of the 2019 annual general meeting of shareholders.

|

|

4.a Re-election of Rodger

Novak, M.D., as member and Chairman.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

4.b Election of Samarth

Kulkarni, Ph.D.

|

|

☐

|

|

☐

|

|

☐

|

|

4.c Re-election of Bradley

Bolzon, Ph.D.

|

|

☐

|

|

☐

|

|

☐

|

|

4.d Re-election of Ali

Behbahani, M.D.

|

|

☐

|

|

☐

|

|

☐

|

|

4.e Re-election of Pablo

Cagnoni, M.D.

|

|

☐

|

|

☐

|

|

☐

|

|

4.f Re-election of Kurt von

Emster

|

|

☐

|

|

☐

|

|

☐

|

|

4.g Re-election of Simeon

J. George, M.D.

|

|

☐

|

|

☐

|

|

☐

|

|

4.h Re-election of Thomas

Woiwode, Ph.D.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

5. The re-election of the members of the Compensation Committee.

The Board of

Directors proposes to re-elect each of Thomas Woiwode, Ph.D., Pablo Cagnoni, M.D., and Simeon J. George, M.D. as members of the Compensation Committee of the Board of Directors, each for a term extending until completion of the 2019 annual general

meeting of shareholders.

|

|

5.a Re-election of

Thomas Woiwode, Ph.D.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

5.b Re-election of Pablo

Cagnoni, M.D.

|

|

☐

|

|

☐

|

|

☐

|

|

5.c Re-election of Simeon

J. George, M.D.

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

6. The approval of the compensation for the Board of Directors and the

Executive Committee.

The Board of Directors proposes the following separate votes on the

non-performance-related and the variable compensation of the Board of Directors and the Executive Committee:

|

|

|

|

|

|

|

6.a Binding vote on total non-performance-related compensation for members of the Board of

Directors from the 2018 Annual General Meeting to the 2019 annual general meeting of shareholders.

The Board of Directors proposes that shareholders approve the total maximum

amount of non-performance-related compensation for the members of the Board of Directors covering the period from the 2018 Annual General Meeting to the 2019 annual general meeting of shareholders, i.e., USD $396,500 (cash fees plus social security

costs).

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

6.b Binding vote on equity for members of the Board of Directors from the 2018 Annual

General Meeting to the 2019 annual general meeting of shareholders.

The Board of Directors proposes that shareholders approve the maximum grant of

equity or equity linked instruments for the members of the Board of Directors covering the period from the 2018 Annual General Meeting to the 2019 annual general meeting of shareholders with maximum value of USD $6,855,000 (equity grant date value

plus social security costs).

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

6.c Binding vote on total non-performance-related compensation for members of the

Executive Committee from July 1, 2018 to June 30, 2019.

The Board of Directors proposes that shareholders approve the total maximum

amount of non-performance-related cash compensation for the members of the Executive Committee covering the period from July 1, 2018 to June 30, 2019, i.e., USD $3,095,000 (cash base compensation plus social security costs).

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.d Binding vote on total variable compensation for members of the Executive Committee for

the current year ending December 31, 2018.

The Board of Directors proposes that shareholders approve the total maximum

amount of variable compensation for the members of the Executive Committee for the current year ending December 31, 2018, i.e., USD $1,960,000 (cash compensation plus social security costs).

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

6.e Binding vote on equity for members of the Executive Committee from the 2018

Annual General Meeting to the 2019 annual general meeting of shareholders.

The Board of Directors proposes that shareholders approve the maximum grant of

equity or equity linked instruments for the members of the Executive Committee covering the period from the 2018 Annual General Meeting to the 2019 annual general meeting of shareholders with maximum value of USD $53,760,000 (equity grant date value

plus social security costs).

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

7. The approval of an increase in the Conditional Share Capital for Employee Benefit

Plans.

The Board of Directors proposes to increase the Company’s conditional share

capital for employee benefit plans by CHF 120,000 to CHF 467’378.88 for the issuance of up to 15’579’296 Common Shares and amend art. 3c para. 1 of the Articles of Association as follows:

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

Art. 3c Conditional Share Capital for Employee Benefit Plans

The share capital of the Company shall be increased by an amount not exceeding CHF

467’378.88 through the issue of a maximum of 15’579’296 registered shares, payable in full, each with a nominal value of CHF 0.03, in connection with the exercise of option rights granted to any employee of the Company or a

subsidiary, and any consultant, members of the Board of Directors, or other person providing services to the Company or a subsidiary.

|

|

|

|

Art. 3c Bedingtes

Aktienkapital für Mitarbeiterbeteiligungspläne

Das Aktienkapital kann

durch die Ausgabe von höchstens 15’579’296 voll zu liberierenden Namenaktien im Nennwert von je CHF 0.03 um höchstens CHF 467’378.88 durch Ausübung von Optionsrechten erhöht werden, welche Mitarbeitenden der

Gesellschaft oder ihrer Tochtergesellschaften, Personen in vergleichbaren Positionen, Beratern, Verwaltungsratsmitgliedern oder anderen Personen, welche Dienstleistungen zu Gunsten der Gesellschaft erbringen, gewährt wurden.

|

|

|

|

|

|

|

|

|

|

8. The approval of the CRISPR Therapeutics AG 2018 Stock Option and Incentive

Plan.

The Board of Directors proposes to approve the CRISPR Therapeutics AG 2018 Stock

Option and Incentive Plan (the “2018 Plan”) and provide for a total number of Common Shares which may be issued pursuant to the 2018 Plan of 4,000,000 Common Shares, plus the remaining number of shares reserved for issuance under the

CRISPR Therapeutics AG Amended and Restated 2016 Stock Option and Incentive Plan, or 2016 Plan, on the effective date of the 2018 Plan, plus any common shares underlying any awards that are forfeited, canceled, held back

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

|

|

upon exercise or settlement of an award to satisfy the exercise price or tax

withholding, reacquired by us prior to vesting, satisfied without any issuance of common shares, expired or are otherwise terminated, other than by exercise, under the 2018 Plan, the 2016 Plan and the CRISPR Therapeutics AG 2015 Stock Option and

Grant Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. The approval of increasing the maximum number of authorized share capital and

extending the date by which the Board of Directors may increase authorized share capital.

The Board of Directors proposes to increase the maximum number of authorized

share capital to 23,001,837 shares and extend the date by which it may increase the authorized share capital to May 29, 2020, and amend art. 3a para. 1 of the Articles of Association to reflect the foregoing as follows:

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

Art. 3a Authorized Share Capital

The Board of Directors is authorized to in-crease the share capital,

in one or several steps until 29 May 2020, by a maximum amount of CHF 690’055.11 by issuing a maximum of 23’001’837 registered shares with a par value of CHF 0.03 each, to be fully paid up. An increase of the share capital (i) by

means of an offering underwritten by a financial institution, a syndicate or another third party or third parties, followed by an offer to the then-existing shareholders of the Company and (ii) in partial amounts shall al-so be permissible.

|

|

|

|

Art. 3a Genehmigtes Kapital

Der Verwaltungsrat ist ermächtigt, jederzeit bis zum 29. Mai 2020, das Aktienkapital im Maximalbetrag von CHF 690’055.11 durch

Ausgabe von höchstens 23’001’837 vollständig zu liberierende Namenaktien mit einem Nennwert von je CHF 0.03 zu erhöhen. Eine Erhöhung des Aktienkapitals (i) durch die Zeichnung von Aktien aufgrund eines von einem

Finanzinstitut, eines Verbandes, einer anderen Drittpartei oder Drittparteien unter-zeichneten Angebots, gefolgt von einem An-gebot gegenüber den zu diesem Zeitpunkt bestehenden Aktionären der Gesellschaft sowie (ii) in Teilbeträgen

ist zulässig.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. The re-election of the independent voting rights representative.

The Board of

Directors proposes that shareholders approve the re-election of lic. iur. Marius Meier, Attorney at Law, Lautengartenstrasse 7, CH-4052 Basel, as the independent voting rights representative until the closing of the 2019 annual general meeting of

shareholders.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. The re-election of the auditors.

The Board of

Directors proposes to re-elect Ernst & Young AG as the Company’s statutory auditor for the term of office of one year and Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December

31, 2018.

|

|

For

☐

|

|

Against

☐

|

|

Abstain

☐

|

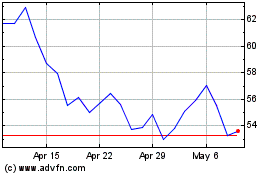

CRISPR Therapeutics (NASDAQ:CRSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

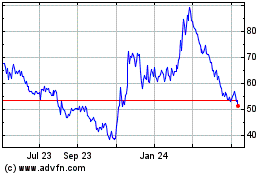

CRISPR Therapeutics (NASDAQ:CRSP)

Historical Stock Chart

From Apr 2023 to Apr 2024