By Ted Greenwald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 18, 2018).

International Business Machines Corp. posted its second

consecutive quarter of higher revenue after nearly six years of

declines, a sign that Chief Executive Ginni Rometty's slow-moving

turnaround may be taking hold.

Revenue in the quarter rose in all of the company's major

business units. Still, the results underscored the fragility of

IBM's shift from older businesses supplying on-site technology to

faster-growing businesses based on cloud computing.

The quarter's performance was plumped by sales of new hardware

that analysts expect to eventually peter out. Profit margins,

meanwhile, continued to narrow from a year earlier.

Revenue rose 5% to $19.07 billion from a year earlier, its

strongest gain for the top line since the third quarter 2011. As in

the previous quarter, though, adjusting for currency-exchange rates

tells a different story. Stripping out the impact of foreign

exchange, IBM said revenue was flat.

Several quarters ago, the company found itself on the other side

of the issue, where unfavorable rates made IBM's revenue declines

steeper than they appeared when adjusted for currencies.

Profit fell 4% to $1.68 billion. Shares of the tech giant sank

5.7% in after-hours trading, after closing up 1.9% at $160.91. The

stock has lost 6% in the past 12 months, even as the S&P 500

index has risen 15%.

The stock market reacted to overoptimism arising from IBM's

revenue turnaround in the fourth quarter, said Daniel Ives, an

analyst with GBH Insights. "Ultimately you'd call it a good

quarter, but the bulls were looking for more," he said.

Ms. Rometty has been working to turn around IBM almost since the

moment she took over from Sam Palmisano in 2012, as the emerging

industry of cloud computing ate away at IBM's business of managing

information technology in customers' facilities.

She has refashioned IBM as a cloud provider, seeking to

differentiate the company's offerings from lower-cost competitors

through buzzy technologies such as its artificial-intelligence

tools and blockchain, a decentralized way to execute and track

transactions.

IBM expects these offerings, which it calls strategic

imperatives, to grow more rapidly than its legacy businesses are

shrinking, propelling IBM to faster revenue growth as they come to

constitute a bigger portion of overall sales.

The company said strategic-imperatives revenue reached $37.7

billion, making up 47% of its revenue over the past 12 months, and

remains on track to reach $40 billion by the end of the year.

"The overarching message," IBM finance chief James Kavanaugh

said, "is that we grew revenue, stabilized our gross margin across

all our lines of business and grew operating profit, cash, and

earnings per share. So a good start to the year, overall."

However, margins remain an issue. The Systems division, which is

responsible for mainframe computers, and the Cognitive Solutions

division that includes high-profile offerings such as Watson, both

took a hit.

Mr. Kavanaugh attributed the narrowing Cognitive Solutions

margin to investments in developing technologies like artificial

intelligence.

Although IBM has two quarters of growth behind it, its rebound

is still a work in progress. The quarter's results benefited from

sales of a refreshed line of computing hardware that may not

last.

Revenue in the Systems division grew 7.5%, or 4% when adjusted

for currency, reflecting healthy sales of the company's latest

mainframes. IBM introduced new hardware last year, helping revenue

in the Systems division grow by double digits in the second half of

2017.

But several analysts expect the mainframe cycle to tail off by

the end of the year, creating a challenge for IBM to maintain its

momentum, especially since hardware sales tend to also have a

beneficial effect on revenue in other divisions. Toni Sacconaghi,

an analyst at Bernstein Research, estimates that hardware drives

sales of related support services, software, storage and financing

that historically have made up roughly 40% of IBM's operating

profit.

IBM will need to turn around declining revenue in its services

businesses to make up the difference, some analysts said. Those

businesses grew around 4.5% in the quarter, reversing their

declining trajectory in recent quarters. Getting those divisions

growing consistently is essential to IBM's long-term health,

according to some analysts.

The Armonk, N.Y., company reported $2.45 in per-share earnings

on an adjusted basis, which omits such items as acquisition- and

retirement-related charges. Analysts had expected $2.42 a share on

$18.84 billion in revenue, according to a survey by Thomson

Reuters.

Corrections & Amplifications IBM reported a quarterly profit

Tuesday. An earlier version of this article incorrectly stated it

reported a loss, in the headline.

--Maria Armental contributed to this article.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

April 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

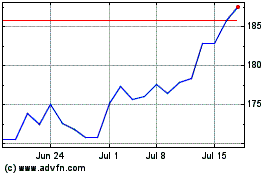

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024