Securities Registration: Employee Benefit Plan (s-8)

March 01 2018 - 6:00PM

Edgar (US Regulatory)

As Filed With the Securities and Exchange Commission on March 1, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM S‑8

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Tandem Diabetes Care, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

20-4327508

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

11075 Roselle Street

San Diego, California 92121

(Address of principal executive offices)

2013 Stock Incentive Plan

2013 Employee Stock Purchase Plan

(Full titles of the Plans)

David B. Berger, Esq.

General Counsel

Tandem Diabetes Care, Inc.

11075 Roselle Street

San Diego, California 92121

(858) 366-6900

(Name and address of agent for service)

Copy to:

Ryan C. Wilkins, Esq.

Stradling Yocca Carlson & Rauth, P.C.

660 Newport Center Drive, Suite 1600

Newport Beach, California 92660

(949) 725-4000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

(

D

o

n

o

t

c

h

e

c

k

i

f

a

s

m

a

l

l

e

r

r

e

p

o

r

t

i

n

g

c

o

m

p

a

n

y

)

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☒

1

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be Registered (1)

|

|

Proposed Maximum Offering Price Per Share

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, par value $0.001 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To be issued under the 2013 Stock Incentive Plan

|

|

|

45,141

|

|

(2)

|

|

$

|

3.01

|

|

(3)

|

|

$

|

135,874.41

|

|

|

$

|

16.92

|

|

|

Issued on December 1, 2017 under the 2013 Stock Incentive Plan

|

|

|

359,635

|

|

(4)

|

|

$

|

2.59

|

|

(5)

|

|

$

|

931,454.65

|

|

|

$

|

115.97

|

|

|

To be issued under the 2013 Employee Stock Purchase Plan

|

|

|

101,194

|

|

(6)

|

|

$

|

2.56

|

|

(7)

|

|

$

|

259,056.64

|

|

|

$

|

32.26

|

|

|

Total

|

|

|

505,970

|

|

|

|

N/A

|

|

|

|

$

|

1,326,385.70

|

|

|

$

|

165.15

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “

Securities Act

”), this Registration Statement shall also cover any additional shares of the registrant’s common stock, par value $0.001 per share (“

Common Stock

”) that become issuable under the registrant’s 2013 Stock Incentive Plan (the “

2013 Plan

”) and 2013 Employee Stock Purchase Plan (the “

2013 ESPP

”) by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of outstanding shares of Common Stock.

|

|

|

(2)

|

Represents additional shares of Common Stock that were automatically added to the number of shares reserved for issuance under the 2013 Plan effective January 1, 2018, pursuant to an evergreen provision contained therein less the shares of Common Stock reserved for issuance pursuant to stock option awards issued on December 1, 2017. Shares available for issuance under the 2013 Plan were previously registered on registration statements on Form S-8 filed with the Securities and Exchange Commission (the “

SEC

”) on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685) and March 8, 2017 (File No. 333-216529). See “Explanatory Note” for additional information.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act on the basis of the average of the high and low prices of the Common Stock as reported on the NASDAQ Global Market on February 23, 2018.

|

|

|

(4)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on December 1, 2017 in anticipation of an automatic increase in the number of shares of Common Stock reserved for issuance based on the application of the evergreen provision contained in the 2013 Plan as of December 31, 2017.

|

|

|

(5)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis of $2.59 per share, which represents the exercise price of stock option awards issued on December 1, 2017.

|

|

|

(6)

|

Represents additional shares of Common Stock that were automatically added to the number of shares reserved for issuance under the 2013 ESPP effective January 1, 2018, pursuant to an evergreen provision contained therein. Shares available for issuance under the 2013 ESPP were previously registered on registration statements on Form S-8 filed with the SEC on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685) and March 8, 2017 (File No. 333-216529). See “Explanatory Note” for additional information.

|

|

|

(7)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act on the basis of the average of the high and low prices of the Common Stock as reported on the NASDAQ Global Market on February 23, 2018 multiplied by 85%, which is the percentage of the trading price per share applicable to purchasers under the 2013 ESPP.

|

2

EXPLANATORY NOTE

REGISTRATION OF ADDITIONAL SHARES

Tandem Diabetes Care, Inc. is filing this Registration Statement on Form S-8 (this “

Registration Statement

”) with the Securities and Exchange Commission (the “

SEC

”) to register (i) 404,776 additional shares of Common Stock under the 2013 Plan, and (ii) 101,194 additional shares of Common Stock under the 2013 ESPP, pursuant to the provisions of those plans providing for an automatic increase in the number of shares reserved for issuance under such plans. Pursuant to General Instruction E of Form S-8, this Registration Statement hereby incorporates by reference the contents of the registrant’s registration statements on Form S-8 filed with the SEC on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685), and March 8, 2017 (File No. 333-216529).

3

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in San Diego, California on March 1, 2018.

|

Tandem Diabetes Care, Inc.

|

|

|

|

|

|

By:

|

|

/s/ Kim D. Blickenstaff

|

|

|

|

Kim D. Blickenstaff

|

|

|

|

President, Chief Executive Officer and Director

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints Kim D. Blickenstaff, Leigh A. Vosseller and David B. Berger, and each or any of them, acting individually, his true and lawful attorney-in-fact and agent, with full power of substitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ KIM D. BLICKENSTAFF

Kim D. Blickenstaff

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

March 1, 2018

|

|

|

|

|

|

/s/ LEIGH A. VOSSELLER

Leigh A. Vosseller

|

|

Senior Vice President, Chief Financial Officer and Treasurer (Principal Financial and Accounting Officer)

|

|

March 1, 2018

|

|

|

|

|

|

/s/ DICK P. ALLEN

Dick P. Allen

|

|

Director and Chairman of the Board

|

|

March 1, 2018

|

|

|

|

|

|

/s/ EDWARD L. CAHILL

Edward L. Cahill

|

|

Director

|

|

March 1, 2018

|

|

|

|

|

|

/s/ FRED E. COHEN

Fred E. Cohen, M.D., D.Phil, F.A.C.P.

|

|

Director

|

|

March 1, 2018

|

|

|

|

|

|

/s/ HOWARD E. GREENE, JR.

Howard E. Greene, Jr.

|

|

Director

|

|

March 1, 2018

|

|

|

|

|

|

/s/ DOUGLAS A. ROEDER

Douglas A. Roeder

|

|

Director

|

|

March 1, 2018

|

|

|

|

|

|

/s/ CHRISTOPHER J. TWOMEY

Christopher J. Twomey

|

|

Director

|

|

March 1, 2018

|

4

EXHIBIT INDEX

|

|

|

|

|

Incorporated by Reference

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

Form

|

|

File No.

|

|

Date of First Filing

|

|

Exhibit Number

|

|

Provided Herewith

|

|

4.1

|

|

Specimen Certificate for Common Stock.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

4.1

|

|

|

|

4.2

|

|

Amended and Restated Certificate of Incorporation of Tandem Diabetes Care, Inc., as currently in effect.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

3.4

|

|

|

|

4.3

|

|

Amended and Restated Bylaws of Tandem Diabetes Care, Inc., as currently in effect.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

3.5

|

|

|

|

4.4

|

|

Tandem Diabetes Care, Inc. 2013 Stock Incentive Plan.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.6

|

|

|

|

4.5

|

|

Form of Stock Option Agreement under 2013 Stock Incentive Plan.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.7

|

|

|

|

4.6

|

|

Form of Stock Option Agreement under 2013 Stock Incentive Plan (Non-Employee Directors).

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.8

|

|

|

|

4.7

|

|

Tandem Diabetes Care, Inc. 2013 Employee Stock Purchase Plan.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.9

|

|

|

|

5.1

|

|

Opinion of Stradling Yocca Carlson & Rauth, P.C.

|

|

|

|

|

|

|

|

|

|

X

|

|

23.1

|

|

Consent of independent registered public accounting firm.

|

|

|

|

|

|

|

|

|

|

X

|

|

23.2

|

|

Consent of Stradling Yocca Carlson & Rauth, P.C. (contained in Exhibit 5.1 hereto).

|

|

|

|

|

|

|

|

|

|

X

|

|

24.1

|

|

Power of Attorney (included in signature page hereto).

|

|

|

|

|

|

|

|

|

|

X

|

5

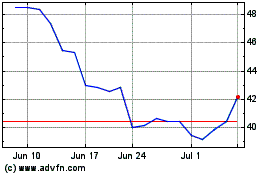

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Aug 2024 to Sep 2024

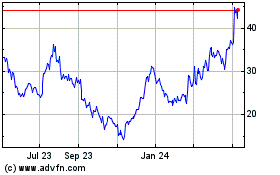

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Sep 2023 to Sep 2024