JPMorgan's Profit Hurt by Tax Law -- Update

January 12 2018 - 7:46AM

Dow Jones News

By Emily Glazer

JPMorgan Chase & Co. said Friday that fourth-quarter profit

fell from a year earlier because of one-time charges related to the

recently passed tax overhaul, while earnings excluding that impact

was roughly flat.

Shares rose 0.7% to $111.65 in premarket trading. The stock is

up 29% over the past year.

The biggest U.S. bank by assets reported net income of $4.23

billion, or $1.07 a share. That is down nearly 40% from a year

earlier because of a $2.4 billion charge related to the new tax

law. Excluding that charge, the bank said, earnings per share were

$1.76, up nearly 3% from a year ago.

Analysts polled by Thomson Reuters had expected earnings of

$1.69 a share. On a reported basis, or under generally accepted

accounting principles, earnings per share were expected at $1.16,

reflecting the tax-law charges.

Investors will next turn to the bank's earnings call Friday

morning to find out whether Chief Executive James Dimon or Chief

Financial Officer Marianne Lake will shed light on topics ranging

from impact of the tax law and its future benefits, as well as the

bank's trading revenue, which could foreshadow results across Wall

Street.

JPMorgan's trading revenues decreased 34% to $3.37 billion from

$4.52 billion a year earlier.

Wall Street was expecting a soft quarter after executives at a

number of banks said trading had remained subdued, a source of

concern for firms for much of 2017.

The tax charges were largely expected after Ms. Lake said during

an early December investor conference -- before the tax bill passed

-- that JPMorgan could have a one-time hit of up to $2 billion in

the fourth quarter if the law was enacted in 2017.

Charges related to changes in the value of the bank's deferred

tax assets and the need to repatriate profits held overseas. Such

charges could reduce the earnings the bank reports, although

investors are likely to look to the core operating results because

these hits will be one-time in nature.

The boost from still low -- but rising -- interest rates also

will likely be a major focus for investors, as an increase in rates

can help the profitability of big consumer lenders like

JPMorgan.

Costs increased to $14.59 billion from $13.83 billion a year

earlier. Ms. Lake said during the December investor presentation

that the bank expects the "absolute dollars to continue to grow"

based on several factors and JPMorgan continues to look for

opportunities to make "strategically good investments."

Return on equity, a key measure of profitability, was 7% in the

fourth quarter compared with 11% a year ago.

Write to Emily Glazer at emily.glazer@wsj.com

(END) Dow Jones Newswires

January 12, 2018 07:31 ET (12:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

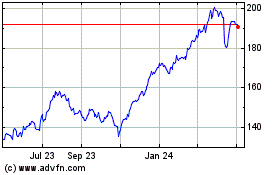

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

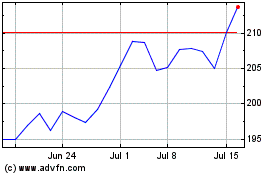

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024