Consumer-Goods Firms Shine in Financial Category -- WSJ

December 06 2017 - 3:02AM

Dow Jones News

P&G, Clorox and Colgate-Palmolive put their cash to good

use. But their markets are challenging.

By Ezequiel Minaya

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 6, 2017).

Consumer-goods companies may be under siege from slumping sales

and aggressive activist investors, but three of the industry's

stalwarts -- Procter & Gamble Co., Clorox Co. and

Colgate-Palmolive Co. -- placed among the top 20 in the

financial-strength category of the Drucker Institute's Management

Top 250 most effectively managed U.S. companies.

These companies excel at churning out profit and putting their

cash to good use. By squeezing reliable profits from toothpaste,

laundry detergent and housecleaning-product brands that date as far

back as a century, this trio of consumer-products giants is also

part of a select group of S&P 500 companies that have raised

dividends annually for 25 consecutive years or more.

The metrics the Drucker Institute used to assess financial

performance include return on assets, return on equity and return

on invested capital, common measures of how efficiently a company

makes money. Drucker also considered companies' market share and

profits, and the total return for investors in their shares.

P&G, Clorox and Colgate-Palmolive were among seven companies

that made the top 20 both in financial strength and overall. The

others were Apple Inc., the leader in financial strength and second

overall, chip maker Nvidia Corp., Alphabet Inc. and Accenture

PLC.

Challenging times

The consumer-products companies have been hard pressed to boost

sales growth while facing increased competition and shifting

consumer tastes. There are concerns over whether they can continue

their strong financial momentum, says Lawrence Crosby, chief

research scientist for the development of the Drucker rankings.

Among the common threads at the three companies: Each has a

chief financial officer who has been with the company at least a

quarter-century, with Colgate CFO Dennis Hickey serving the longest

tenure, at 40 years.

Those long terms of employment make the finance leaders at these

companies good at cost-cutting, says Peter Crist, chairman of

executive-search firm Crist|Kolder Associates. "They know how to

pull the levers," he says.

P&G in recent years has narrowed its focus, cutting back

from more than 100 brands to 65, in hopes of speeding revenue

growth and reversing market-share erosion, says finance chief Jon

Moeller.

The 180-year-old company, ranked No. 4 for financial strength by

Drucker, has cut some 20,000 jobs between 2012 and 2016, while

trimming $10 billion in costs. Company leaders have vowed to cut an

additional $10 billion by 2021, mostly by streamlining their supply

chain and bureaucracy, and focusing efforts on top brands.

"The strategy was put in place two or three years now," Mr.

Moeller says. "We want to be in categories that are used

daily."

Meanwhile, the company has grappled with a bruising proxy fight

with activist investor Nelson Peltz. Mr. Peltz argues that P&G,

the maker of Tide detergents, Pampers diapers and Gillette razors,

is burdened by excessive costs and bureaucracy and isn't moving

fast enough to boost sales and profit.

Adapting to change

Oakland, Calif.-based Clorox, 16th in Drucker's measure of

financial strength, has been able to adapt to changing market

dynamics with new or acquired products, such as its disinfecting

wipes and its Burt's Bees brand, helping it match up with smaller,

agile competitors, says Jason Gere, a consumer-products analyst at

KeyBanc Capital Markets.

The company's financial strength is reflected in its dividend

policy. Over the past four years, Clorox has returned $2 billion

through share buybacks and dividends, says CFO Stephen Robb. "We've

increased our dividend for 40 straight years," he says.

New York-based Colgate is 18th in financial strength (tied with

Boeing Co.), thanks in part to strong return on invested capital.

Slightly more than half of the company's cash is generated from

capital investments.

But Colgate's international reach has posed some challenges.

Most of the company's sales come from outside North America, and it

has seen its top line dented by currency woes.

Mr. Minaya is a reporter for CFO Journal at The Wall Street

Journal in New York. He can be reached at

ezequiel.minaya@wsj.com.

(END) Dow Jones Newswires

December 06, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

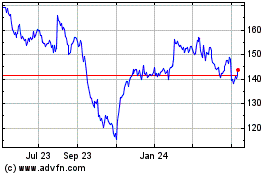

Clorox (NYSE:CLX)

Historical Stock Chart

From Apr 2024 to May 2024

Clorox (NYSE:CLX)

Historical Stock Chart

From May 2023 to May 2024