UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14D-9

(Amendment No. 20)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

NXP Semiconductors N.V.

(Name of Subject Company)

NXP

Semiconductors N.V.

(Name of Person Filing Statement)

Common Stock, Par Value EUR 0.20 Per Share

(Title of Class of Securities)

N6596X109

(CUSIP Number

of Class of Securities)

Dr. Jean A.W. Schreurs

SVP and Chief Corporate Counsel

60 High Tech Campus

5656

AG

Eindhoven, The Netherlands

+31-40-2728686

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the person filing statement)

With copies to:

Kenton J.

King

Allison R. Schneirov

Alexandra J. McCormack

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New

York, New York 10036

212-735-3000

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Amendment No. 20 to Schedule

14D-9

(this

“

Amendment No.

20

”) amends and supplements the Solicitation/Recommendation Statement on Schedule

14D-9

originally filed with the Securities and Exchange Commission (the

“

SEC

”) on November 18, 2016 (together with any subsequent amendments and supplements thereto, the “

Schedule

14D-9

”), by NXP Semiconductors N.V., a public limited

liability company (

naamloze

vennootschap

) organized under the laws of The Netherlands (the “

Company

” or “

NXP

”). The Schedule

14D-9

relates to the offer by

Qualcomm River Holdings B.V. (“

Buyer

”), a private company with limited liability (

besloten vennootschap met beperkte aansprakelijkheid

) organized under the laws of The Netherlands and an indirect, wholly owned subsidiary of

QUALCOMM Incorporated, a Delaware corporation (“

Parent

”), to acquire all of the outstanding common shares, par value €0.20 per share, of the Company (the “

Shares

”) at a purchase price of $110.00 per Share, less

any applicable withholding taxes and without interest to the holders thereof, payable in cash (such offer, on the terms and subject to the conditions set forth in the offer to purchase, dated November 18, 2016, and in the related letter of

transmittal, each as filed on Schedule TO, together with any amendments or supplements thereto, the “

Offer

”).

All

information regarding the Offer as set forth in the Schedule

14D-9,

including all exhibits and annexes that were previously filed with the Schedule

14D-9,

is hereby

expressly incorporated by reference into this Amendment No. 20, except that such information is hereby amended and supplemented to the extent specifically provided for herein. Capitalized terms used but not defined in this Amendment No. 20

have the meanings ascribed to them in the Schedule

14D-9.

|

Item 2.

|

Identity and Background of Filing Person

|

The disclosure in Item 2 of the Schedule

14D-9

under the heading “

(b) Tender Offer

” is hereby amended and supplemented by replacing “5:00 p.m., New York City time, on November 17, 2017” in provision (i) of the second

paragraph of such section with “5:00 p.m., New York City time, on December 15, 2017”.

The disclosure in Item 2 of the

Schedule

14D-9

under the heading “

(b) Tender Offer

” is hereby further amended and supplemented by adding the following paragraphs after the last paragraph of such section:

“The Offer, which was previously scheduled to expire at 5:00 p.m., New York City time, on November 17, 2017, is being extended in

accordance with the Purchase Agreement until 5:00 p.m., New York City time, on December 15, 2017, unless further extended or earlier terminated in accordance with the Purchase Agreement.

On November 17, 2017, Parent issued a press release announcing the extension of the Offer. The full text of the press release is filed as

Exhibit (a)(5)(aa) to the Schedule

14D-9.”

|

Item 6.

|

Interest in Securities of the Subject Company

|

The disclosure in Item 6 of the Schedule

14D-9

is hereby amended and supplemented to add the following, reflecting transactions by Mr. Richard L. Clemmer, the Company’s Executive Director, President and Chief Executive Officer, with respect

to Shares owned by him, which transactions have been effected in the period between October 26, 2017 and November 16, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Person

|

|

Transaction Date

|

|

Number of Shares

|

|

|

Share Price

|

|

Nature of the Transaction

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 26, 2017

|

|

|

272,950

|

|

|

$13.27 (exercise price)

$117.19 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 26, 2017

|

|

|

410,000

|

|

|

$16.84 (exercise price)

$117.19 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 26, 2017

|

|

|

617,050

|

|

|

€15.00 (exercise price)

$117.19 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 27, 2017

|

|

|

335,024

|

|

|

$23.49 (exercise price)

$117.15 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 27, 2017

|

|

|

482,950

|

|

|

$15.00 (exercise price)

$117.17 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

74,976

|

|

|

$23.49 (exercise price)

$116.73 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

166,024

|

|

|

$39.58 (exercise price)

$116.73 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

2,786

|

|

|

$39.58 (exercise price)

$116.75 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

75,000

|

|

|

€15.00 (exercise price)

$116.73 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

234,000

|

|

|

€30.00 (exercise price)

$116.73 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 30, 2017

|

|

|

374,252

|

|

|

€40.00 (exercise price)

$116.75 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 31, 2017

|

|

|

175,825

|

|

|

$39.58 (exercise price)

$116.89 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 31, 2017

|

|

|

121,256

|

|

|

$64.18 (exercise price)

$116.89 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

October 31, 2017

|

|

|

72,108

|

|

|

$116.82

|

|

Sale

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 1, 2017

|

|

|

90,000

|

|

|

$117.31

|

|

Sale

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 1, 2017

|

|

|

82,938

|

|

|

$73.00 (exercise price)

$117.30 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 1, 2017

|

|

|

15,375

|

|

|

$76.31 (exercise price)

$117.30 (sale

price)

|

|

Same-day

option exercise and sale for tax planning purposes

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 2, 2017

|

|

|

30,400

|

|

|

$117.41

|

|

Sale

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 2, 2017

|

|

|

258,567

|

|

|

$117.32

|

|

Sale

|

|

|

|

|

|

|

|

Richard L. Clemmer

|

|

November 3, 2017

|

|

|

5,740

|

|

|

$118.00

|

|

Sale

|

Additionally, during the period from October 26, 2017 through November 16, 2017, the other members

of the Company’s executive officer group (excluding Richard L. Clemmer, whose transactions are listed above) collectively sold 406,767 Shares for sale prices between $115.80 through $118.17.

|

Item 8.

|

Additional Information

|

The disclosure in Item 8 of the Schedule

14D-9

under the heading “

(b) Regulatory and Other Approvals

” is hereby amended and supplemented by adding the following sentence to the end of the ninth paragraph of such section:

“On November 17, 2017, the JFTC granted clearance of the transactions.”

Item 9 of the Schedule

14D-9

is hereby

amended and supplemented by adding the following exhibit:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(5)(aa)

|

|

Press release issued by Parent, dated November 17, 2017 (incorporated by reference to Exhibit (a)(5)(U) to the Schedule TO).

|

4

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

Date: November 17, 2017

|

|

|

|

|

NXP SEMICONDUCTORS N.V.

|

|

|

|

|

By:

|

|

/s/ Dr. Jean A.W. Schreurs

|

|

|

|

Dr. Jean A.W. Schreurs

|

|

|

|

SVP and Chief Corporate Counsel

|

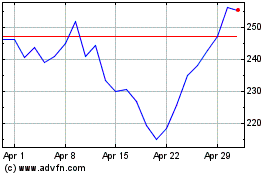

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

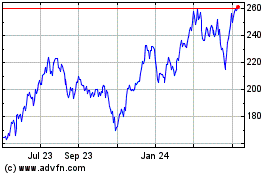

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Apr 2023 to Apr 2024