Current Report Filing (8-k)

November 17 2017 - 7:42AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 17, 2017

MATCH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-37636

(Commission

File Number)

|

26-4278917

(IRS Employer

Identification No.)

|

8750 North Central Expressway, Suite 1400

Dallas, TX 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(214) 576-9352

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

On November 17, 2017, Match Group, Inc. (“Match Group” or the “Company”) announced that it intends to commence a proposed private unregistered offering (the “Offering”) of $450 million aggregate principal amount of senior notes due 2027 (the “Notes”). Match Group issued a press release announcing the commencement of the Offering, a copy of which is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 8.01.

In connection with the Offering, Match Group is disclosing in this Current Report on Form 8-K certain retrospective updates that have been made to the financial information of the Company that was previously filed with the Securities and Exchange Commission (“SEC”) by Match Group on February 28, 2017 in its Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Form 10-K”), such updates being made to reflect the sale by Match Group on March 31, 2017 of its Non-dating business, which operated under the umbrella of The Princeton Review. As a result of the sale, the Company moved the results of The Princeton Review to discontinued operations and Match Group is managed as a portfolio of dating brands and has one operating segment, Dating.

In addition, in this Current Report on Form 8-K the Company has:

•

updated the disclosures related to recent accounting pronouncements that were included in its Form 10-Q for the Quarter Ended September 30, 2017, which was filed on November 9, 2017, including to reflect its adoption of ASU No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, effective January 1, 2017 and

•

included as subsequent events, the Company’s conversion of all outstanding equity awards of its wholly-owned Tinder business into Match Group options; the incremental borrowing and repricing of the Company’s term loan; and the sale of a cost method investment.

The following items of the 2016 Form 10-K are being updated retrospectively to reflect the above-mentioned changes:

|

|

|

|

|

|

1.

|

Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

2.

|

Part II—Item 8. Consolidated Financial Statements and Supplementary Data:

|

|

|

Consolidated Balance Sheet

|

|

|

Consolidated and Combined Statement of Operations

|

|

|

Consolidated and Combined Statement of Cash Flows

|

|

|

Note 1—Organization

|

|

|

Note 2—Summary of Significant Accounting Policies

|

|

|

Note 3—Income Taxes

|

|

|

Note 4—Business Combination

|

|

|

Note 5—Discontinued Operations

|

|

|

Note 6—Goodwill and Intangible Assets

|

|

|

Note 12—Earnings per Share

|

|

|

Note 14—Geographic Information

|

|

|

Note 15—Commitments

|

|

|

Note 19—Benefit Plans

|

|

|

Note 21—Consolidated and Combined Financial Statement Details

|

|

|

Note 22—Quarterly Results (Unaudited)

|

|

|

Note 23—Subsequent Events

|

The above sections, as updated, are included in Exhibit 99.2 to this Current Report on Form 8-K and are incorporated herein by reference. This Current Report on Form 8-K should be read in conjunction with the 2016 Form 10-K, provided that the foregoing sections supersede the corresponding sections included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Consolidated Financial Statements and Supplementary Data” contained in the 2016 Form 10-K. Except to reflect the matters specifically noted above, this Current Report on Form 8-K does not reflect events occurring after the filing of the original 2016 Form 10-K, and does not modify or update the disclosures therein in any way. More current information is contained in the Company’s subsequent filings with the SEC, including its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2017, June 30, 2017 and September 30, 2017 as filed with the SEC.

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

23.1

|

Consent of Ernst & Young LLP

|

|

99.1

|

Press Release of Match Group, Inc. dated November 17, 2017

|

|

99.2

|

Portion of the 2016 Form 10-K:

Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II—Item 8. Consolidated Financial Statements and Supplementary Data

|

|

101.INS XBRL

|

Instance

|

|

101.SCH XBRL

|

Taxonomy Extension Schema

|

|

101.CAL XBRL

|

Taxonomy Extension Calculation

|

|

101.DEF XBRL

|

Taxonomy Extension Definition

|

|

101.LAB XBRL

|

Taxonomy Extension Labels

|

|

101.PRE XBRL

|

Taxonomy Extension Presentation

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

MATCH GROUP, INC.

|

|

|

|

|

|

|

By:

|

/s/ Gary Swidler

|

|

|

|

Gary Swidler

|

|

|

|

Chief Financial Officer

|

Date: November 17, 2017

INDEX TO EXHIBITS

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

|

|

|

|

|

|

|

Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II—Item 8. Consolidated Financial Statements and Supplementary Data

|

|

101.INS XBRL

|

Instance

|

|

101.SCH XBRL

|

Taxonomy Extension Schema

|

|

101.CAL XBRL

|

Taxonomy Extension Calculation

|

|

101.DEF XBRL

|

Taxonomy Extension Definition

|

|

101.LAB XBRL

|

Taxonomy Extension Labels

|

|

101.PRE XBRL

|

Taxonomy Extension Presentation

|

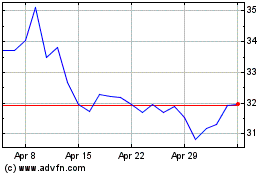

Match (NASDAQ:MTCH)

Historical Stock Chart

From Apr 2024 to May 2024

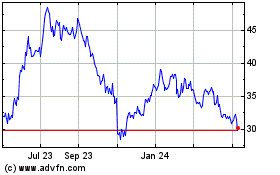

Match (NASDAQ:MTCH)

Historical Stock Chart

From May 2023 to May 2024