Zedge, Inc. (NYSE American:ZDGE) today announced results for the

fourth quarter and full fiscal year 2017, the three and twelve

months ended July 31, 2017.

Fourth Quarter and Full FY 2017

Operational and Financial Highlights

(Results are for the 4th quarter and full FY 2017 compared to

the 4th quarter and full FY 2016 respectively, unless otherwise

noted)

- MAU (Monthly Active Users) for the last

30 days of the quarter increased 1.9% to 31.7 million from 31.1

million in the comparable period of 2016, even as Q4 continued the

shift in our user base to emerging markets from more well-developed

countries. We have begun to see a reversal of the trend in Q1 of

fiscal 2018;

- Total installs at July 31, 2017

increased 26.5% to 273.7 million from 216.4 million at July 31,

2016;

- Quarterly revenue increased 3.9% to

$2.547 million from $2.452 million;

- Average revenue per MAU derived from

our apps (ARPMAU) increased for the third consecutive quarter,

rising 2.4% sequentially to $0.0255 from $0.0249;

- Full year revenue decreased 9.7% to

$10.0 million compared to $11.1 million;

- Loss from operations during the 4th

quarter of FY 2017 was $264 thousand compared to loss from

operations of $771 thousand;

- Full year loss from operations was $683

thousand compared to income from operations of $1.173 million;

- Net loss per diluted share of $0.02 in

the 4th quarter of FY 2017 compared to net loss per diluted share

of $0.08;

- Full year diluted loss per share of

$0.06 compared to diluted EPS of $0.11;

- Zedge Marketplace expected to launch in

late 2017;

- Instituting cost cutting initiatives

expected to yield $1.5 - $2.0 million annually, ex-Freeform. Some

of these savings will be used for initial funding of the Zedge

Marketplace initiative.

Management Remarks

“Zedge remains exceptionally committed to investing resources in

activities that will increase revenues, expand our user base,

improve frequency of use and retention while also managing our

costs,” said Tom Arnoy, CEO.

“Although Q4 was generally flat when compared to the year ago

quarter and to Q3 of FY ’17, our targeted focus is starting to bear

fruit as we are witnessing improved fundamentals, across revenue,

engagement and user growth, in the current quarter. Furthermore, we

have undertaken a set of cost cutting initiatives, including a

modest workforce reduction, reconfiguring key infrastructure for

better efficiency and lower cost, and instituting tighter

discretionary spending controls. We expect these actions to deliver

$1.5 - $2.0 million in annual savings. Additionally, Jonathan Reich

and I have opted to take voluntary salary cuts as a part of our

commitment to manage the company for sustained, long term,

growth.

“With the Freeform acquihire behind us, later this year we plan

on rolling out the Zedge Marketplace where artists will sell their

digital creations and help us in growing our user base, introducing

new revenue streams and improving engagement. Initial funding for

this promising endeavor will come from the savings that we generate

from the cost cutting steps we are implementing.”

Jonathan Reich, CFO and COO of Zedge, said, “During fiscal 2017,

we invested in several key infrastructure projects and product

enhancements that are now starting to pay off allowing us to

simultaneously scale our business and cut costs. We accomplished

the Freeform transaction with a structure that provides a

manageable risk profile for an initiative designed to drive new

user growth and revenue contribution and will only pay the full

price if success is achieved. We will continue to look at organic

and creative ways to grow our user base, expand revenue, contain

costs and unlock value.”

Financial Results by Quarter (in

thousands of USD)

Zedge, Inc.’s FY 2017 audit by its independent auditors is not

fully completed.

Q4FY '17 Q4FY '16

DELTA

%Change

Q4FY '17 Q3FY '17

DELTA

% Change

FY '17 FY '16 DELTA

% Change

Revenue $2,547 $2,452 $95 3.9% $2,547

$2,530 $17 0.7% $10,031 $11,113

($1,082) -9.7% Direct Cost of Revenue $381

$367 $14 3.8% $381 $406 ($25)

-6.2% $1,567 $1,299 $268 20.6% Total SG&A

$2,247 $2,439 ($192) -7.9% $2,247

$2,151 $96 4.5% $8,468 $7,755

$713 9.2% Depreciation & Amortization $156

$135 $21 15.6% $156 $166 ($10)

-6.0% $643 $605 $38 6.3% Write Off of Software

/ Tech Development $27 $281 ($254)

-90.4% $27 $0 $27 $36 $281

($245) -87.2% (Loss)/Income from Operations

($264) ($771) $507 -65.8% ($264) ($193)

($71) 36.8% ($683) $1,173 ($1,856)

-158.2% Net (Loss)/Gain from FX & Other $60

($17) $77 -452.9% $60 ($46) $106

-230.4% $56 ($47) $103 -219.1% (Benefit

From)/Provision For Income Taxes ($4) ($9) $5

-55.6% ($4) $0 ($4) $16

($143) $159 -111.2% Net (Loss)/Income ($208)

($780) $572 -73.3% ($208) ($239)

$31 -13.0% ($611) $983 ($1,594) -162.2%

Diluted (Loss)/Earnings Per Share ($0.02) ($0.08)

$0.06 -75.0% ($0.02) ($0.02) $0.00

0.0% ($0.06) $0.11 ($0.17) -154.5% MAU

(Million) 31.7 31.1 0.6 1.9% 31.7

31.7 0.0 0.0% 31.7 31.1 0.6

1.9% Total Installs (Million) 273.7 216.4

57.3 26.5% 273.7 260.4 13.3 5.1%

273.7 216.4 57.3 26.5% ARPMAU $0.0255

$0.0244 $0.0011 4.5% $0.0255 $0.0249

$0.0006 2.4% $0.0244 $0.0269 ($0.0025)

-9.3%

Earnings Announcement and Supplemental

Information

Zedge will host a conference call at 5:00 PM ET today, October

18th, beginning with management’s discussion of results, outlook

and strategy followed by Q&A with investors.

To participate in the call, please dial toll-free 1-888-317-6003

(from the U.S.) or 1-412-317-6061 (outside the U.S.) at least five

minutes before the 5:00 PM Eastern start, ask for the Zedge

earnings conference call, and enter the conference ID: 7596341

The conference call will also be webcast and can be accessed

both live and for three months following the call through this URL:

http://services.choruscall.com/links/zdge171018C8rjqToL.html

Forward Looking

Statements

All statements above that are not purely about historical facts,

including, but not limited to, those in which we use the words

“believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,”

“target” and similar expressions, are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. While these forward-looking statements represent our

current judgment of what may happen in the future, actual results

may differ materially from the results expressed or implied by

these statements due to numerous important factors. Our filings

with the SEC provide detailed information on such statements and

risks, and should be consulted along with this release. To the

extent permitted under applicable law, we assume no obligation to

update any forward-looking statements.

About Zedge

Zedge is a content platform, and global leader in smartphone

personalization, with more than 273 million app installs and 32

million monthly active users. People use Zedge to make their

smartphones more personal; to express their emotions, tastes and

interests using wallpapers, icons, widgets, ringtones and more. The

Zedge platform enables brands, artists and creators to share their

smartphone personalization content with their fans in order to

extend their reach, reinforce their message and gain valuable

insight into how customers interact with their content.

ZEDGE, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

July 31,

2017 2016

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 4,580 $ 5,978 Trade accounts receivable, net of

allowance for doubtful accounts of $0 at July 31, 2017 and 2016

1,712 1,668 Prepaid expenses 315 210 Other current assets

427 107

TOTAL CURRENT ASSETS

7,034 7,963 Property and equipment, net 2,678 1,843 Goodwill 2,518

2,361 Other assets 301 266

TOTAL ASSETS $ 12,531 $ 12,433

LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT

LIABILITIES: Trade accounts payable $ 33 $ 36 Accrued expenses

1,840 1,487 Deferred revenue — 15 Due to IDT Corporation 36

299

TOTAL CURRENT LIABILITIES

1,909 1,837

TOTAL

LIABILITIES 1,909 1,837

Commitments and contingencies (Note 8) STOCKHOLDERS’

EQUITY: Preferred stock, $0.01 par value; authorized

shares—2,400; no shares issued — — Class A common stock; $0.01 par

value; authorized shares—2,600; 525 shares issued and outstanding

at July 31, 2017 and 2016 5 5 Class B common stock; $0.01 par

value; authorized shares—40,000; 9,123 and 8,819 shares issued and

outstanding at July 31, 2017 and 2016, respectively 91 88

Additional paid-in capital 21,446 21,045 Accumulated other

comprehensive loss (584 ) (817 ) Accumulated deficit (10,336

) (9,725 )

TOTAL STOCKHOLDERS’ EQUITY

10,622 10,596

TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY $ 12,531 $ 12,433

ZEDGE, INC.

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE (LOSS) INCOME

(in thousands, except per share

data)

Year ended July 31,

2017

2016 REVENUES

$

10,031

$ 11,113

COSTS AND EXPENSES: Direct cost of revenue

(exclusive of amortization of capitalized software and technology

development costs included below) 1,567 1,299 Selling, general and

administrative 8,468 7,755 Depreciation and amortization 643 605

Write-off of capitalized software and technology development costs

36 281

(LOSS) INCOME FROM

OPERATIONS (683 ) 1,173 Interest and other income 19 2 Net gain

(loss) resulting from foreign exchange transactions 37

(49 )

(LOSS) INCOME BEFORE INCOME TAXES

(627 ) 1,126 Benefit from (provision for) income taxes 16

(143 )

NET (LOSS) INCOME (611 ) 983

Other comprehensive income (loss): Changes in foreign currency

translation adjustment 233 (162 )

TOTAL OTHER COMPREHENSIVE INCOME (LOSS) 233

(162 )

TOTAL COMPREHENSIVE (LOSS) INCOME $

(378 ) $ 821 (Loss) earnings per share

attributable to Zedge, Inc. common stockholders: Basic $ (0.06 )

$ 0.12 Diluted $ (0.06 ) $ 0.11

Weighted-average number of shares used in

calculation of (loss) earnings per share:

Basic 9,467 8,346 Diluted

9,467 9,279

ZEDGE, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(in thousands)

Year ended July 31,

2017

2016 OPERATING ACTIVITIES Net (loss) income

$

(611

)

$ 983 Adjustments to reconcile net (loss) income to net cash (used

in) provided by operating activities: Depreciation and amortization

643 605 Deferred income taxes (28 ) (26 ) Write-off of capitalized

software and technology development costs 36 281 Stock-based

compensation 275 166 Change in assets and liabilities: Trade

accounts receivable (45 ) (46 ) Prepaid expenses and other current

assets (481 ) (94 ) Other assets (8 ) (7 ) Trade accounts payable

and accrued expenses 400 39 Due to IDT Corporation (263 ) (70 )

Deferred revenue (15 ) 11 Net cash

(used in) provided by operating activities (97 ) 1,842

INVESTING

ACTIVITIES Capitalized software and technology development

costs and purchase of equipment (1,506 )

(1,006 ) Net cash used in investing activities (1,506 ) (1,006 )

FINANCING ACTIVITIES Proceeds from exercise of stock options

166 9 Sale of equity prior to the Spin-Off —

3,000 Net cash provided by financing activities

166 3,009 Effect of exchange

rates on cash and cash equivalents 39

(37 ) Net (decrease) increase in cash and cash equivalents (1,398 )

3,808 Cash and cash equivalents at beginning of year 5,978

2,170 Cash and cash equivalents at end

of year $ 4,580 $ 5,978

SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION Cash

payments made for income taxes $ — $ 112

SUPPLEMENTAL SCHEDULE OF NON-CASH FINANCING ACTIVITIES

Receivable for exercise of stock options $ —

$ 56 Reclassification of mezzanine equity

— $ 100

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171018006352/en/

ZedgeJonathan Reichir@zedge.net

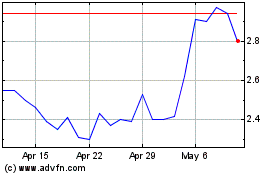

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Apr 2023 to Apr 2024