Current Report Filing (8-k)

October 05 2017 - 6:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) September 25, 2017

DSG

GLOBAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-53988

|

|

26-1134956

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

214

- 5455 152nd Street

Surrey,

British Columbia V3S 5A5, Canada

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code

(604) 575-3848

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.02 Unregistered Sales of Equity Securities.

On

September 19

th

, a convertible promissory note of $107,000 that carries an interest rate of 10%, matures on March 6,

2018, and grants a senior secured debt position became effective from its issuance date of September 6

th,

2017. The

note gives the holder a right to convert the principal to common shares. The conversion price (the “Conversion Price”)

shall equal the lesser of the (i) lowest Trading Price (as defined below) during the previous twenty-five (25) Trading Day period

ending on the latest complete Trading Day prior to the date of this Note and (ii) lowest Trading Price during the previous twenty-five

(25) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date (the result of which shall mean

the “Fixed Conversion Price”), provided,

The

Conversion Price is subject to full ratchet anti-dilution in the event that the Company issues any common stock at a per share

price lower than the Conversion Price (each a “Dilutive Price”) then in effect, provided, however, that Holder shall

have the sole discretion in deciding whether to utilize such Dilutive Price instead of the Conversion Price otherwise in effect

at the time of the respective conversion.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

DSG

|

|

|

|

|

|

|

|

By:

|

/s/

Robert Silzer

|

|

|

|

Robert

Silzer

|

|

|

|

Chief

Executive Officer

|

|

Date:

October 4, 2017

EXHIBIT

INDEX

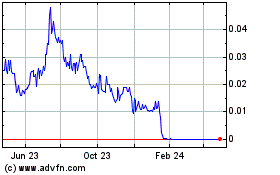

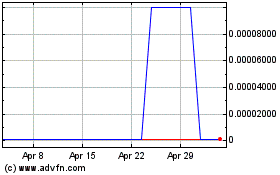

DSG Global (CE) (USOTC:DSGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

DSG Global (CE) (USOTC:DSGT)

Historical Stock Chart

From Sep 2023 to Sep 2024