Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 20 2017 - 6:10AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated July 19, 2017

Registration Statement No. 333-219312

XPO Logistics, Inc.

11,000,000 Shares

The following

information supplements the Preliminary Prospectus Supplement dated July 17, 2017 (the “Preliminary Prospectus Supplement”).

|

|

|

|

|

Issuer:

|

|

XPO Logistics, Inc.

|

|

|

|

|

Shares of common stock

offered by the Issuer:

|

|

5,000,000 shares of our common stock (or 6,650,000 shares of our common stock if the underwriters’ option to purchase additional shares is exercised in full).

|

|

|

|

|

Shares of common stock

offered by the Forward

Counterparties:

|

|

6,000,000 shares of our common stock

|

|

|

|

|

Public Offering Price:

|

|

$60.50 per share

|

|

|

|

|

Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

J.P. Morgan

Securities LLC

Barclays Capital Inc.

Citigroup Global Markets

Inc.

Deutsche Bank Securities Inc.

Merrill Lynch, Pierce,

Fenner & Smith Incorporated

Credit Suisse Securities (USA) LLC

|

|

|

|

|

Co-managers:

|

|

KeyBanc Capital Markets Inc.

Oppenheimer

& Co. Inc.

Raymond James & Associates, Inc.

Stifel,

Nicolaus & Company, Incorporated

Cowen and Company, LLC

HSBC Securities (USA) Inc.

Credit Agricole Securities (USA)

Inc.

Macquarie Capital (USA) Inc.

Wolfe Research Securities,

LLC

Seaport Global Securities, LLC

|

Capitalized terms used herein and not otherwise defined shall have the meanings assigned to such terms in the Preliminary

Prospectus Supplement.

We have been advised by the underwriters that on July 19, 2017, one of the underwriters purchased, on behalf of the

syndicate, 85,255 shares of the Issuer’s common stock at an average price of $60.4917 per share in stabilizing transactions in accordance with Regulation M.

The issuer has filed a registration statement (including a prospectus supplement) with the SEC for the offering to which this communication relates. Before

you invest, you should read the prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will

arrange to send you the prospectus supplement and accompanying base prospectus if you request them from Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd

Floor, New York, NY 10014 or by telephone at (866) 718-1649 or JP. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by telephone at (866) 803-9204.

2

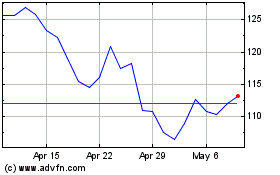

XPO (NYSE:XPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

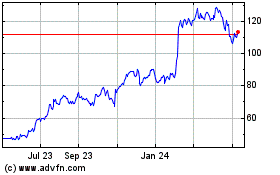

XPO (NYSE:XPO)

Historical Stock Chart

From Apr 2023 to Apr 2024