UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of March, 2025

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Exhibit

Index

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

March 10, 2025 |

|

|

| |

By: |

/s/

Roger Hamilton |

| |

Name: |

Roger

Hamilton |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

Exhibit

1

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

Registered

Office:

8

Amoy Street #01-01

Singapore

049950

NOTICE

OF EXTRAORDINARY GENERAL MEETING

NOTICE

IS HEREBY GIVEN THAT an Extraordinary General Meeting (“EGM”) of the Genius Group Limited (the “Company”)

will be held at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square Singapore 049949 on 7 April 2025 at 4:00 p.m.

(Singapore time), for the purpose of considering and, if thought fit, passing with or without modifications, the resolutions as set out

below:

| 1. |

ORDINARY

RESOLUTION - PROPOSED SHARE BUYBACK MANDATE |

To

consider and, if thought fit, to pass the following Resolution as an Ordinary Resolution, with or without amendments:

“THAT:

| |

(a) |

for

the purposes of the Companies Act 1967 of Singapore (the “Companies Act”), the exercise by the directors of the

Company (“Directors”) of all the powers of the Company to purchase or otherwise acquire the issued ordinary shares

in the capital of the Company (“Shares”) not exceeding in aggregate the Prescribed Limit (as herein defined),

at such price(s) as may be determined by the Directors from time to time up to the Maximum Price (as herein defined) whether by way

of: |

| |

(i) |

market

purchases (each a “Market Purchase”) on the NYSE American; and/or |

| |

|

|

| |

(ii) |

off-market

purchases (each an “Off-Market Purchase”) effected otherwise than on the NYSE American in accordance with an equal

access scheme(s) as may be determined or formulated by the Directors as they consider fit, which scheme(s) shall satisfy all the

conditions prescribed by the Companies Act, |

and

otherwise in accordance with all applicable laws, regulations and the listing rules of the NYSE American as may for the time being be

applicable, be and is hereby authorized and approved generally and unconditionally (the “Share Buyback Mandate”);

| |

(b) |

the

authority conferred on the Directors pursuant to the Share Buyback Mandate may be exercised by the Directors of the Company at any

time and from time to time during the period commencing from the date of passing of this Resolution and expiring on the earlier of: |

| |

(i) |

the

date on which the next annual general meeting of the Company (“AGM”) is held or is required by law to be held; |

| |

|

|

| |

(ii) |

the

date on which the Share buybacks pursuant to the Share Buyback Mandate are carried out to the full extent mandated; or |

| |

|

|

| |

(iii) |

the

date on which the authority contained in the Share Buyback Mandate is varied or revoked; |

| |

(i) |

“Prescribed

Limit” means 20% of the total number of issued Shares (excluding treasury shares and subsidiary holdings) as at the date

of passing of this Resolution, unless the Company has effected a reduction of the share capital of the Company in accordance with

the applicable provisions of the Companies Act at any time during the Relevant Period, in which event the total number of issued

Shares shall be taken to be the total number of issued Shares as altered, excluding any subsidiary holdings and treasury shares,

that may be held by the Company from time to time; |

| |

|

|

| |

(ii) |

“Relevant

Period” means the period commencing from the date of passing of this Resolution and expiring on the date the next AGM is

held or is required by law to be held, whichever is the earlier; |

| |

(iii) |

“Maximum

Price” in relation to a Share to be purchased, means an amount (excluding brokerage, stamp duties, applicable goods and

services tax and other related expenses) not exceeding 130% of the Average Closing Price; |

| |

|

|

| |

(iv) |

“Average

Closing Price” means the average of the closing market prices of a Share over the last five (5) Market Days, on which transactions

in the Shares were recorded, in the case of a Market Purchase, preceding the day of the Market Purchase, and deemed to be adjusted

for any corporate action that occurs during the relevant 5-day period and the date of the Market Purchase, or in the case of an Off-Market

Purchase, preceding the date on which the Company makes an offer for the purchase or acquisition of Shares from Shareholders, stating

therein the relevant terms of the equal access scheme for effecting the Off- Market Purchase; and |

| |

(d) |

the

Directors be and are hereby authorised to complete and do all such acts and things (including executing such documents as may be

required) as they may consider expedient or necessary to give effect to the transactions contemplated by this Resolution.” |

Explanatory

Note relating to the proposed Ordinary Resolution 1:

The

Ordinary Resolution 1 proposed above will empower the Directors from the date of the above Meeting to purchase or otherwise acquire Shares

by way of Market Purchases or Off-Market Purchases, provided that the aggregate number of Shares to be purchased or acquired under the

Share Buyback Mandate does not exceed the Prescribed Limit, and at such price(s) as may be determined by the Directors of the Company

from time to time up to but not exceeding the Maximum Price.

Source

of Funds

The

Company may only apply funds for the purchase or acquisition of Shares as provided in the Constitution and in accordance with the applicable

laws in Singapore. The Company may not purchase or acquire its Shares for a consideration other than in cash or, in the case of a Market

Purchase, for settlement otherwise than in accordance with the trading rules of the NYSE American.

The

Company may use internal sources of funds or external borrowings or a combination of both to finance the Company’s purchase or

acquisition of Shares pursuant to the Share Buyback Mandate. The Directors do not propose to exercise the Share Buyback Mandate to such

an extent that it would have a material adverse effect on the working capital requirements of the Group.

Financial

Effects

It

is not possible for the Company to realistically calculate or quantify the impact of purchases or acquisitions of Shares that may be

made pursuant to the Share Buyback Mandate on the net tangible assets (“NTA”) per Share and earnings per share (“EPS”)

as the resultant effect would depend on, inter alia, the aggregate number of Shares purchased or acquired, whether the purchase or acquisition

is made out of capital or profits, the purchase prices paid for such Shares, the amount (if any) borrowed by the Company to fund the

purchase or acquisition and whether the Shares purchased or acquired are cancelled or held as treasury shares.

The

Company’s total number of issued Shares will be diminished by the total number of Shares purchased by the Company and which are

not held as treasury shares. The NTA of the Company will be reduced by the aggregate purchase price (including any expenses such as brokerage

and commission) paid by the Company for the Shares.

Under

the Companies Act, purchases or acquisitions of Shares by the Company may be made out of the Company’s capital or profits so long

as the Company is solvent. Where the consideration paid by the Company for the purchase or acquisition of Shares is made out of profits,

such consideration will correspondingly reduce the amount available for the distribution of cash dividends by the Company.

The

purchase or acquisition of Shares will only be effected by the Company after the Directors have considered relevant factors such as the

working capital requirements, the availability of financial resources and the expansion and investment plans of the Company, and the

prevailing market conditions.

For

illustrative purposes only, the financial effects of the Share Buyback Mandate on the Company, based on the unaudited financial statements

of the Company for the financial year ended 31 December 2024 are based on the assumptions set out below:

| |

(a) |

based

on 71,519,983 Shares in issue (excluding treasury shares and subsidiary holdings) as at 24 February 2025 (the “Latest Practicable

Date”) and assuming no further Shares are issued and no reduction of share capital of the Company takes place, not more

than 14,303,996 Shares (representing 20% of the total number of issued Shares (excluding treasury shares and subsidiary holdings))

may be purchased by the Company pursuant to the Share Buyback Mandate (if renewed). As the Company does not have any treasury shares

as at the Latest Practicable Date, the maximum number of Shares the Company can purchase or acquire and hold as treasury shares pursuant

to the proposed Share Buyback Mandate is 7,151,998 Shares; |

| |

|

|

| |

(b) |

assuming

that the Company purchases or acquires 14,303,996 Shares at the Maximum Price of 0.566 for one Share (being the price equivalent

to 130% above the Average Closing Price of the Shares for the five consecutive Market Days on which the Shares were traded on the

NYSE American immediately preceding the Latest Practicable Date), the maximum amount of funds required for the purchase or acquisition

of the 14,303,996 Shares (excluding related expenses) is approximately US$8,096,062. |

For

illustrative purposes only, and based on the assumptions set out in sub-paragraphs (a) and above and assuming that:

| |

(i) |

such

purchase or acquisition of Shares is made entirely out of capital and financed solely by internal sources of funds; |

| |

|

|

| |

(ii) |

the

Share Buyback Mandate had been effective on 1 January 2024; |

| |

|

|

| |

(iii) |

the

Company had purchased or acquired 14,303,996 Shares on 1 January 2024; and |

| |

|

|

| |

(iv) |

related

expenses incurred directly in the purchases or acquisitions by the Company of the Shares at the relevant time are not taken into

account, |

the

financial effects of:

| |

(1) |

the

purchase or acquisition of 14,303,996 Shares by the Company and out of which 7,151,998 Shares are held as treasury shares; and |

| |

|

|

| |

(2) |

the

purchase or acquisition of 14,303,996 Shares by the Company and all 14,303,996 Shares are cancelled, |

on

the unaudited financial statements of the Company for the financial year ended 31 December 2024 pursuant to the Share Buyback Mandate,

are summarised in the following tables:

| |

(1) |

the

purchase or acquisition of 14,303,996 Shares by the Company and out of which 7,151,998 Shares are held as treasury shares |

| As at 31 December 2024 | |

Before Share Purchase | | |

After Market Purchase | | |

After Off- Market Purchase | |

| | |

| | |

| | |

| |

| Issued capital and reserves | |

| 166,042,890 | | |

| 157,946,828 | | |

| 157,946,828 | |

| Treasury shares | |

| 0 | | |

| 4,048,031 | | |

| 4,048,031 | |

| Total equity | |

| 166,042,890 | | |

| 161,994,859 | | |

| 161,994,859 | |

| Current assets (1) | |

| 36,833,704 | | |

| 28,737,642 | | |

| 28,737,642 | |

| Current liabilities | |

| 10,752,102 | | |

| 10,752,102 | | |

| 10,752,102 | |

| Working capital | |

| 26,081,602 | | |

| 17,985,540 | | |

| 17,985,540 | |

| Total Borrowing | |

| 10,267,977 | | |

| 10,267,977 | | |

| 10,267,977 | |

| Net Asset | |

| 82,762,396 | | |

| 74,666,334 | | |

| 74,666,334 | |

| Number of Shares (excluding treasury shares) (‘000)(2) | |

| 71,519,983 | | |

| 57,215,987 | | |

| 57,215,987 | |

| Treasury shares (‘000) | |

| 0 | | |

| 7,151,998 | | |

| 7,151,998 | |

| | |

| | | |

| | | |

| | |

| Financial Ratios | |

| | | |

| | | |

| | |

| NTA per Share ($) | |

| 1.16 | | |

| 1.30 | | |

| 1.30 | |

| Current ratio (times) | |

| 3.43 | | |

| 2.67 | | |

| 2.67 | |

| Net gearing ratio (%) | |

| 0.12 | | |

| 0.14 | | |

| 0.14 | |

*(1)

Current assets include digital currencies including BTC holding of the Company

*(2)

Number of shares includes total number of shares as of record date (24 February 2025)

| |

(2) |

the

purchase or acquisition of 14,303,996 Shares by the Company and all 14,303,996 Shares are cancelled |

| As at 31 December 2024 | |

Before Share Purchase | | |

After Market Purchase | | |

After Off- Market Purchase | |

| | |

| | |

| | |

| |

| Issued capital and reserves | |

| 166,042,890 | | |

| 157,946,828 | | |

| 157,946,828 | |

| Treasury shares | |

| 0 | | |

| 0 | | |

| 0 | |

| Total equity | |

| 166,042,890 | | |

| 157,946,828 | | |

| 157,946,828 | |

| Current assets (1) | |

| 36,833,704 | | |

| 28,737,642 | | |

| 28,737,642 | |

| Current liabilities | |

| 10,752,102 | | |

| 10,752,102 | | |

| 10,752,102 | |

| Working capital | |

| 26,081,602 | | |

| 17,985,540 | | |

| 17,985,540 | |

| Total Borrowing | |

| 10,267,977 | | |

| 10,267,977 | | |

| 10,267,977 | |

| Net Asset | |

| 82,762,396 | | |

| 74,666,334 | | |

| 74,666,334 | |

| Number of Shares (excluding treasury shares) (‘000)(2) | |

| 71,519,983 | | |

| 57,215,987 | | |

| 57,215,987 | |

| Treasury shares (‘000) | |

| 0 | | |

| 0 | | |

| 0 | |

| | |

| | | |

| | | |

| | |

| Financial Ratios | |

| | | |

| | | |

| | |

| NTA per Share ($) | |

| 1.16 | | |

| 1.30 | | |

| 1.30 | |

| Current ratio (times) | |

| 3.43 | | |

| 2.67 | | |

| 2.67 | |

| Net gearing ratio (%) | |

| 0.12 | | |

| 0.14 | | |

| 0.14 | |

*(1)

Current assets include digital currencies including BTC holding of the Company

*(2)

Number of shares includes total number of shares as of record date (24 February 2025)

| 2. |

SPECIAL

RESOLUTION - THE PROPOSED ADOPTION OF THE NEW CONSTITUTION |

To

consider and, if thought fit, to pass the following Resolution as a Special Resolution, with or without amendments:

“THAT:

| |

(a) |

the

regulations contained in the new constitution of the Company as set out in https://ir.geniusgroup.net/corporate-governance/governance-documents

(the “New Constitution”) be and are hereby approved and adopted as the constitution of the Company in

substitution for, and to the exclusion of, the Existing Constitution with immediate effect from the passing of this special resolution;

and |

| |

|

|

| |

(b) |

the

Directors and each of them be and are hereby authorized to complete and do all such acts and things (including executing all such

documents as may be required) as they and/or he may consider expedient, desirable or necessary to give effect to the adoption of

the New Constitution and all transactions contemplated and/or authorized by this special resolution.” |

Definitions

For

purposes of this Notice (including the Proxy Form) the following definitions are used:

| 1. |

Beneficial

Shareholders means persons or entities holding their interests in the Company’s shares as, or through, a participant in

The Depository Trust Company (“DTC”), or its nominee, Cede & Co. in book entry form at VStock Transfer, LLC

(“VStock”) or such other entity that may be engaged as registrar of members or transfer agent on behalf of the

Company, a broker, dealer, securities depository or other intermediary and who are reflected in the books of such intermediary; also

commonly referred to in the United States as “street name holders”. |

| |

|

| 2. |

Shareholder

of Record means a person or entity whose name is reflected in the Company’s register of members, and who is not necessarily

a Beneficial Shareholder. |

| |

|

| 3. |

NYSE

American Shareholders means Beneficial Shareholders. |

General

Matters relating to the EGM:

| 1. |

The

Company’s EGM will be held in a wholly physical format at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square

Singapore 049949 on 7 April 2025 at 4:00 p.m. (Singapore time), for considering and, if thought fit, passing the Ordinary and Special

Resolution set out in this Notice of EGM. There will be no option for shareholders to participate virtually. |

| 2. |

Quorum:

The quorum required to transact business at the EGM is for at least two Shareholders to be present. Shares represented at the

meeting for which an abstention from voting has been recorded are counted towards the quorum. |

| 3. |

Basis

of voting: Votes shall be taken on a poll with one vote for each share. In order for Ordinary Resolution to be passed, more than

50% of the eligible votes cast on the Resolution must be in favour of the Resolution and for the Special Resolution to be passed,

more than 75% of the eligible votes cast on the Resolution must be in favour of the Resolution. Whilst shares for which an abstention

from voting has been recorded are counted toward the quorum of the meeting, the calculation of the percentage of votes cast in favour

of the Resolution disregards abstained votes. A person entitled to more than one vote need not use all his votes or cast all the

votes he uses in the same way. |

| |

|

| 4. |

Identification

of Beneficial Shareholders and Shareholders on Records and their corporate representatives: Before any person may participate

in the EGM, the Chairman of the EGM must be reasonably satisfied that the right of the person to participate at the EGM has been

reasonably verified. |

| |

|

| 5. |

Record

Date for determining Beneficial Shareholders’ eligibility to vote: Only those Beneficial Shareholders recorded in the records

of the relevant securities depository on 24 February 2025 are eligible to vote. |

Participation

in the EGM

| 1. |

Notice

and Proxy Form: Printed copies of this Notice and accompanying proxy form will be sent to Shareholders and published on the Company’s

corporate website at the URL https://ir.geniusgroup.net/. |

| |

|

| 2. |

Submission

of questions: Shareholders may submit questions related to the resolution to be tabled no later than 11:59 p.m. on 4 April 2025

(Singapore time) via email to investors@geniusgroup.net. For verification purpose, when submitting any questions, Shareholders

MUST provide the Company with their particulars (comprising full name (for individuals) / company name (for corporates), email address,

contact number, NRIC / passport number / company registration number, shareholding type and number of shares held). The Company will

endeavour to address the substantial and relevant queries from Shareholders no later than 48 hours prior to the closing date and

time for the lodgement of the proxy forms through an announcement to be released on the Company’s corporate website at the

URL https://ir.geniusgroup.net/. If questions or follow-up questions are submitted after the 4 April 2025 deadline, the Company

will endeavour to address these questions at the EGM itself. Where substantially similar questions are received, the Company will

consolidate such questions and consequently not all questions may be individually addressed. |

| 3. |

Appointment

of Proxies: |

| |

(a) |

Shareholders

may exercise their voting rights at the EGM via proxy voting. A proxy need not be a Shareholder. |

| |

|

|

| |

(b) |

Shareholders

who wish to appoint proxies (including appointing the Chairman of the Meeting (the “Chairman”) as their proxy)

to attend the EGM and vote at the EGM on their behalf must complete and submit the Proxy Form in accordance with the instructions

below or on the proxy card; by 4:00 p.m. on 4 April 2025 (Singapore time). |

| |

|

|

| |

(c) |

A

Shareholder who wishes to submit an instrument of proxy must first complete and sign the proxy form mailed to them with the Notice

(or downloaded from the Company’s corporate website), before delivering or scanning and sending a clear copy of it: |

| |

(i) |

in

the case of NYSE American Shareholders, by following the instruction on the proxy form by 4:00 p.m. on 4 April 2025 (Singapore time);

and |

| |

(ii) |

in

the case of Shareholders on Record, to VStock Transfer, LLC, 18 Lafayette Place or by email to vote@vstocktransfer.com or

by following the instruction on the proxy form by 4:00 p.m. on 4 April 2025 (Singapore time). |

| |

(d) |

In

the Proxy Form, a Shareholder should specifically direct the proxy on how he/she is to vote for or vote against (or abstain from

voting on) the resolution to be tabled at the EGM. If no specific direction as to voting is given, the proxy (including the Chairman

if he is appointed as proxy) will vote or abstain from voting at his/her discretion. All valid votes cast via proxy on each resolution

will be counted. |

| 4. |

Personal

Data Privacy: |

By

participating in the EGM (through pre-registration, attendance or the submission of any questions to be raised at the EGM) and/or any

adjournment thereof, submitting an instrument appointing a proxy to attend, speak and vote at the EGM and/or any adjournment thereof,

or submitting any details of the Shareholder’s corporate representatives in connection with the EGM, a Shareholder (whether a Beneficial

Shareholder or a Shareholder of Record) (a) consents to the collection, use and disclosure of the Shareholder’s personal data by

the Company (or its agents or service providers) for the purpose of the processing, administration and analysis by the Company (or its

agents or service providers) of proxies appointed for the EGM (including any adjournment thereof) and the preparation and compilation

of the attendance lists, minutes and other documents relating to the EGM (including any adjournment thereof), and in order for the Company

(or its agents or service providers) to comply with any applicable laws, take-over rules, listing rules, regulations and/or guidelines

(collectively, the “Purposes”); (b) warrants that where the Shareholder discloses the personal data of the Shareholder’s

proxy or corporate representative to the Company (or its agents or service providers), the Shareholder has obtained the prior consent

of such proxy or corporate representative for the collection, use and disclosure by the Company (or its agents or service providers)

of the personal data of such proxy or corporate representative for the Purposes; and (c) agrees that the Shareholder will indemnify the

Company in respect of any penalties, liabilities, claims, demands, losses and damages as a result of the Shareholder’s breach of

warranty.

By

Order of the Board

Roger

James Hamilton

Director

Date:

07 March 2025

Attachments:

Proxy Form

GENIUS

GROUP LIMITED

(Company

Registration No. 201541844C)

(Incorporated

in the Republic of Singapore)

PROXY

FORM

EXTRAORDINARY

GENERAL MEETING

IMPORTANT

| 1. |

By submitting an instrument appointing a proxy, the Shareholder

accepts and agrees to the personal data privacy terms set out in the Notice of Extraordinary General Meeting (“EGM”) dated

March 7, 2025 . |

| 2. |

Alternative arrangements relating to submission of questions

in advance of the EGM and voting during the EGM or by appointing a proxy or proxies (including the Chairman of the Meeting as proxy)

at the EGM, are set out in the Notice of EGM dated March 7, 2025. |

| 3. |

Please read the notes to the Proxy Form. |

I/We,

(Name) (NRIC/Passport/Registration No.) of (Address) being the Shareholder of Record / Beneficial Shareholder of __________________

ordinary shares in Genius Group Limited (the “Company”) hereby appoint:

| Name |

|

Address |

|

NRIC

/ Passport Number/Registration No. |

|

Email

Address |

|

Proportion

of

Shareholdings (%) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

*and/or

(delete as appropriate)

| Name |

|

Address |

|

NRIC

/ Passport Number/Registration No. |

|

Email

Address |

|

Proportion

of

Shareholdings (%) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

or

failing *the person or both of the persons above, the Chairman of the EGM as my/our proxy to attend, speak and vote for me/us on my/our

behalf at the AGM of the Company to be held at Genius Central Singapore Pte Ltd, 7 Amoy Street #01-01 Far East Square Singapore 049949

on Monday, 7 April 2025 at 4:00 p.m. (Singapore time) and at any adjournment thereof.

I/We

direct the proxy(ies) of the EGM, to vote “For” or “Against”, or “Abstain” from voting on the Resolutions

proposed at the EGM as indicated hereunder. If no specific directions as to voting is given or in the event of any other matter arising

at the EGM and at any adjournment thereof, the proxy will vote or abstain from voting at his/her discretion.

| No |

|

Resolution |

|

Number

of votes FOR |

|

Number

of votes AGAINST |

|

Number

of votes ABSTAIN |

| 1 |

|

Ordinary

Resolution: Proposed Share Buyback Mandate |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| 2 |

|

Special

Resolution: Proposed Adoption of New Constitution |

|

|

|

|

|

|

Notes:

(Please

indicate with a tick [“√”] in the space provided whether you wish to cast all your votes for or against or to

abstain from voting on each resolution as set out in the Notice of EGM. Alternatively, if you wish to exercise your votes both for and

against any resolution and/or to abstain from voting on any resolution, please indicate the number of shares in the respective spaces

provided.)

Dated

this ________ day of ______________________ 2025

___________________________________

Signature(s)

of member(s) or common seal

IMPORTANT:

PLEASE READ NOTES OVERLEAF

NOTES

TO PROXY FORM:

| 1. |

An

instrument appointing a proxy shall be in writing and: |

| |

(a) |

in

the case of an individual shall be signed by the appointor or by his attorney; and |

| |

|

|

| |

(b) |

in

the case of a corporation shall be either under the common seal or signed by its attorney or by a duly authorised officer on behalf

of the corporation. |

| 2. |

A

proxy need not be a member of the Company. A Shareholder may choose to appoint the Chairman of the EGM as his/her/its proxy. |

| |

|

| 3. |

Shareholders

who wish to submit an instrument of proxy must first complete and sign the proxy form mailed to them with the Notice (or downloaded

from the Company’s corporate website), before delivering it (or scanning and sending a clear copy of it): |

| |

(i) |

in

the case of NYSE American Shareholders by following the instruction on the proxy form by 4:00 p.m. on 4 April 2025 (Singapore time);

and |

| |

|

|

| |

(ii) |

in

the case of Shareholders on Record to VStock Transfer, LLC,18 Lafayette Place or by email to vote@vstocktransfer.com or by following

the instruction on the proxy form by 4:00 p.m. on 4 April 2025 (Singapore time). |

| 4. |

The

power of attorney (if applicable) or other authority, if any, appointing a person to attend and vote at the EGM must be submitted

to the Company via email to investors@geniusgroup.net, not less than 72 hours before the time appointed for holding the EGM i.e.

by 4:00 p.m. on 4 April 2025 (Singapore time). |

| |

|

| 5. |

A

corporation which is a Shareholder of the Company may authorise by resolution of its directors or other governing body, such person

as it thinks fit to act as its representative at the EGM in accordance with Section 179 of the Companies Act 1967 of Singapore. |

| |

|

| 6. |

Shareholders

shall insert the relevant number of those shares owned by them that is to be represented in this Proxy Form. Shareholders are not

obliged to vote all their shares or to vote all their shares in the same manner. |

| |

|

| 7. |

Shareholders

shall insert the relevant number of shares in respect of which they wish to vote in the relevant space under the columns headed “For”,

“Against”, “Abstain”, as appropriate if they wish to split their votes across the voting options or to cast

their votes in respect of a lesser number of shares than they own in the Company. Shareholders are not obliged to use all the votes

exercisable by them, but the total of the votes cast and in respect of which abstention is recorded may not exceed the total of the

votes exercisable by them. If Shareholders wishes to cast all of the votes of those shares owned by them that are represented in

this Proxy Form in the same way in respect of a particular resolution, such Shareholders need not fill in such number of shares,

and shall indicate their vote as either “For”, “Against” or “Abstain” by placing a “√”

within the box provided. |

| 8. |

Any

deletions, alterations or corrections made to this Proxy Form must be initialled by the Shareholder. |

| |

|

| 9. |

In

the case of joint Shareholders, all holders must sign this Proxy Form. |

| |

|

| 10. |

The

Chairman of the EGM may accept any voting instruction submitted other than in accordance with these notes if he is satisfied as to

the manner in which the Shareholder wishes to vote. |

| |

|

| 11. |

Any

form that is incomplete, improperly completed or illegible or where the true intentions of the person executing the Proxy Form are

not ascertainable may be rejected. |

| 12. |

In

any case where a Shareholder on Record is a securities depository whose name or whose nominee’s name is entered as a member

in the register of members of the Company in respect of book-entry securities in the Company (“Depository”), the

Company shall be entitled and bound: |

| |

(a) |

to

reject any instrument of proxy lodged if a person who has an account directly with the Depository, which account is credited with

book-entry securities in the Company, (“Depositor”) is not shown to have any shares entered against his name in

the register maintained by the Depository in respect of book-entry securities in the Company (“Depository Register”)

as at 72 hours before the time of the EGM as certified by the Depository to the Company; and |

| |

|

|

| |

(b) |

to

accept as the maximum number of votes which in aggregate the proxy appointed by the Depositor is or are able to cast on a poll a

number which is the number of shares entered against the name of that Depositor in the Depository Register as at 72 hours before

the time of the EGM as certified by the Depository to the Company, whether that number is greater or smaller than the number specified

in any instrument of proxy executed by or on behalf of that Depositor. If that number is smaller than the number specified in the

instrument of proxy, the maximum number of votes “For”, “Against” or “Abstain” shall be accepted

in (as nearly as may be) the respective proportions set out in the instrument of proxy. |

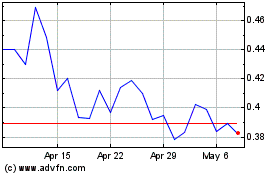

Genius (AMEX:GNS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Mar 2025