U.S. Stocks May Move Back To The Upside In Early Trading

July 01 2024 - 10:04AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Monday, with stocks likely to move back to the upside

following the downturn seen over the course of the previous

session.

Optimism about the outlook for interest rates may lead to

renewed buying interest on Wall Street following last Friday’s

closely watched inflation data.

The report showed a slowdown in the annual rate of consumer

price growth, leading to increased speculation the Federal Reserve

is likely to lower interest rates at least once this year.

Overall trading activity may be somewhat subdued, however, as

traders look ahead to the release of the Labor Department’s closely

watched monthly jobs report on Friday.

The report, which is expected to show a slowdown in the pace of

job growth in the month of June, could impact the outlook for

interest rates.

Traders may also stick to the sidelines ahead of remarks by Fed

Chair Jerome Powell on Tuesday as well as the Independence Day

holiday on Thursday.

Stocks moved mostly higher in early trading on Friday but showed

a significant downturn over the course of the session. The major

averages pulled back well off their early highs and into negative

territory.

After reaching record intraday highs, the Nasdaq slid 126.08

points or 0.7 percent to 17,732.60 and the S&P 500 fell 22.39

points or 0.4 percent to 5,460.48. The narrower Dow posted a more

modest loss, edging down 45.20 points or 0.1 percent to

39,118.86.

For the week, the Nasdaq rose by 0.2 percent but the Dow and the

S&P 500 both edged down by 0.1 percent. However, the Nasdaq and

the S&P 500 posted substantial gains for the first half of the

year.

The early strength on Wall Street came following the release of

a Commerce Department report showing readings on consumer price

inflation in the month of May came in line with economist

estimates.

The report said the personal consumption expenditures (PCE)

price index came in unchanged in May after rising by 0.3 percent in

April, while the annual rate of growth slowed to 2.6 percent from

2.7 percent.

The core PCE price index, which excludes food and energy prices,

inched up by 0.1 percent in May after climbing by an upwardly

revised 0.3 percent in April.

The annual rate of growth by core prices also slowed to 2.6

percent in May from 2.8 percent in April, in line with economist

estimates.

While the data initially generated renewed optimism about the

outlook for interest rates, buying interest waned over the course

of the session.

The subsequent pullback by the markets may have reflected a

negative reaction to a turnaround by treasury yields, which

initially moved lower following the release of the data but

subsequently rebounded firmly into positive territory.

Treasury yields advanced as some analysts pointed out that pace

of consumer price growth remains well above the Federal Reserve’s

2.0 percent target and suggested the latest data is not likely to

convince the central bank to accelerate its plans to lower

rates.

“While an improvement from trends earlier this year, the

elevated inflation readings in yesterday’s revised GDP data

indicate persistent pricing pressures,” said John Lynch, Chief

Investment Officer for Comerica Wealth Management.

“The expected number of rate cuts for this year have steadily

declined, but traders continue to ignore the Fed’s higher for

longer stance,” he added. “Since the fed funds rate remains higher

than nominal GDP growth, we believe the Fed will need to cut 1-2

times over the next six months. Any hope for further accommodation,

absent recession, is likely misguided.”

Despite the pullback by the broader markets, networking stocks

continued to see substantial strength on the day, with the NYSE

Arca Networking Index surging by 2.4 percent to a four-month

closing high.

Infinera (NASDAQ:INFN) led the sector higher, spiking by 15.8

percent after the telecom equipment maker agreed to be acquired by

Noka (NYSE:NOK) for $2.3 billion.

Considerable strength also remained visible among banking

stocks, as reflected by the 2.3 percent jump by the KBW Bank

Index.

Steel, transportation and semiconductor stocks also saw notable

strength, while utilities and computer hardware stocks moved to the

downside.

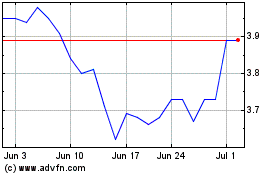

Nokia (NYSE:NOK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Jul 2023 to Jul 2024