UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13E-3

(Amendment No. 3)

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

Consolidated

Communications Holdings, Inc.

(Name of the Issuer)

Consolidated

Communications Holdings, Inc.

Condor Holdings LLC

Condor Merger Sub Inc.

Searchlight III CVL, L.P.

Searchlight III CVL GP, LLC

Eric Zinterhofer

(Names of Persons Filing Statement)

Common Stock, $0.01 par value

(Title of Class of Securities)

209034107

(CUSIP Number of Class of Securities)

J.

Garrett Van Osdell

Chief Legal Officer

Consolidated Communications Holdings, Inc.

2116 South 17th Street

Mattoon, Illinois 61938-5973

(217) 235-3311

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications

on Behalf of the Persons Filing Statement)

With copies to

Robert I. Townsend, III

O. Keith Hallam, III

Cravath, Swaine & Moore LLP

825 8th Avenue

New York, NY 10019

(212) 474-1000 |

Steven A. Cohen

Victor Goldfeld

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

(212) 403-1000 |

Ryan J. Maierson

Ryan J. Lynch

Latham & Watkins LLP

811 Main Street

Houston, TX 77002

(713) 546-7420 |

This statement is filed in connection with (check

the appropriate box):

| a. |

x |

The filing of solicitation materials

or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. |

¨ |

The filing of a registration statement under the Securities

Act of 1933. |

| c. |

¨ |

A tender offer. |

| d. |

¨ |

None of the above. |

Check the following box if the soliciting materials

or information statement referred to in checking box (a) are preliminary copies: ¨

Check the following box if the filing is a final

amendment reporting the results of the transaction: ¨

INTRODUCTION

This Amendment No. 3 (this “Amendment No.

3”), which amends and supplements the Rule 13e-3 transaction statement on Schedule 13E-3 filed with the Securities and Exchange

Commission (the “SEC”) on November 20, 2023 (as amended by Amendment No. 2 filed with the SEC on December 18, 2023 and Amendment

No. 1 filed with the SEC on December 13, 2023, together with the exhibits hereto, the “Schedule 13E-3” or “Transaction

Statement”), is being filed pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together with the rules

and regulations promulgated thereunder, the “Exchange Act”), jointly by the following persons (each, a “Filing Person,”

and collectively, the “Filing Persons”): (i) Consolidated Communications Holdings, Inc. (“Consolidated” or the

“Company”), a Delaware corporation and the issuer of the common stock, par value $0.01 per share (the “Shares”),

that is subject to the Rule 13e-3 transaction, (ii) Condor Holdings LLC, a Delaware limited liability company (“Parent”),

(iii) Condor Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), (iv) Searchlight

III CVL, L.P., a Delaware partnership and the sole member of Parent (“Searchlight III CVL”), (v) Searchlight III CVL GP, LLC,

a Delaware limited liability company and the general partner of Searchlight III CVL (“Searchlight III CVL GP”) and (vi) Eric

Zinterhofer, the sole member of Searchlight III CVL GP. Parent, Merger Sub, Searchlight III CVL and Searchlight III CVL GP are Filing

Persons of this Transaction Statement because they are affiliates of the Company under the SEC rules governing “going-private”

transactions.

On

October 15, 2023, the Company entered into an Agreement and Plan of Merger (as amended, restated, supplemented or otherwise modified

from time to time, the “Merger Agreement”) with Parent and Merger Sub, pursuant to which, subject to the terms and

conditions thereof, Merger Sub will merge with and into the Company (the “Merger”) with the Company continuing as the surviving

corporation and a wholly owned subsidiary of Searchlight III CVL.

In connection with the Merger Agreement,

Parent has obtained equity financing commitments from British Columbia Investment Management Corporation, in respect of a pooled

investment portfolio formed under the Pooled Investment Portfolios Regulation (British Columbia) and known as the “2020

Private Equity Fund” (“BCI”) and certain affiliates of Parent (together with BCI, the “Guarantors”)

in an aggregate amount of $370,000,000 to fund the transactions contemplated by the Merger Agreement (the “Equity Commitment

Letters”). The consummation of the Merger is not subject to a financing condition. The Company is entitled to specific

performance, subject to the terms and conditions of the Merger Agreement and the applicable equity commitments, to require each

Guarantor to fund its respective equity commitment and Parent to close the Merger, if, among other things, all closing conditions

are met. In addition, concurrently with the execution of the Merger Agreement, each of the Guarantors also entered into a limited

guaranty with the Company (the “Limited Guaranties”) pursuant to which the Guarantors have each provided a limited

guaranty with respect to the payment of their pro rata portion of certain payment obligations of Parent and Merger Sub that may be

owed to the Company under the Merger Agreement up to the applicable aggregate amount set forth in the Limited Guaranties.

Subject

to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger (the “Effective Time”),

each Share issued and outstanding immediately prior to the Effective Time (other than Shares (i) held by Parent, Merger Sub, or any subsidiary

of the Company or Parent, (ii) held by the Company as treasury shares or (iii) held by any person who properly exercises appraisal rights

under Delaware law (collectively, the “Excluded Shares”)) shall be converted into the right to receive an amount in cash

equal to $4.70 per share, without interest (the “Merger Consideration”), subject to any withholding of taxes required by

applicable law.

In addition, pursuant to the Merger Agreement,

at the Effective Time, (i) each award of restricted shares of Company common stock subject to time-based vesting conditions that is held

by a non-employee director or by certain affiliates of Parent (each, a “director Company RSA”) will vest and be converted

into the right to receive a cash payment equal to (a) the Merger Consideration multiplied by (b) the number of shares of Company common

stock subject to such director Company RSA, (ii) each other award of restricted shares of Company common stock that remains subject solely

to service-based vesting conditions (each, a “Company RSA”) will be converted into an award representing the right to receive

an amount in cash (without interest) (a “contingent cash award”) with a value equal to (a) the Merger Consideration multiplied

by (b) the number of shares of Company common stock subject to such Company RSA and (iii) each performance-based award of restricted

shares of Company common stock (each, a “Company PSA”) will be converted into a contingent cash award with a value equal

to (a) the Merger Consideration multiplied by (b) the number of shares of Company common stock subject to such Company PSA. The number

of shares of Company common stock subject to a Company PSA will be determined based on the number of shares of Company common stock that

would have been earned under such Company PSA based on the actual level of achievement of the performance goals (other than the total

shareholder return modifier, which will be deemed to be achieved at the target level (i.e., 100%)) through the end of the performance

period (as determined by the board of directors of the surviving corporation (or the appropriate committee thereof) in reasonable good

faith).

Each contingent cash award will be subject to

the same terms and conditions (other than the total shareholder return modifier), including vesting conditions, applicable to the underlying

Company RSA or Company PSA from which it was converted (including any accelerated vesting terms and conditions).

Concurrently with the execution of the Merger

Agreement, the Company entered into a voting agreement (the “Voting Agreement”) with Searchlight III CVL, which, directly

or indirectly, beneficially owns approximately 33.8% of the outstanding Shares, pursuant to which, among other things, Searchlight III

CVL has agreed to vote (or cause to be voted) all of the Shares held by Searchlight III CVL or Searchlight Capital Partners, L.P. in

favor of the adoption of the Merger Agreement and approval of the Merger and the other transactions contemplated by the Merger Agreement.

On December 18, 2023, the Company filed with the

SEC a definitive proxy statement (the “Proxy Statement”) under Regulation 14A of the Exchange Act, relating to a special

meeting of the stockholders of the Company (the “Special Meeting”) at which the stockholders of the Company will consider

and vote upon a proposal to adopt the Merger Agreement and cast an advisory (non-binding) vote to approve the compensation that may be

paid or become payable to the named executive officers of the Company in connection with the consummation of the Merger. Concurrently

with the filing of this Amendment No. 3, the Company is filing definitive additional materials under Regulation 14A of the Exchange Act

(the “Supplement”, a copy of which is attached hereto as Exhibit (a)(2)(iv)) to amend and supplement the Proxy Statement.

The adoption of the Merger Agreement will require the affirmative vote (in person or by proxy) of the holders of (a) a majority of the

voting power represented by the Shares that are entitled to vote thereon in accordance with the Delaware General Corporation Law and

(b) a majority of the voting power represented by the Shares that are entitled to vote thereon in accordance with the DGCL and held by

Unaffiliated Stockholders (as defined in the Proxy Statement). A copy of the Proxy Statement is attached hereto as Exhibit (a)(2)(i)

and incorporated herein by reference. A copy of the Merger Agreement is attached hereto as Exhibit (d)(i) and is also included as Annex

A to the Proxy Statement and incorporated herein by reference.

The board of directors of the Company (the “Board”)

formed a special committee of independent and disinterested members of the Board (the “Special Committee”) to, among other

things, evaluate the Merger, and the Special Committee has unanimously determined that it was fair to and in the best interests of the

Company and the Unaffiliated Stockholders for the Company to enter into the Merger Agreement and unanimously recommended that the Board:

(i) approve and declare advisable the Merger Agreement and the transactions contemplated by the Merger Agreement, (ii) approve the execution,

delivery and performance of the Merger Agreement by the Company and the consummation of the Merger and the other transactions contemplated

by the Merger Agreement, (iii) direct that the Merger Agreement be submitted to the holders of Shares entitled to vote thereon for its

adoption and (iv) recommend the adoption of the Merger Agreement and approval of the Merger and the other transactions contemplated by

the Merger Agreement by the holders of Shares.

The Board, acting upon the recommendation of the

Special Committee, by unanimous vote of those directors present at a special meeting of the Board (excluding the Searchlight Directors,

who recused themselves), determined that it was fair to and in the best interests of the Company and the Unaffiliated Stockholders for

the Company to enter into the Merger Agreement and approved and declared advisable the Merger Agreement and the transactions contemplated

by the Merger Agreement and (i) approved the execution, delivery and performance of the Merger Agreement by the Company and the consummation

of the Merger and the other transactions contemplated by the Merger Agreement, (ii) directed that the Merger Agreement be submitted to

the holders of Shares entitled to vote thereon for its adoption and (iii) recommended the adoption of the Merger Agreement and approval

of the Merger and the other transactions contemplated by the Merger Agreement by the holders of Shares.

The Merger is subject to the satisfaction or waiver

of the conditions set forth in the Merger Agreement, including the approval and adoption of the Merger Agreement by the Company’s

stockholders.

The cross-references below are being supplied

pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included

in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy

Statement, including all appendices thereto, is incorporated in its entirety herein by reference, and the responses to each item in this

Schedule 13E-3 are qualified in their entirety by the information contained in the Proxy Statement and the appendices thereto.

Capitalized terms used but not expressly defined in this Schedule 13E-3 shall have the respective meanings

given to them in the Proxy Statement.

The information concerning the Company contained

in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by the Company. Similarly, all information

concerning each other Filing Person contained in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied

by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other

Filing Person.

Item

1. Summary Term Sheet

The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

Item

2. Subject Company Information

(a)

Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein

by reference:

“THE PARTIES TO THE MERGER”

(b)

Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Beneficial Ownership of Common Stock by Management and Directors”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

(c) Trading

Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“SUMMARY TERM SHEET”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

(d)

Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

(e)

Prior Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated

herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Prior Public Offerings”

(f) Prior

Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

Item

3. Identity and Background of Filing Person

(a)–(c)

Name and Address; Business and Background of Entities; Business and Background of Natural Persons. Consolidated Communications

Holdings, Inc. is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“THE PARTIES TO THE MERGER”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY”

“OTHER IMPORTANT INFORMATION REGARDING

PARENT”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Item

4. Terms of the Transaction

(a)(1)

Tender Offers. Not Applicable.

(a)(2)

Merger or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Certain

Financial Forecasts”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Effects

on the Company if the Merger Is Not Consummated”

“SPECIAL FACTORS — Alternatives

to the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Material

U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS — Regulatory

Approvals in Connection with the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“SPECIAL FACTORS — Accounting

Treatment”

“THE SPECIAL MEETING — Vote

Required”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

(c)

Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT —

Consideration To Be Received in the Merger”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(d)

Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SPECIAL FACTORS — Appraisal

Rights”

“THE SPECIAL MEETING — Appraisal

Rights”

Annex A — Agreement

and Plan of Merger

(e) Provisions

for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Provisions

for Unaffiliated Stockholders”

(f) Eligibility

for Listing or Trading. Not Applicable.

Item

5. Past Contacts, Transactions, Negotiations and Agreements

(a)

Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(b)

Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(c) Negotiations

or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

(d)

Conflicts of interest. Not Applicable.

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Parent

Vote”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

6. Purposes of the Transaction and Plans or Proposals

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

(b)

Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

"DELISTING AND DEREGISTRATION OF COMMON

STOCK"

Annex A — Agreement

and Plan of Merger

(c)(1)–(8)

Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Parent

Vote”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

7. Purposes, Alternatives, Reasons and Effects

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

(b)

Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

(c)

Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

Annex C — Opinion

of Rothschild & Co US Inc.

(d)

Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Effects

on the Company if the Merger Is Not Consummated”

“SPECIAL FACTORS — Alternatives

to the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Material

U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“SPECIAL FACTORS — Accounting

Treatment”

“THE MERGER AGREEMENT — Effects

of the Merger”

“THE MERGER AGREEMENT — Directors

and Officers of the Surviving Corporation”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

“THE MERGER AGREEMENT — Excluded

Shares”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE MERGER AGREEMENT — Payment

for Securities; Surrender of Certificates”

“THE MERGER AGREEMENT — Termination

of Exchange Fund”

“THE MERGER AGREEMENT — Dissenting

Shares”

“THE MERGER AGREEMENT — Indemnification

and Insurance”

“THE MERGER AGREEMENT — Employee

Benefit Matters”

“THE MERGER AGREEMENT — Fees

and Expenses”

“THE MERGER AGREEMENT — Withholding

Taxes”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

Item

8. Fairness of the Transaction

(a)–(b)

Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Indemnification

and Insurance”

Annex C — Opinion

of Rothschild & Co US Inc.

The discussion materials prepared

by Rothschild & Co US Inc. and provided to the Special Committee, dated May 16, 2023, June 6, 2023, June 22, 2023, September 6, 2023,

September 13, 2023, September 23, 2023 and October 14, 2023, are attached hereto as Exhibit (c)(ii) through and including Exhibit (c)(viii)

and are each incorporated by reference herein.

(c)

Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“THE MERGER AGREEMENT — Company

Stockholder Meeting; Proxy Statement”

“THE MERGER AGREEMENT — Conditions

of the Merger”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“THE SPECIAL MEETING — Vote

Required”

“THE SPECIAL MEETING — Voting

Procedures”

“THE SPECIAL MEETING — How

Proxies Are Voted”

“THE SPECIAL MEETING — Revocation

of Proxies”

Annex A — Agreement

and Plan of Merger

(d)

Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

(e)

Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

(f) Other

Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

“THE MERGER AGREEMENT — No

Solicitation; Change in Board Recommendation”

Annex A — Agreement

and Plan of Merger

Item

9. Reports, Opinions, Appraisals and Negotiations

(a)–(c)

Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference.

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex C — Opinion

of Rothschild & Co US Inc.

The discussion materials prepared

by Rothschild & Co US Inc. and provided to the Special Committee, dated May 16, 2023, June 6, 2023, June 22, 2023, September 6, 2023,

September 13, 2023, September 23, 2023 and October 14, 2023, are attached hereto as Exhibit (c)(ii) through and including Exhibit (c)(viii)

and are each incorporated by reference herein.

The reports, opinions or appraisals

referenced in this Item 9 are filed herewith or incorporated by reference herein and will be made available for inspection and copying

at the principal executive offices of the Company during its regular business hours by any interested holder of Shares or representative

who has been designated in writing, and copies may be obtained by requesting them in writing from the Company at the email address provided

under the caption “Where You Can Find Additional Information” in the proxy statement, which is incorporated herein

by reference.

Item

10. Source and Amount of Funds or Other Consideration

(a)-(b)

Source of Funds; Conditions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Closing

and Effective Time of the Merger”

“THE MERGER AGREEMENT — Covenants

Regarding Conduct of Business by the Company Pending the Closing”

“THE MERGER AGREEMENT — Conditions

of the Merger”

Annex A — Agreement

and Plan of Merger

(c)

Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Fees

and Expenses”

“THE MERGER AGREEMENT — Termination

of the Merger Agreement”

“THE MERGER AGREEMENT — Termination

Fees”

“THE MERGER AGREEMENT — Fees

and Expenses”

“THE SPECIAL MEETING — Solicitation

of Proxies”

Annex A — Agreement

and Plan of Merger

(d)

Borrowed Funds.

“SPECIAL FACTORS — Financing

of the Merger”

Item

11. Interest in Securities of the Subject Company

(a) Securities

Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY—Beneficial Ownership of Common Stock by Management and Directors”

Annex B — Voting

Agreement

(b)

Securities Transactions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of the Company Common Stock”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

12. The Solicitation or Recommendation

(d)

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Parent

Vote”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“THE SPECIAL MEETING — Voting

by Company Directors, Executive Officers and Principal Securityholders”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY—Beneficial Ownership of Common Stock by Management and Directors”

Annex B — Voting

Agreement

(e)

Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

Item

13. Financial Statements

(a)

Financial Information. The audited financial statements set forth in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, originally filed on March 6, 2023 (see pages F-1 through F-45 therein) and the unaudited

condensed consolidated statements of operations, condensed consolidated statements of comprehensive income, condensed consolidated balance

sheets, condensed consolidated statements of changes in mezzanine equity and shareholders’ equity and condensed consolidated statements

of cash flows set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, originally filed

on November 7, 2023 (see pages 1 through 26 therein) are incorporated herein by reference. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS —

Certain Financial Forecasts”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY – Selected Historical Consolidated Financial Data”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY – Book Value per Share”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

(b)

Pro Forma Information. Not Applicable.

Item

14. Persons/Assets, Retained, Employed, Compensated or Used

(a)-(b)

Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Filers for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Filers as to the Fairness of the Merger”

“SPECIAL FACTORS — Fees

and Expenses”

“THE MERGER AGREEMENT — Fees

and Expenses”

"THE SPECIAL MEETING"

“THE SPECIAL MEETING — Solicitation

of Proxies”

Item

15. Additional Information

(b)

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

Annex A — Agreement

and Plan of Merger

(c)

Other Material Information. The entirety of the Proxy Statement, including all appendices thereto, is incorporated

herein by reference.

Item

16. Exhibits

The following exhibits are filed herewith:

| Exhibit No. |

Description |

| (a)(2)(i)* |

Definitive Proxy Statement of Consolidated Communications Holdings, Inc. (included in the Schedule 14A filed on December 15, 2023, and

incorporated herein by reference) (the “Definitive Proxy Statement”). |

| (a)(2)(ii)* |

Form of Proxy Card (included in the Definitive Proxy Statement and incorporated herein by reference). |

| (a)(2)(iii)* |

Letter to Stockholders (included in the Definitive Proxy Statement and incorporated herein by reference). |

| (a)(2)(iv) |

Definitive Additional Materials to the Proxy Statement of Consolidated

Communications Holdings, Inc. (included in the Schedule 14A filed on January 24, 2024 and incorporated herein by reference) (the “Supplement”) |

| (a)(2)(v)* |

Notice of Special Meeting of Stockholders (included in the Definitive Proxy Statement and incorporated

herein by reference). |

| (a)(5)(i)* |

Press Release, dated October

16, 2023 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings,

Inc. with the Commission on October 16, 2023). |

| (a)(5)(ii)* |

Investor Presentation (incorporated

by reference to Exhibit 99.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on October 16, 2023). |

| (a)(5)(iii) |

Press Release, dated as of December 27, 2023 (included in the Schedule 14A filed on December 27, 2023 and incorporated herein by reference). |

| (a)(5)(iv) |

Press Release, dated as of January 3, 2024 (included in the Schedule 14A filed on January 3, 2024 and incorporated herein by reference). |

| (a)(5)(v) |

Investor Presentation, dated as of January 10, 2024 (included in the Schedule 14A filed on January 10, 2024 and incorporated herein by reference). |

| (a)(5)(vi) |

Investor Presentation, dated as of January 10, 2024 (included in the Schedule 14A filed on January 11, 2024 and incorporated herein by reference). |

| (a)(5)(vii) |

Press Release, dated as of January 11, 2024 (included in the Schedule 14A filed on January 11, 2024 and incorporated herein by reference). |

| (a)(5)(viii) |

Press Release, dated as of January 19, 2024 (included in the Schedule 14A filed on January 19, 2024 and incorporated herein by reference). |

| (a)(5)(ix) |

Press Release, dated as of January 22, 2024 (included in the Schedule 14A filed on January 22, 2024 and incorporated herein by reference). |

| (a)(5)(x) |

Press Release, dated as of January 23, 2024 (included in the Schedule 14A filed on January 23, 2024 and incorporated herein by reference). |

| (c)(i)* |

Opinion of Rothschild &

Co US Inc., dated as of October 15, 2023 |

| (c)(ii)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated May 16, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(iii)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated June 6, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(iv)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated June 22, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(v)* |

Discussion

materials prepared by Rothschild & Co US Inc., dated September 6, 2023, for the Special Committee of the Board of Directors of

Consolidated Communications Holdings, Inc. |

| (c)(vi)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated September 13, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(vii)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated September 23, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(viii)* |

Discussion materials prepared

by Rothschild & Co US Inc., dated October 14, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(ix)* |

Discussion materials prepared

by Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC, dated March 15, 2023, for Condor Holdings LLC, Condor Merger Sub Inc.,

Searchlight III CVL, L.P. and Searchlight III CVL GP, LLC |

| (d)(i)* |

Agreement and Plan of Merger,

dated October 15, 2023, by and among Condor Holdings LLC, Condor Merger Sub Inc. and Consolidated Communications Holdings, Inc. (incorporated

by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on October 16, 2023). |

| (d)(ii)* |

Voting Agreement, dated

October 15, 2023, by and between Consolidated Communications Holdings, Inc., and Searchlight III CVL, L.P (incorporated by reference

to Exhibit 10.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission on October

16, 2023). |

| (d)(iii)* |

Interim Investors’

Agreement, dated October 15, 2023, by and between Condor Holdings LLC, Condor Merger Sub Inc., Searchlight Capital III, L.P., Searchlight

III CVL, L.P and British Columbia Investment Management Corporation. |

| (d)(iv)* |

Equity Commitment Letter,

dated October 15, 2023, by and between Condor Holdings LLC, Searchlight Capital III, L.P. and Searchlight Capital III PV, L.P. |

| (d)(v)* |

Limited Guaranty, dated

October 15, 2023, by and between Consolidated Communications Holdings, Inc., Searchlight Capital III, L.P. and Searchlight Capital

III PV, L.P. |

| (d)(vi)* |

Governance Agreement, dated

as of September 13, 2020, by and between Consolidated Communications Holdings, Inc. and Searchlight III CVL, L.P. (incorporated by

reference to Exhibit 10.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on September 13, 2020). |

| (d)(vii)* |

Registration Rights Agreement,

dated as of October 2, 2020, by and between Consolidated Communications Holdings, Inc. and Searchlight III CVL, L.P. (incorporated

by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on October 2, 2020). |

| (d)(viii)* |

Waiver, dated as of November

22, 2022, made by Searchlight III CVL, L.P. (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by

Consolidated Communications Holdings, Inc. with the Commission on November 22, 2022). |

| (f) |

Section 262 of the DGCL (included in the Definitive Proxy Statement and incorporated herein by reference). |

| (g) |

Not Applicable. |

| 107* |

Filing Fee Table. |

* Previously

filed.

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | CONSOLIDATED COMMUNICATIONS HOLDINGS,

INC. |

| By: | /s/ C. Robert Udell,

Jr. |

| Name: | C. Robert Udell,

Jr. |

| | Title: | President and Chief Executive Officer |

Date: January 24, 2024

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | CONDOR HOLDINGS LLC |

| | |

| | By: Searchlight III CVL L.P., its sole member |

| | By: Searchlight III CVL GP, LLC, its general partner |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: January 24, 2024

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: January 24, 2024

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | SEARCHLIGHT III CVL, L.P. |

| | |

| | By: Searchlight III CVL GP, LLC, its general partner |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: January 24, 2024

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | SEARCHLIGHT III CVL GP, LLC |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: January 24, 2024

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January 24, 2024

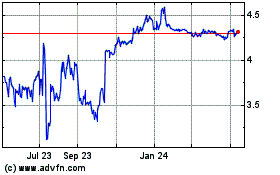

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Oct 2024 to Nov 2024

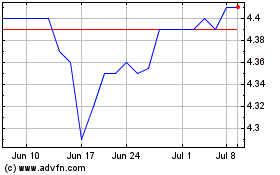

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Nov 2023 to Nov 2024