Form 8-K - Current report

December 15 2023 - 3:48PM

Edgar (US Regulatory)

false

0001391933

0001391933

2023-12-11

2023-12-11

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

|

| |

|

Washington, D.C. 20549

|

| |

|

FORM 8-K

|

| |

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

|

Date of Report (Date of earliest event reported)

|

December 11, 2023

|

| |

|

QUAINT OAK BANCORP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

Pennsylvania

|

000-52694

|

35-2293957

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

501 Knowles Avenue, Southampton, Pennsylvania

|

18966

|

|

(Address of principal executive offices)

|

(Zip Code)

|

| |

|

Registrant's telephone number, including area code

|

(215) 364-4059

|

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

| |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

«»

Securities registered pursuant to Section 12(b) of the Act: None

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

| |

|

|

| |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 4.02. Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On December 11, 2023, the Audit Committee of the Board of Directors of Quaint Oak Bancorp, Inc. (the “Company,” “we” or “our”) concluded that the Company’s previously issued consolidated financial statements for the interim periods ended June 30, 2023 and September 30, 2023 (the “Restated Periods”), should no longer be relied upon because of a reclassification related to expenses on deposit accounts obtained from a correspondent banking relationship that resulted in material misstatements of interest expense and other non-interest expense for the Restated Periods. The Company entered into the correspondent banking relationship in May 2022. The Audit Committee concluded that the effect on the consolidated financial statements for the three months ended March 31, 2023 and the year ended December 31, 2022 were not material. Additionally, the Company’s earnings releases and other public communications for the Restated Periods should no longer be relied upon to the extent that they relate to our consolidated financial statements for the Restated Periods.

The Audit Committee determined that the Company accounted for the expense related to checking account deposits received from the correspondent banking relationship as other non-interest expense rather than interest expense on deposits. The deposits which were reported as non-interest bearing deposits on our consolidated balance sheets have been reclassified, in part, as interest-bearing deposits for the Restated Periods. A portion of the deposits related to the correspondent banking relationship remain classified as non-interest bearing deposits. As a result of the reclassification, interest expense for the Restated Periods increased resulting in a decrease in net interest income for the Restated Periods. Other non-interest expense and total non-interest expense decreased for the Restated Periods as a result of the reclassification. In addition, as a result of the restatement, the Company’s interest rate spread and net interest margin will decrease for the Restated Periods.

The Company does not believe that the restatement reflects any significant financial impact on the Company’s financial condition or earnings as of and for the periods ended June 30, 2023 and September 30, 2023, or any trends in the Company’s business or its prospects. The restatements are not expected to have any impact on total balance sheet amounts, including total deposits and stockholders’ equity for the Restated Periods. The restatements are not expected to have any impact on net income or earnings per share for the Restated Periods.

Impact of Financial Restatements

The following tables summarize the expected effects of the restatement on select statement of operations and balance sheet amounts as reported as of and for the periods stated and are unaudited; no changes to the statement of cash flows resulted from the restatement.

| |

|

At September 30, 2023

|

|

|

At June 30, 2023

|

|

| |

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

| |

|

In thousands (unaudited)

|

|

|

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing

|

|

$ |

151,111 |

|

|

$ |

(72,830 |

) |

|

$ |

78,281 |

|

|

$ |

123,400 |

|

|

$ |

(52,589 |

) |

|

$ |

70,811 |

|

|

Interest-bearing

|

|

|

444,445 |

|

|

|

72,830 |

|

|

|

517,275 |

|

|

|

449,998 |

|

|

|

52,589 |

|

|

|

502,587 |

|

|

Total deposits

|

|

$ |

595,556 |

|

|

$ |

- |

|

|

$ |

595,556 |

|

|

$ |

573,398 |

|

|

$ |

- |

|

|

$ |

573,398 |

|

| |

|

For the Three Months Ended

|

|

|

For the Nine Months Ended

|

|

| |

|

September 30, 2023

|

|

|

September 30, 2023

|

|

| |

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

| |

|

In thousands (unaudited)

|

|

|

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

$ |

4,318 |

|

|

$ |

750 |

|

|

$ |

5,068 |

|

|

$ |

11,811 |

|

|

$ |

1,462 |

|

|

$ |

13,273 |

|

|

Total Interest Expense

|

|

|

6,049 |

|

|

|

750 |

|

|

|

6,799 |

|

|

|

18,153 |

|

|

|

1,462 |

|

|

|

19,615 |

|

|

Net Interest Income

|

|

|

4,921 |

|

|

|

(750 |

) |

|

|

4,171 |

|

|

|

15,532 |

|

|

|

(1,462 |

) |

|

|

14,070 |

|

|

Net Interest Income after

Provision for Credit Losses

|

|

|

4,664 |

|

|

|

(750 |

) |

|

|

3,914 |

|

|

|

15,072 |

|

|

|

(1,462 |

) |

|

|

13,610 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

1,491 |

|

|

|

750 |

|

|

|

741 |

|

|

|

3,560 |

|

|

|

(1,462 |

) |

|

|

2,098 |

|

|

Total Non-Interest Expense

|

|

|

8,430 |

|

|

|

750 |

|

|

|

7,680 |

|

|

|

24,421 |

|

|

|

(1,462 |

) |

|

|

22,959 |

|

| |

|

For the Three Months Ended

|

|

|

For the Six Months Ended

|

|

| |

|

June 30, 2023

|

|

|

June 30, 2023

|

|

| |

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

| |

|

In thousands (unaudited)

|

|

|

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

$ |

3,983 |

|

|

$ |

456 |

|

|

$ |

4,439 |

|

|

$ |

7,493 |

|

|

$ |

712 |

|

|

$ |

8,205 |

|

|

Total Interest Expense

|

|

|

6,816 |

|

|

|

456 |

|

|

|

7,272 |

|

|

|

12,325 |

|

|

|

712 |

|

|

|

13,037 |

|

|

Net Interest Income

|

|

|

5,302 |

|

|

|

(456 |

) |

|

|

4,846 |

|

|

|

10,611 |

|

|

|

(712 |

) |

|

|

9,899 |

|

|

Net Interest Income after

Provision for Credit Losses

|

|

|

5,491 |

|

|

|

(456 |

) |

|

|

5,035 |

|

|

|

10,408 |

|

|

|

(712 |

) |

|

|

9,696 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

1,348 |

|

|

|

(456 |

) |

|

|

892 |

|

|

|

2,069 |

|

|

|

(712 |

) |

|

|

1,357 |

|

|

Total Non-Interest Expense

|

|

|

8,361 |

|

|

|

(456 |

) |

|

|

7,905 |

|

|

|

15,991 |

|

|

|

(712 |

) |

|

|

15,279 |

|

As soon as practicable, we intend to amend our Form 10-Qs for the quarterly periods ended September 30, 2023 and June 30, 2023, to reflect the restatement of our consolidated financial statements for the Restated Periods.

Management and the Audit Committee have discussed the matters disclosed in this report with S.R. Snodgrass, P.C., the Company’s current independent registered public accounting firm.

Forward-Looking Statements Are Subject to Change

This report contains certain forward-looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward-looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of the Company and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward-looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward-looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumptions, many of which are difficult to predict and generally are beyond the control of the Company and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward-looking statements. The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Item 9.01 Financial Statements and Exhibits

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Exhibits

|

The following exhibit is included with this Report:

|

Exhibit Number

|

|

Description

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

QUAINT OAK BANCORP, INC.

|

| |

|

|

| |

|

|

| |

|

|

|

Date: December 15, 2023

|

By:

|

/s/ John J. Augustine |

| |

|

John J. Augustine

|

| |

|

Executive Vice President and Chief Financial Officer

|

v3.23.3

Document And Entity Information

|

Dec. 11, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

QUAINT OAK BANCORP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 11, 2023

|

| Entity, Incorporation, State or Country Code |

PA

|

| Entity, File Number |

000-52694

|

| Entity, Tax Identification Number |

35-2293957

|

| Entity, Address, Address Line One |

501 Knowles Avenue

|

| Entity, Address, City or Town |

Southampton

|

| Entity, Address, State or Province |

PA

|

| Entity, Address, Postal Zip Code |

18966

|

| City Area Code |

215

|

| Local Phone Number |

364-4059

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001391933

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

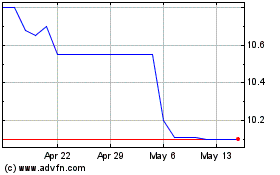

Quaint Oak Bancorp (QB) (USOTC:QNTO)

Historical Stock Chart

From Apr 2024 to May 2024

Quaint Oak Bancorp (QB) (USOTC:QNTO)

Historical Stock Chart

From May 2023 to May 2024