0001568385FALSE00015683852023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 14, 2023

Bright Mountain Media, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Florida | | 000-54887 | | 27-2977890 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | |

| | 6400 Congress Avenue, Suite 2050 Boca Raton, Florida | | 33487 |

| | (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 561-998-2440

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

Title of Each Class | | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Conditions |

On August 14, 2023, Bright Mountain Media, Inc, Inc. (the "Company") issued a press release announcing its financial results for its second quarter and six months ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section. In addition, this information shall not be deemed incorporated by reference into any of the Company’s filings with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in any such filing.

The Company makes reference to certain non-GAAP financial measures in the press release. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures and reasons why the Company believes these non-GAAP financial measures are useful are contained in the attached press release.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

August 14, 2023

Bright Mountain Media, Inc.

| | | | | |

| (Registrant) |

| |

| By: | /s/ Miriam Martinez |

| Miriam Martinez |

| Chief Financial Officer |

Bright Mountain Media, Inc Announces Second Quarter 2023 Financial Results

Boca Raton, FL, August 14, 2023 — Bright Mountain Media, Inc. (OTCQB: BMTM) (“Bright Mountain” or the “Company”), a global holding company with current investments in digital publishing, advertising technology, consumer insights, and creative media services, today announced its unaudited financial results for the three and six months ended June 30, 2023.

Second Quarter 2023 Highlights

•Revenue increased 121% to $12.6 million compared to $5.7 million in the prior year period

•Gross margin increased 23% to $3.5 million compared to $2.8 million in the prior year period

•Quarterly brand events fuse our digital publishing with insights for greater cross selling opportunities

Matt Drinkwater, Chief Executive Officer of the Company stated, “Bright Mountain Media completed its acquisition of Big Village Insights and Big Village Agency on April 20th, 2023. The resulting company is now a global holding company with current investments in digital publishing, advertising technology, consumer insights, and creative and media services. The addition of Big Village evolves Bright Mountain to meet and lead the current media market, transforming the company from a simple media publishing organization to a complete media solutions provider that pairs publishing, creative media, data-driven research that creates in-depth customer insights, and technology-enhanced optimization and targeting. Big Village allows Bright Mountain to refer to internal opportunities providing overlap across our varied customer bases. With this overlap, Bright Mountain can monetize existing customer relationships multiple times, creating a flywheel effect.”

Mr. Drinkwater concluded: “We believe we are now beginning to leverage the combined abilities of our advertising technology with our digital publishing businesses. Our first brand briefing event was held in June, which was a great use case study to leverage publishing and insights to create valuable media solutions to a growing customer base. Attendees of these brand events are provided access to proprietary and valuable data about the buying power and influence of younger generations. Because of increased regulatory scrutiny of data and privacy, companies across the spectrum continue to look for impactful data to understand their target audiences. We intend to leverage the platform we have built to scale to profitability and drive increased shareholder value.”

Financial Results for the Three Months Ended June 30, 2023

•Revenue was $12.6 million, an increase of $6.9 million or 121% compared to $5.7 million for the same period of 2022. Advertising technology revenue was approximately $11.2 million and digital publishing contributed approximately $1.4 million during the second quarter of 2023, with $9.2 million or 82% attributable to Big Village’s Agency and Insights divisions.

•Gross margin was $3.5 million, an increase of 23%, compared to $2.8 million in the same period of 2022. Cost of revenue increased to $9.2 million as a result of higher direct salaries and project costs associated with the acquisition of Big Village’s Agency and Insights divisions.

•General and administrative expense was $7.4 million, an increase of 114%, compared to $3.4 million in the same period of 2022. The increase was primarily attributed to increased personnel and professional fees as a result of the acquisition of Big Village’s Agency and Insights divisions.

•Net loss was $6.1 million, an increase of 316%, compared to a $1.5 million net loss in the same period of 2022.

•Adjusted EBITDA loss was $1.9 million compared to Adjusted EBITDA of $39,000 in the same period of 2022.

Financial Results for the Six Months Ended June 30, 2023

•Revenue was $14.1 million, an increase of $4.9 million or 54% compared to $9.2 million for the same period of 2022. Advertising technology revenue was approximately $11.7 million and digital publishing contributed approximately $2.4 million during the first half of 2023, with $9.2 million or 79% attributable to Big Village’s Agency and Insights divisions.

•Gross margin was $4.0 million, a reduction of 12%, compared to $4.5 million in the same period of 2022. Cost of revenue increased to $10.1 million as a result of higher direct salaries and project costs associated with the acquisition of Big Village’s Agency and Insights divisions.

•General and administrative expense was $10.8 million, an increase of 48%, compared to $7.3 million in the same period of 2022. The increase was primarily attributed to increased professional fees of $2.2 million as a result of the acquisition of Big Village’s Agency and Insights divisions.

•Net loss was $9.9 million, an increase of 176%, compared to a $3.6 million net loss in the same period of 2022.

•Adjusted EBITDA loss was $3.9 million compared to Adjusted EBITDA loss of $1.4 million in the same period of 2022.

About Bright Mountain Media

Bright Mountain Media, Inc. (OTCQB: BMTM) unites a diverse portfolio of companies to deliver a full spectrum of advertising, marketing, technology, and media services under one roof—fused together by data-driven insights. Bright Mountain Media’s brands include Big-Village Agency, BV Insights, Wild Sky Media, and Bright Mountain LC. For more Information, please visit www.brightmountainmedia.com.

Forward-Looking Statements for Bright Mountain Media, Inc.

This press release contains certain forward-looking statements that are based upon current expectations and involve certain risks and uncertainties. Such forward-looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” and “proposes,” and similar words. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation, statements made with respect to expectations of our ability to successfully integrate acquisitions, and the realization of any expected benefits from such acquisitions. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading “Risk Factors” in Bright Mountain Media, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022 and our other filings with the SEC. Bright Mountain Media, Inc. does not undertake any duty to update any forward-looking statements except as may be required by law.

Contact:

Brian M. Prenoveau, CFA

MZ North America

561-489-5315

BMTM@mzgroup.us

BRIGHT MOUNTAIN MEDIA, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share figures)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, 2023 | | June 30, 2022 | | June 30, 2023 | | June 30, 2022 |

| Revenue | | $ | 12,616 | | | $ | 5,717 | | | $ | 14,114 | | | $ | 9,176 | |

| Cost of revenue | | 9,162 | | | 2,900 | | | 10,132 | | | 4,628 | |

| Gross margin | | 3,454 | | | 2,817 | | | 3,982 | | | 4,548 | |

| General and administrative expenses | | 7,374 | | | 3,443 | | | 10,802 | | | 7,293 | |

| Loss from operations | | (3,920) | | | (626) | | | (6,820) | | | (2,745) | |

| | | | | | | | |

| Financing (expense) income | | | | | | | | |

| Gain on forgiveness of PPP loan | | — | | | 296 | | | — | | | 1,137 | |

| Other income | | 103 | | | 39 | | | 381 | | | 39 | |

| Interest expense - Centre Lane Senior Secured Credit Facility - related party | | (2,244) | | | (1,160) | | | (3,407) | | | (1,994) | |

| Interest expense - Convertible Promissory Notes - related party | | (6) | | | (6) | | | (11) | | | (11) | |

| Other interest expense | | (4) | | | (1) | | | (10) | | | (1) | |

| Total financing (expense) | | (2,151) | | | (832) | | | (3,047) | | | (830) | |

| Net loss before income tax | | (6,071) | | | (1,458) | | | (9,867) | | | (3,575) | |

| Income tax provision | | — | | | — | | | — | | | — | |

| Net loss | | (6,071) | | | (1,458) | | | (9,867) | | | (3,575) | |

| | | | | | | | |

| Dividends | | | | | | | | |

| | | | | | | | |

| Preferred stock dividends | | — | | | (1) | | | — | | | (2) | |

| | | | | | | | |

| Net loss attributable to common shareholders | | $ | (6,071) | | | $ | (1,459) | | | $ | (9,867) | | | $ | (3,577) | |

| Foreign currency translation | | 119 | | | 17 | | | 133 | | | 17 | |

| Comprehensive loss | | $ | (5,952) | | | $ | (1,442) | | | $ | (9,734) | | | $ | (3,560) | |

| | | | | | | | |

| Net loss per common share | | | | | | | | |

| Basic and diluted | | $ | (0.04) | | | $ | (0.01) | | | $ | (0.06) | | | $ | (0.02) | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic and diluted | | 166,779,390 | | 149,159,461 | | 158,291,304 | | 149,130,579 |

BRIGHT MOUNTAIN MEDIA, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share figures)

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31,

2022* |

| | (Unaudited) | | |

| ASSETS | | | | |

| Current Assets | | | | |

| Cash and cash equivalents | | $ | 3,350 | | | $ | 316 | |

| Accounts receivable, net | | 15,225 | | | 3,585 | |

| Prepaid expenses and other current assets | | 1,423 | | | 600 | |

| Total Current Assets | | 19,998 | | | 4,501 | |

| Property and equipment, net | | 214 | | | 40 | |

| Intangible assets, net | | 19,556 | | | 4,510 | |

| Goodwill | | 20,936 | | | 19,645 | |

| Operating lease right-of-use asset | | 338 | | | 367 | |

| Other assets | | 187 | | | 137 | |

| Total Assets | | $ | 61,229 | | | $ | 29,200 | |

| LIABILITIES AND SHAREHOLDERS' (DEFICIT) | | | | |

| Current Liabilities | | | | |

| Accounts payable and accrued expenses | | $ | 15,202 | | | $ | 10,317 | |

| Other liabilities | | 4,788 | | | 1,838 | |

Interest payable – 10% Convertible Promissory Notes - related party | | 35 | | | 31 | |

| | | | |

| Deferred revenue | | 4,863 | | | 737 | |

Note payable – 10% Convertible Promissory Notes, net of discount – related party | | 75 | | | 68 | |

| Note payable – Centre Lane Senior Secured Credit Facility – related party (current portion) | | 4,048 | | | 4,860 | |

| Total Current Liabilities | | 29,011 | | | 17,851 | |

| Note payable – Centre Lane Senior Secured Credit Facility – net of discount, related party | | 53,061 | | | 25,101 | |

| Operating lease liability | | 276 | | | 319 | |

| Total Liabilities | | 82,348 | | | 43,271 | |

| Shareholders' Deficit | | | | |

| Convertible preferred stock, par value $0.01, 20,000,000 shares authorized, no shares issued or outstanding at June 30, 2023 and December 31, 2022 | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Common stock, par value 0.01, 324,000,000 shares authorized, 172,106,629 and 150,444,636 issued and 171,281,454 and 149,619,461 outstanding at June 30, 2023 and December 31, 2022, respectively | | 1,721 | | | 1,504 | |

Treasury stock, at cost; 825,175 shares at June 30, 2023 and December 31, 2022 | | (220) | | | (220) | |

| Additional paid-in capital | | 101,266 | | | 98,797 | |

| Accumulated deficit | | (124,136) | | | (114,269) | |

| Accumulated other comprehensive income | | 250 | | | 117 | |

| Total shareholders’ deficit | | (21,119) | | | (14,071) | |

| Total liabilities and shareholders' deficit | | $ | 61,229 | | | $ | 29,200 | |

*Derived from audited consolidated financial statements.

BRIGHT MOUNTAIN MEDIA, INC.

RECONCILIATION OF NET LOSS TO NON-GAAP EBITDA AND ADJUSTED EBITDA

(in thousands)

Non-GAAP Financial Measure

Non-GAAP results are presented only as a supplement to the financial statements and for use within management's discussion and analysis based on U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information is provided to enhance the reader's understanding of the Company's financial performance, but non-GAAP measures should not be considered in isolation or as a substitute for financial measures calculated in accordance with GAAP.

All of the items included in the reconciliation from net loss to EBITDA and from EBITDA to Adjusted EBITDA are either (i) non-cash items (e.g., depreciation, amortization of purchased intangibles, stock-based compensation, etc.) or (ii) items that management does not consider to be useful in assessing the Company's ongoing operating performance (e.g., M&A costs, income taxes, gain on sale of investments, loss on disposal of assets, etc.). In the case of the non-cash items, management believes that investors can better assess the Company's operating performance if the measures are presented without such items because, unlike cash expenses, these adjustments do not affect the Company's ability to generate free cash flow or invest in its business.

We use, and we believe investors benefit from the presentation of, EBITDA and Adjusted EBITDA in evaluating our operating performance because it provides us and our investors with an additional tool to compare our operating performance on a consistent basis by removing the impact of certain items that management believes do not directly reflect our core operations. We believe that EBITDA is useful to investors and other external users of our financial statements in evaluating our operating performance because EBITDA is widely used by investors to measure a company's operating performance without regard to items such as interest expense, taxes, and depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired.

Because not all companies use identical calculations, the Company's presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. However, these measures can still be useful in evaluating the Company's performance against its peer companies because management believes the measures provide users with valuable insight into key components of GAAP financial disclosures.

A reconciliation of net loss to EBITDA and Adjusted EBITDA is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss before tax plus: | | $ | (6,071) | | | $ | (1,458) | | | $ | (9,867) | | | $ | (3,575) | |

| Depreciation expense | | 39 | | | 8 | | | 46 | | | 12 | |

| Amortization of intangibles | | 728 | | | 390 | | | 1,114 | | | 786 | |

| Amortization of debt discount | | 540 | | | 335 | | | 844 | | | 615 | |

| Other interest expense | | 8 | | | 1 | | | 10 | | | 1 | |

| Interest expense – Centre Lane Senior Secured Credit Facility and Convertible Promissory Notes – related party | | 1,709 | | | 836 | | | 2,573 | | | 1,396 | |

| EBITDA | | (3,047) | | | 112 | | | (5,280) | | | (765) | |

| Stock compensation expense | | 33 | | | 30 | | | 58 | | | 176 | |

| Gain on forgiveness of PPP loan | | — | | | (296) | | | — | | | (1,137) | |

| Non-restructuring severance expense | | 114 | | | 29 | | | 236 | | | 29 | |

| Non-recurring professional fees | | 685 | | | 164 | | | 685 | | | 308 | |

| Non-recurring legal fees | | 359 | | | — | | | 359 | | | — | |

| Adjusted EBITDA | | $ | (1,856) | | | $ | 39 | | | $ | (3,942) | | | $ | (1,389) | |

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

Bright Mountain Media, Inc.

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity File Number |

000-54887

|

| Entity Tax Identification Number |

27-2977890

|

| Entity Address, Address Line One |

6400 Congress Avenue,

|

| Entity Address, Address Line Two |

Suite 2050

|

| Entity Address, City or Town |

Boca Raton,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

561

|

| Local Phone Number |

998-2440

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001568385

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

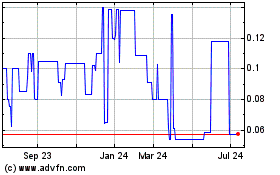

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Apr 2024 to May 2024

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From May 2023 to May 2024